March 8, 2024

The Week’s Biggest Winner & Loser

Coinbase (COIN)

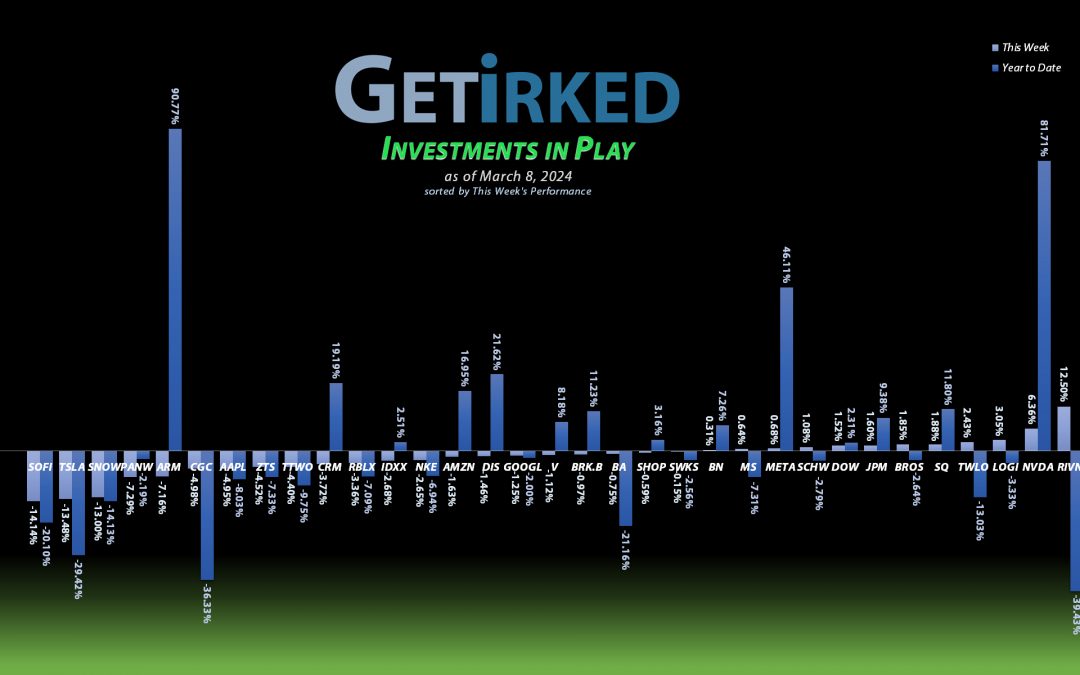

For a company whose stock was once left-for-dead in the $30s, Coinbase (COIN) has made a triumphant return thanks to Bitcoin’s rally to new all-time highs.

Coinbase gets the dubious honor of being the Week’s Biggest Winner for two weeks-in-a-row after rallying another +24.70% on the heels of Bitcoin’s new all-time highs. I can honestly say I never thought I’d see this one go profitable in my portfolio, but here we are!

SoFi Technologies (SOFI)

If you’re a financial company right now – even a fintech company – announcing a capital raise does not come off as good news. In fact, it comes off as potentially terrifying.

That’s what happened to SoFi Technologies (SOFI) earlier in the week when it announced a capital raise, causing analysts to paint the company with the same brush being used to paint ailing New York Community Bank.

While analysts did come to SoFi’s defense later in the week and created a bullish picture for the company’s need of capital, SOFI still lost -14.14% on the week which is enough to earn it the spot of the Week’s Biggest Loser.

