March 22, 2024

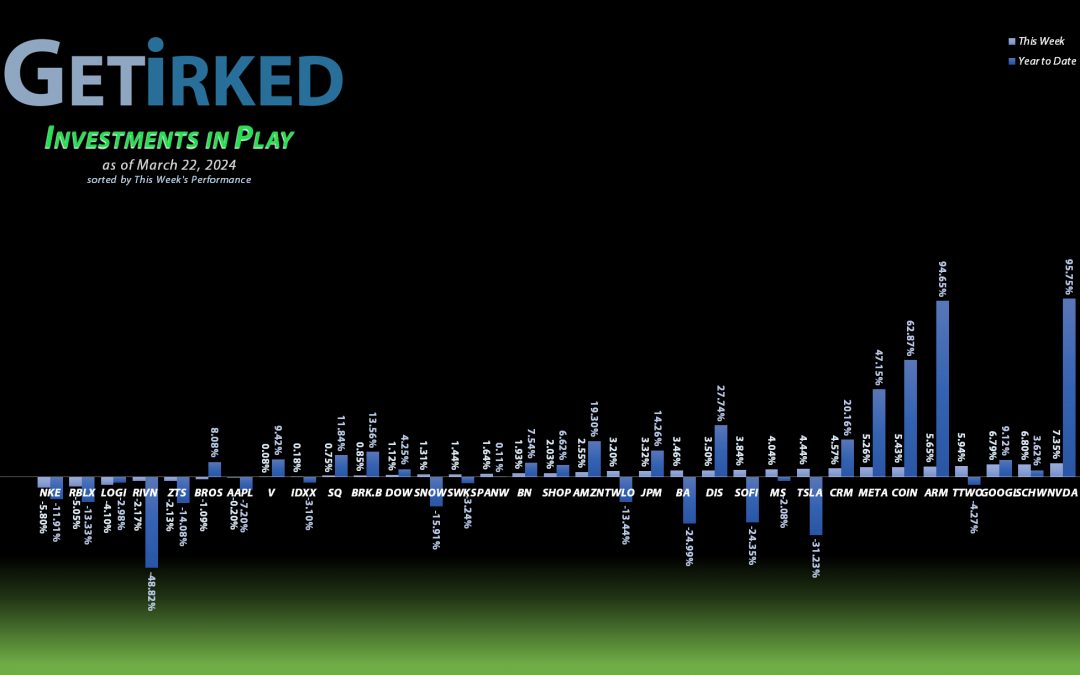

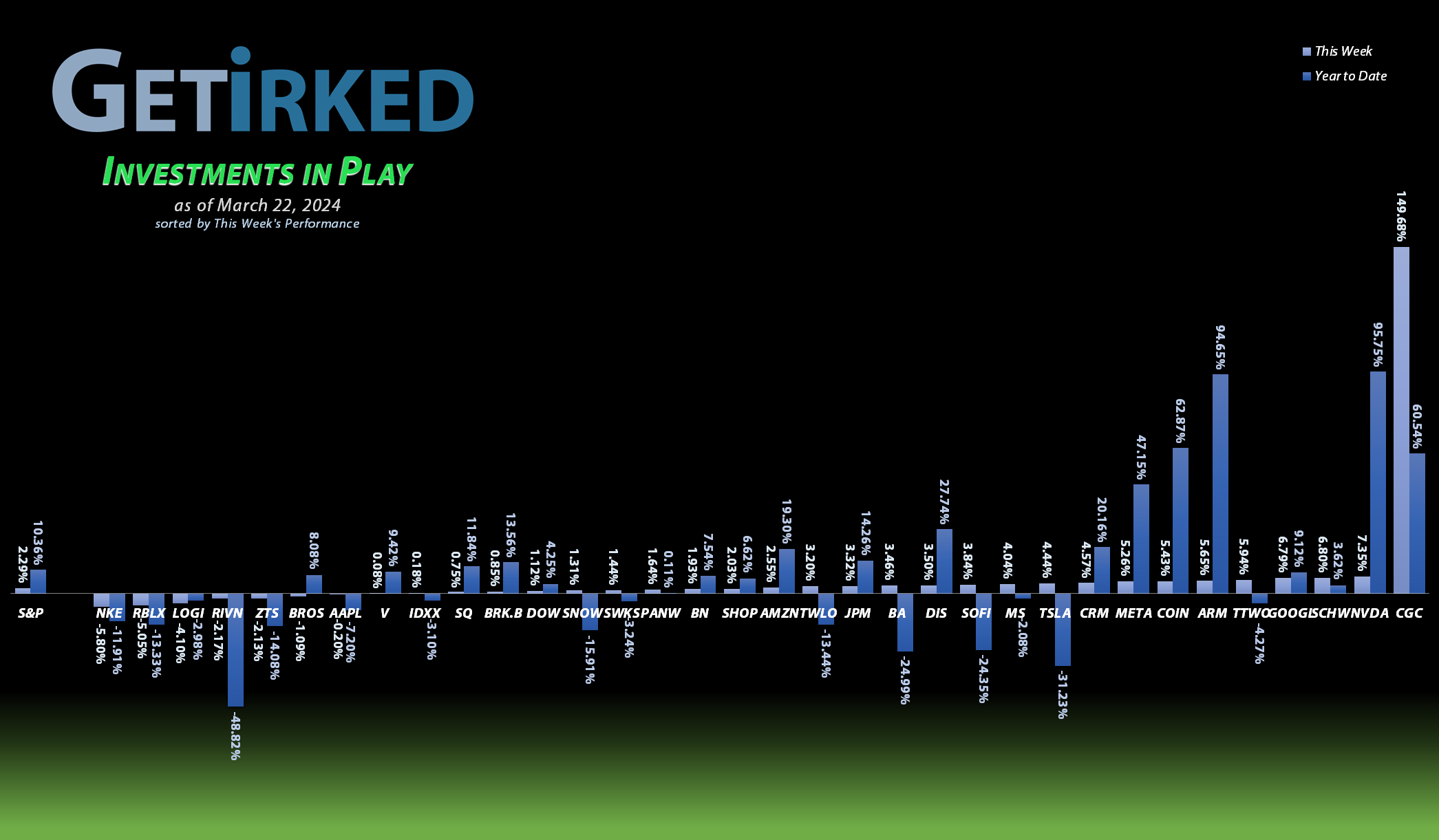

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

We’re cooking with gas now! Obviously, the entire cannabis sector is smelling out the DEA reclassification which must be coming any day now. Canopy Growth Corporation (CGC), my absolute POS play on the cannabis space, rallied an astounding +149.68% this week, taking on all comers and destroying the performance of the rest of the portfolio, easily taking the spot of the Week’s Biggest Winner.

Before I get too excited, it’s worth noting that I’m still down a mind-blowing -80.51% in my position even after this week’s insane run… LOL!

Nike (NKE)

My beloved Nike (NKE) reported earnings this week and the results are not good. Nike seems to have forgotten how to innovate, and must now invest a lot of revenue into coming up with ways to beating the fierce competitors currently nibbling at their… sneakers.

I do have faith in Nike for the long-term – they’ve been in this exact spot before and always come out ahead – but investors weren’t so sure, selling NKE down -5.80% to swing in as the Week’s Biggest Loser.

