February 9, 2024

The Week’s Biggest Winner & Loser

Arm Holdings (ARM)

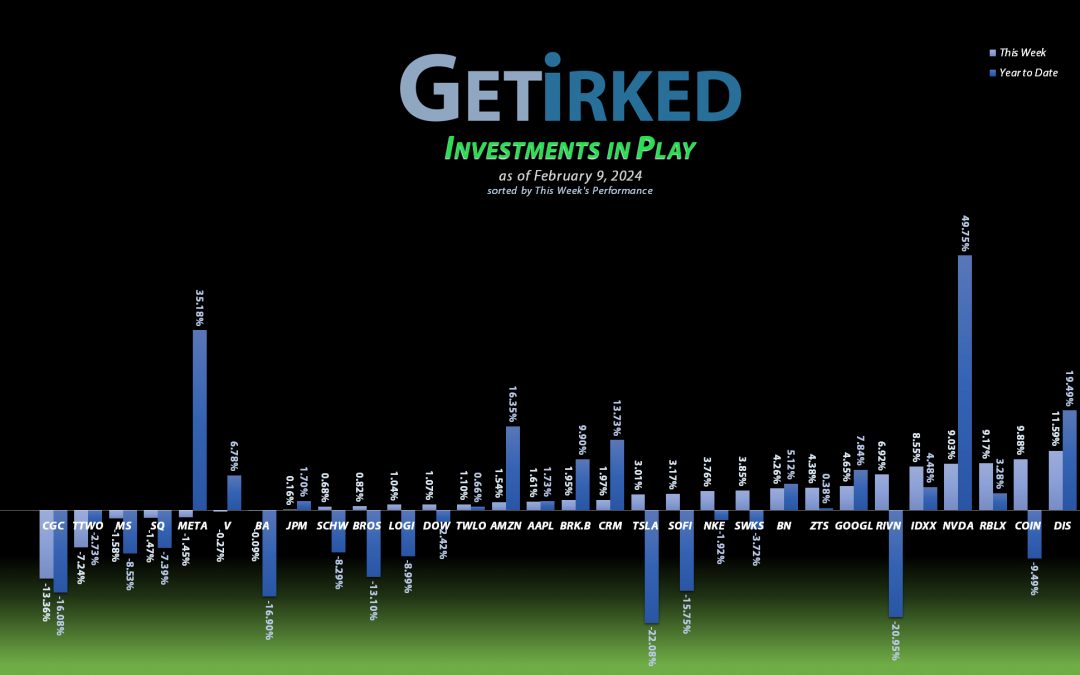

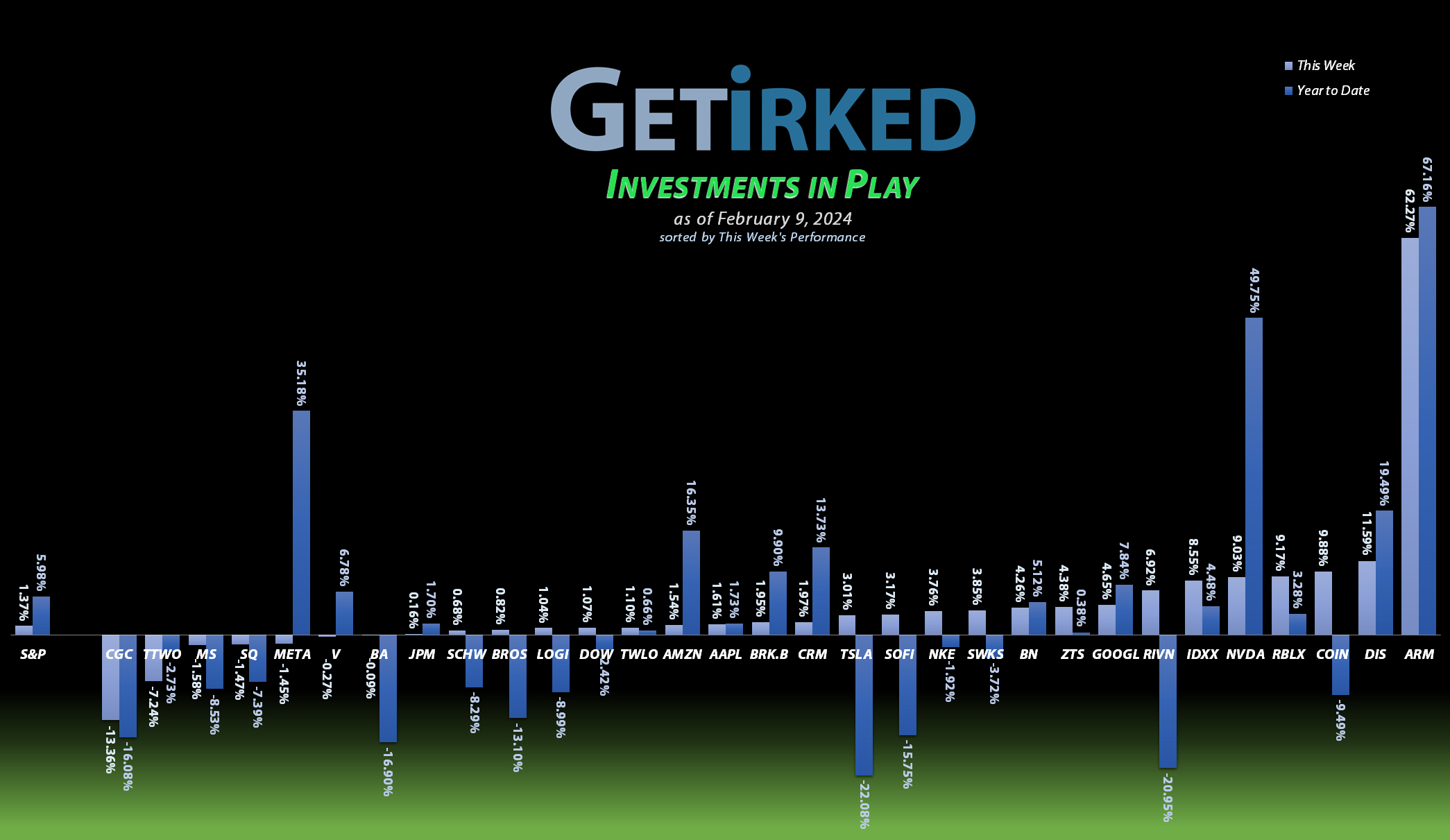

There’s been no question that Artificial Intelligence is the new hot darling of the stock market, but it looked like no one even thought Arm Holdings (ARM) was even in the race this week. ARM reported a blowout quarter and the stock rallied… wait for it… +62.37% with the vast majority of that move happening in a single day.

Obviously, ARM is the Week’s Biggest Winner by an incredible margin, and I find it hard to think that I’ll ever see another position earn so much in a week… astounding!

Canopy Growth Corp (CGC)

I’m not sure why I even continue to cover the crapper that is Canopy Growth Corp (CGC). The entire cannabis sector has been rallying since the start of 2024, but Canopy is so bad that it hasn’t seen any of the upside many of its compatriots have.

In fact, there’s significant question as to whether or not Canopy is long for this world… it’s just that badly run as a company. Canopy Growth dropped -13.36% this week on the back of bad earnings (as if there’s any kind when it comes to this Week’s Biggest Loser).

