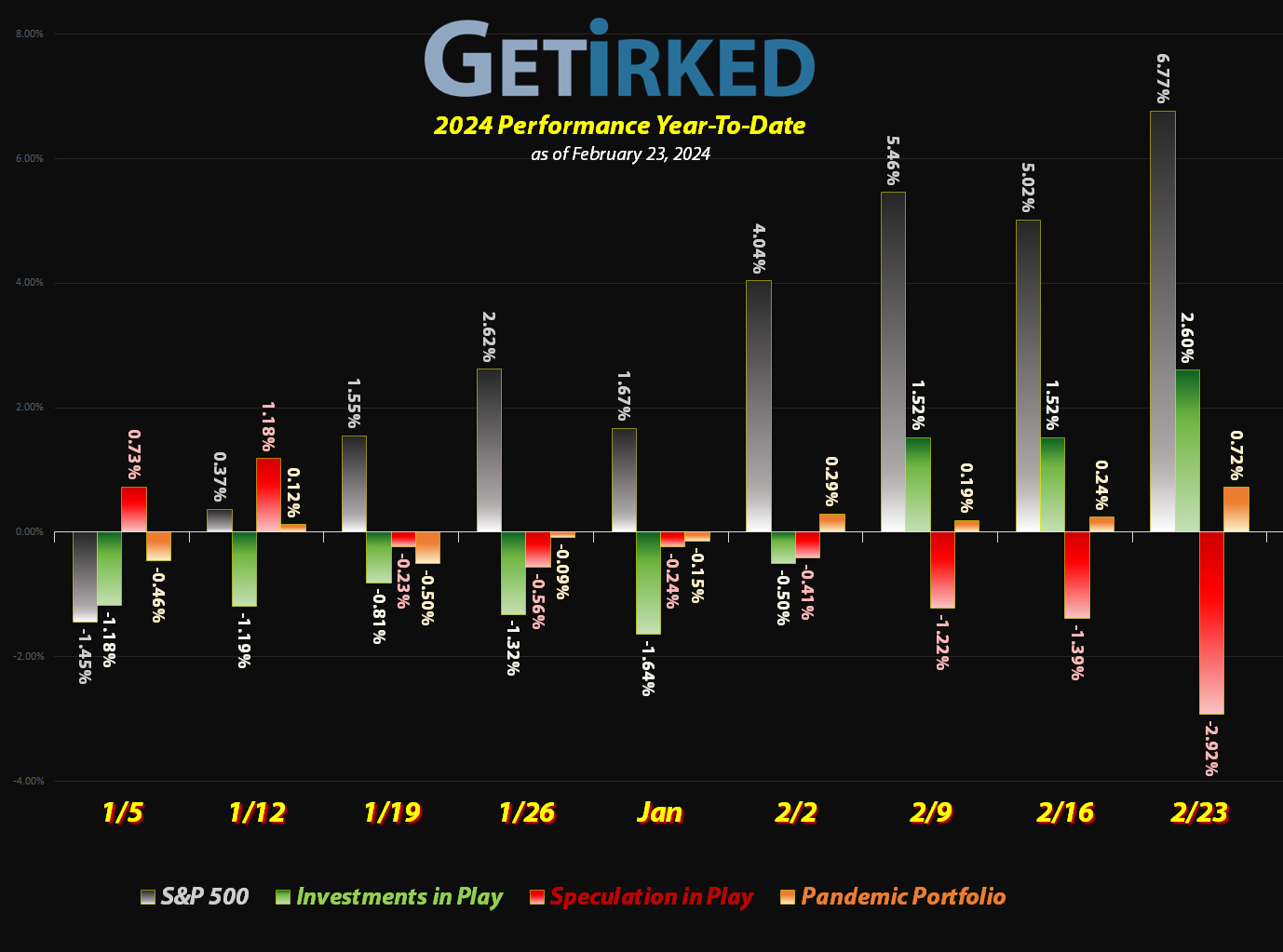

February 23, 2024

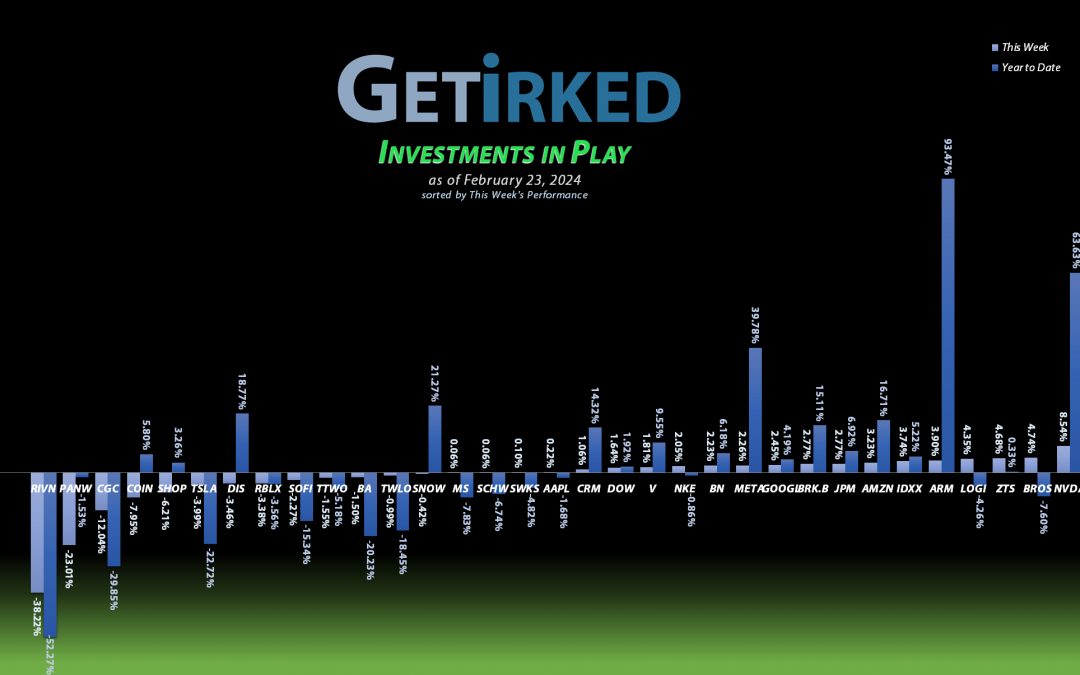

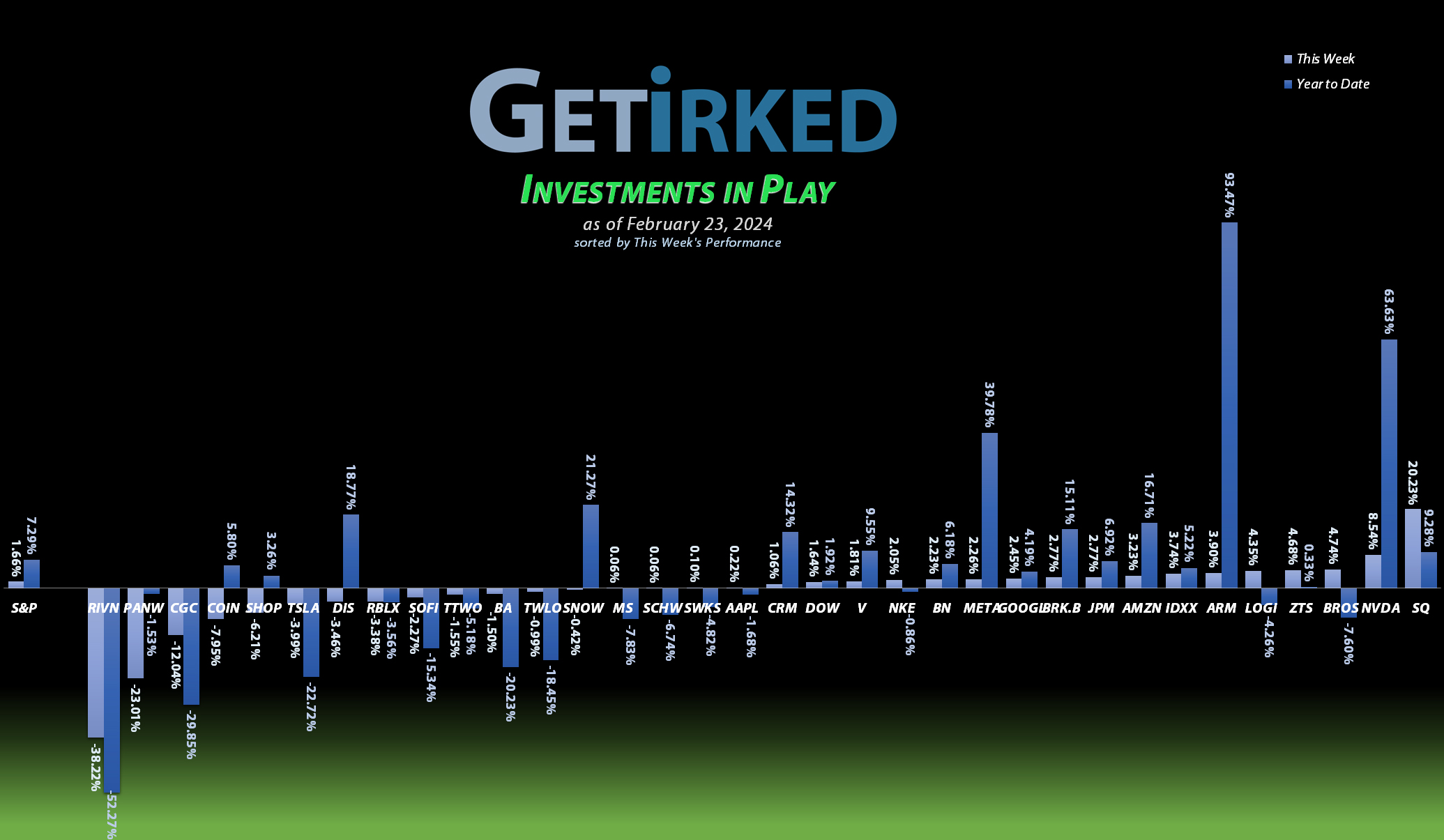

The Week’s Biggest Winner & Loser

Block (SQ)

It’s always hip to be Square… erm… Block (SQ). I’ve said it a thousand times but I’ll say it a thousand more, if you want exposure to the fintech sector, you have to bet on Block and Jack Dorsey. Block reported great revenue with excellent forward guidance during its earnings call, and, as a result, jumped +20.23% this week, beating out even Nvidia (NVDA) as the Week’s Biggest Winner!

Rivian (RIVN)

Turns out everyone who’s ever wanted to own an Electric Vehicle (EV) has already bought one.

What? You didn’t know?

You and the rest of Rivian’s (RIVN) shareholders! Rivian positively imploded after warning that demand was nowhere near what everyone thought it was.

Rivian’s stock sold off an absolutely epic -38.22% this week, and there’s doubt that the company will survive long enough to even have a chance to pull back from this.

It goes without saying that such a deadly show of destruction earned this once-darling EV maker the spot of the Week’s Biggest Loser.