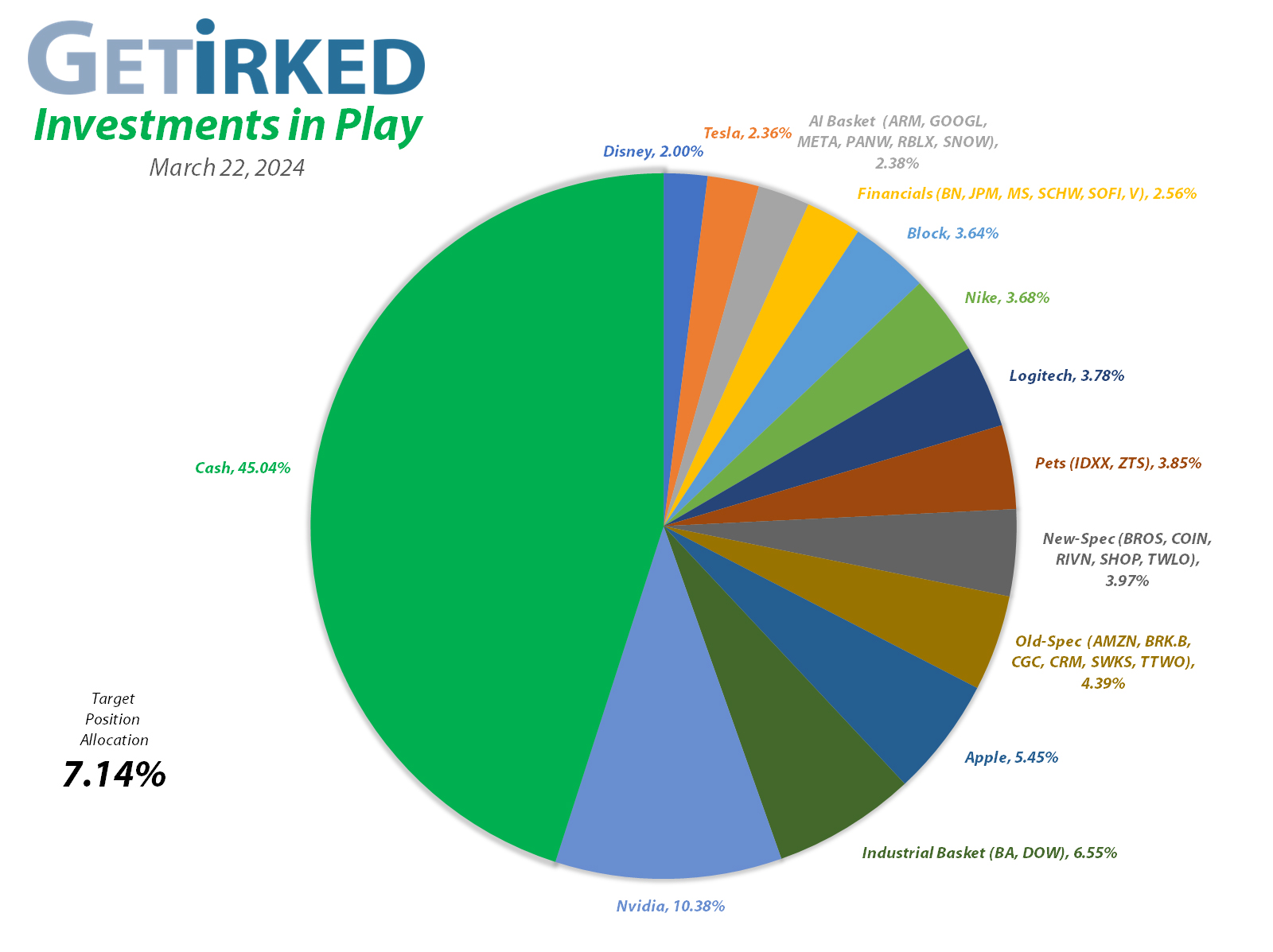

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+2338.06%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$565.77)*

Apple (AAPL)

+917.86%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$86.99)*

Logitech (LOGI)

+751.79%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+650.90%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$182.25)*

Block (SQ)

+588.88%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Skyworks (SWKS)

+487.16%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.05)*

Tesla (TSLA)

+472.63%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

IDEXX Labs (IDXX)

+459.97%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+376.19%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+350.86%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.318*

Amazon (AMZN)

+265.04%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+248.84%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+198.69%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$9.15)*

JP Morgan (JPM)

+148.68%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$81.50)*

Arm Hldgs (ARM)

+138.49%*

1st Buy 9/14/2023 @ $57.28

Current Per-Share: (-$24.50)*

Meta (META)

+128.70%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Alphabet (GOOGL)

+128.21%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $66.07

Take Two (TTWO)

+127.73%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Morgan Stan (MS)

+125.31%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $40.80

SoFi (SOFI)

+92.12%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Berkshire (BRK.B)

+83.70%*

1st Buy 8/2/2019 @ $199.96

Current Per-Share: (-$2,281.99)*

Visa (V)

+52.60%*

1st Buy 5/9/2022 @ $194.00

Current Per-Share: (-$510.58)

Brookfield (BN)

+38.76%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Zoetis (ZTS)