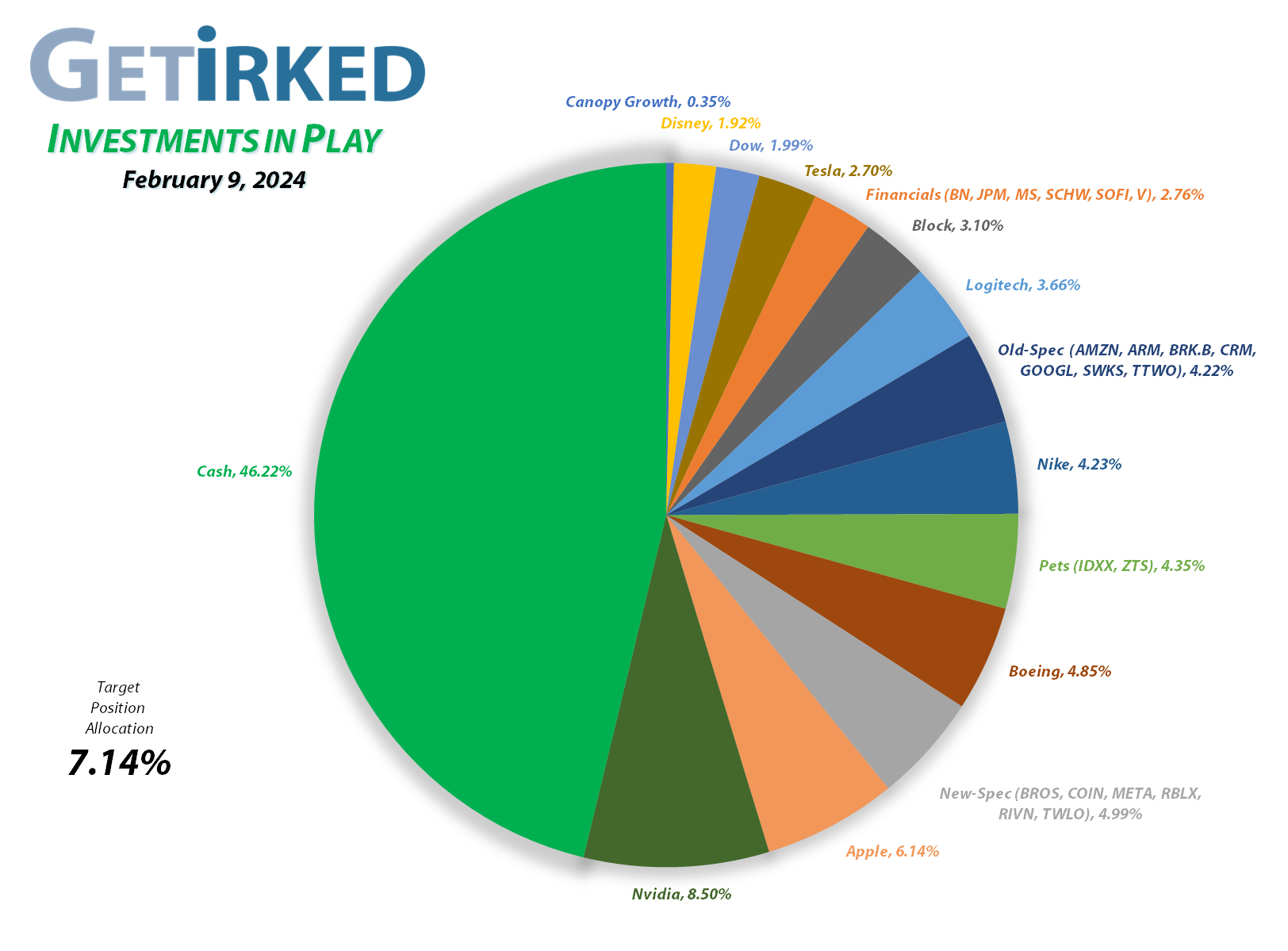

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1990.12%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$515.10)*

Apple (AAPL)

+975.64%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$87.10)*

Logitech (LOGI)

+709.10%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+683.79%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Block (SQ)

+533.45%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Tesla (TSLA)

+522.27%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

IDEXX Labs (IDXX)

+485.35%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Skyworks (SWKS)

+483.05%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

Nike (NKE)

+414.97%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+324.62%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+256.02%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+230.27%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Alphabet (GOOGL)

+209.48%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $48.15

Disney (DIS)

+186.80%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$9.15)*

JP Morgan (JPM)

+135.48%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$39.42)*

Take Two (TTWO)

+131.39%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+122.29%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Arm Hldgs (ARM)

+121.95%*

1st Buy 9/14/2023 @ $57.28

Current Per-Share: (-$24.50)*

SoFi (SOFI)

+113.96%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Berkshire (BRK.B)

+83.28%*

1st Buy 8/2/2019 @ $199.96

Current Per-Share: (-$2,281.99)*

Zoetis (ZTS)

+52.43%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Visa (V)

+51.67%*

1st Buy 5/9/2022 @ $194.00

Current Per-Share: (-$75.58)

Morgan Stan (MS)

+50.01%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $57.25

Brookfield (BN)

+35.60%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Roblox (RLBX)

+5.34%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.15

Schwab (SCHW)

+2.21%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $62.00

Dutch Bros (BROS)

-18.58%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-20.79%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Coinbase (COIN)

-37.08%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $225.66

Rivian (RIVN)

-40.11%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $27.85

Canopy (CGC)

