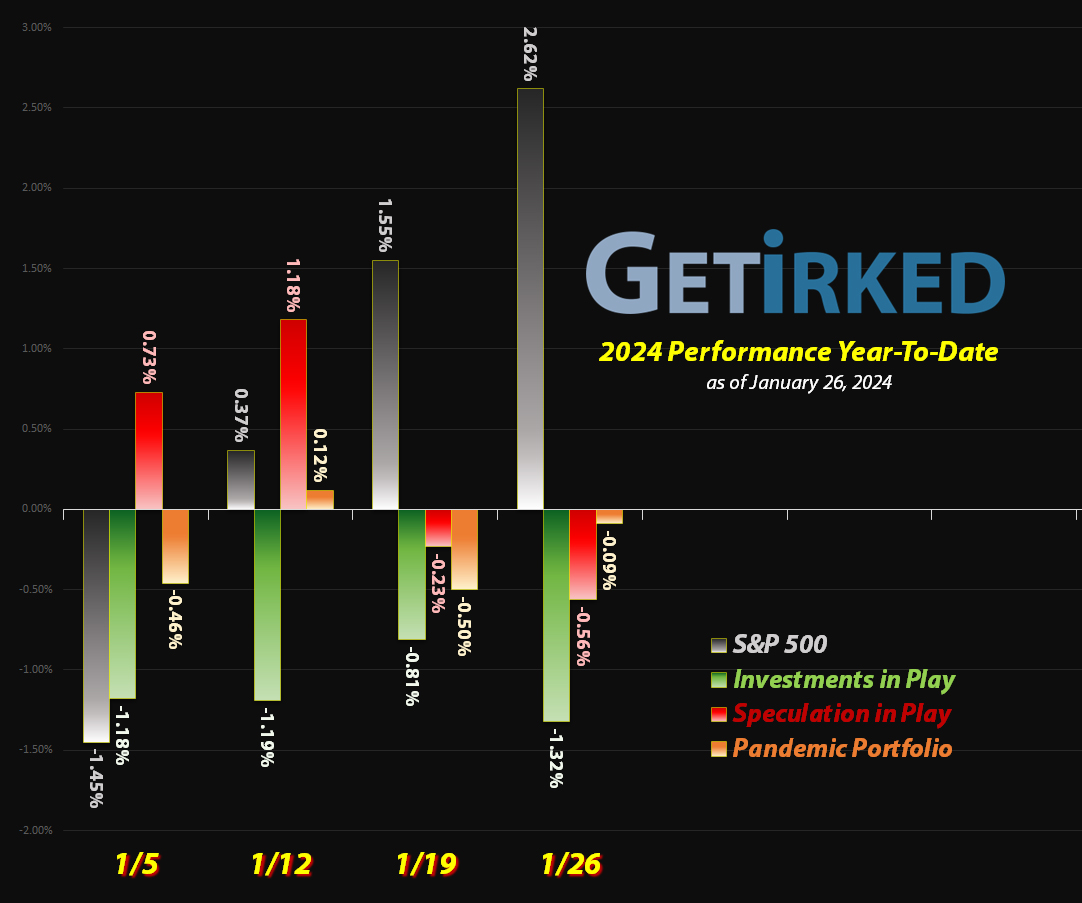

January 26, 2024

The Week’s Biggest Winner & Loser

Berkshire-Hathaway (BRK.B)

Berkshire-Hathaway (BRK.B) rallies when the rest of the market rallies because, well, BRK.B basically captures the vast majority of the sectors in the stock market and almost makes a decent proxy to the S&P 500 itself.

Berkshire finished the week up +5.02%, outperforming the S&P 500 and earning itself the spot of the Week’s Biggest Winner.

