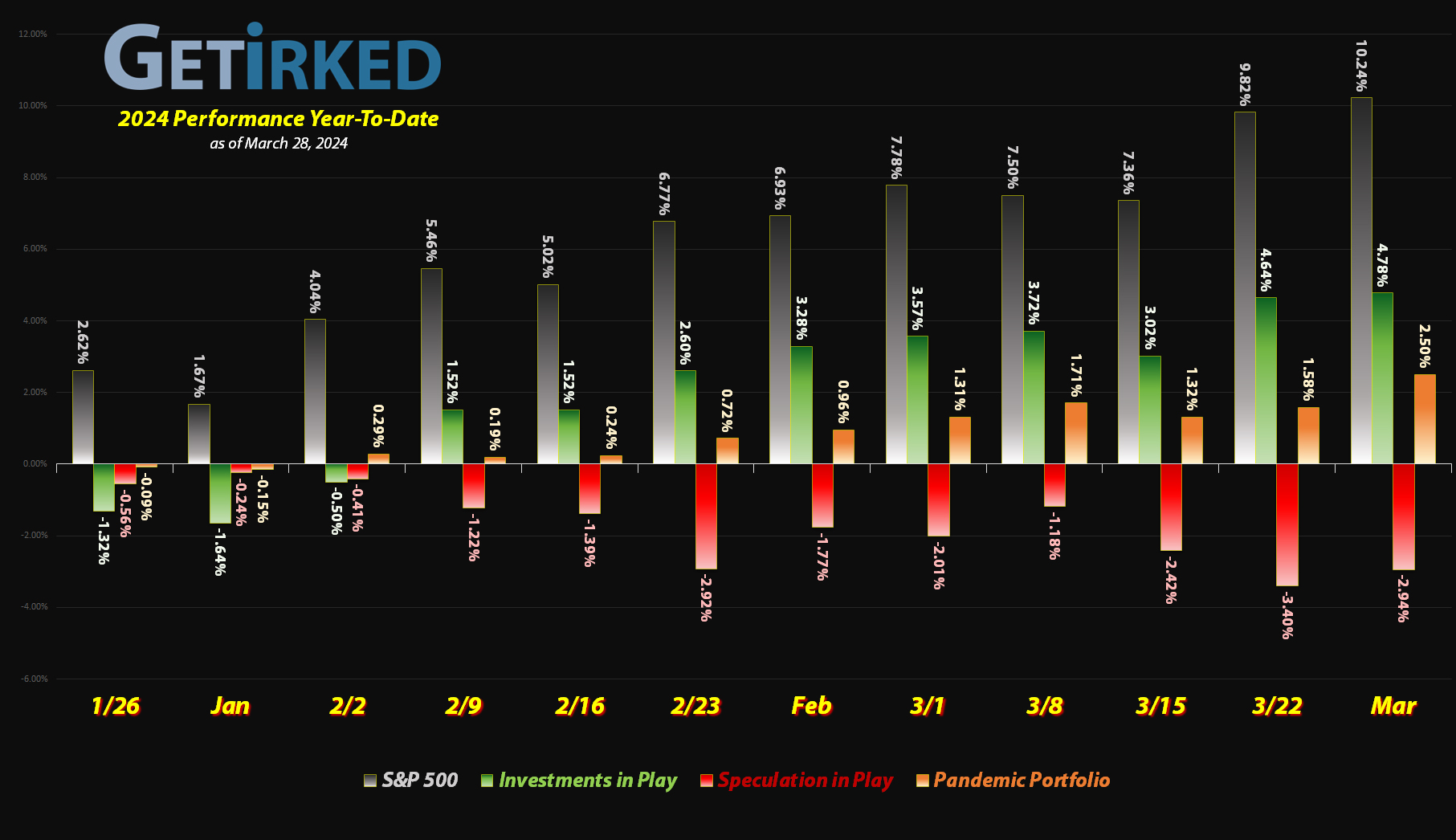

March 28, 2024

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

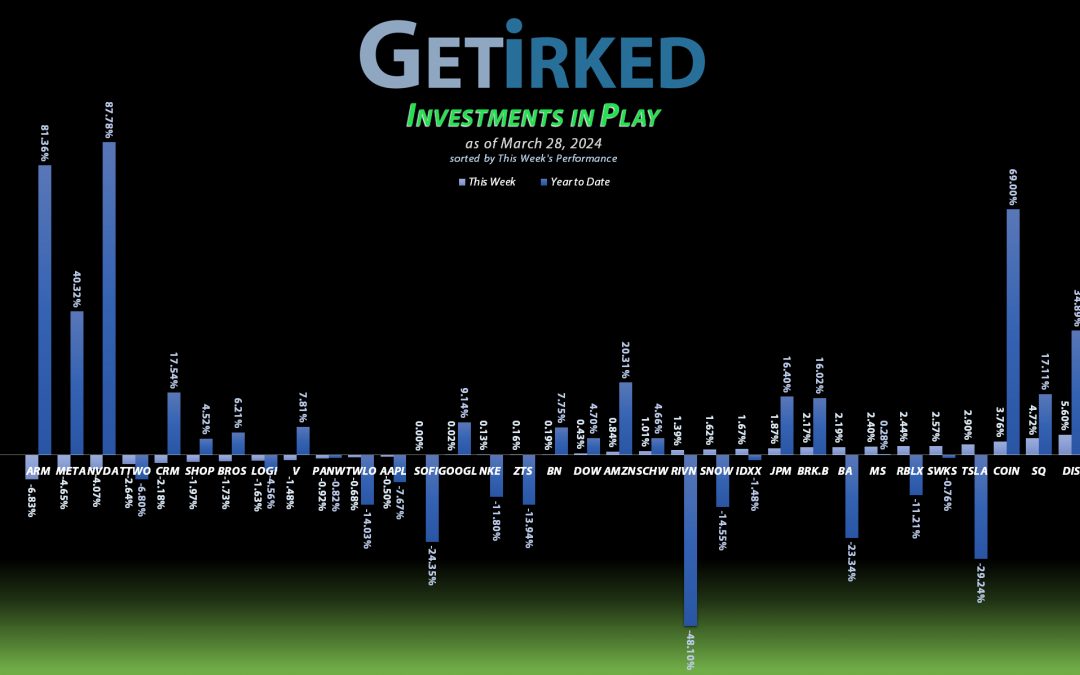

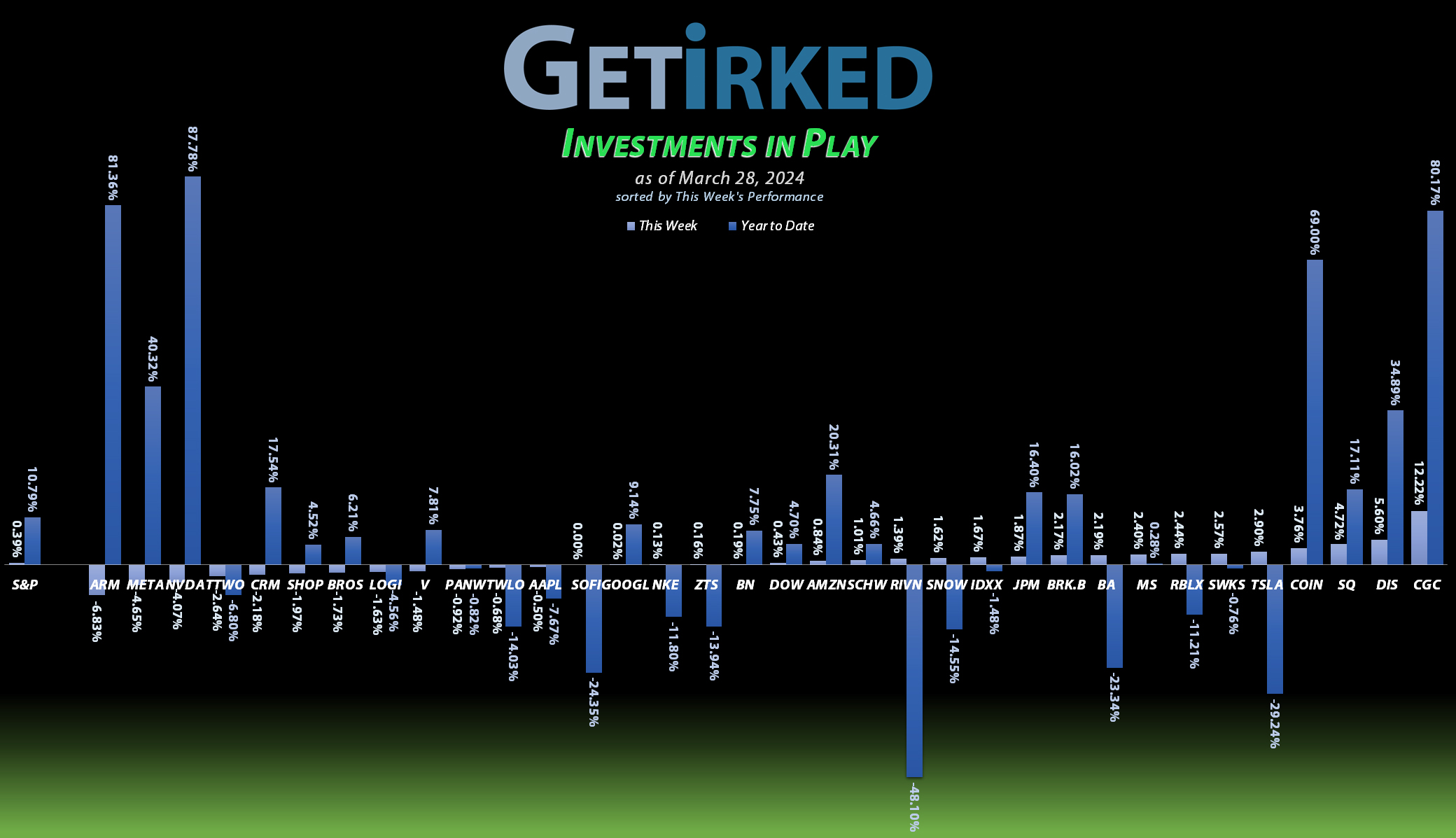

Thanks to the growing popularity of the cannabis sector, Canopy Growth Corporation (CGC) just scored a two-in-a-row for the spot of the Week’s Biggest Winner. This beaten-up pot stock rose another +12.22% this week, enough to slide in as #1 in the portfolio.

Arm Holdings (ARM)

Artificial intelligence stocks took a breather this week, and the ones that were especially volatile high flyers like Arm Holdings (ARM) got smacked a bit harder than others. ARM lost -6.83% this week, and while it’s still up an astounding +81.36% YTD, that was enough of a loss to bring it in as the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+2278.59%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$565.77)*

Apple (AAPL)

+914.78%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$86.99)*

Logitech (LOGI)

+740.56%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+658.05%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$182.25)*

Block (SQ)