-89.81%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

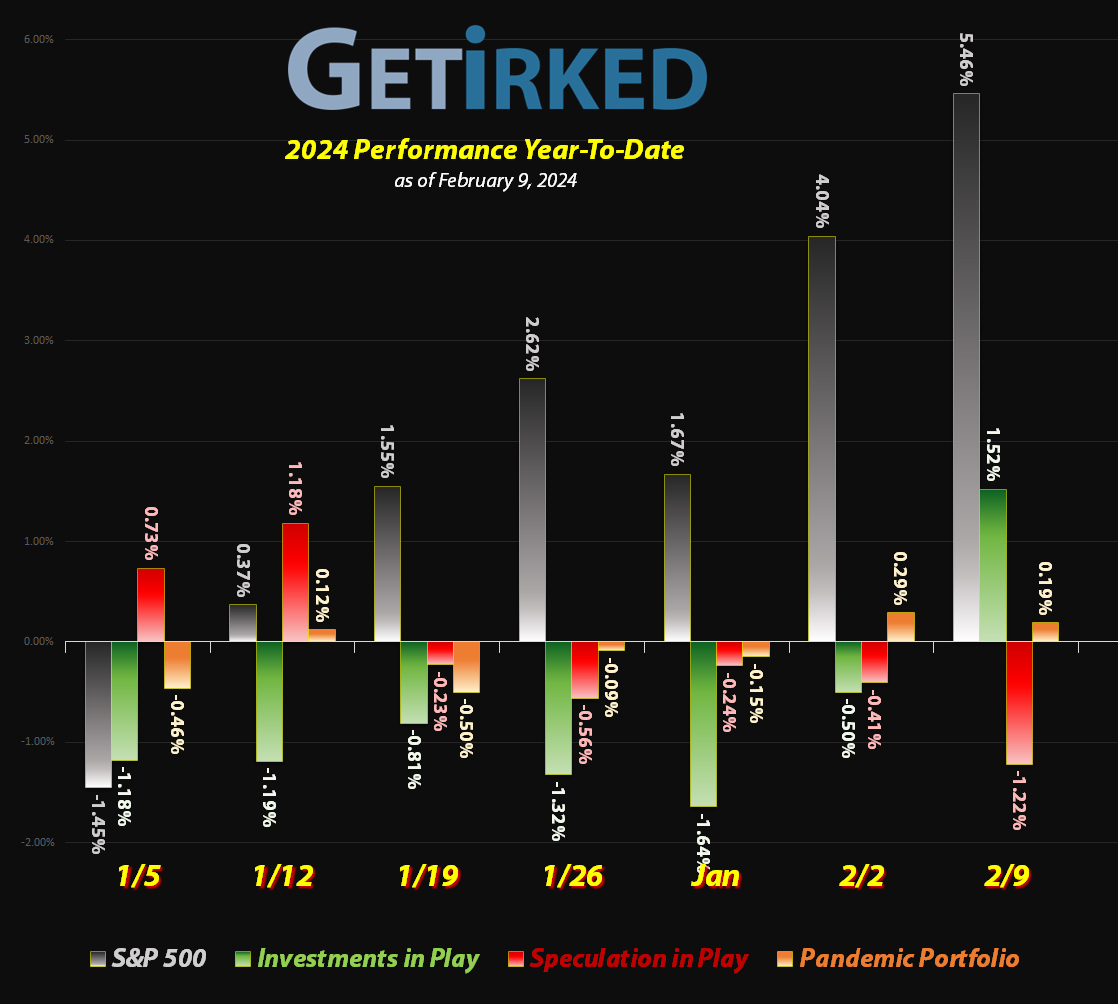

Arm Holdings (ARM): Profit-Taking

Arm Holdings (ARM), the company responsible for making the CPUs that work in conjunction with Nvidia’s (NVDA) AI GPUs didn’t just beat earnings Wednesday night, they exploded all expectations!

The stock rocketed more than 30% and triggered my next sell order in after-hours trading which sold 50% of my position at $99.92. The sale locked in +73.47% in gains on shares I bought for $57.60 when ARM re-IPO’ed back on September 14, 2023.

The sale lowered my per-share cost -$62.21 from $37.71 to -$24.50 (a negative per-share cost indicates all capital has been removed in addition to $24.50 per share added to the portfolio’s bottom line in addition to each share’s current value).

Given how red-hot this stock has become along with the entire artificial intelligence sector, I will not be taking any additional profits for the foreseeable future as I want to hold what I have remaining to see where we go from here. I will also start adding back to the position if we see any kind of selloff with my next buy target at $79.90, just around Arm’s previous all-time high where it will likely find support (if it ever sells off that much).