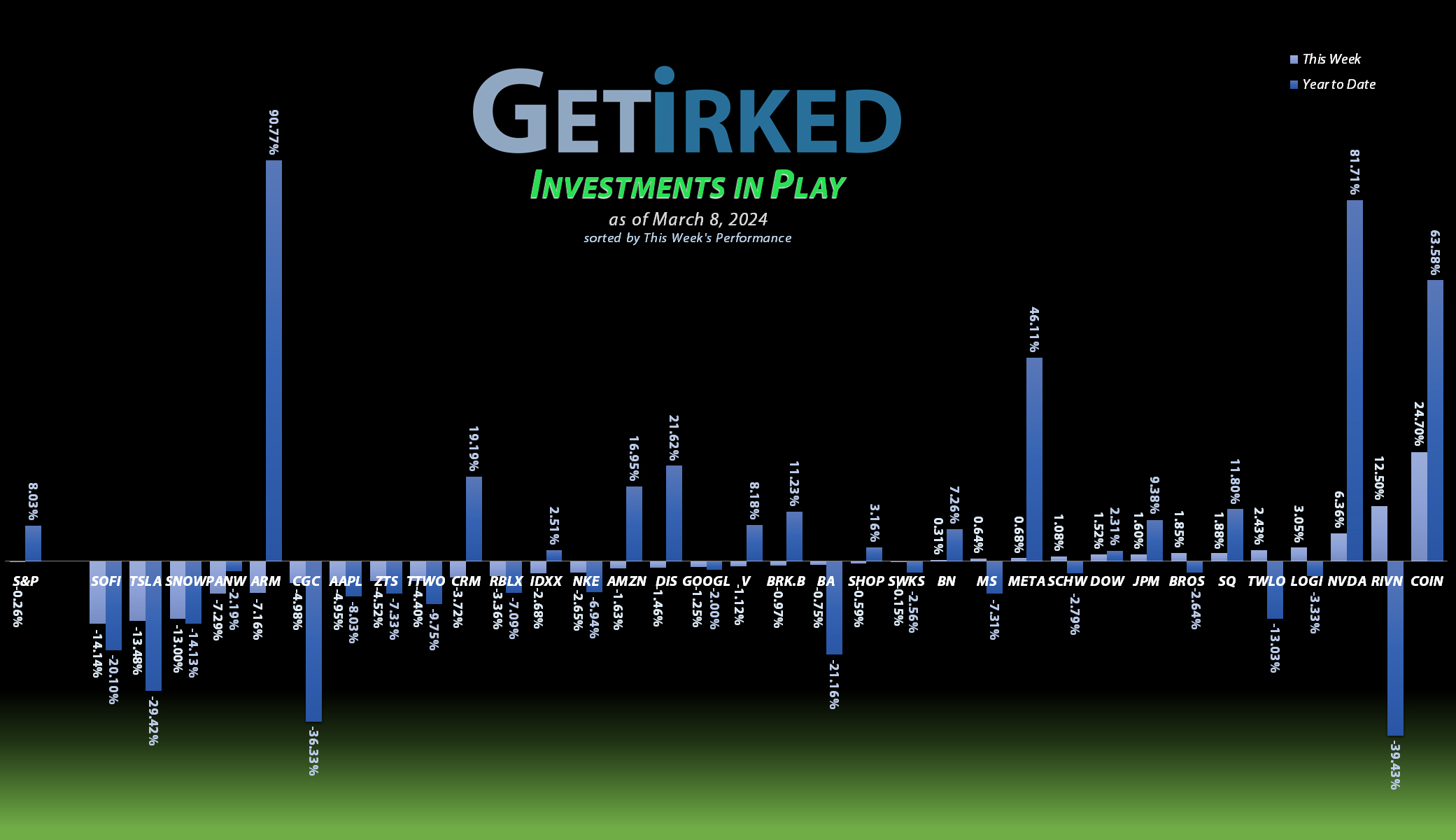

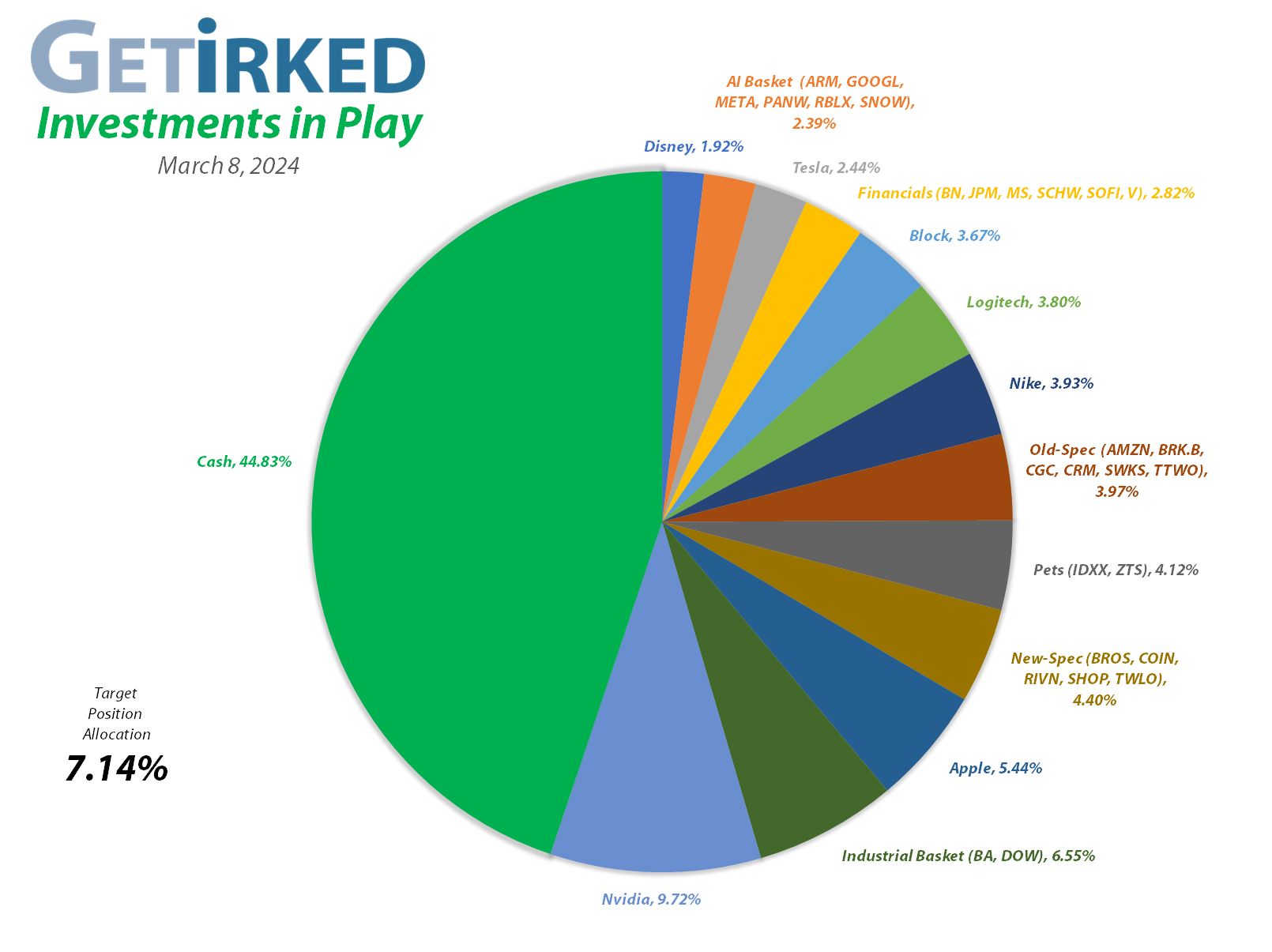

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+2233.28%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$565.77)*

Apple (AAPL)

+912.37%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$86.99)*

Logitech (LOGI)

+749.28%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+666.00%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Block (SQ)

+588.76%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Skyworks (SWKS)

+487.46%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

Tesla (TSLA)

+482.56%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

IDEXX Labs (IDXX)

+478.75%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+395.76%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+340.28%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+257.85%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+246.27%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+189.91%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$9.15)*

Arm Hldgs (ARM)

+136.16%*

1st Buy 9/14/2023 @ $57.28

Current Per-Share: (-$24.50)*

JP Morgan (JPM)

+143.82%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$39.42)*

Meta (META)

+128.14%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Take Two (TTWO)

+114.69%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Alphabet (GOOGL)

+104.96%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $66.07

SoFi (SOFI)

+102.91%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Berkshire (BRK.B)

+83.43%*

1st Buy 8/2/2019 @ $199.96

Current Per-Share: (-$2,281.99)*

Morgan Stan (MS)

+53.54%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $56.69

Visa (V)

+52.37%*

1st Buy 5/9/2022 @ $194.00

Current Per-Share: (-$510.58)