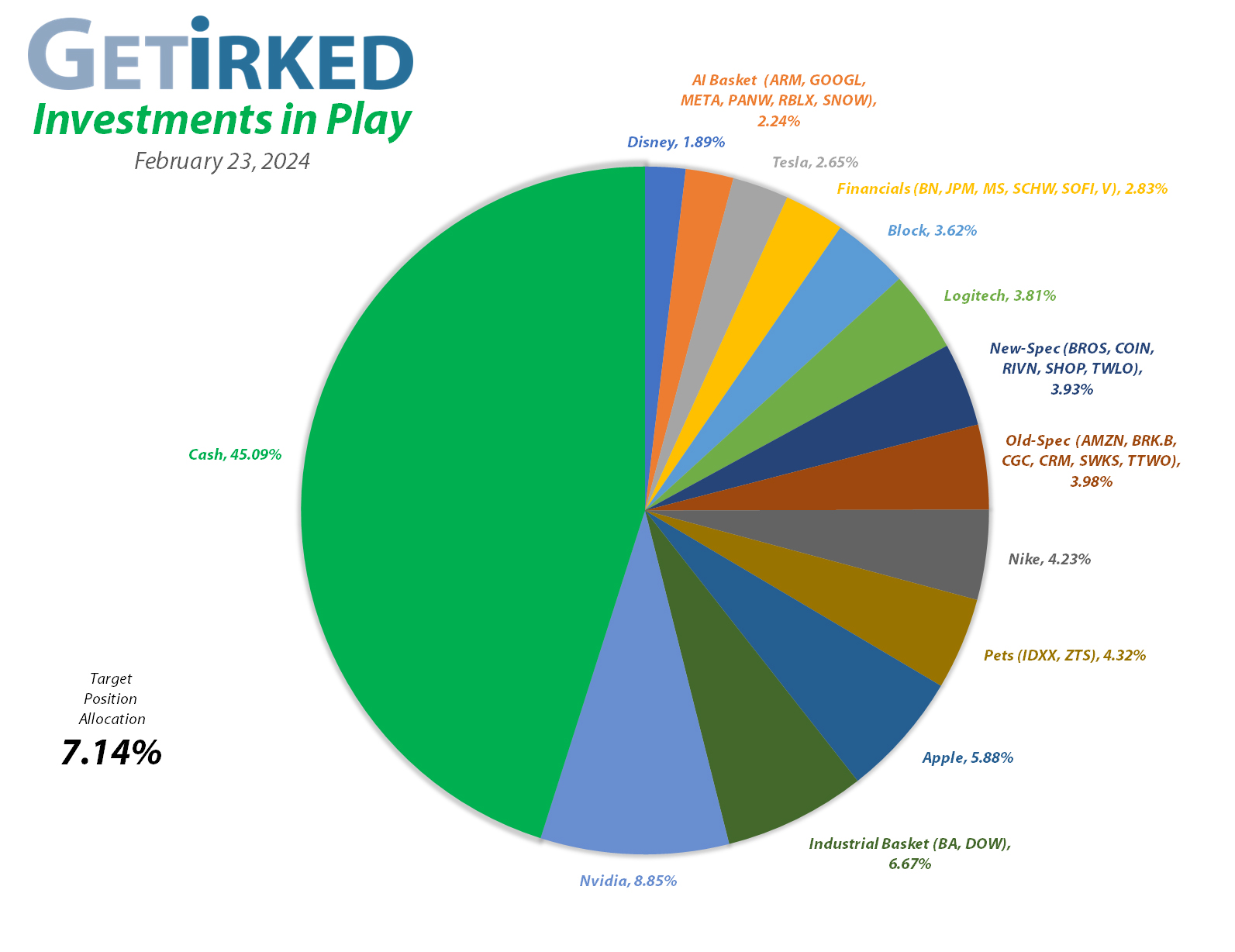

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+2098.28%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$565.77)*

Apple (AAPL)

+954.11%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$86.99)*

Logitech (LOGI)

+742.68%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+669.86%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Block (SQ)

+581.43%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Tesla (TSLA)

+518.81%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

IDEXX Labs (IDXX)

+487.85%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Skyworks (SWKS)

+478.89%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

Nike (NKE)

+419.05%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+338.97%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+257.12%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+231.94%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Alphabet (GOOGL)

+199.01%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $48.15

Disney (DIS)

+185.84%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$9.15)*

JP Morgan (JPM)

+141.21%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$39.42)*

Arm Hldgs (ARM)

+137.78%*

1st Buy 9/14/2023 @ $57.28

Current Per-Share: (-$24.50)*

SoFi (SOFI)

+125.56%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Take Two (TTWO)

+125.56%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+124.75%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+83.87%*

1st Buy 8/2/2019 @ $199.96

Current Per-Share: (-$2,281.99)*

Morgan Stan (MS)

+52.71%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $56.69

Zoetis (ZTS)

+52.34%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Visa (V)

+51.67%*

1st Buy 5/9/2022 @ $194.00

Current Per-Share: (-$511.38)

Brookfield (BN)

+37.00%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Palo Alto N (PANW)

+4.48%

1st Buy 2/22/2024 @ $270.00

Current Per-Share: $270.00

Schwab (SCHW)

+3.94%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $62.00

Snowflake (SNOW)

-0.72%

1st Buy 2/12/2024 @ $231.00

Current Per-Share: $231.00

Roblox (RLBX)

-1.64%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.15

Shopify (SHOP)

-13.27%

1st Buy 2/12/2024 @ $91.00

Current Per-Share: $87.90

Dutch Bros (BROS)

-13.42%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Coinbase (COIN)

-26.45%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $225.66

Twilio (TWLO)

-35.83%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-59.82%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $25.06

Canopy (CGC)

-91.48%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Introducing the Industrial Basket

In another round of housekeeping, I wanted to be able to split another allocation between the Old-Spec, New-Spec, and AI Baskets without having to dilute the target position allocation. While Boeing (BA) has been one of the best overall performers in the portfolio and Dow (DOW) is no slouch, either, I realized that I’m not sure I want two separate allocations to the industrial sector.

Eureka! There’s my solution!

I combined Boeing and Dow together to create the Industrial Basket, thereby limiting my overall exposure to the industrial sector while also freeing up another allocation to split between the three baskets made above.

I know, this is incredibly dry material, but it explains why there’s a mysterious position now taking up the #2 biggest position in the portfolio now…

Apple (AAPL): Dividend Reinvestment

Apple (AAPL) paid out its quarterly dividend on Friday, February 16, which, after reinvestment, raised my per-share “cost” +0.13% from -$87.10 to -$86.99 (a negative per-share cost indicates all capital has been removed in addition to $86.99 per share added to the portfolio’s bottom line in addition to each share’s current value).

