July 12, 2019

Portfolio Allocation

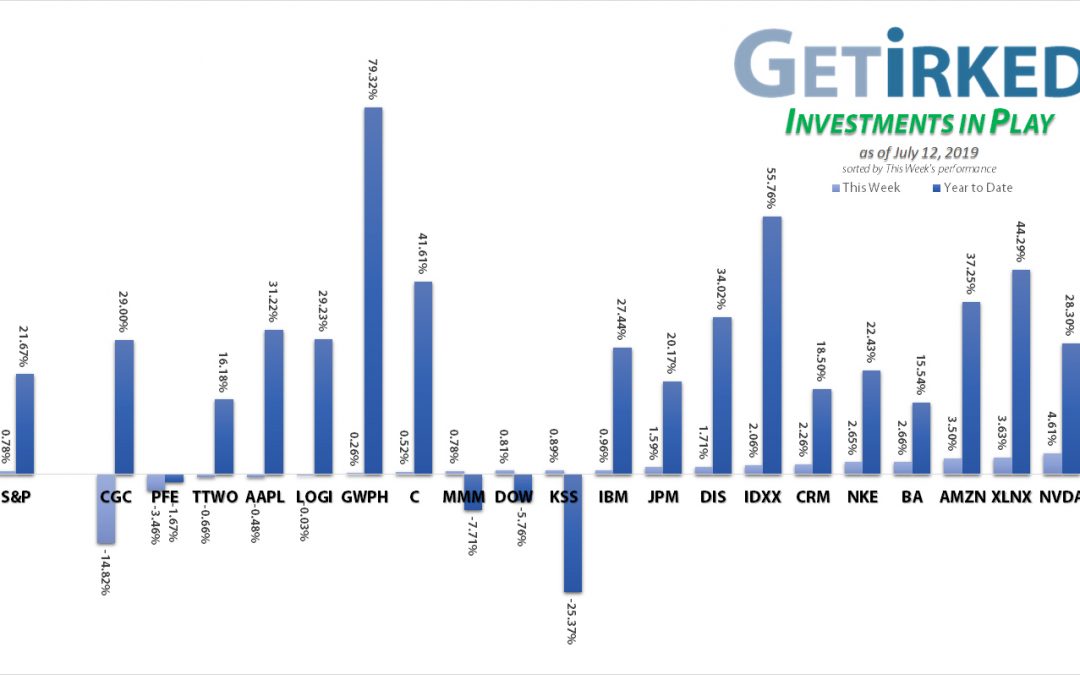

Positions

%

Target Position Size

Current Position Performance

Square (SQ)*

+557.08%

1st Buy 8/5/2016 @ $11.10

Current Per-Share Cost: $0.00*

Boeing (BA)*

+535.60%

1st Buy 2/14/2012 @ $79.58

Current Per-Share Cost: $0.00*

Nvidia (NVDA)

+469.13%

1st Buy 9/6/2016 @ $63.10

Current Per-Share Cost: $29.45

Apple (AAPL)*

+399.06%

1st Buy 4/18/2013 @ $56.38

Current Per-Share Cost: $0.00*

Nike (NKE)*

+329.03%

1st Buy 2/14/2012 @ $26.71

Current Per-Share Cost: $0.00*

Disney (DIS)*

+284.37%

1st Buy 2/14/2012 @ $41.70

Current Per-Share Cost: $0.00*

IDEXX Labs (IDXX)

+185.67%

1st Buy 7/26/2017 @ $167.29

Current Per-Share Cost: $99.50

Canopy Growth (CGC)

+115.41%

1st Buy 5/24/2018 @ $29.53

Current Per-Share Cost: $17.50

GW Pharma (GWPH)

+32.93%

1st Buy 7/25/2018 @ $142.28

Current Per-Share Cost: $129.73

Salesforce.com (CRM)

+31.63%

1st Buy 6/11/2018 @ $134.05

Current Per-Share Cost: $120.10

Amazon (AMZN)

+24.45%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share Cost: $1,615.85

Logitech (LOGI)

+19.73%

1st Buy 11/11/2016 @ $24.20

Current Per-Share Cost: $33.01

IBM (IBM)

+19.72%

1st Buy 11/6/2018 @ $120.87

Current Per-Share Cost: $119.23

Citigroup (C)

+17.61%

1st Buy 10/26/2017 @ $74.06

Current Per-Share Cost: $61.02

JP Morgan (JPM)

+13.63%

1st Buy 10/26/2017 @ $102.30

Current Per-Share Cost: $101.47

Xilinx (XLNX)

+12.05%

1st Buy 5/13/2019 @ $111.57

Current Per-Share Cost: $107.39

Take Two Inter (TTWO)

