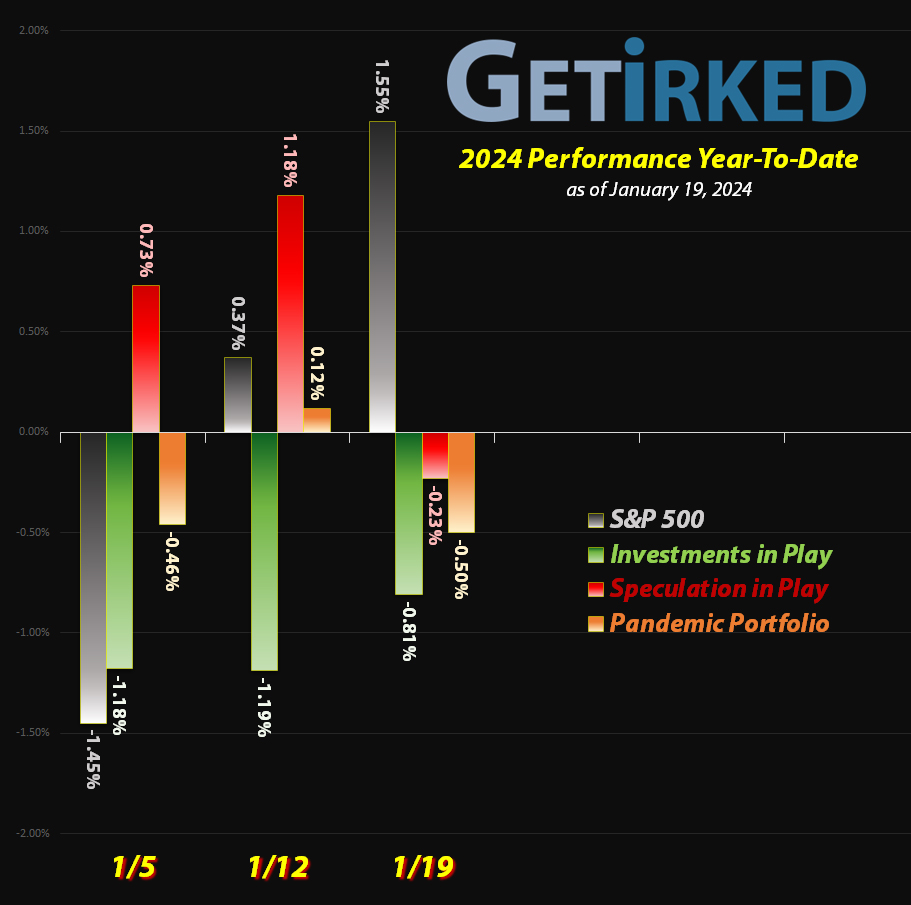

January 19, 2024

The Week’s Biggest Winner & Loser

Arm Holdings (ARM)

