August 16, 2019

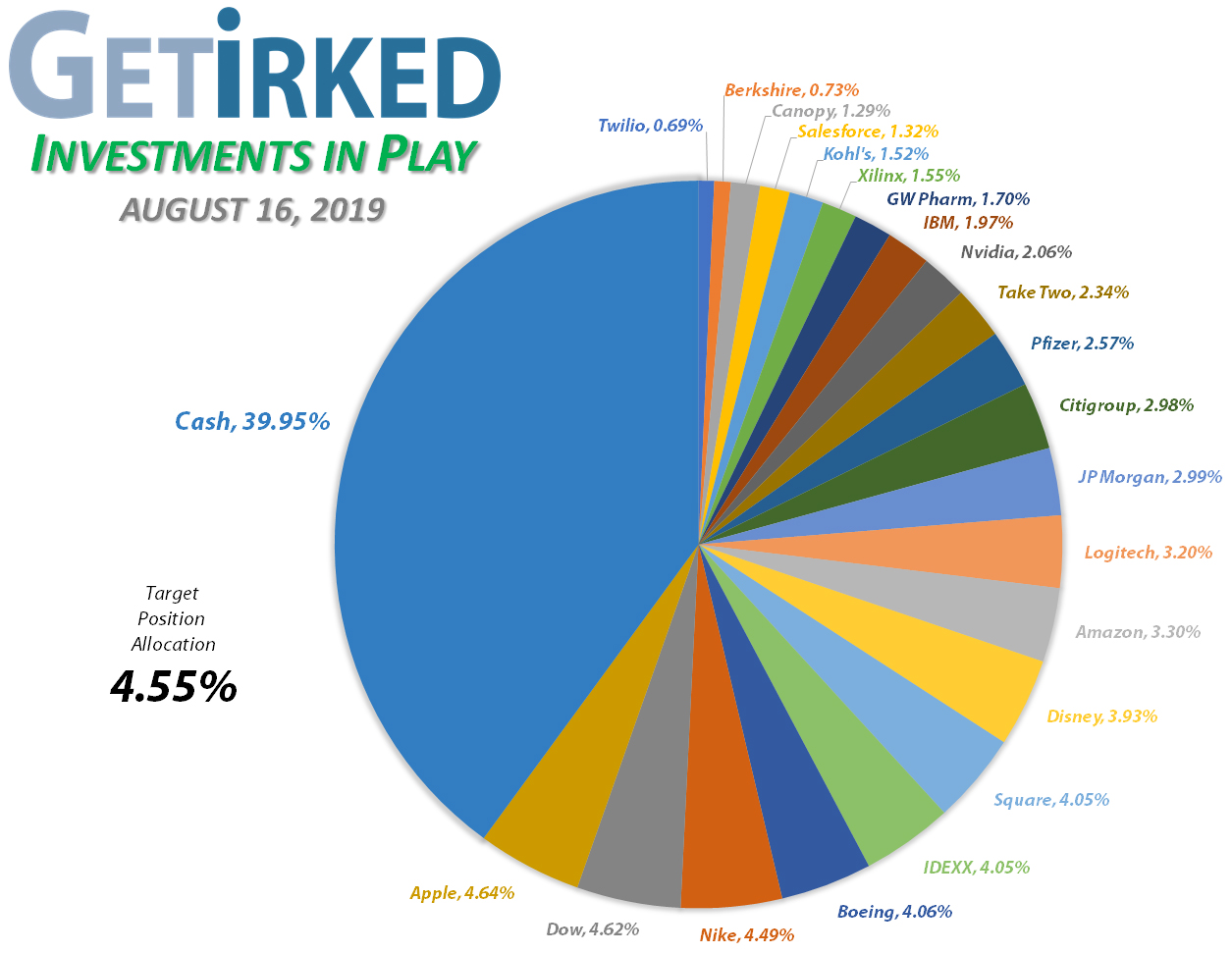

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+524.94%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$1,059.57)*

Square (SQ)

+489.35%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$48.71)*

Apple (AAPL)

+461.16%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$27.78)*

Nvidia (NVDA)

+441.79%

1st Buy 9/6/2016 @ $63.10

Current Per-Share: $29.45

Nike (NKE)

+421.73%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$21.94)*

Disney (DIS)

+360.40%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$23.30)*

IDEXX Lab (IDXX)

+176.79%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $99.50

Canopy (CGC)

+60.63%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $17.50

Take Two (TTWO)

+22.25%

1st Buy 7/30/2018 @ $120.99

Current Per-Share: $104.05

IBM (IBM)

+19.96%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $111.51

Salesforce (CRM)

+19.81%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $120.10

GW Pharm (GWPH)