+11.92%

1st Buy 7/30/2018 @ $120.99

Current Per-Share Cost: $104.05

Pfizer (PFE)

+6.09%

1st Buy 1/28/2019 @ $40.50

Current Per-Share Cost: $39.97

3M (MMM)

+0.56%

1st Buy 5/1/2019 @ $188.97

Current Per-Share Cost: $172.38

Dow (DOW)

-0.53%

1st Buy 5/13/2019 @ $53.18

Current Per-Share Cost: $49.98

Kohl’s (KSS)

-0.76%

1st Buy 6/3/2019 @ $50.45

Current Per-Share Cost: $49.08

* Indicates a position where the capital investment was sold.

Divide position’s current price by gains to calculate initial buy price

Highlights from the Week

Biggest Winner: Square (SQ)

Fintech took off this week as investors want exposure to fast-moving financial plays and the investment banks’ relative performance just doesn’t cut it anymore. Enter market favorite, Square (SQ), which earned an additional +10.73% this week, making it our Weekly Winner by a substantial lead.

Biggest Loser: Canopy Growth Corporation (CGC)

The cannabis craze may be coming down from its high this week as Canopy Growth’s (CGC) disappointing quarter is dragging down the entire consumer marijuana space, with the Best in Breed player losing a whopping -14.82% and earning it the not-so-coveted spot of our Weekly Loser.

This Week’s Moves

3M (MMM): Position Reduction

3M (MMM) seems to have bottomed around $159, but its volatile swings between its low and our per-share cost led us to place a trailing stop to reduce our position size.

Our trailing stop filled on Friday at $172.53, a nominal amount above our $172.42 per-share cost. While our per-share cost reduced a few pennies to $172.38, our intent was to successfully reduce our allocation in case 3M releases a bad earnings report and heads lower to “create additional buying opportunities.”

Our next buy target is around in the $150-160 range.

3M closed the week at $173.34, up +0.5% from where we sold.

IDEXX Laboratories (IDXX): Profit-Taking

IDEXX Labs (IDXX) made a new all-time high of $284.27 on Wednesday and breached overbought levels on almost all time-frames of its Relative Strength Indicator (RSI) – 4-hour, Daily, Weekly and Monthly – leading us to take profits on some of our position.

We locked in gains at $283.97 and lowered our per-share cost to $99.50 from $120, a reduction of more than 17% to our cost basis. We find taking profits to be a near-excruciating experience in stocks we have full faith are headed higher, however discipline always trumps conviction in both trading and investing.

IDXX remains a long-term holding of our portfolio, representing the humanification of pets play as millennials and other generations (including those of us at Get Irked) continue to spend more and more money on our pets.

Should IDXX pull back on a market-wide selloff, we will be replacing the shares we sold today at much lower levels. We’re currently eyeing $198.65-$216.32 as a potential range for buying, a drop of 23-30% from Wednesday’s levels.

IDXX closed the week at $284.24, up $0.27 (less than 0.01%) from where we sold Wednesday.

Take Two Interactive (TTWO): Profit-Taking

As much as we enjoy playing video games (heck, Irk has been doing it for more than 35 years now) and think the sector provides interesting opportunities, we have become increasingly disillusioned with investing in the almost movie-like production of video game development studios where their stocks are judged based on their most recent release.

Following this reasoning, we took some profits in Take Two Interactive (TTWO) at $113.78 to reduce our position size when it showed weakness on Thursday. The sale also reduced our per-share cost by 3.5% from $107.82 to $104.50.

For the long term, we prefer Logitech (LOGI) as our main play in the video game space over Take Two, although TTWO is certainly the Best of Breed when compared to other video game developing competitors like Electronic Arts (EA) and Activision-Blizzard (ATVI).

Logitech, on the other hand, has the ability to make products for any console as well as the PC combined with a significant enterprise products division making it less dependent on releasing hit after hit like the video game development studios. Add to that Logitech’s 1.75% dividend ($0.69 per share) and you have an investment opportunity that’s far more tempting for long-term investing.

All that being said, we will continue to keep a position in Take Two. We wanted to take profits prior to its earnings in early August after surviving the nightmarish draw-down from earlier this year when TTWO dropped nearly -25% after weakness reared its head in the sector thanks to Tencent’s (TCEHY) mega-hit Fortnite seemed to be destroying traditional video game sales.

If we add to our Take Two position, we won’t start until it drops far below the $100 mark, preferably in the $85-90 range.

TTWO closed the week at $116.46, up +2.4% from where we sold Thursday.

Want Further Clarification?

As always, if you have questions about any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.