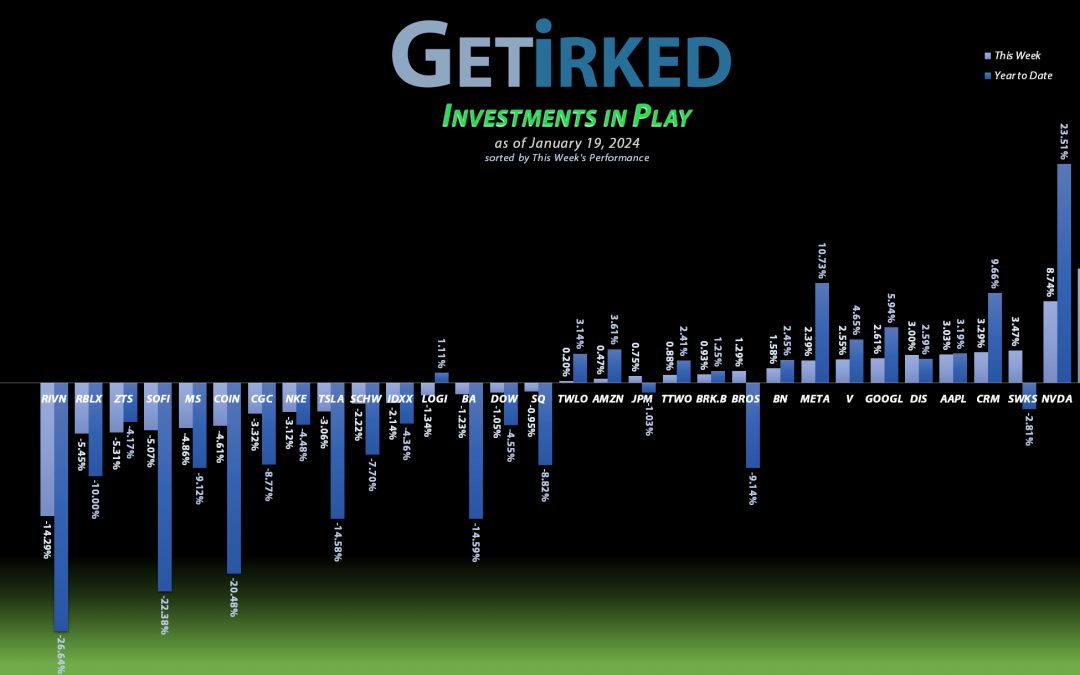

Arm Holdings (ARM) caught a big bid with the rest of the Artificial Intelligence (AI) sector this week on the back of good news lifting Advanced Micro Devices (AMD) and Nvidia (NVDA) higher.

I keep reading questionable reports suggesting Arm is overladen in debt, however the markets ignored any potentially negative news in the stock, causing ARM to rocket +12.36%, beating out even AI leader Nvidia to swing in as the Week’s Biggest Winner.

Rivian (RIVN)

The entire Electric Vehicle (EV) space got hit by negative news this week as adoption just isn’t happening as quickly as industry experts expected it to.

This already-bad bad news was compounded when an analyst report targeted Rivian (RIVN), specifically, on Thursday, causing Rivian to finish the week down a whopping -14.29% and earning it the spot of the Week’s Biggest Loser.