+30.77%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.15

Coinbase (COIN)

+19.66%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $213.54

Schwab (SCHW)

+15.89%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $61.76

Palo Alto N (PANW)

+6.21%

1st Buy 2/22/2024 @ $270.00

Current Per-Share: $270.00

Dutch Bros (BROS)

+1.63%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.05

Shopify (SHOP)

-10.42%

1st Buy 2/12/2024 @ $91.00

Current Per-Share: $87.90

Roblox (RLBX)

-11.60%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.15

Snowflake (SNOW)

-23.17%

1st Buy 2/12/2024 @ $231.00

Current Per-Share: $206.90

Twilio (TWLO)

-31.89%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-56.91%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $25.06

Canopy (CGC)

-80.51%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

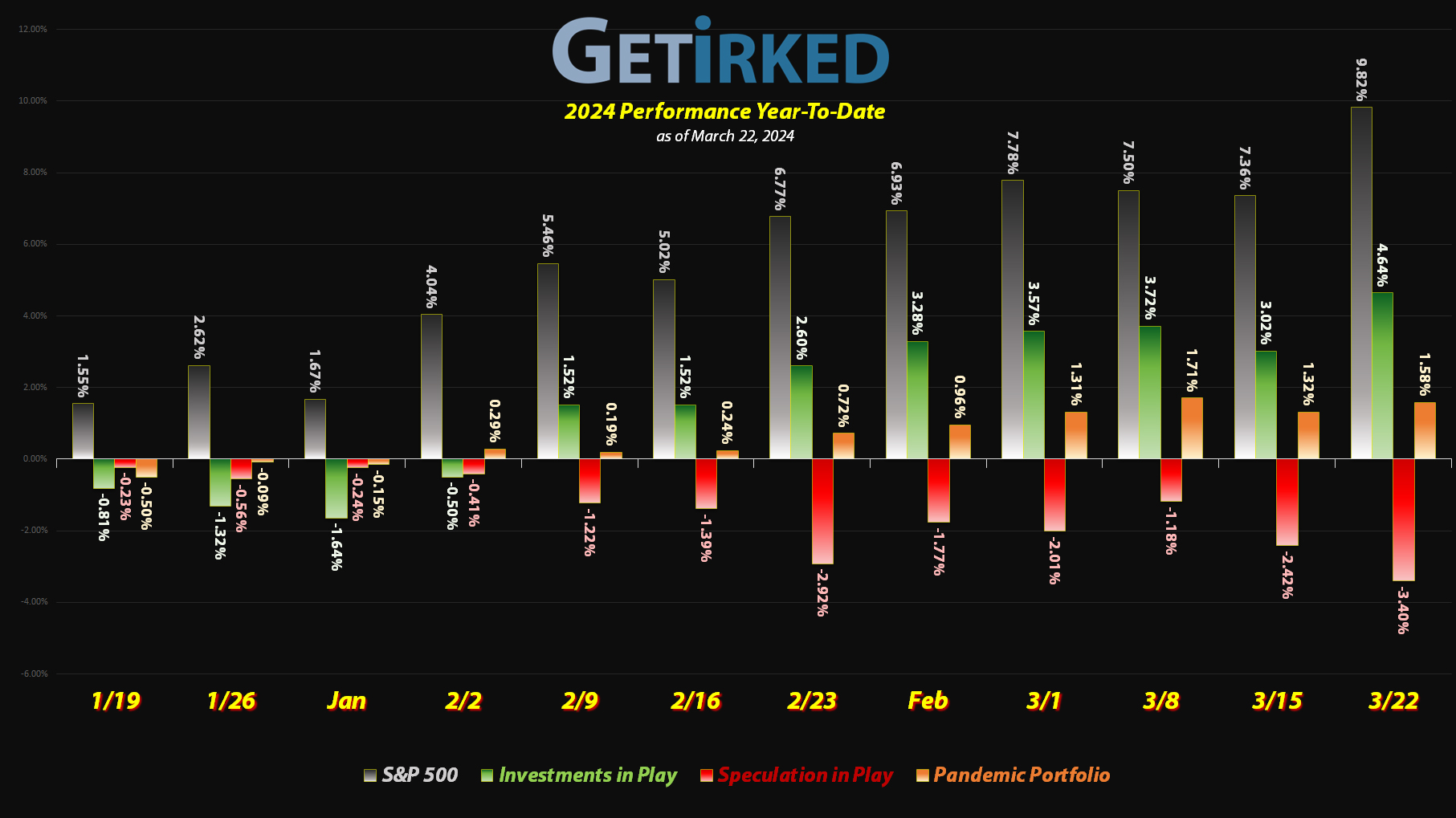

Boeing (BA): Added to Position

After recovering mightily toward the end of 2023, Boeing (BA) has once again proven itself to be the gang who can’t shoot straight. Following the door plug blowout in January, investigations into the company found a series of ill-advised, poorly-assembled, and incompetently-managed projects and planes. Not good for any company, but particularly not good if you’re building flying coffins… *cough*… airplanes.

As I forecasted in my recent video on Boeing, the 20% selloff pundits were predicting wasn’t nearly a deep enough cut. As of Monday, Boeing had sold off nearly –34% from its high just in December 2023.

Boeing finally broke through support on Monday, triggering my next buy order which filled at $177.82 and added 4.87% to my position. This buy locked in a -25.19% discount replacing shares I sold for $237.68 back on December 8, 2023. The buy raised my per-share “cost” +8.99% from -$200.25 to -$182.25 (a negative per-share cost indicates all capital has been removed in addition to $182.25 per share added to the portfolio’s bottom line in addition to each share’s current value).

It might confuse some why I keep adding to this position. While I do believe in Boeing for the long-term (it’s one of only two plane manufacturers on the planet), it’s also been one of the most profitable long-term positions in the portfolio, having opened it on February 12, 2012. The position has added more than 7X the original investment to the portfolio’s bottom line, not including the value of the shares currently held.

From here, my next buy target is much lower at $142.30, above a past point of support Boeing saw not too long ago in October 2022, and my next sell target is $266.83, just under Boeing’s high in December 2023.