+18.86%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $129.73

Logitech (LOGI)

+17.34%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $33.01

Amazon (AMZN)

+10.94%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $1,615.85

JP Morgan (JPM)

+6.89%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $100.77

Citigroup (C)

+4.03%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $61.02

Twilio (TWLO)

-0.76%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $125.71

Berkshire (BRK.B)

-1.11%

1st Buy 8/2/2019 @ $201.96

Current Per-Share: $201.96

Xilinx (XLNX)

-1.58%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $107.15

Kohl’s (KSS)

-7.28%

1st Buy 6/3/2019 @ $50.45

Current Per-Share: $49.08

Dow (DOW)

-8.40%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $48.59

Pfizer (PFE)

-10.76%

1st Buy 1/28/2019 @ $40.50

Current Per-Share: $38.83

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

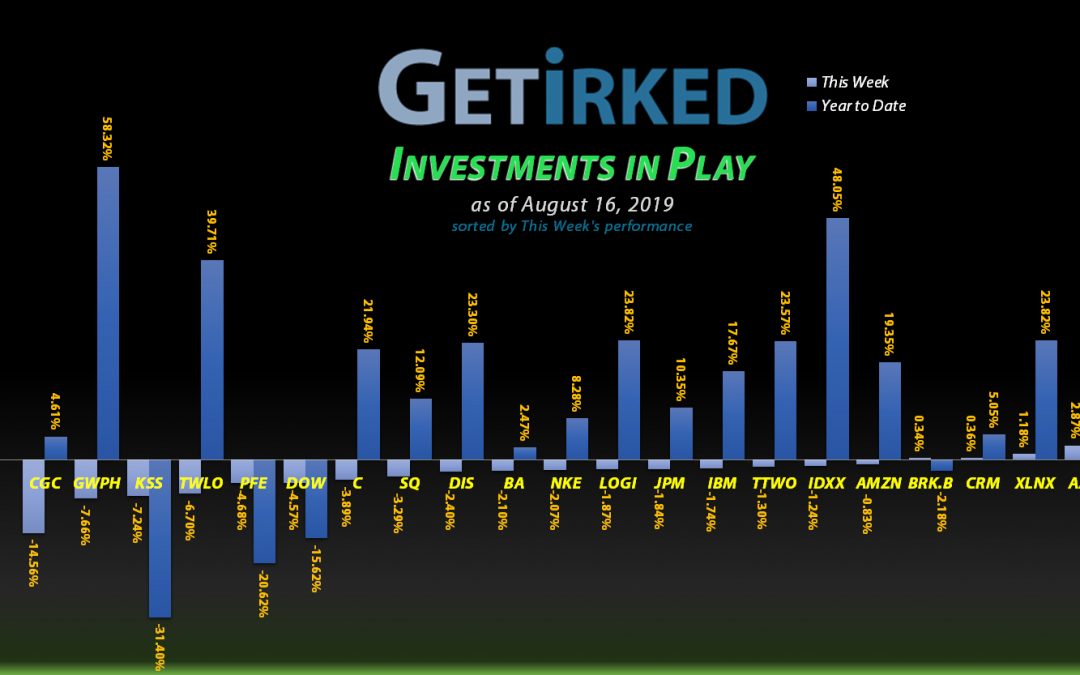

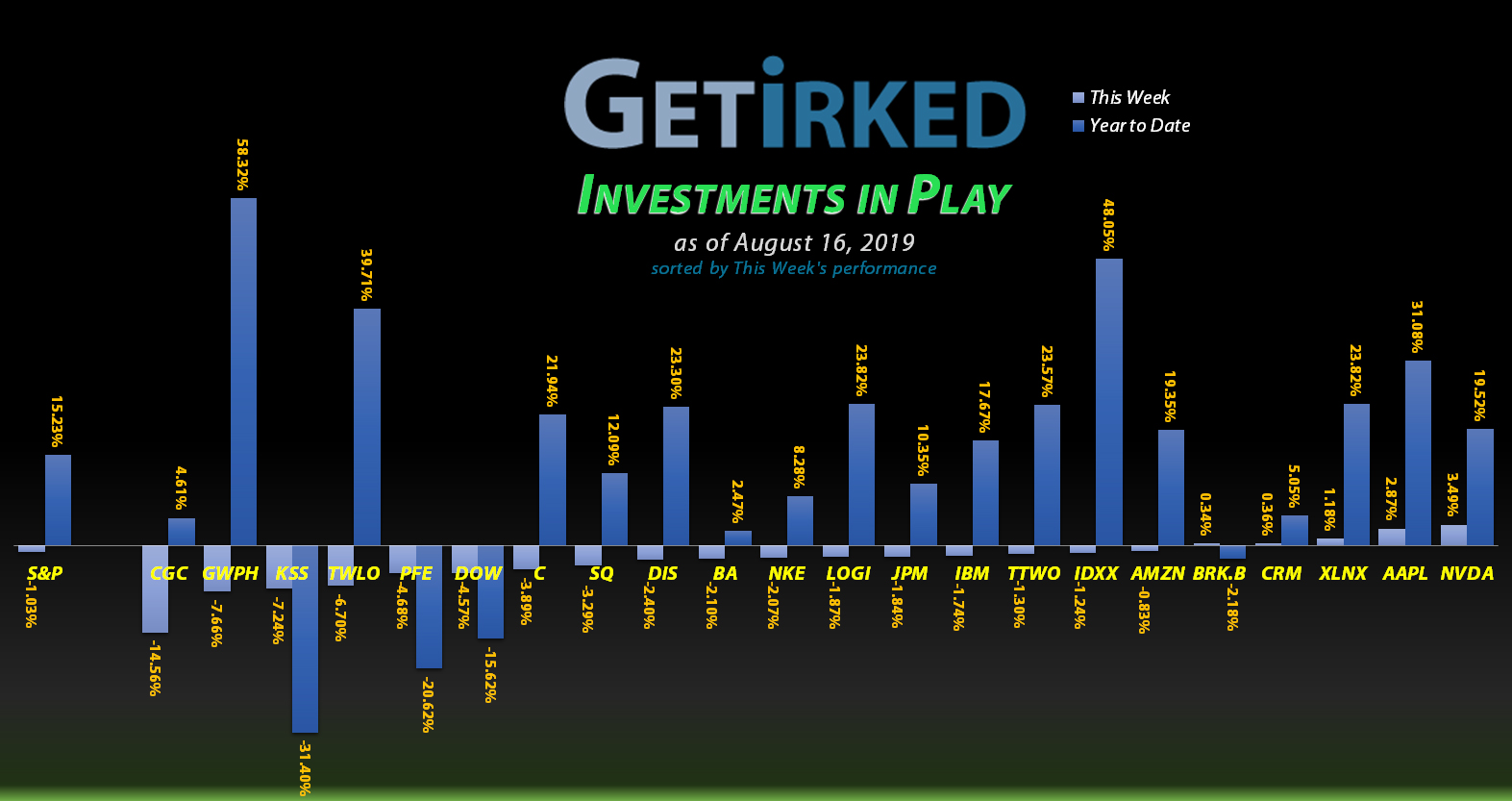

Highlights from the Week

Biggest Winner: Nvidia (NVDA)

Nvidia (NVDA) proved it still has what it takes this week, reporting a “Better Than Feared” quarterly report and swapping a down week for a positive +3.49% in a sea of red. That certainly earns the company its place as this week’s Biggest Winner.

Biggest Loser: Canopy Growth Corporation (CGC)

The hype is dead. Now that the cannabis stocks are being judged on the actual fundamentals (who would of thought of doing that?!), even sector leader Canopy Growth Corp (CGC) can’t make ends meet, once again reporting a missed quarter losing more money than expected.

