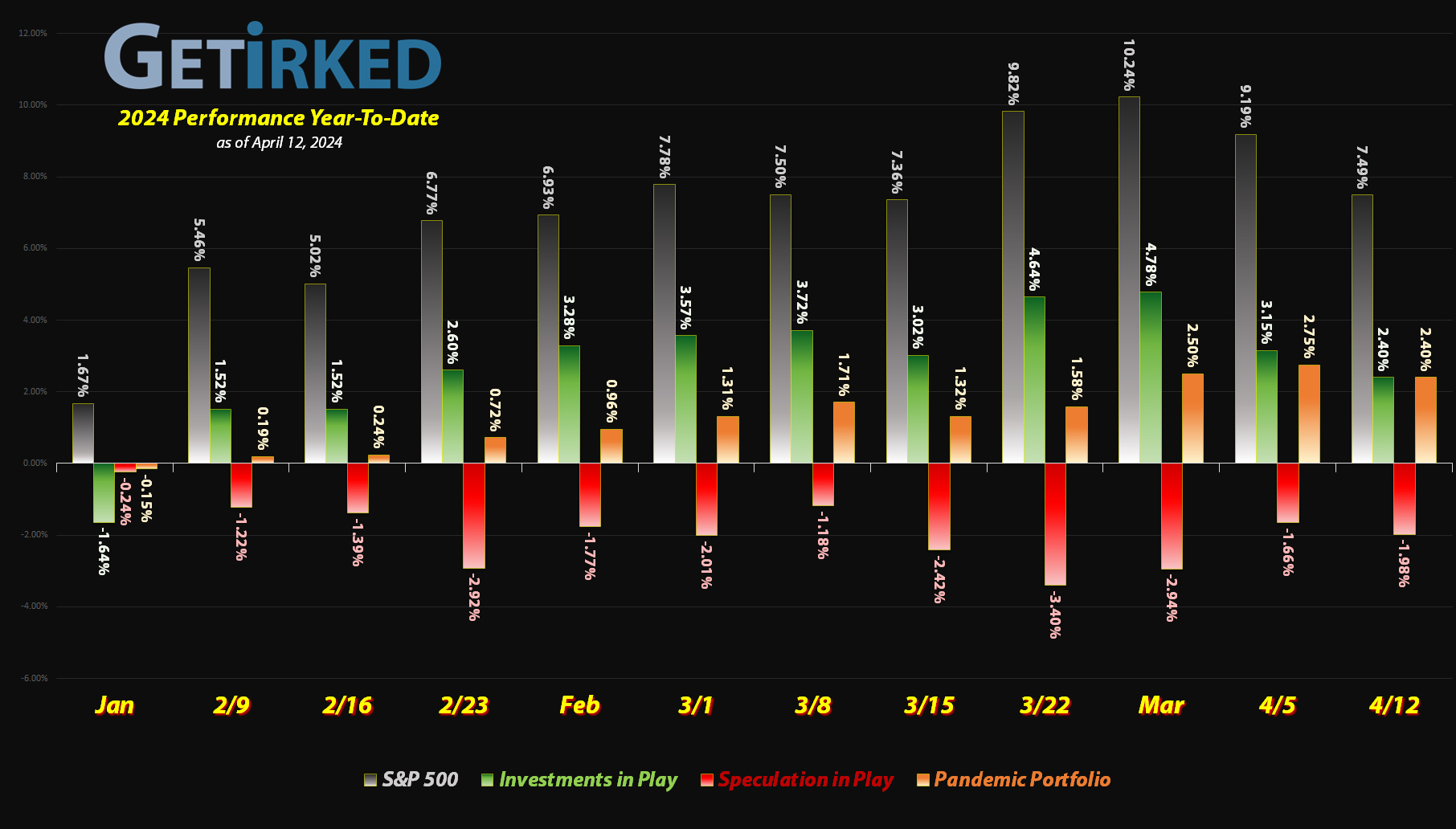

April 12, 2024

The Week’s Biggest Winner & Loser

Apple (AAPL)

