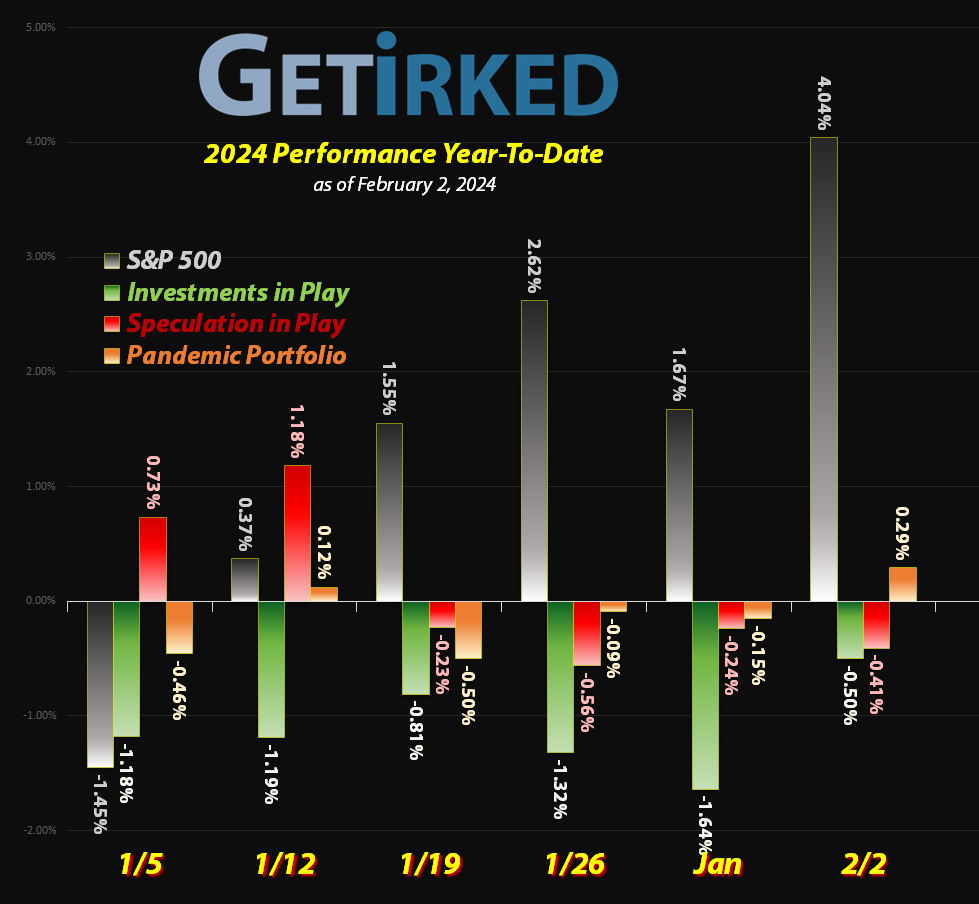

February 2, 2024

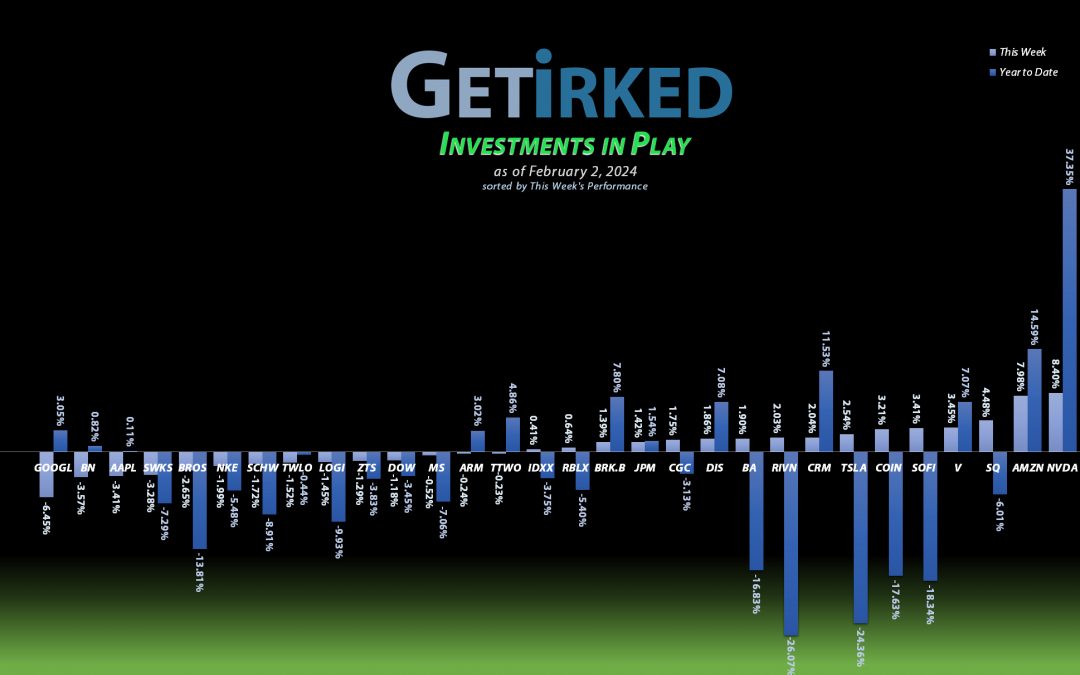

The Week’s Biggest Winner & Loser

Meta (META)

The name of the game this week was earnings and artificial intelligence, and Meta (META) blew away everyone when they reported an absolutely stellar quarter. In addition to giving great guidance, Meta also announced a $2/shr annual dividend, the first time in its history to do that. Meta exploded +20.51% in a single day after taking on all comers Thursday evening and easily snagged the spot of the Week’s Biggest Winner.

Alphabet (GOOGL)

It was a tale of two A.I. cities this week, and Alphabet (GOOGL) continues to be the loser that can’t get out of its own way. After meeting the quarter respectably, management refused to give forward guidance. Then, no matter how hard analysts tried, management wouldn’t say anything about how GOOGL’s AI prospects, Bard and Gemini, refusing to break AI out as its own revenue stream. As a result, investors streamed from the stock to the tune of a -6.45% drop, giving Google the Biggest Loser Spot once more as this gang can’t figure out how to shoot the AI gun.