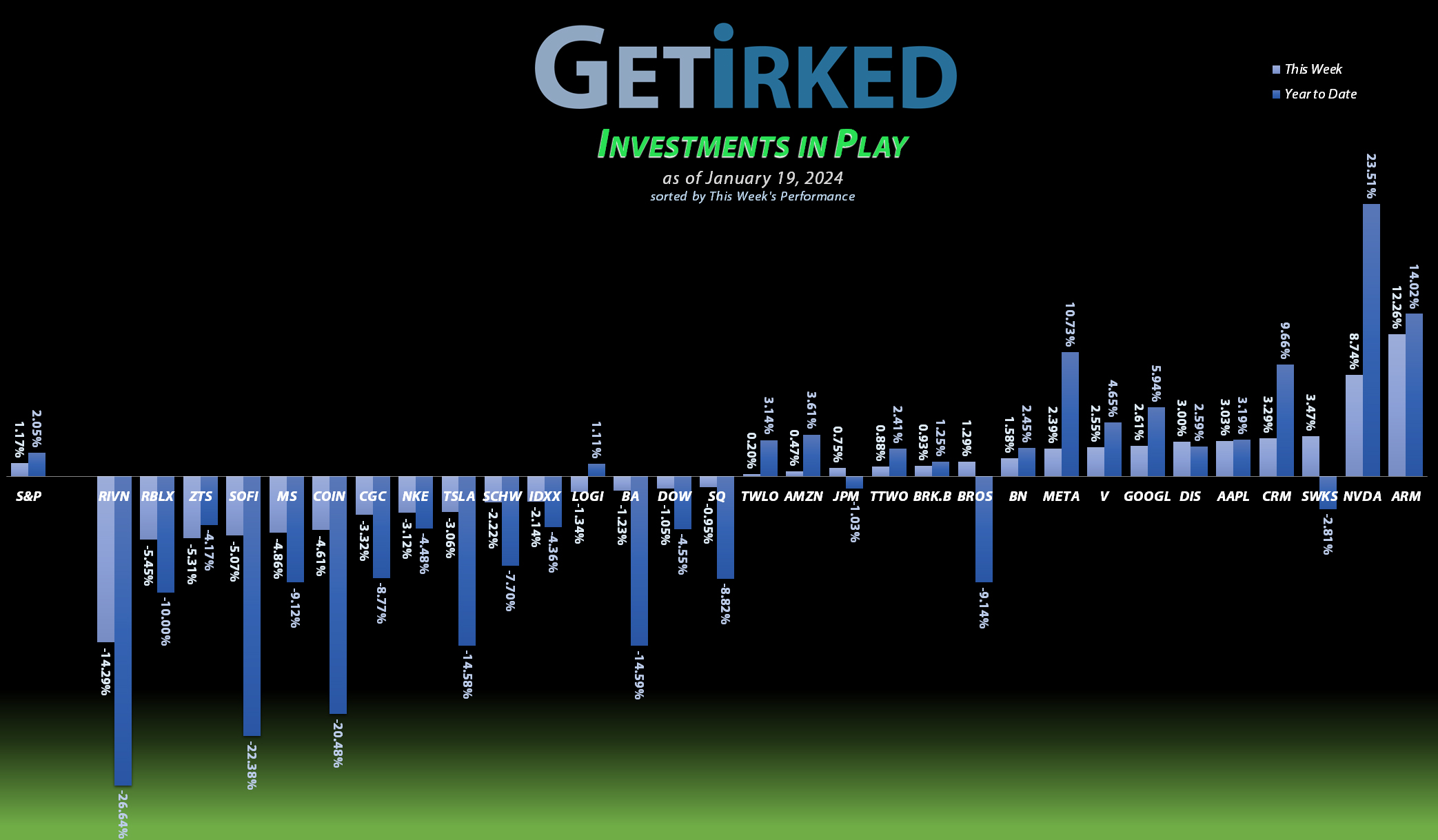

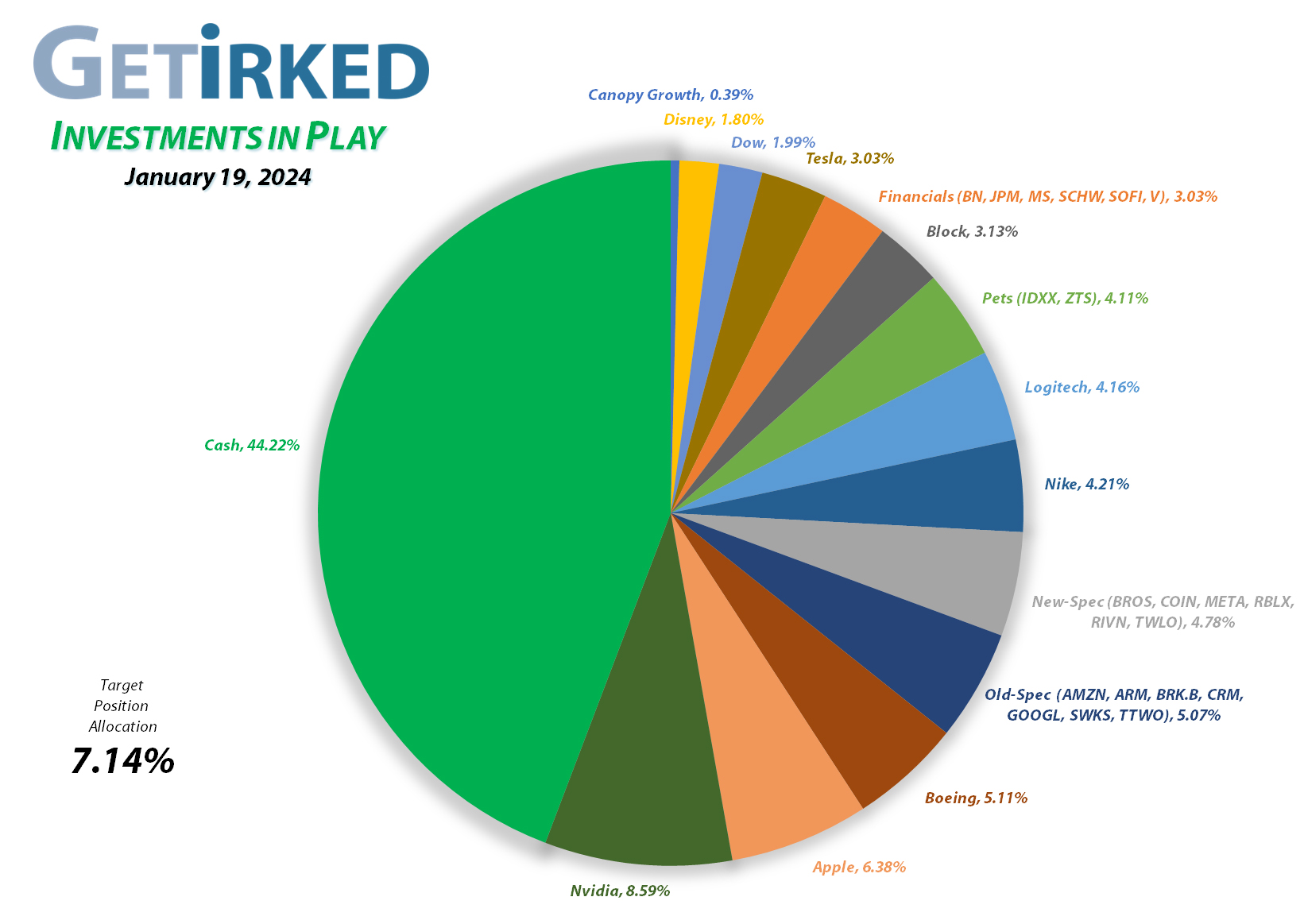

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1765.37%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$321.42)*

Apple (AAPL)

+985.22%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$87.10)*

Logitech (LOGI)

+780.83%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+693.53%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Tesla (TSLA)

+562.48%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+529.37%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Skyworks (SWKS)

+486.49%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

IDEXX Labs (IDXX)

+455.74%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+405.21%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+317.57%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+217.02%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+218.73%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+161.35%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.22)*

Take Two (TTWO)

+143.62%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

JP Morgan (JPM)

+131.75%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$39.70)*

Meta (META)

+109.21%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Arm Hldgs (ARM)

+108.38%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $37.73

SoFi (SOFI)

+97.12%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Berkshire (BRK.B)

+95.47%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Alphabet (GOOGL)

+78.51%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Visa (V)

+56.35%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.24

Morgan Stan (MS)

+49.09%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $57.25

Zoetis (ZTS)

+45.52%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Brookfield (BN)