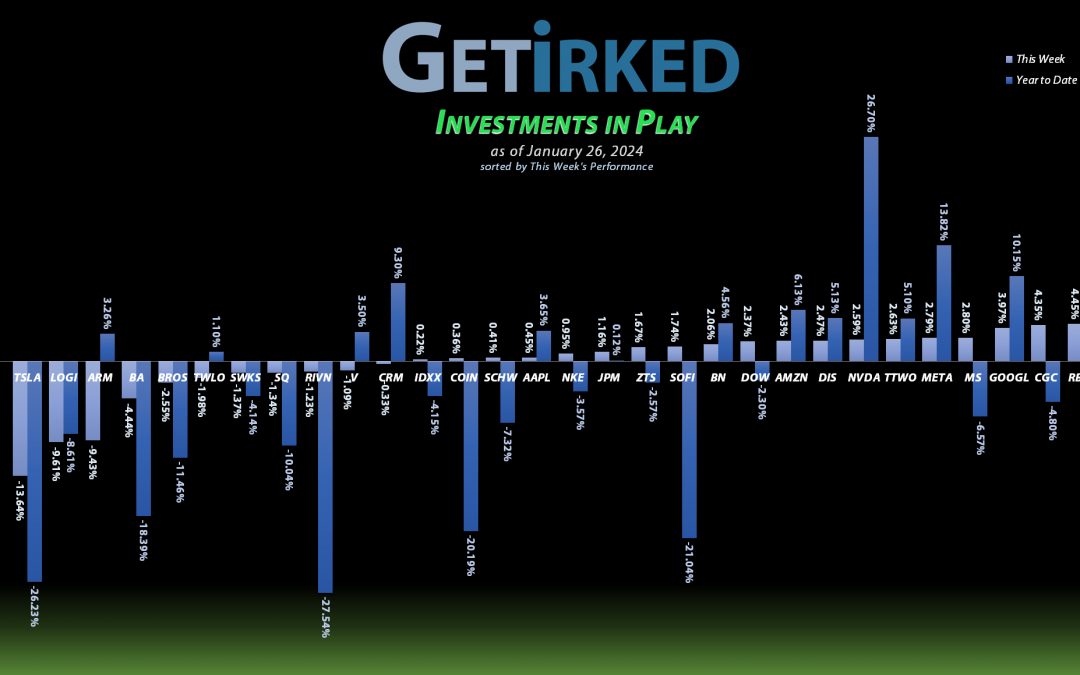

Tesla (TSLA)

While many Tesla (TSLA) bulls felt the #1 Electric-Vehicle (EV) maker would pull a rabbit out of its hat with earnings last week, I was extremely skeptical. Studies have shown EV demand isn’t where many thought it would be and the headwinds facing Tesla in China and elsewhere aren’t small.

Well, love him or hate him, Elon Musk came out and delivered the bad news – Tesla missed on pretty much every metric and gave terrible forward guidance, causing the stock to crash -13.64% and giving its performance a dump of -26.23% Year-To-Date (and the year’s barely started!!!) easily parking Tesla in the Week’s Biggest Loser Spot this week.