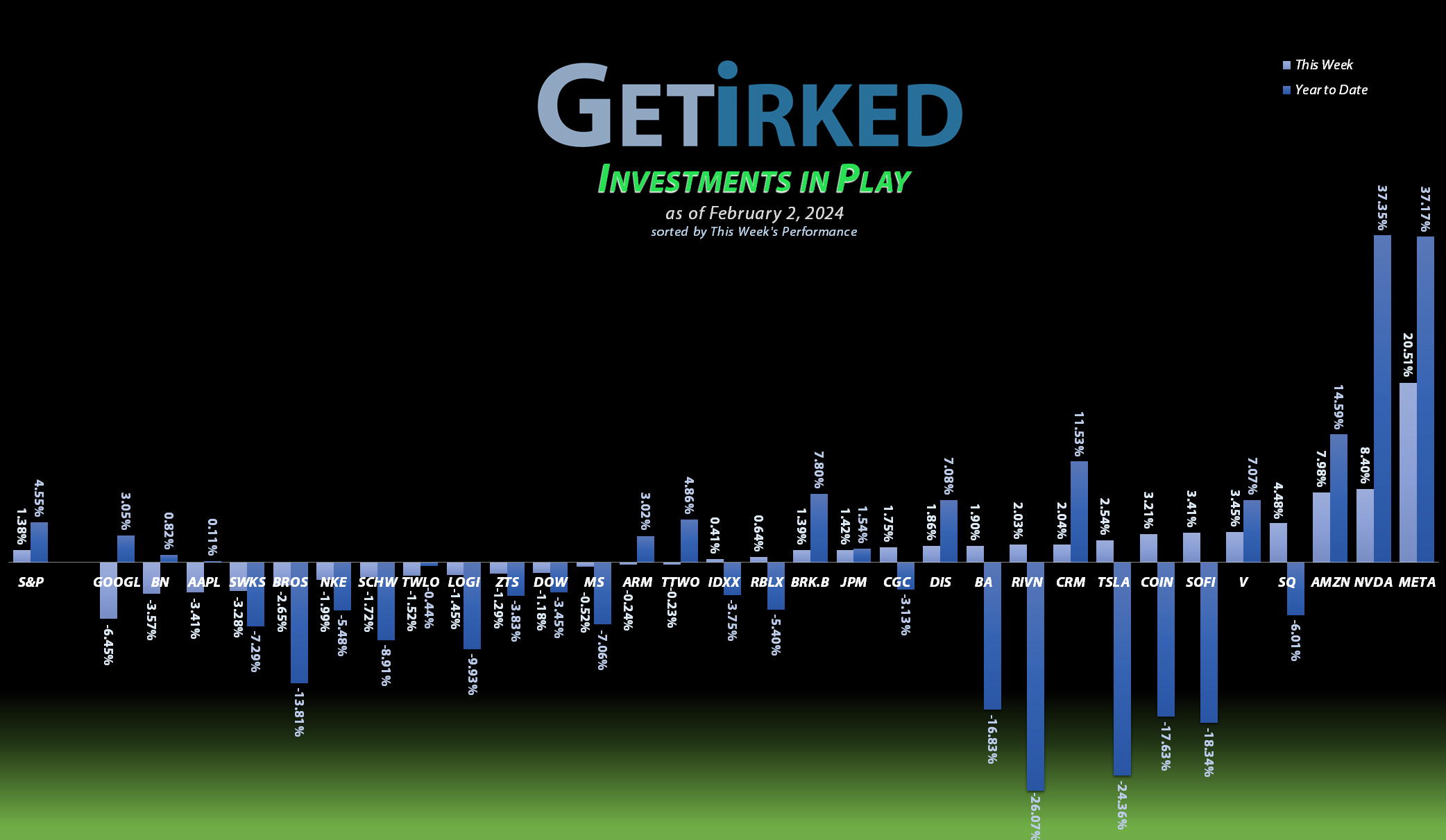

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

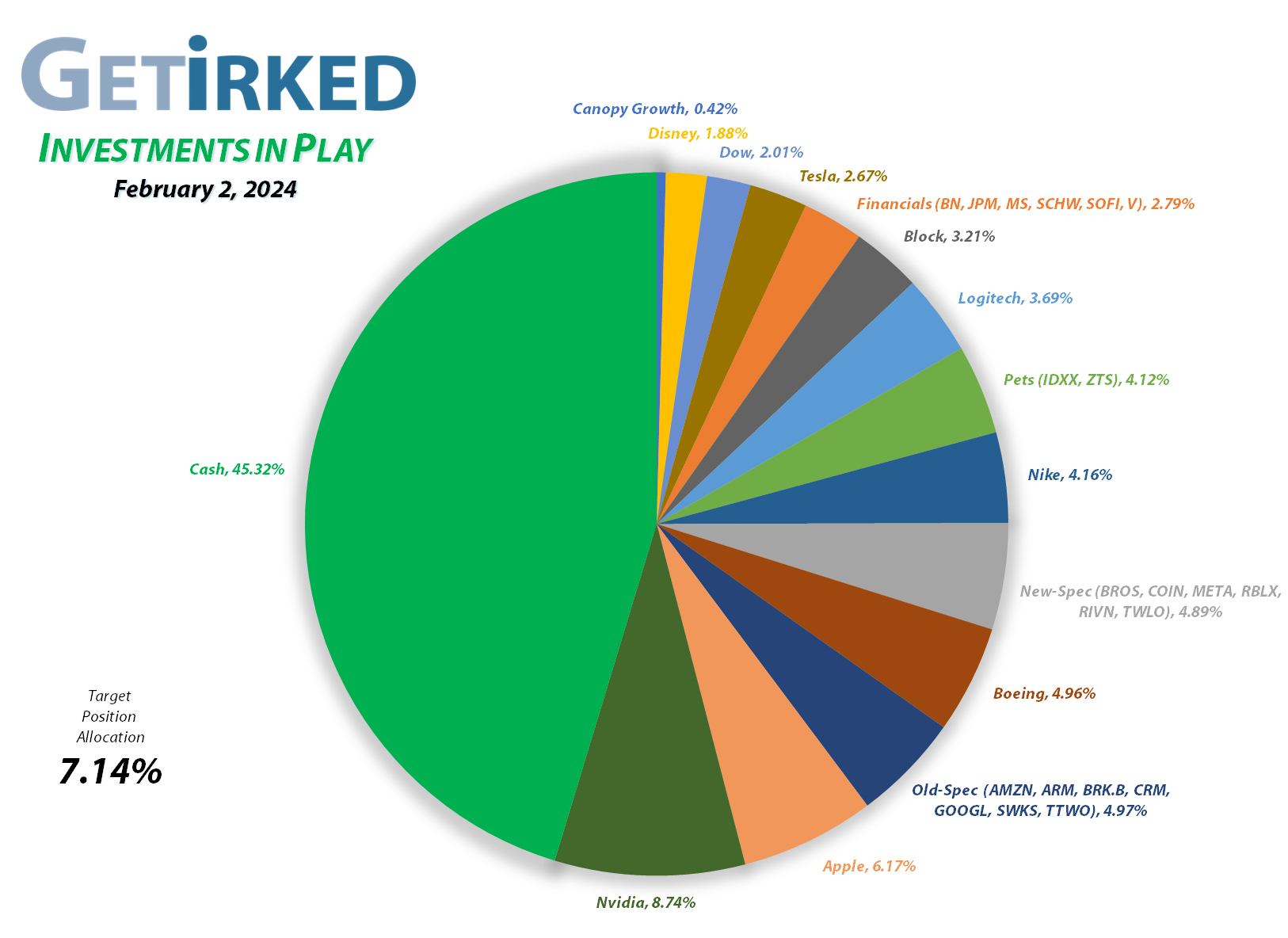

Nvidia (NVDA)

+1884.58%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$404.30)*

Apple (AAPL)

+965.03%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$87.10)*

Logitech (LOGI)

+702.42%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+684.19%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Block (SQ)

+537.52%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Tesla (TSLA)

+510.04%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Skyworks (SWKS)

+469.57%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

IDEXX Labs (IDXX)

+457.77%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+401.27%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+321.21%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+250.63%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+223.90%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Alphabet (GOOGL)

+195.73%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $48.15

Disney (DIS)

+168.31%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.22)*

Take Two (TTWO)

+149.45%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

JP Morgan (JPM)

+135.29%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$39.42)*

Meta (META)

+123.36%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+108.10%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

SoFi (SOFI)

+107.38%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Arm Hldgs (ARM)

+88.28%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $37.73

Morgan Stan (MS)

+52.41%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $57.25

Visa (V)

+51.67%*

1st Buy 5/9/2022 @ $194.00

Current Per-Share: (-$75.58)

Zoetis (ZTS)

+46.03%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Brookfield (BN)

+30.09%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Schwab (SCHW)

+1.52%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $62.00

Roblox (RLBX)

-4.31%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.50

Dutch Bros (BROS)

-19.25%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-21.66%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Coinbase (COIN)

-42.74%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $225.66

Rivian (RIVN)

-43.99%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $27.85

Canopy (CGC)

-88.24%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

JP Morgan Chase (JPM): Dividend Reinvestment

JP Morgan Chase (JPM) paid out its quarterly dividend on Thursday. After reinvestment, this dividend payment raised my per-share “cost” +0.70% from -$39.70 to -$39.42 (a negative per-share cost indicates all capital has been removed in addition to $39.42 per share added to the portfolio’s bottom line in addition to each share’s current value).

Why did my cost basis raise after receiving a dividend?

Whenever all capital has been removed from a position, a dividend reinvestment adds more shares to the position, not more profits. So, the profit in the position is divided by more shares and raises the per-share cost even though the value of the entire position is also increased by the new shares from the dividend.

From here, my next buy target for JP Morgan is $136.89, above a past point of support, and my next sell target is $199.75 right under the round-number psychological resistance provided by the $200.00 mark.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.