Why did my cost basis raise after receiving a dividend?

Whenever all capital has been removed from a position, a dividend reinvestment adds more shares to the position, not more profits. So, the profit in the position is divided by more shares and raises the per-share cost even though the value of the entire position is also increased by the new shares from the dividend.

From here, my next buy target remains unchanged at $155.43, -20% lower than where I last took profits at $195.27 on December 13, 2023, and higher than a key point of past support. My next sell target is $269.55, a price calculated using the Fibonacci Method which I honestly don’t expect Apple to see for a very long time.

Morgan Stanley (MS): Dividend Reinvestment

Morgan Stanley (MS) paid out its quarterly dividend on Friday, February 16, which, after reinvestment, lowered my per-share cost -0.98% from $57.25 to $56.69.

Given that I initially opened this position at $83.50 on April 25, 2022, I’m pretty pleased that my risk management has reduced my per-share cost -32.11% in less than two years, however I will be buying above my cost basis with my next buy target at $74.67, above a key level of support Morgan Stanley has seen several times in the past few years.

Despite this position holding a very small allocation in my portfolio – even with its slot in the Financial Basket – I will continue to take profits with my next sell target at $94.06, slightly below the high Morgan Stanley last saw in December 2023.

Nvidia (NVDA): Profit-Taking

After Nvidia’s (NVDA) unbelievable quarter, the stock rocketed higher for the remainder of the week, triggering my next sell order on Friday which sold 3.67% of my position at $807.97, locking in +5,056.16% in gains on shares I bought when I originally opened the position at $15.67 on September 6, 2016.

The sale lowered my per-share “cost” -$50.67 from -$515.10 to -$565.77 (a negative per-share cost indicates all capital has been removed in addition to $565.77 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, I will start aggressively adding back into the position with my next buy target at $667.89, above the low Nvidia saw right before it reported earnings this week. As for selling, despite the fact the position still remains 9.13% of the portfolio (and should be less than 7.14%), I will let it run hot with my next sell target at $999.66, just under that magical $1,000 price target.

NVDA closed the week at $788.17, down -2.45% from where I took profits Friday.

Palo Alto Networks (PANW): *New Position*

Palo Alto Networks (PANW) is the best-in-breed when it comes to cybersecurity, however, when CEO Nikesh Arora announced a revolutionary plan for dominating the space going forward, investors were disappointed that the company wouldn’t be focusing on profit. As a result, the stock sold off nearly 30%… in a single day.

Arora is a visionary CEO and I not only have faith in his leadership, but also in the plan he proposed. I believe he will take PANW to greater heights going forward, so on Thursday, I put my money where my mouth is and opened a position in PANW with a 20.93% buy at $270.00.

Given how volatile the space has been, however, I am not giving a full allocation to PANW, choosing instead to place it in my A.I. Basket given how much artificial intelligence directly connects to identifying and defeating cybersecurity threats.

From here, my next buy target is $242.00, above a key Fibonacci Retracement level from the past, and I have no sell targets as I build this position going forward.

PANW closed the week at $282.09, up +4.48% from where I opened it Thursday.

Rivian (RIVN): Added to Position x 2

Rivian (RIVN) didn’t just disappoint when it reported earnings Wednesday night, it downright terrified investors. On Thursday, Rivian shot through my next two buy targets which added 12.90% to my position with an average price of $11.89, lowering my per-share cost -10.02% from $27.85 to $25.06.

Given that Rivian has now made a new all-time low at $11.36, I’m going to be very conservative with my next buy target at $8.08, a price calculated using a variety of different factors. If RIVN develops a more solid floor of support, I may raise that target in the future, but, for the moment, that’s where it stands.

If Rivian recovers, I will start trimming the position substantially if it makes it above my cost basis with my next sell target at $25.18, quite a bit below the highs it saw in 2023.

RIVN closed the week at $10.07, down -15.31% from my $11.89 average buy.

Visa (V): Added to Position

Visa (V) pulled back to a key area of support on Monday, leading me to add some of the capital I had taken out before earnings with a tiny buy which put 0.91% back into the position at $274.66.

The buy raised my per-share “cost” to -$511.38 (a negative per-share cost indicates all capital has been removed in addition to $511.38 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, I will continue adding small at aggressive support levels with my next buy target at $265.89, and I currently have no plans to reduce the size of this position at this time.

V closed the week at $283.80, up +3.33% from where I added on Monday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.