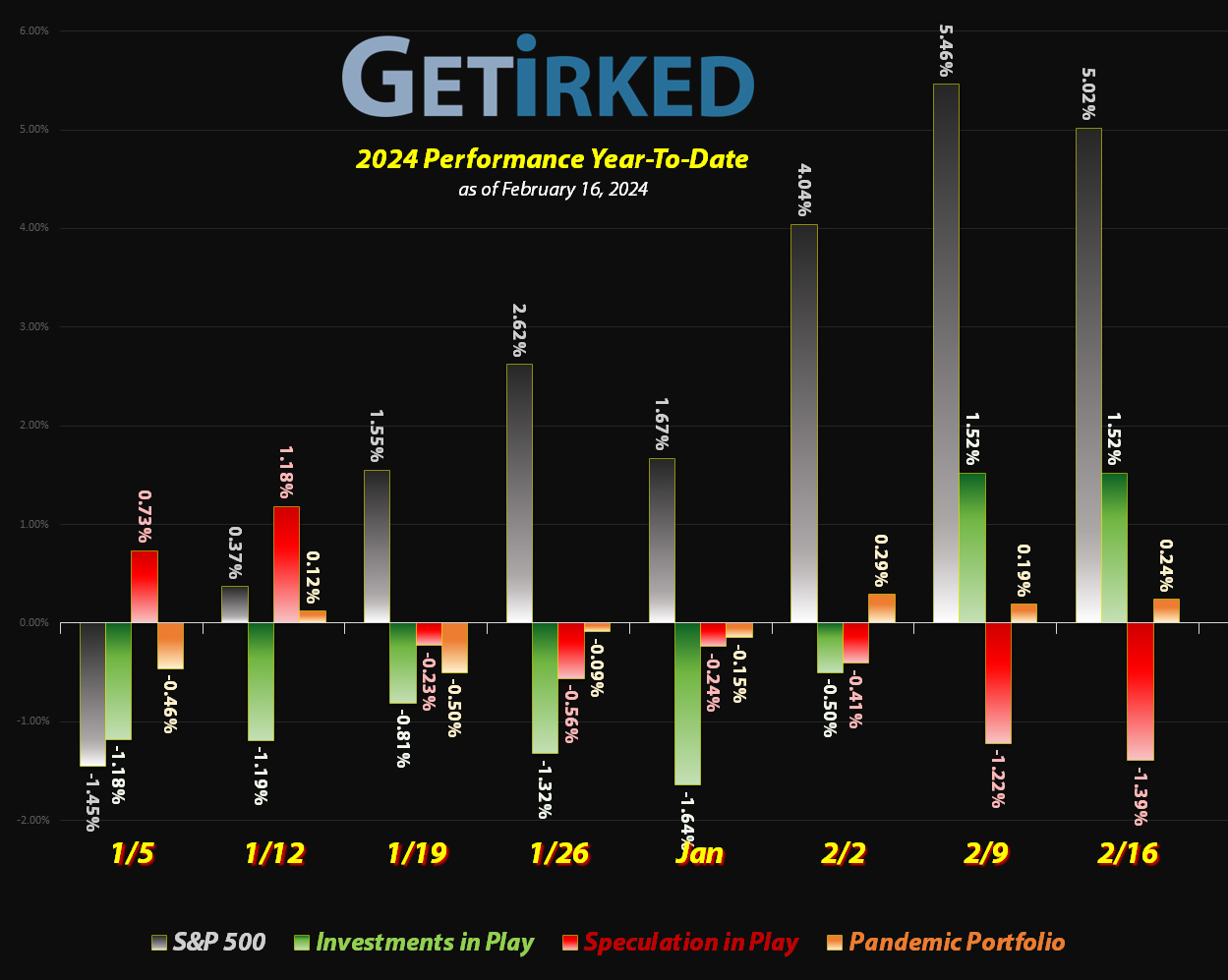

February 16, 2024

The Week’s Biggest Winner & Loser

Coinbase (COIN)

When your stock price is correlated to the price of a rallying Bitcoin and you report the first profitable quarter you’ve had in two years, your stock is bound to rally.

Especially when you’re the crypto exchange, Coinbase (COIN) and all the Bears were betting against you going into earnings!

COIN rallied a pretty remarkable +26.99% in an otherwise dismal week, easily securing its spot as the Week’s Biggest Winner!

Twilio (TWLO)

If the market has been pretty unforgiving to companies who miss earnings this quarter, it’s absolutely destructive to companies who miss earnings and happen to be in the tech sector.