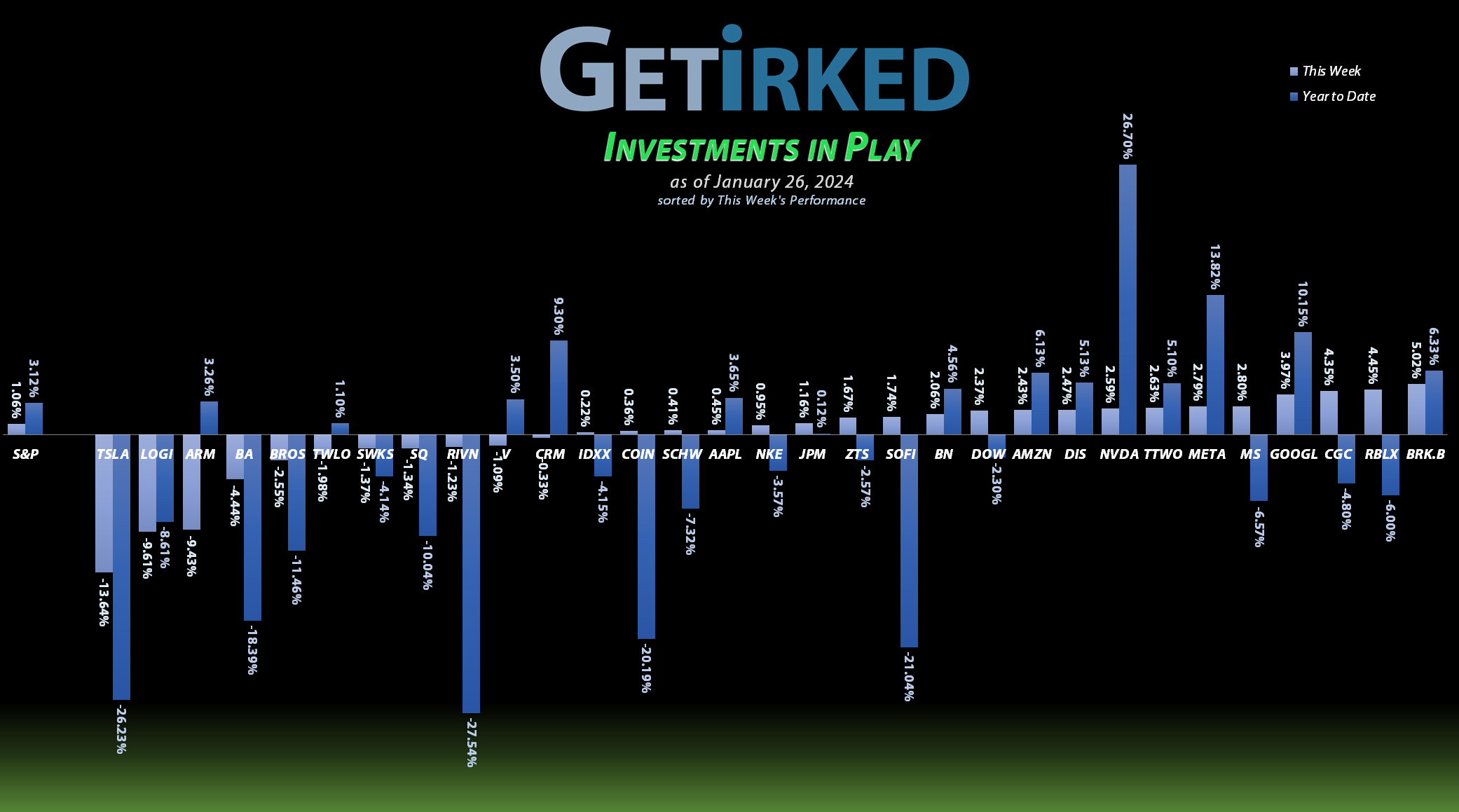

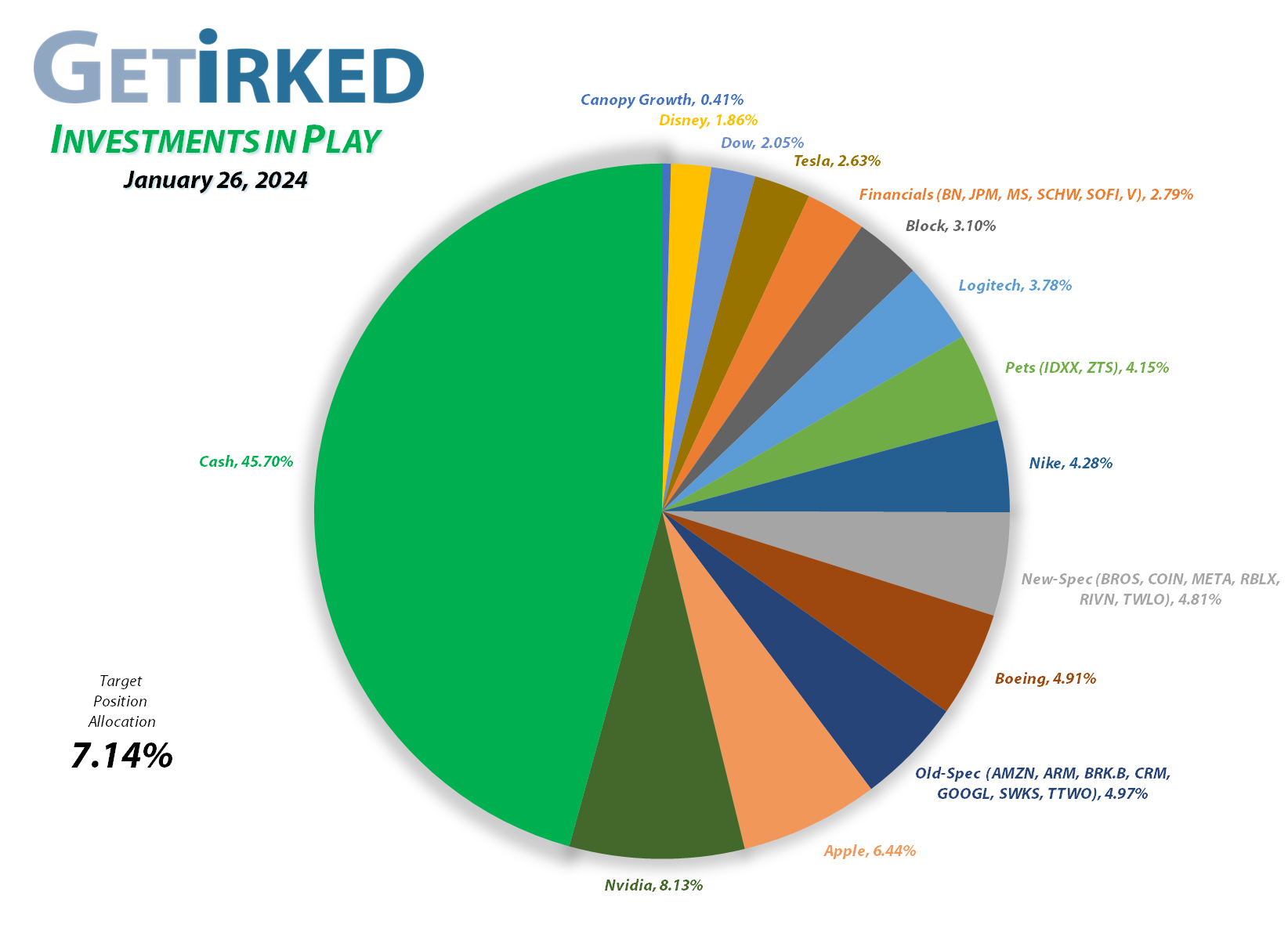

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1793.90%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$404.30)*