Zoetis (ZTS)

+40.72%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Brookfield (BN)

+38.41%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Coinbase (COIN)

+15.10%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $222.95

Schwab (SCHW)

+8.76%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $61.76

Palo Alto N (PANW)

+3.78%

1st Buy 2/22/2024 @ $270.00

Current Per-Share: $270.00

Roblox (RLBX)

-5.22%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.15

Dutch Bros (BROS)

-8.78%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Shopify (SHOP)

-13.34%

1st Buy 2/12/2024 @ $91.00

Current Per-Share: $87.90

Snowflake (SNOW)

-21.51%

1st Buy 2/12/2024 @ $231.00

Current Per-Share: $206.90

Twilio (TWLO)

-31.57%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-49.01%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $25.06

Canopy (CGC)

-92.27%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

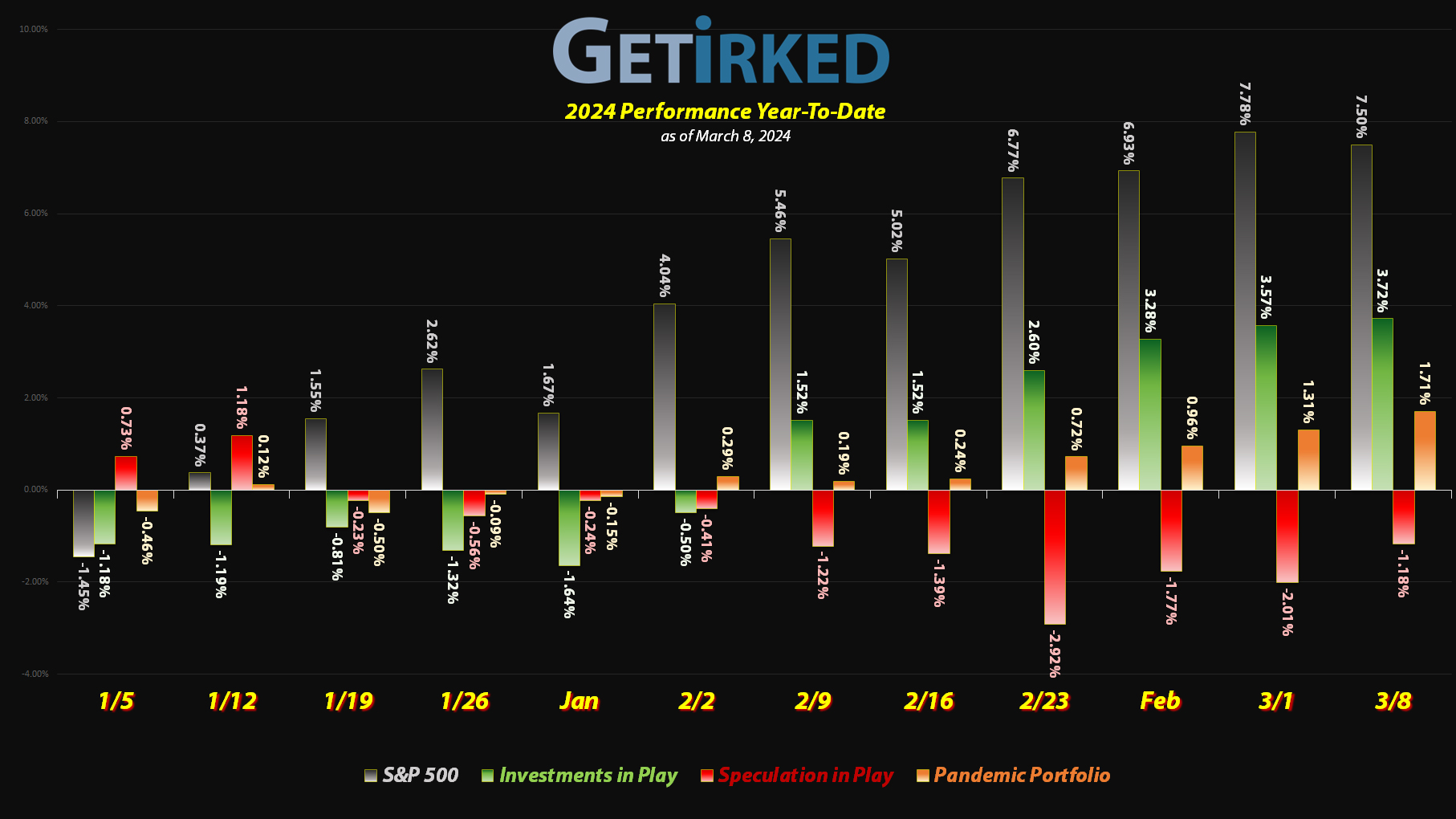

Alphabet (GOOGL): Added to Position

Alphabet (GOOGL) resumed last week’s breakdown on Monday, triggering my next buy order which filled at $133.19, adding 2.67% to the position and locking in -11.03% in discount on some of the shares I sold for $149.71 on January 24. The buy raised my per-share cost +13.44% from $58.24 to $66.07, still a -35.18% reduction from where I first opened the position at $101.93 on September 16, 2022.

I do anticipate GOOGL could continue selling off in the event of any market pullback. Since Google’s current weakness is based on the poor performance of its AI products, the market is already falling out-of-love with the company. If the stock market entered a correction or consolidation – which would be healthy even in a bull market – Google could see additional weakness.

Accordingly, my next buy target is $121.89, above the low GOOG saw back in October 2023, and my next sell target is $199.64, just under the round-number psychological resistance of $200.00.

GOOGL closed the week at $135.41, up +1.67% from where I added Monday.

Coinbase (COIN): Profit-Taking x 2

Words I never thought I’d say back in 2022: “When Coinbase (COIN) rallied over my cost basis on Monday, I had to take profits.”

My sell order filled at $230.79, selling 12.50% and lowering my per-share cost just -0.32% from $225.66 to $224.93. However, reducing my cost basis wasn’t the point, taking huge gains and reducing my allocation was the top priority.

The sale locked in +146.18% in profits on shares I bought for $93.75 back on May 9, 2022 during Coinbase’s epic crash!

