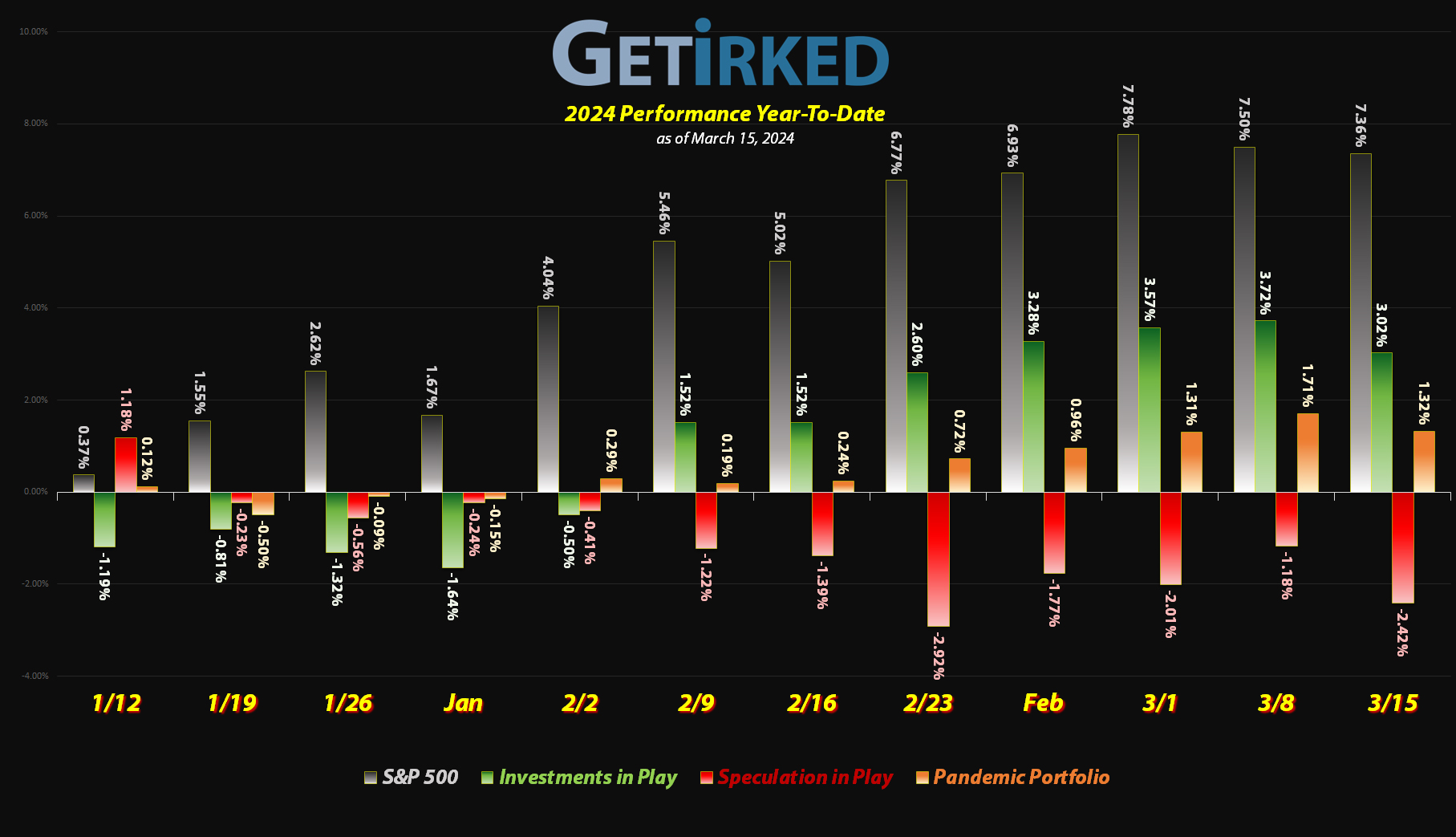

March 15, 2024

The Week’s Biggest Winner & Loser

Dutch Bros (BROS)