Apple (AAPL)

+988.26%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$87.10)*

Logitech (LOGI)

+711.82%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+677.68%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Block (SQ)

+525.92%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Tesla (TSLA)

+499.98%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Skyworks (SWKS)

+481.46%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

IDEXX Labs (IDXX)

+456.45%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+408.58%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+325.04%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+224.73%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+217.39%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Alphabet (GOOGL)

+216.10%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $48.15

Disney (DIS)

+165.24%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.22)*

Take Two (TTWO)

+150.03%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

JP Morgan (JPM)

+132.99%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$39.70)*

Meta (META)

+110.86%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+105.32%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

SoFi (SOFI)

+100.54%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Arm Hldgs (ARM)

+88.73%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $37.73

Morgan Stan (MS)

+53.24%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $57.25

Visa (V)

+51.66%*

1st Buy 5/9/2022 @ $194.00

Current Per-Share: (-$75.58)

Zoetis (ZTS)

+47.95%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Brookfield (BN)

+34.91%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Schwab (SCHW)

+3.29%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $62.00

Roblox (RLBX)

-4.92%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.50

Dutch Bros (BROS)

-17.04%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-20.45%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Coinbase (COIN)

-44.52%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $225.66

Rivian (RIVN)

-45.10%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $27.85

Canopy (CGC)

-88.44%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Alphabet (GOOGL): Profit-Taking

After rallying nearly 25% since its October lows and approaching its all-time high, I decided it was time to substantially reduce my Alphabet (GOOGL) position on Wednesday with an order that sold 33.33% of my position at $149.71. I love Google as a long-term play, but the amount of froth I’m seeing across the board makes me feel like taking profits and reducing exposure as we head into earnings season where expectations are for utter perfection.

The sale locked in +46.88% in gains on some of the shares I bought for $101.93 when I initially opened the position on September 16, 2022, and lowered my per-share cost -41.28% from $82.00 down to $48.15.

From here, my next sell target is much higher at $199.29, just under the psychological round-number resistance at $200.00, where I will remove the remaining capital (and some profits) from the position. My next buy target is $120.89, slightly above the low Alphabet saw just a few months ago in October 2023.

GOOGL closed the week at $152.19, up +1.66% from where I took profits Wednesday.

Nvidia (NVDA): Profit-Taking

It was time, once again, to take profits in the AI behemoth that is Nvidia (NVDA) when it made new all-time highs on Wednesday with an order that sold 8.23% of my position at $603.11, locking in +3,748.82% in gains on shares I bought for $15.67 when I initially opened the position on September 6, 2016.

Nvidia is increasing so fast, that it’s gained +21.49% since I last took profits at $496.42, a little over just two months ago!

The sale lowered my per-share “cost” -$82.88 from -$321.42 to -$404.30 (a negative per-share cost indicates all capital has been removed in addition to $404.30 per share added to the portfolio’s bottom line in addition to each share’s current value).

As much as I believe in the long-term prospects for this amazing company, the rocketing stock price causes it to outgrow my maximum target allocation for the portfolio dramatically. In fact, even after this sale, NVDA remains the largest position in the portfolio at 8.05% when the biggest a position should get is 7.14%.

From here, I will continue to let Nvidia run hot with my next sell target at $749.89, just under the psychological round-number resistance of $750, and my next buy target is $410.73, quite a bit above the low Nvidia saw not even three months ago!

NVDA closed the week at $610.31, up +1.19% from where I took profits Wednesday.

Visa (V): Profit-Taking

Visa (V) has been an absolute beast since I initially opened the position at $194.00 back on May 9, 2022. After briefly, dipping to a low of $174.60 in October 2022, Visa has rallied more than +56% in about a year and a half, a remarkable move for any stock but particularly a financial/fintech stock such as V.

Given how expectations couldn’t be higher for its earnings report later in the week, I decided the prudent thing to do would be to remove all remaining capital from the position headed to earnings, which I did on Monday with a sell order which filled at $272.24.

The sale locked in +40.33% in gains on shares I bought for $194.00 when I opened the position, and lowered my per-share cost -$251.54 from $175.96 to -$75.58 (a negative per-share cost indicates all capital has been removed in addition to $75.58 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, I have no additional sell targets, and I will start putting the profits back to work if Visa pulls back to $255.29, a level of support V has seen very recently.

V closed the week at $267.90, down -1.59% from where I took profits Monday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.