January 12, 2024

The Week’s Biggest Winner & Loser

Nvidia (NVDA)

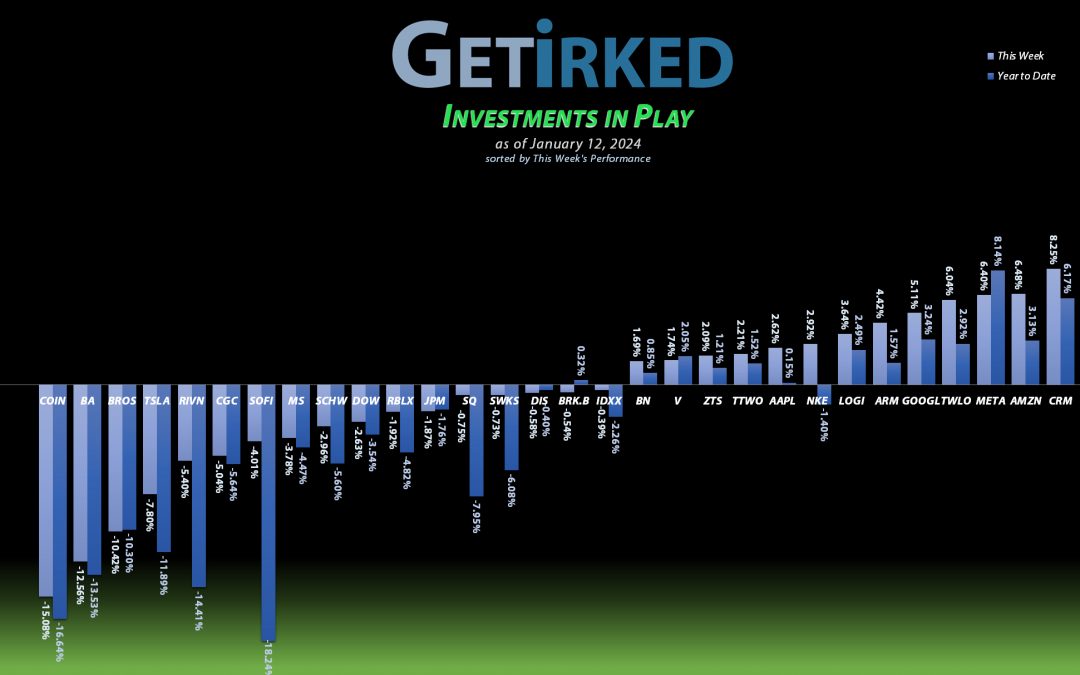

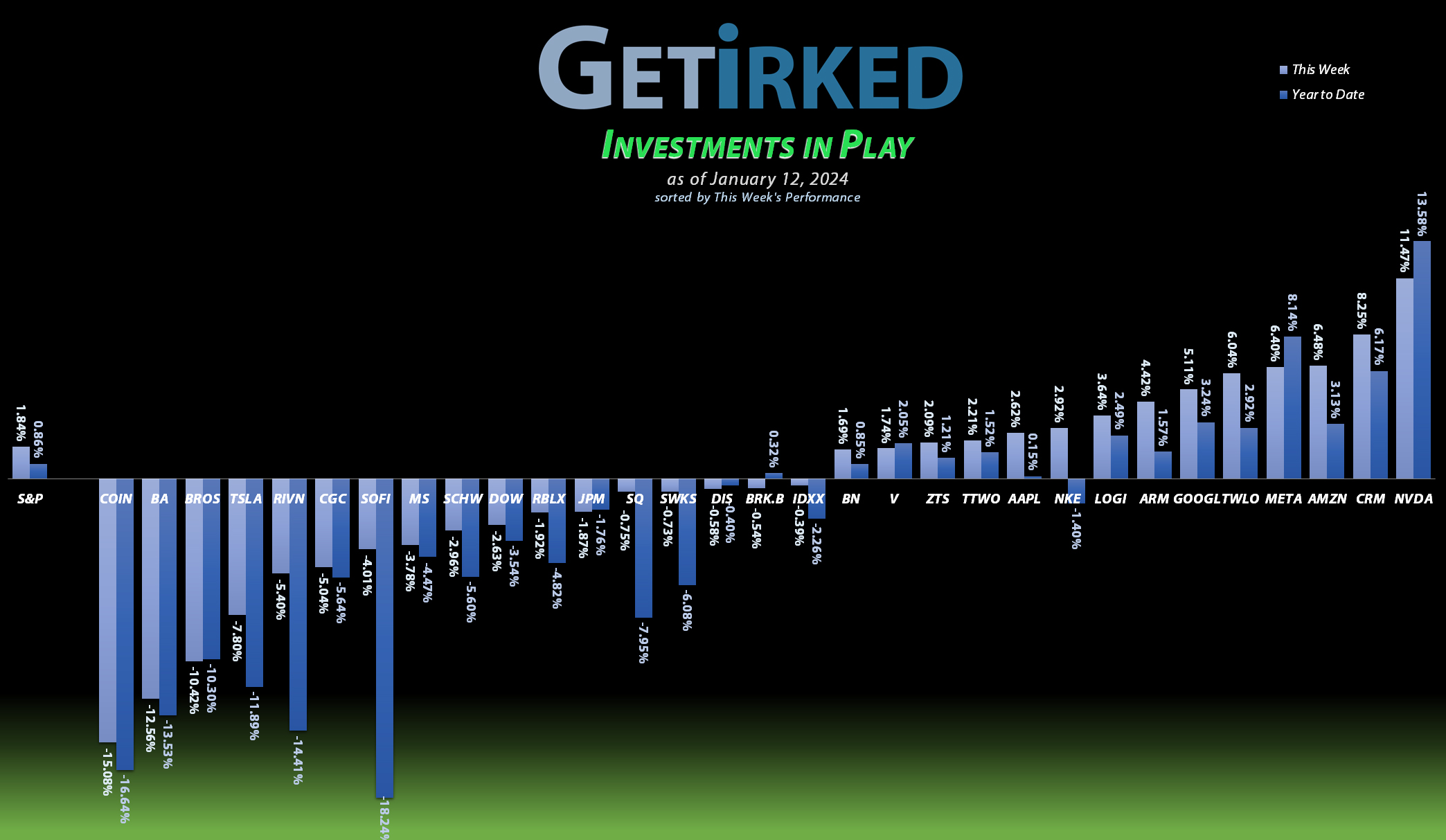

Nvidia (NVDA) exploded higher after announcing new(ish) gamer graphic cards at the Consumer Entertainment Show in Las Vegas. I’m not complaining, but the resulting +11.47% pop just shows how few investors understand Nvidia’s business. The new graphics cards were slightly boosted versions of their existing 4000-series. Yes, that’s slightly interesting, but it’s not that exciting. Regardless, Nvidia swings in as the week’s Biggest Winner as investors still can’t get enough of the Artificial Intelligence hype.

Coinbase (COIN)

After the Bitcoin ETFs were approved on Wednesday and started trading on Thursday, it seems that investors finally realized, “Hey, wait a second – if people can buy Bitcoin through an easy-to-manage ETF, won’t that mean fewer people will use Coinbase (COIN)???”

Maybe that wasn’t the real reason, but Coinbase dropped a whopping -15.08% this week, earning itself the spot of the week’s Biggest Loser.