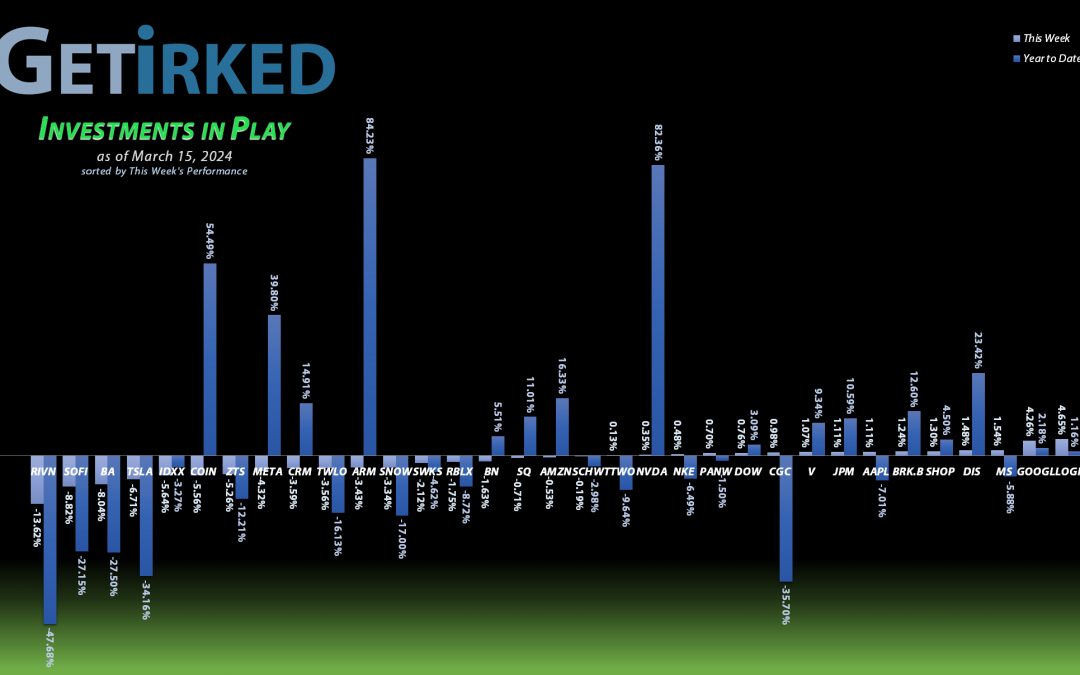

It did strike me as odd when Dutch Bros (BROS) reported an excellent quarter a few weeks ago and the stock barely moved. It seems that investors woke up this week, because, despite a down week for much of the market, BROS popped +12.24%, easily snagging the spot of the Week’s Biggest Winner.

Rivian (RIVN)

After an impressive reveal of Rivian’s (RIVN) next vehicle really impressed investors last week, it seems the reality of how no one wants to buy any Electric Vehicle (EV) really hit home this week as investors gave it all back. RIVN dropped -13.62% this week and parked in the spot of the Week’s Biggest Loser.

