July 19, 2019

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)*

+543.85%

1st Buy 8/5/2016 @ $11.10

Current Per-Share Cost: (-$48.71)*

Boeing (BA)*

+539.23%

1st Buy 2/14/2012 @ $79.58

Current Per-Share Cost: (-$1,059.57)*

Nvidia (NVDA)

+471.91%

1st Buy 9/6/2016 @ $63.10

Current Per-Share Cost: $29.45

Apple (AAPL)*

+397.88%

1st Buy 4/18/2013 @ $56.38

Current Per-Share Cost: (-$27.78)*

Nike (NKE)*

+323.73%

1st Buy 2/14/2012 @ $26.71

Current Per-Share Cost: (-$21.94)*

Disney (DIS)*

+278.88%

1st Buy 2/14/2012 @ $41.70

Current Per-Share Cost: (-$23.44)*

IDEXX Labs (IDXX)

+186.09%

1st Buy 7/26/2017 @ $167.29

Current Per-Share Cost: $99.50

Canopy Growth (CGC)

+116.69%

1st Buy 5/24/2018 @ $29.53

Current Per-Share Cost: $17.50

IBM (IBM)

+34.39%

1st Buy 11/6/2018 @ $120.87

Current Per-Share Cost: $111.51

Salesforce.com (CRM)

+30.52%

1st Buy 6/11/2018 @ $134.05

Current Per-Share Cost: $120.10

GW Pharma (GWPH)

+27.56%

1st Buy 7/25/2018 @ $142.28

Current Per-Share Cost: $129.73

Amazon (AMZN)

+21.57%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share Cost: $1,615.85

Logitech (LOGI)

+18.91%

1st Buy 11/11/2016 @ $24.20

Current Per-Share Cost: $33.01

Citigroup (C)

+16.25%

1st Buy 10/26/2017 @ $74.06

Current Per-Share Cost: $61.02

Xilinx (XLNX)

+14.28%

1st Buy 5/13/2019 @ $111.57

Current Per-Share Cost: $107.39

JP Morgan (JPM)

+11.93%

1st Buy 10/26/2017 @ $102.30

Current Per-Share Cost: $101.47

Take Two Inter (TTWO)

+11.52%

1st Buy 7/30/2018 @ $120.99

Current Per-Share Cost: $104.05

Pfizer (PFE)

+7.04%

1st Buy 1/28/2019 @ $40.50

Current Per-Share Cost: $39.97

Dow (DOW)

+3.19%

1st Buy 5/13/2019 @ $53.18

Current Per-Share Cost: $49.92

Kohl’s (KSS)

+0.48%

1st Buy 6/3/2019 @ $50.45

Current Per-Share Cost: $49.08

3M (MMM)

+0.14%

1st Buy 5/1/2019 @ $188.97

Current Per-Share Cost: $172.38

* Indicates a position where the capital investment was sold.

Negative buy price indicates removal of investment plus additional profits.