With Coinbase still overweight in the speculative portfolio, I decided to use a stop-loss limit sale order on Thursday when it encountered repeated resistance around $242. My sale filled at $236.83, selling 14.29% of the position and leaving me with an average selling price for the week of $233.81.

This sale locked in +74.01% in gains on shares I bought for $136.10 on April 22, 2022 and lowered my per-share cost -0.88% from $224.93 to $222.95. Again, the priority here is allocation reduction, not cost basis reduction.

Despite the two sales, COIN still remains overweight in the basket, so I will take additional profits at $279.94, just under a key past area of resistance. Since Coinbase has been a painfully volatile stock, I will also wait to add back to the position down at $119.71, just slightly above the lows COIN saw less than two months ago!

COIN closed the week at $256.62, up +9.76% from my $233.81 average sale price.

Tesla (TSLA): Added to Position

Since I’ve been playing with the House’s Money since mid-2020, I decided it was time to put some of those profits to work. When Tesla (TSLA) gapped-down at the open on Tuesday, it triggered my next buy order which filled at $183.37, adding 3.26% to my position.

This buy raised my per-share “cost” +9.18% from -$48.28 to -$43.85 (a negative per-share cost indicates all capital has been removed in addition to $43.85 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $153.29, above a past point of support, and my next sell target is $294.82, just under Tesla’s 2023 high.

TSLA closed the week at $175.34, down -4.38% from where I added Tuesday.

Visa (V): Dividend Reinvestment

Visa (V) paid out its rather paltry quarterly dividend on Monday which, after reinvestment, raised my per-share “cost” +0.16% from -$511.38 to -$510.58 (a negative per-share cost indicates all capital has been removed in addition to $510.58 per share added to the portfolio’s bottom line in addition to each share’s current value).

Why did my cost basis raise after receiving a dividend?

Whenever all capital has been removed from a position, a dividend reinvestment adds more shares to the position, not more profits. So, the profit in the position is divided by more shares and raises the per-share cost even though the value of the entire position is also increased by the new shares from the dividend.

From here, my next buy target for Visa is down at $265.89, a point of support, and I have no plans to take additional profits at this time.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.