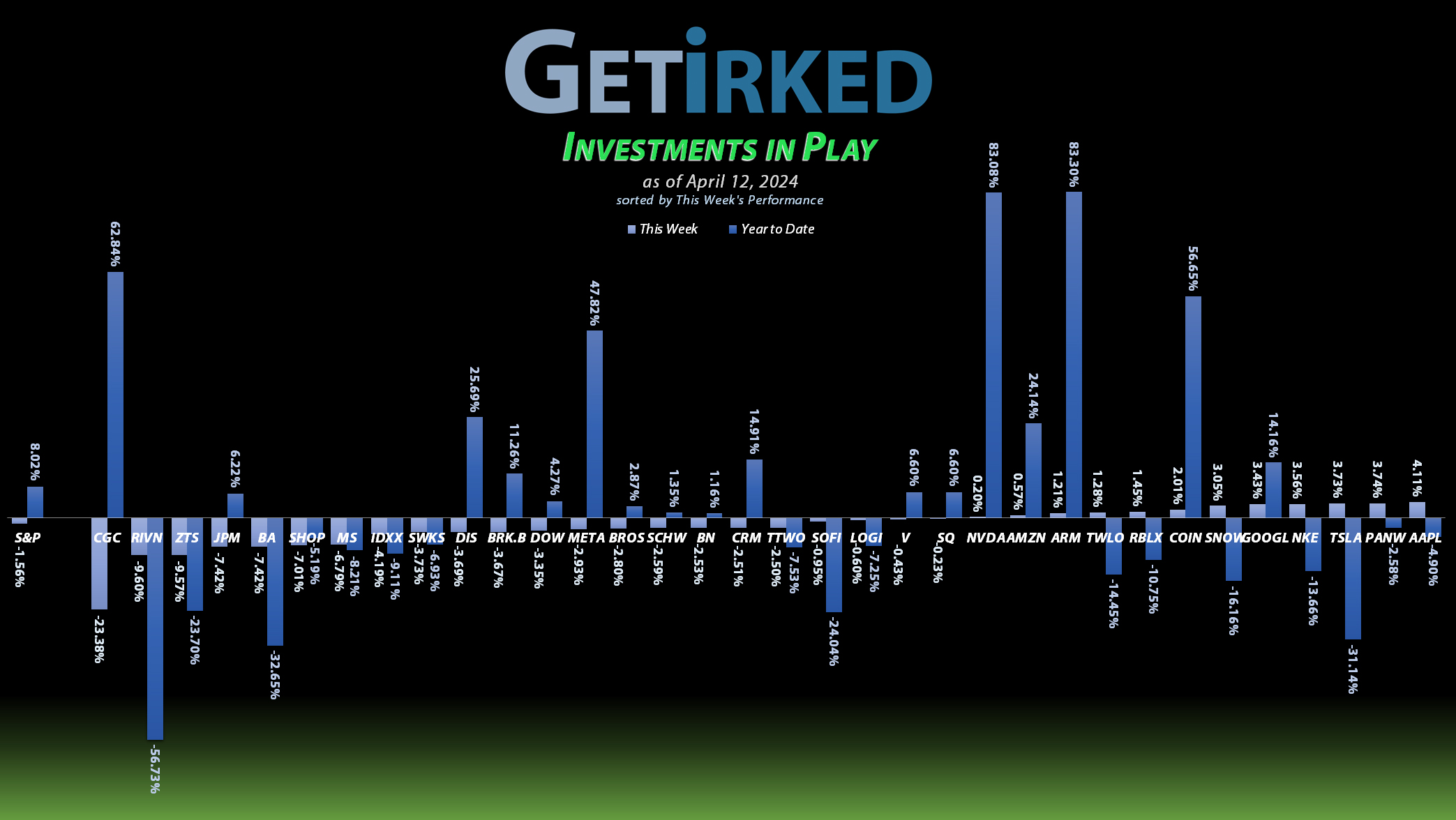

Guess who’s back? Back again! Apple (AAPL) finally said the two magic letters every investor has been hoping they’d say for months now: “A.I.”

That’s right! On Thursday, Apple announced that they would be introducing a new lineup of Macs including chips specially-designed to help with artificial intelligence computing. As a result, in a very bad, not very good week, Apple (AAPL) actually came in with a respectable +4.11% gain and earned the spot of the Week’s Biggest Winner.

Canopy Growth Corp (CGC)

With Canopy Growth (CGC) taking home the crown for three weeks in a row, it’s little surprise that when the market rolled over, the highest-flying speculative sector – cannabis – got punched directly in the face. Canopy lost a whopping -23.38% on no news aside from the air coming out of cannabis, and butted in as the Week’s Biggest Loser.