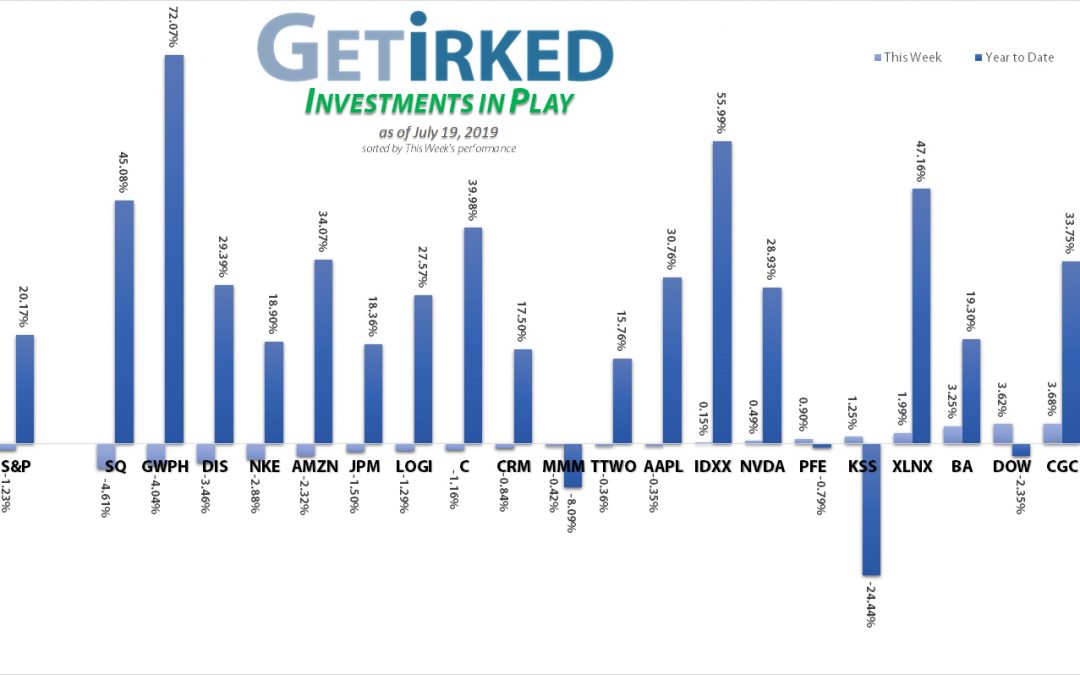

Highlights from the Week

Biggest Winner: IBM (IBM)

I know what you’re thinking – IBM?! How could IBM (IBM), the stodgy old typewriter-company-turned-computer-company-turned-cloud-play be the weekly winner?

Well, when you can’t beat ’em, buy ’em, and “buy ’em” IBM did, finally closing on their acquisition of Red Hat and reporting a quarter that, actually, wasn’t all that good, but, darn it, people like Red Hat so now they have to like IBM, right?

IBM popped +4.98% this week and even closed above a key trend line which might indicate great things ahead for this re-energized cloud play that still offers a dividend in excess of 4%.

Biggest Loser: Square (SQ)

Last week’s winner is this week’s loser as Square (SQ) dropped -4.61% over the course of the week. Don’t feel bad for everyone’s favorite payment processor, though, as Square did pop more than 10% last week.

Although Square hasn’t been the cool kid on the block for some time with newer names taking all the attention, the markets aren’t forgetting about Square as the stock is up more than +45% just this year.

Add to this that Square’s getting play from the media, too, as Jim Cramer of Mad Money suggested Facebook (FB) forget all this Libra cryptocurrency mess and just acquire Square.

Although said partly tongue-in-cheek, there have been rumblings that Square is a major takeover target. If you saw the takeover of one of my favorites – Cypress Semiconductor (CY) – just a few months ago, you know that takeovers can be very lucrative for shareholders (although it does mean we have to find somewhere else to put our newly-gotten gains).

This Week’s Moves

Dow Chemical (DOW): Position Reduction

Thanks to other companies’ positive earnings reports early in the week, Dow (DOW) popped over my per-share cost of $49.98 on Monday. Given this stock’s tendency to drop significantly below these levels, I placed a trailing stop to reduce my position and reserve some funds to add back in at lower levels should it retrace.

Dow has a dividend in excess of 5% which makes it a very tempting long-term investment, however my position was too close to the full allocation target of 4.76% of the portfolio. I wanted to lower my per-share cost by buying more at lower levels without having to become overweight in the position, so I placed the trailing stop.

The order filled at $50.58, a gain of just +1.2% over our per-share cost, but the move effectively reduced my allocation from 3.99% down to 3.11%. Naturally, Dow continued higher, hitting a weekly high of $52.64 (an extra 4%+) before pulling back, but I’d rather miss those gains than risk being overweight into a selloff.

I do plan to add more to this position if it pulls back to lower levels with its all-time low of $46.75 and recent low of $47.18, down 6.7%-7.57%, respectively, from where my order filled.

DOW closed the week at $51.52, up +1.86% from where I sold on Monday.

IBM (IBM): Profit-Taking

IBM (IBM) skyrocketed more than +5% during Thursday trading following a good – although oddly not that good – earnings report.

Analysts were pleased to see the integration of new acquisition, Red Hat Linux, going well, and, for some reason, the markets were very pleased to see it, resulting in some pretty spectacular upside for the stock.

IBM also reported that their foray into “The Cloud” is yielding profits, however, it’s not a significant part of their overall revenue at this time.

IBM has been trading in a downtrend for nearly a decade now, making it a riskier long-term investment than others even with its 4.5%+ dividend at these levels, so I placed a trailing stop order which filled at $150.11.

The order took profits on some of the shares I added back on May 13 of this year at $131.62, a gain of +14.05% in slightly longer than two months – not too shabby. The sale also lowered my position’s per-share cost -6.47% from $119.23 to $111.51 and the allocation size from 2.61% to 2.09% .

For the moment, I plan to hold the rest of the position as I wait to see what the market thinks of this “all-new” IBM. Some analysts believe if IBM can close and hold above $150, that it may finally break out and try to return its past all-time high of $215.90, 93.6% more than my new per-share cost.

IBM closed the week at $149.68, down -0.29% from where I sold on Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.