Until other countries start legalizing recreational marijuana use on a federal level (hello, U.S.), the entire sector is going to be in a rough way.

In a week of losers, CGC is king, losing an epic -14.56% and rapidly approaching being flat for the year.

In second place is GW Pharmaceuticals (GWPH), getting the smackdown to the tune of -7.66% for the week. Even though GWPH is a fantastic company with outstanding earnings, it’s getting painted with the same brush as its recreational-pot-cohort since it’s considered a cannabis play. Hopefully, the market will grow wise and start treating GWPH as the successful biopharma play it is rather than just another pot stock.

This Week’s Moves

Pfizer (PFE): Added to Position

Following news of protests in Hong Kong combined with financial concerns, Pfizer (PFE) sold off more than 4% during Monday trading, breaking through the $35.00 mark where I added to my position at $34.98.

Pfizer is down more than -22% since July 3 following its announcement that it would be spinning off its consumer drug division, a significant contributor to its revenue and sales.

For the long-term investor, Pfizer has the potential for blockbuster drugs in its pipeline to come to market, however, its prospects aren’t great for the short term. At these prices, Pfizer yields a dividend of more than 4%.

As the market continues to sell off, I have additional price targets to add to my position at $31.15, $24.56 and even $19.08, all much lower than here.

PFE closed the week at $34.65, down -0.94% from where I added on Monday. It hurts to watch a stock go lower after I buy, even when I’m sticking to my discipline and trading plan. Must. Think. Long. Term.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.