+604.08%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Skyworks (SWKS)

+496.76%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.05)*

Tesla (TSLA)

+483.55%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

IDEXX Labs (IDXX)

+465.60%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+376.98%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+352.43%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.318*

Amazon (AMZN)

+268.12%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+241.47%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+208.75%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$18.15)*

JP Morgan (JPM)

+150.60%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$81.50)*

Arm Hldgs (ARM)

+130.49%*

1st Buy 9/14/2023 @ $57.28

Current Per-Share: (-$24.50)*

Alphabet (GOOGL)

+128.25%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $66.07

Meta (META)

+125.12%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Morgan Stan (MS)

+130.80%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $40.80

Take Two (TTWO)

+121.80%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

SoFi (SOFI)

+92.12%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Berkshire (BRK.B)

+83.97%*

1st Buy 8/2/2019 @ $199.96

Current Per-Share: (-$2,281.99)*

Visa (V)

+52.31%*

1st Buy 5/9/2022 @ $194.00

Current Per-Share: (-$510.58)

Brookfield (BN)

+39.06%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Zoetis (ZTS)

+31.02%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.15

Coinbase (COIN)

+24.16%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $213.54

Schwab (SCHW)

+17.13%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $61.76

Palo Alto N (PANW)

+5.23%

1st Buy 2/22/2024 @ $270.00

Current Per-Share: $270.00

Dutch Bros (BROS)

-0.15%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.05

Roblox (RLBX)

-9.42%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.15

Shopify (SHOP)

-12.21%

1st Buy 2/12/2024 @ $91.00

Current Per-Share: $87.90

Snowflake (SNOW)

-21.89%

1st Buy 2/12/2024 @ $231.00

Current Per-Share: $206.90

Twilio (TWLO)

-32.36%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-56.31%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $25.06

Canopy (CGC)

-78.12%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Introducing the Entertainment Basket!