Twilio (TWLO) didn’t just report a bad quarter, it reported a terrible quarter, and investors escaped from the stock in droves. Twilio collapsed -18.17% this week alone, taking the stock’s Year-To-Date performance deep into negative territory and falling from the Cloud to become the Week’s Biggest Loser.

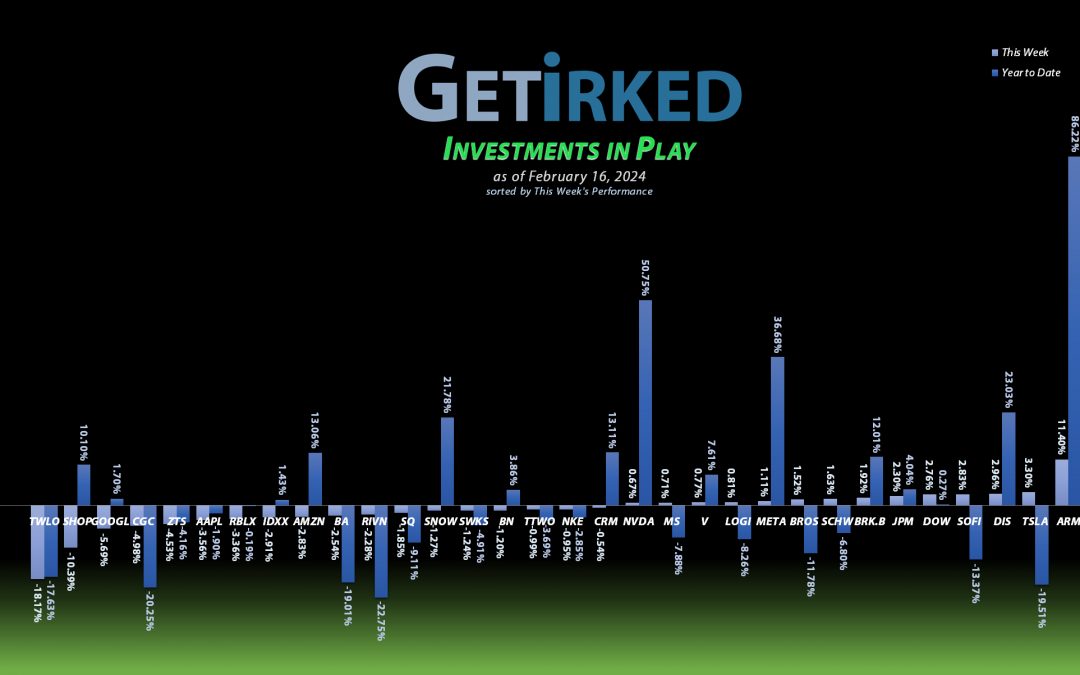

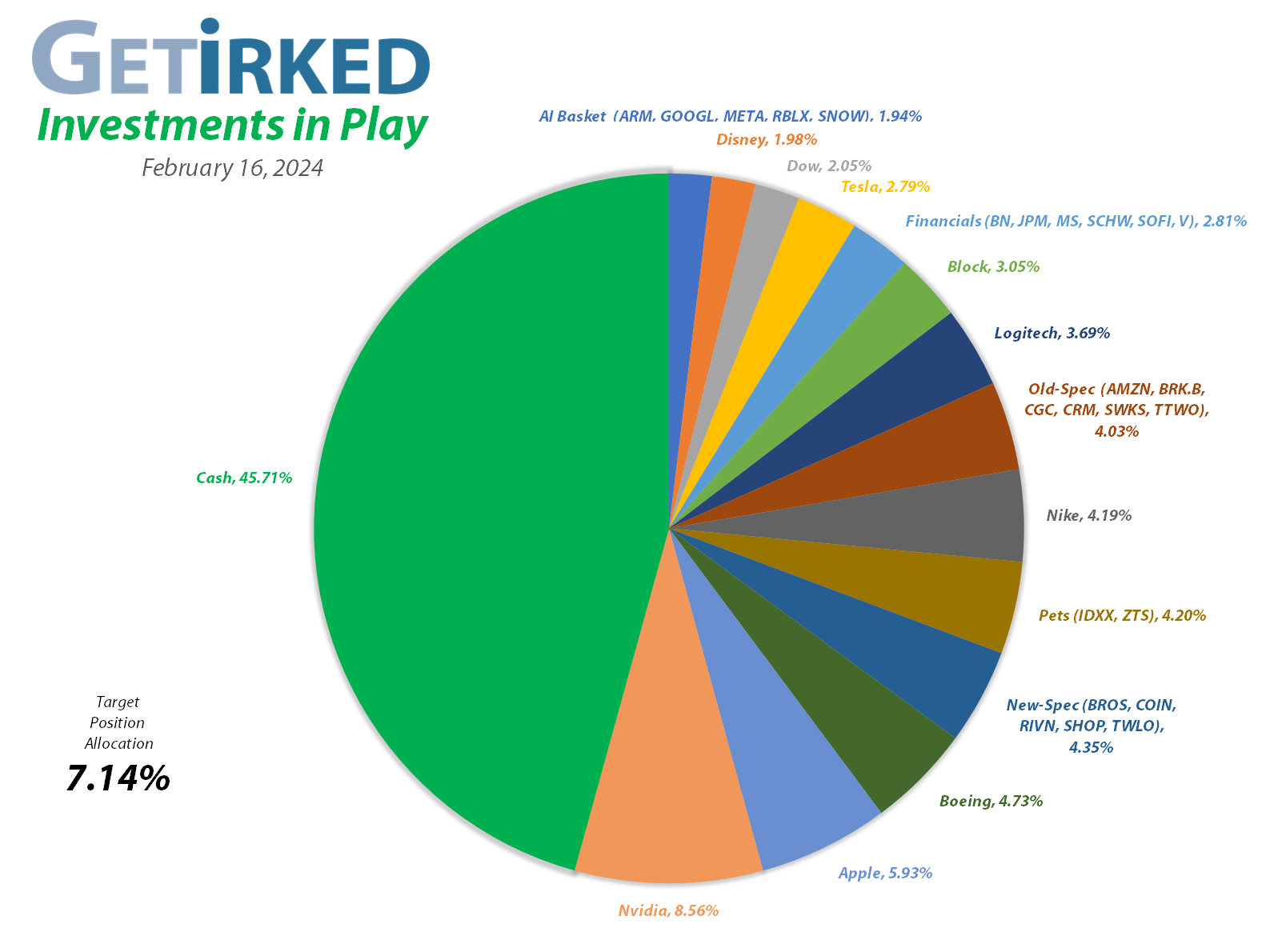

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1997.85%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$515.10)*

Apple (AAPL)

+952.52%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$87.10)*

Logitech (LOGI)

+714.33%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+674.87%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Block (SQ)

+528.51%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Tesla (TSLA)

+536.04%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Skyworks (SWKS)

+478.55%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

IDEXX Labs (IDXX)

+475.15%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+411.40%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+333.50%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+245.94%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+228.40%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+191.90%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$9.15)*

Alphabet (GOOGL)

+191.87%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $48.15

JP Morgan (JPM)

+138.02%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$39.42)*

Arm Hldgs (ARM)

+133.41%*

1st Buy 9/14/2023 @ $57.28

Current Per-Share: (-$24.50)*

Take Two (TTWO)

+129.10%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+123.10%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

SoFi (SOFI)

+120.01%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Berkshire (BRK.B)

+83.51%*

1st Buy 8/2/2019 @ $199.96

Current Per-Share: (-$2,281.99)*