ARM closed the week at $115.21, up +15.30% from where I took profits Wednesday.

Berkshire-Hathaway (BRK.B): Profit-Taking

I love Warren Buffett and Berkshire-Hathaway (BRK.B) as much as the next capitalist, but when BRK.B started to move parabolic over the past few weeks, I decided to take all of the remaining capital (and quite a bit of profits) out of my position on Wednesday with a sell order which filled at $398.16.

The sale dumped a whopping 92.15% of my position, locking in +127.52% in gains on shares I bought for $175.00 back in the middle of the throes of the pandemic selloff on March 16, 2020, and lowered my per-share cost -$2,469.76 from $187.77 to -$2,281.99 (a negative per-share cost indicates all capital has been removed in addition to $2,281.99 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, I will start to aggressively add back into the position with my next buy target at $360.89, above a key level of support Berkshire saw just a few weeks ago. I have no sell targets at this time as I comfortable holding the remainder of the position for decades from now if I can’t add more at lower levels.

BRK.B closed the week at $398.33, up +$0.17 from where I took profits Wednesday.

Disney (DIS): Profit-Taking

Disney (DIS) finally stopped disappointing and reported a good quarter after the market closed on Wednesday, causing the stock price to pop in after-hours and trigger my next sell order which filled at $103.80, selling 6.13% of the position.

The sale locked in +148.92% in gains on shares I bought when I initially opened the position for $41.70 on February 14, 2012 (yes, that’s how little Disney has moved in almost exactly 12 years). The sale also lowered my per-share “cost” -$6.93 from -$2.22 to -$9.15 (a negative per-share cost indicates all capital has been removed in addition to $9.15 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $118.18, below the next point of key resistance, and my next buy target is $79.72, a bit above the low Disney saw a few months ago in 2023.

DIS closed the week at $108.37, up +4.40% from where I took profits Wednesday.

Nvidia (NVDA): Profit-Taking

Nvidia (NVDA) doesn’t stop going up! I mean, literally. This stock does NOT stop going up. In fact, Nvidia has rallied nearly +20% from where I last took profits at $603.11, less than three weeks ago! On Friday, Nvidia represented 9.335% of the portfolio – a portfolio whose maximum allocation target is 7.14% – so I couldn’t wait any longer, I had to sell.

My sell order went through at $720.95, selling 8.96% of my position and locking in +4,500.77% in gains on shares I bought for $15.67 when I initially opened the position on September 6, 2016. The sale lowered my per-share cost -$110.80 from -$404.30 to -$515.10 (a negative per-share cost indicates all capital has been removed in addition to $515.10 per share added to the portfolio’s bottom line in addition to each share’s current value).

I have let Nvidia run so hot that, even after Friday’s sale, the position still represents 8.50% of the entire portfolio, still 1.36% bigger than it should be. From here, my next sell target is $899.91, just under the round-number psychological resistance of $900.00 because… well… why not? Let the hot stock run even hotter, I guess.

My next buy target is $460.45, more than an astounding -35% lower than where I just took profits, but above a key Fibonacci Retracement level, and a price Nvidia saw less than two months ago!

NVDA closed the week at $721.33, up +$0.38 from where I took profits Friday.

Roblox (RBLX): Profit-Taking

I don’t normally use after-hours trading, but after Schwab fully incorporated Ameritrade’s systems a few weeks ago, the broker introduced the ability to place limit orders which also fill in the after-hours. On Wednesday, this feature came in particularly handy when Roblox (RBLX) reported a blowout quarter, causing this notoriously volatile stock to rocket through my next sell target, letting go of 7.14% of my position at $47.05, before coming back down to Earth before the market opened.

The sale locked in +57.35% in gains on shares I bought for $29.90 on April 27, 2022, and lowered my per-share cost just -0.82% from $42.50 to $42.15. Given Roblox’s volatility, I must always trim the position whenever it makes new highs above my cost basis because the possibility of it returning back to the $20s seems consistently likely.

From here, my next buy target is $26.41, above a key point of support Roblox saw in September 2023, and my next sell target is $50.55, just under a high RBLX hasn’t seen since summer 2022.

RBLX closed the week at $44.40, down -5.63% from where I took profits Wednesday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.