BA closed the week at $188.91, up +6.24% from where I added Monday.

Dutch Bros (BROS): Profit-Taking

Dutch Bros (BROS) caught a bid on Thursday and triggered my next sell order which filled at $35.05, selling 5.00% of my position and locking in +54.41% in gains on shares I bought last year for $22.70 on September 28, 2023. The sale only lowered my per-share cost -0.30% from $33.15 to $33.05, but, more importantly, locked in those gains and reduced exposure on this notoriously volatile stock.

From here, my next sell target is $38.45, slightly below a past point of resistance, and my next buy target is $25.70, slightly above the low BROS saw just a few weeks ago.

BROS closed the week at $33.59, down -4.17% from where I took profits Thursday.

JPMorgan (JPM): Profit-Taking

When JPMorgan (JPM) kept making all-time highs, I started to keep a careful eye on it. Last week, JPM encountered resistance just under $192.00, so I decided to take profits if it made a stab at that level again, which it did on Monday. My sale order filled at $191.51, selling 15.41% of my position.

The sale locked in +87.20% in gains on shares I bought for $102.30 when I initially opened the position on October 26, 2017. The sale lowered my per-share “cost” -$42.08 from -$39.42 to -$81.50 (a negative per-share cost indicates all capital has been removed in addition to $81.50 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $165.89, above a point of support JPMorgan saw earlier in 2024, and I’m going to hold the remainder of my position until we see where JPM heads from here.

JPM closed the week at $196.70, up +2.64% from where I took profits Monday.

Morgan Stanley (MS): Profit-Taking

The financials rallied like crazy after Wednesday’s Fed meeting with Morgan Stanley (MS) triggering my next sell order on Thursday, selling 30.11% of the position at $93.58. The sale locked in +12.07% in gains on shares I bought for $83.50 when I originally opened the position on April 25, 2022.

The sale lowered my per-share cost -28.03% from $56.69 to $40.80. From here, my next buy target is $74.68, slightly above a key point of resistance Morgan Stanley has seen several times in the past, and my next sell target is $109.25, just under Morgan Stanley’s all-time high where I will remove all remaining capital and some profits from the position.

MS closed the week at $91.92, down -1.77% from where I took profits Thursday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.