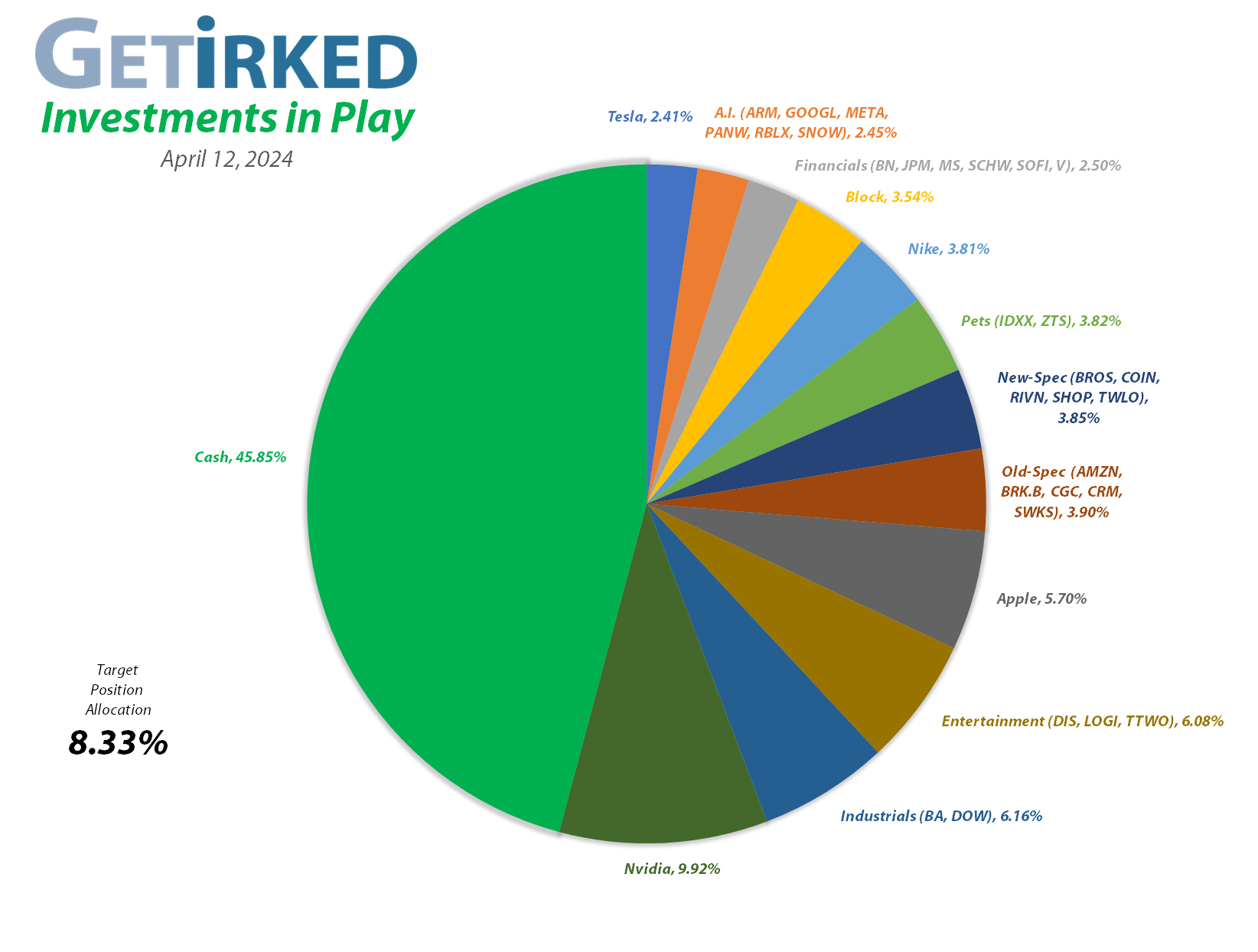

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+2243.53%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$565.75)*

Apple (AAPL)

+932.97%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$86.99)*

Logitech (LOGI)

+721.46%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+616.94%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$182.25)*

Block (SQ)

+573.65%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Skyworks (SWKS)

+473.14%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.05)*

Tesla (TSLA)