Visa (V)

+51.67%*

1st Buy 5/9/2022 @ $194.00

Current Per-Share: (-$75.58)

Morgan Stan (MS)

+51.13%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $57.25

Zoetis (ZTS)

+45.52%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Brookfield (BN)

+34.01%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Schwab (SCHW)

+3.89%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $62.00

Roblox (RLBX)

+1.83%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.15

Snowflake (SNOW)

-0.34%

1st Buy 2/12/2024 @ $231.00

Current Per-Share: $231.00

Shopify (SHOP)

-7.52%

1st Buy 2/12/2024 @ $91.00

Current Per-Share: $87.90

Dutch Bros (BROS)

-17.29%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Coinbase (COIN)

-20.10%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $225.66

Twilio (TWLO)

-35.20%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-41.47%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $27.85

Canopy (CGC)

-90.32%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

The Horrible, Awful, Very Bad Story of Canopy Growth Corporation

Long-time readers of my blog have likely noticed my deep-seated hatred for Canopy Growth Corporation (CGC), home to some of the biggest investing mistakes and best discipline lessons in the entire portfolio. I initially bought CGC at $295.30 in 2018, rode it all the way up to $550+ twice, took all of my capital out the second time, and had what would have been a winning lottery ticket on the legalization of cannabis.

… until I added investment capital back into it all the way on its crash down to $3.46.

As a result, I implemented a new rule:

Never, ever turn a winner into a loser.

In other words, once I take all of the investment capital out of a sizable position, I can no longer put capital back in, only profits. No matter how much confidence I have in a long-term investment, discipline must trump conviction.