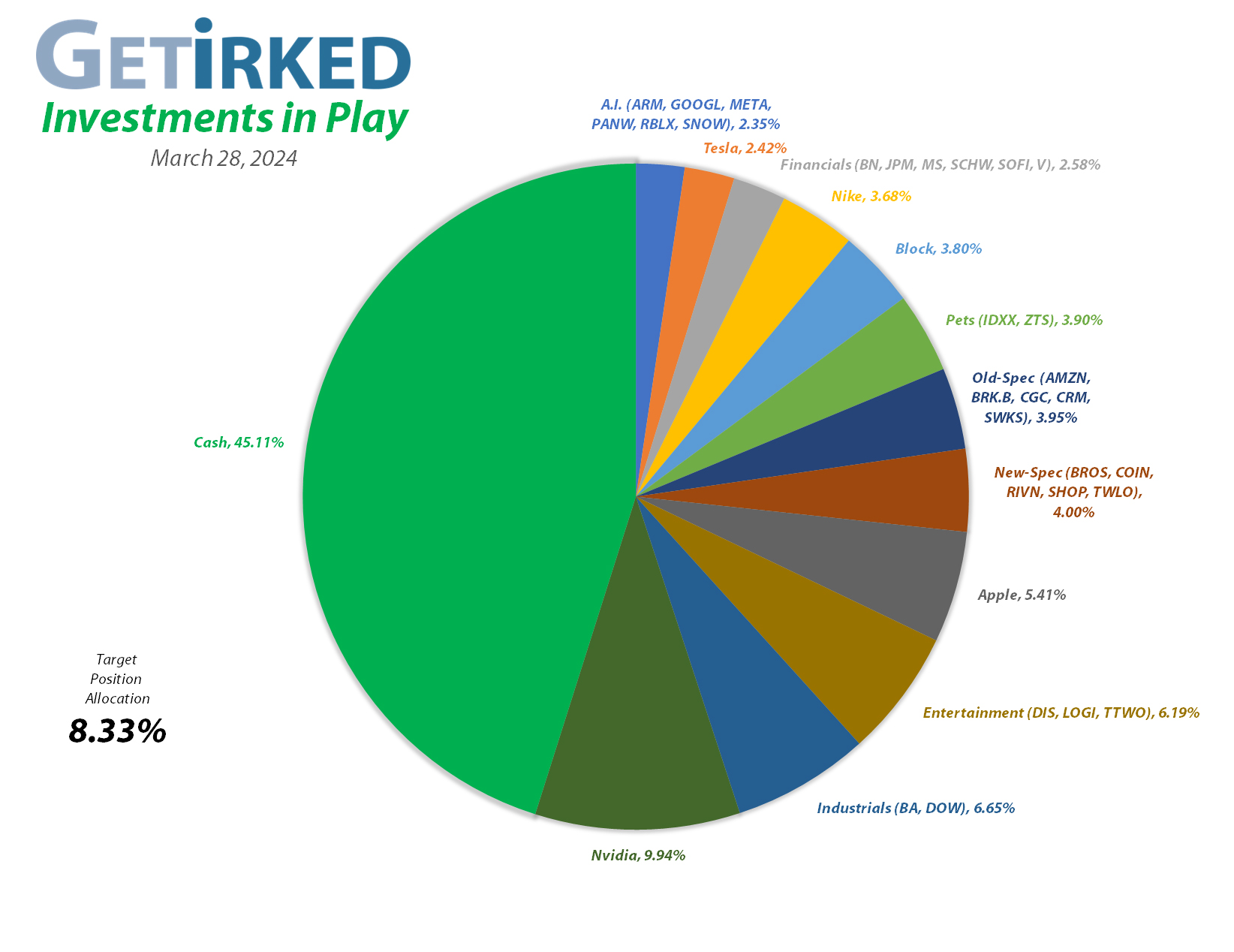

I regularly review my portfolio allocations and try to find ways to consolidate positions into baskets. Doing this allows the bigger winning positions to remain bigger as it decreases the number of positions, thereby increasing the Target Position Allocation.

This week, I realized that I had two individual allocations, Disney (DIS) and Logitech (LOGI), which both have all the capital removed. I wouldn’t be able to add enough back into them to increase their allocation to the target as I have a key rule: Never turn a winner into a loser.

Once I’ve removed all of an investment’s original capital, I can only add profits back in, I can never give the position a positive cost basis again. When I had added capital back into positions in the past, it ended extremely poorly (see: Canopy Growth Corporation).

I decided to roll Logitech and Disney in with Take Two Interactive (TTWO) (previously in the Old-Spec Basket) to create an Entertainment Basket since Logitech makes gaming peripherals, Take Two Interactive makes video games, and Disney, well, quite obviously, makes entertainment in the form of media, theme parks, experiences, and so much more.

Doing this reduced the number of positions by two (2) since each Disney and Logitech had their own allocation, and increased the Target Position Allocation substantially from 7.14% to 8.33%.

Disney (DIS): Profit-Taking

Disney’s (DIS) incredible rally (incredible for Disney, I guess…) continued this week with my next sell order getting triggered on Tuesday, selling 6.53% of my position at $119.61. The sale locked in +186.83% in gains on some of the shares I bought when I originally opened the position at $41.70 on February 14, 2012.

The sale lowered my per-share “cost” -$9.00 from -$9.15 to -$18.15 (a negative per-share cost indicates all capital has been removed in addition to $18.15 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $142.19, just under a past point of resistance, and my next buy target is $91.29, just above a key point of support from the past.

DIS closed the week at $122.36, up +2.30% from where I took profits Tuesday.

Meta (META): Dividend Reinvestment

Meta (META), the artist formerly known as Facebook, paid out its first quarterly dividend on Wednesday. At $0.50/shr each quarter, this dividend isn’t going to light the world on fire (the annual yield was 0.40% at the time of payout), I’m never going to look free money in the mouth … that’s a heck of a mixed metaphor, there.

After reinvestment, the dividend had no effect on my cost basis, so it also had no effect on my buy target which remains at $388.89, above a past point of support.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.