+32.18%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Schwab (SCHW)

+2.87%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $62.00

Roblox (RLBX)

-9.01%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.50

Dutch Bros (BROS)

-14.93%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-18.85%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-44.42%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $27.85

Coinbase (COIN)

-44.72%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $225.66

Canopy (CGC)

-88.92%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Rivian (RIVN): Added to Position

With studies showing that Americans aren’t as enthusiastic about the adoption of Electric Vehicles (EVs) as was previously thought, the entire EV sector was positively pounded this week with downgrades and warnings about everyone from the Big Daddy, Tesla (TSLA), all the way down to smaller companies like Rivian (RIVN).

Rivian, specifically, received an analyst downgrade mid-week which caused the stock to positively plummet, hitting my next buy target on Friday and adding 3.89% to my position at $15.25.

While a relatively small buy, this order still lowered my per-share cost -3.63%, from $28.90 to $27.85 (a total reduction of -78.07% from where I initially opened the position at $127.00 back on November 12, 2021).

From here, I will continue adding if RIVN continues selling off with my next buy target at $13.60, above a past point of support. I will also start reducing my position if Rivian makes it back up to my cost basis as the position is slightly overweight in the basket it shares and my cost basis is now slightly under its $28.06 high from 2023.

RIVN closed the week at $15.48, up +1.51% from where I added Friday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.