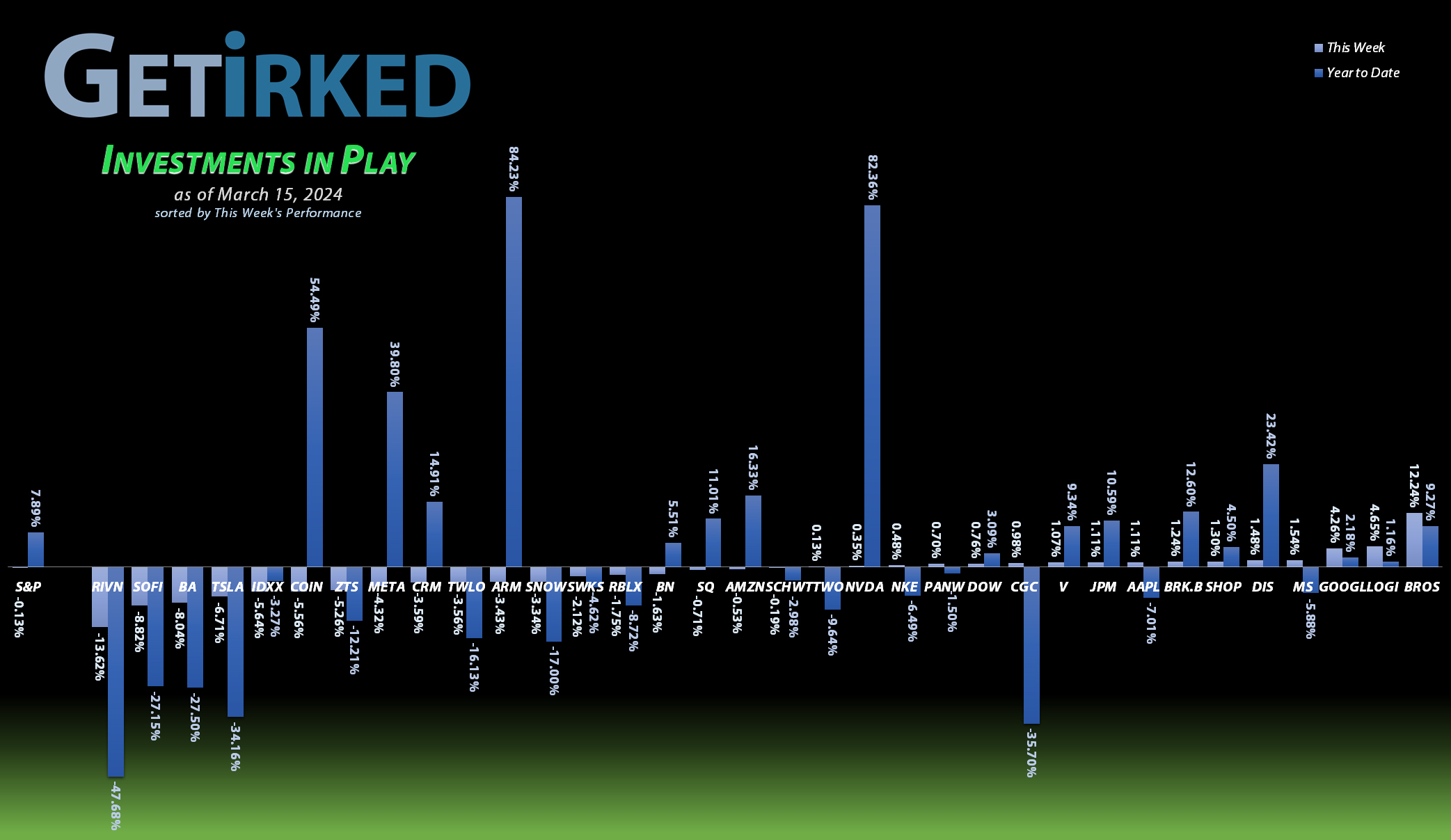

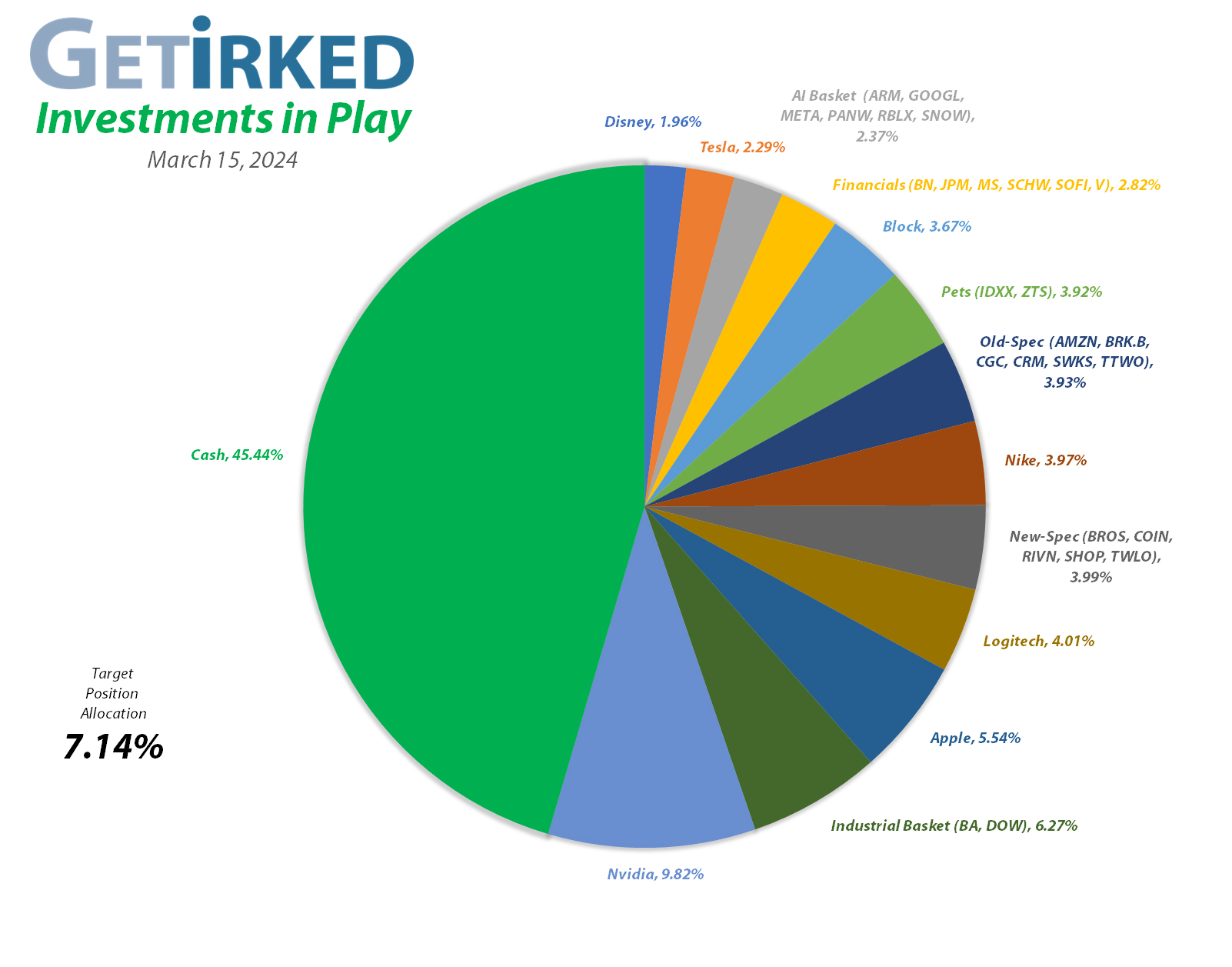

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+2238.06%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$565.77)*

Apple (AAPL)

+919.06%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$86.99)*

Logitech (LOGI)

+781.21%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+639.32%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Block (SQ)

+586.49%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Skyworks (SWKS)

+481.93%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.05)*

IDEXX Labs (IDXX)

+459.38%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Tesla (TSLA)

+456.65%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Nike (NKE)

+397.42%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+347.05%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.318*

Amazon (AMZN)

+255.96%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+233.71%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+192.49%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$9.15)*

JP Morgan (JPM)

+145.14%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$39.42)*

Arm Hldgs (ARM)

+132.22%*

1st Buy 9/14/2023 @ $57.28

Current Per-Share: (-$24.50)*

Meta (META)

+124.76%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Take Two (TTWO)

+114.96%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Alphabet (GOOGL)

+113.69%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $66.07

SoFi (SOFI)

+85.01%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Berkshire (BRK.B)

+83.59%*

1st Buy 8/2/2019 @ $199.96

Current Per-Share: (-$2,281.99)*

Morgan Stan (MS)

+55.91%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $56.69

Visa (V)