+473.12%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

IDEXX Labs (IDXX)

+439.81%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+371.50%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$7.60)*

Dow (DOW)

+351.40%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$2.25)*

Amazon (AMZN)

+279.85%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+233.62%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+196.43%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$18.15)*

JP Morgan (JPM)

+141.24%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$81.50)*

Alphabet (GOOGL)

+138.74%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $66.07

Arm Hldgs (ARM)

+131.66%*

1st Buy 9/14/2023 @ $57.28

Current Per-Share: (-$24.50)*

Meta (META)

+129.14%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: (-$323.00)*

Take Two (TTWO)

+119.98%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Morgan Stan (MS)

+111.46%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $40.80

SoFi (SOFI)

+92.91%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Berkshire (BRK.B)

+83.44%*

1st Buy 8/2/2019 @ $199.96

Current Per-Share: (-$2,281.99)*

Visa (V)

+52.20%*

1st Buy 5/9/2022 @ $194.00

Current Per-Share: (-$284.13)*

Brookfield (BN)

+30.87%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.03

Coinbase (COIN)

+15.08%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $213.54

Schwab (SCHW)

+13.42%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $61.76

Zoetis (ZTS)

+12.30%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $133.55

Palo Alto N (PANW)

+3.36%

1st Buy 2/22/2024 @ $270.00

Current Per-Share: $270.00

Dutch Bros (BROS)

-3.42%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.05

Roblox (RLBX)

-8.94%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.15

Shopify (SHOP)

-20.38%

1st Buy 2/12/2024 @ $91.00

Current Per-Share: $87.90

Snowflake (SNOW)

-23.35%

1st Buy 2/12/2024 @ $231.00

Current Per-Share: $206.90

Twilio (TWLO)

-32.70%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-61.80%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $23.90

Canopy (CGC)

-80.23%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Rivian (RIVN): Added to Position

When stocks drop through particular price levels, they really tend to crash. Rivian (RIVN) did that this week when it lost support at the key round-number psychological support of $10.00 on Thursday. It actually dipped down and touched my next buy target at $9.38 on Thursday, but my buy order didn’t get filled.

When I’ve seen that kind of price action in the past, I know that the stock typically has another dip down on the following day, so I lowered my buy target to $9.24. Like clockwork, Rivian dipped lower on Friday, hit my new buy target – which filled this time – and added 2.79% to my position. The buy lowered my per-share cost -4.63% from $25.06 down to $23.90, a total reduction of -81.18% from where I initially started this position at $127.00 on November 12, 2021.

I do know that it’s going to be a long slog with this EV company, but unlike the other smaller EV companies out there, I truly believe Rivian has what it takes to succeed for the long term, so I will continue adding to it. My next buy target is $7.86, a price calculated using the Fibonacci Method, and my next sell target is $24.30, just below the highs Rivian saw in late 2023.

RIVN closed the week at $9.13, down -1.19% from where I added.

Visa (V): Added to Position

Visa (V) broke down a bit on Tuesday, breaking through it low from last week and triggering my next buy order which added 1.64% to the position at $273.70. Since I’m only adding profits back into the position at this time, the buy raised my per-share “cost” +$226.45 from -$510.58 to -$226.45 (a negative per-share cost indicates all capital has been removed in addition to $226.45 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $265.89, above the next key area of support, and I still have no plans to take profits, yet, as I want to rebuild this small position.

V closed the week at $276.09, up +0.87% from where I added on Tuesday.

Zoetis (ZTS): Added to Position

On Friday, Zoetis (ZTS), the animal pharmaceutical company, really broke down on the back of reports of inflation and the big banks giving frightening forward guidance. ZTS collapsed through my next buy order which filled at $151.49, adding 4.26% to my position and locking in a -21.32% discount on shares I sold last year for $192.53 on December 13, 2023.

The buy raised my cost basis +3.41% from $129.15 to $133.55. As many of my readers know, I absolutely hate raising my cost basis, but I believe in Zoetis for the long term and my new cost basis still represents a -15.234% reduction from where I initially opened my position on June 13, 2022 at $157.55.

From here, my next buy target is $132.94, just under my new cost basis and above a past point of support, and my next sell target is $201.89, just under the high Zoetis saw late in 2023.

ZTS closed the week at $149.98, down -1.00% from where I added Friday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.