Some readers have asked why I don’t just cut my losses on Canopy. There are a few reasons for this:

- At 0.354% of the portfolio, Canopy’s so small that cutting losses wouldn’t be worth it.

- The portfolio is currently 46%+ cash. I don’t need to sell Canopy to raise funds.

- There’s always a possibility, no matter how infinitesimal, that Canopy actually recovers one day.

As crazy as this sounds, I never cut losses.

Every time I have cut losses – every single time – the underlying investment rockets to the moon after I do so. As a result, I’ve learned that, for me, missing out on a huge gain is much, much more painful than taking a controlled loss.

I manage risk by never putting more money into a single investment than I’m willing to lose entirely. I deeply research the investment. I know its fundamentals. I know its technicals. I know its long-term business narrative and thesis, and I believe in it.

As a result, I make a buying plan for every asset all the way down to zero.

And, when I make mistakes like I did in Canopy, I learn from those mistakes and implement new rules to my discipline to ensure I never make the same mistake twice.

As for Canopy Growth, this week, I am no longer allowing it to occupy a full allocation in my portfolio and have rolled it into the Old-Spec Basket. By doing this, I freed up an allocation to assign to the new Artificial Intelligence Basket (see below).

Just a little housekeeping… and a rant.

Introducing the A.I. Basket

There’s no question that Artificial Intelligence (A.I.) will have an immense and profound impact on society and the world as we head into the future. Accordingly, I wanted to have more funds to allocate specifically to A.I.-related stocks.

Granted, Nvidia (NVDA) is the biggest position in my portfolio and will maintain its own full allocation status, but this basket will accommodate the other A.I. plays I want to make that I don’t feel quite so confident about to have entire positions.

Additionally, doing this will increase the size of the Old-Spec and New-Spec baskets, too, so all stocks in these baskets will be able to grow a bit more.

A.I. Basket: Arm Holdings (ARM), Alphabet (GOOGL), Meta (META), Roblox (RBLX) and Snowflake (SNOW) new position added this week – see below.

Old-Spec Basket: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Canopy Growth (CGC), Salesforce (CRM), Skyworks Solutions (SWKS), and Take Two Interactive (TTWO).

New-Spec Basket: Coinbase (COIN), Dutch Bros (BROS), Rivian (RIVN), Shopify (SHOP) new position added this week – see below, and Twilio (TWLO).

Shopify (SHOP): *New Position*

I opened a new position in Shopify (SHOP) on Monday before it reported earnings on Tuesday morning. Shopify (SHOP) is an e-commerce platform responsible for empowering small businesses (as well as medium and large businesses) globally to build an online presence and thrive selling their products internationally. Not to mention, Shopify is also Canadian, and everyone knows we have to stick together. Since I’m not quite ready to make Shopify its own allocation in the portfolio, I’m rolling it into the New-Spec Basket.

I opened my position with a 30.79% allocation at $91.00. I started smaller than I’d prefer, but that’s simply because I want to wait until after Shopify reports earnings. Regardless of whether earnings are good or bad, I will add more to the position.

It was a good thing, too, because although Shopify beat earnings revenue, they gave foggy forward guidance, causing the stock to sell off more than 10% on Tuesday and triggering my next buy order which filled at $78.60, adding 13.00% to the position.

The second buy lowered my per-share cost -3.41% from $91.00 to $87.90. From here, my next buy target is $71.15, slightly above a point of support SHOP has tested a few times already in 2024, and my next sell target is $175.80, slightly under Shopify’s all-time high set back in 2021.

SHOP closed the week at $81.29, down -7.52% from my cost basis.

Snowflake (SNOW): *New Position*

I opened a new position in Snowflake (SNOW) on Monday. Snowflake offers artificial intelligence services to clients who can choose to “pay-as-they-go” meaning they only pay for what they need instead of paying for an entire contract they may not use. As a result, Snowflake has become incredibly popular.

I’ve been eyeing Snowflake for some time and decided to open a position even after its recent rally simply because I have far too much cash. However, I’m not ready to make Snowflake its own allocation, so it shares a spot in the A.I. Basket.

I opened my position buying 26.28% of my allocation at $231.00 with the intent of adding more after Snowflake reports earnings on Wednesday, February 28, regardless of which direction it heads. From here, my tentative next buy target is $209.00, but, as I said, I will be adding to this position regardless after earnings next week. I have no sell targets for this position at this time as it is simply too new to tell how far it has to go.

SNOW closed the week at $230.22, down -0.34% from where I started it.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.