+52.57%*

1st Buy 5/9/2022 @ $194.00

Current Per-Share: (-$510.58)

Brookfield (BN)

+36.17%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Zoetis (ZTS)

+33.62%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.15

Coinbase (COIN)

+13.50%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $213.54

Schwab (SCHW)

+8.55%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $61.76

Palo Alto N (PANW)

+4.50%

1st Buy 2/22/2024 @ $270.00

Current Per-Share: $270.00

Dutch Bros (BROS)

+2.38%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Roblox (RLBX)

-6.90%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.15

Shopify (SHOP)

-12.23%

1st Buy 2/12/2024 @ $91.00

Current Per-Share: $87.90

Snowflake (SNOW)

-24.13%

1st Buy 2/12/2024 @ $231.00

Current Per-Share: $206.90

Twilio (TWLO)

-34.00%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-55.95%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $25.06

Canopy (CGC)

-92.19%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Coinbase (COIN): Profit-Taking

Coinbase (COIN) gapped up on Monday morning along with Bitcoin hitting new all-time highs before pulling back sharply. Fortunately, the movement wasn’t quick enough and my next sell order filled at $270.00, selling 16.67% of the allocation and finally weighting COIN correctly in its speculative basket.

The sale locked in +36.00% in gains on shares I bought for $172.80 on January 24, 2022 and lowered my per-share cost -4.22% from $222.95 to $213.54. From here, my next sell target is $293.89, just under a past point of resistance, and my next buy target is $120.31, slightly above the lows Coinbase saw less than two months ago.

COIN closed the week at $242.36, down -10.24% from where I took profits Monday.

Dow (DOW): Dividend Reinvestment

Dow (DOW) paid out its ample quarterly dividend on Monday which, after reinvesting, raised my per-share “cost” +6.25% from -$0.32 to -$0.318 (a negative per-share cost indicates all capital has been removed in addition to $0.318 per share added to the portfolio’s bottom line in addition to each share’s current value).

Why did my cost basis raise after receiving a dividend?

Whenever all capital has been removed from a position, a dividend reinvestment adds more shares to the position, not more profits. So, the profit in the position is divided by more shares and raises the per-share cost even though the value of the entire position is also increased by the new shares from the dividend.

Dow’s been slowly rallying higher and higher since October, but since I took all of my investing capital out a long time ago and it pays out 4.876% in dividends annually at its current prices, I have no problem hanging on for the long term. My next sell target is $59.93, just below a past point of resistance, and my next buy target is $48.59, above a past point of support.

Skyworks Solutions (SWKS): Dividend Reinvestment

Skyworks Solutions (SWKS) paid out its quarterly dividend on Tuesday which, after reinvesting, raised my per-share “cost” +0.64% from -$34.27 to -$34.05 (a negative per-share cost indicates all capital has been removed in addition to $34.05 per share added to the portfolio’s bottom line in addition to each share’s current value).

Why did my cost basis raise after receiving a dividend?

Whenever all capital has been removed from a position, a dividend reinvestment adds more shares to the position, not more profits. So, the profit in the position is divided by more shares and raises the per-share cost even though the value of the entire position is also increased by the new shares from the dividend.

Skyworks has been trading in a range since before the start of the year, but I have no interest in making any moves until it breaks out or breaks down from here. My next buy target is $85.58, slightly above the lows SWKS saw in November 2023, and my next sell target is $123.53, slightly below the highs SWKS saw in 2023.

Zoetis (ZTS): Dividend Reinvestment

Somehow, I overlooked that Zoetis (ZTS) paid out its quarterly dividend last week on Monday, March 4, which after reinvestment, lowered my cost basis -0.23% from $129.45 to $129.15.

Zoetis has taken an absolute pounding over the last few weeks, so my next buy target is much lower than here, down at $151.24, slightly above the low ZTS saw at the beginning of November 2023.

Since this position is still quite a bit smaller than I prefer, I do have a profit-taking price target, but not unless Zoetis makes a stab at its all-time with my target at $246.65, slightly below that high.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.