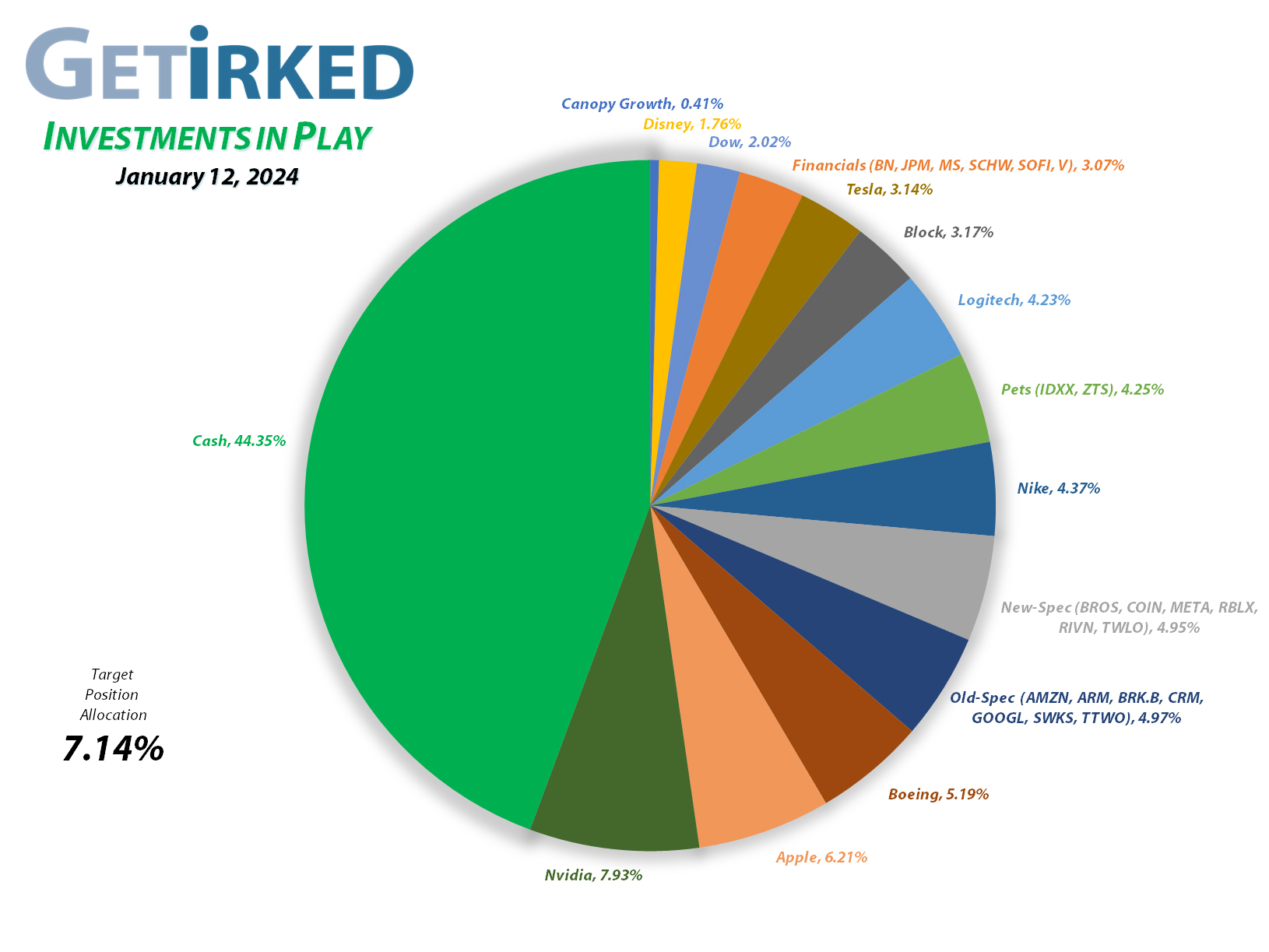

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1673.26%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$321.42)*

Apple (AAPL)

+965.28%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$87.10)*

Logitech (LOGI)

+790.61%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+698.04%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Tesla (TSLA)

+576.94%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+531.86%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Skyworks (SWKS)

+474.14%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

IDEXX Labs (IDXX)

+462.76%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+417.03%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+320.91%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+215.55%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+208.15%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+156.81%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.22)*

Take Two (TTWO)

+141.50%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

JP Morgan (JPM)

+130.96%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$39.70)*

Meta (META)

+107.82%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

SoFi (SOFI)

+107.64%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Berkshire (BRK.B)

+93.71%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Arm Hldgs (ARM)

+85.63%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $37.73

Alphabet (GOOGL)

+73.96%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Morgan Stan (MS)

+56.69%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $57.25

Zoetis (ZTS)

+53.68%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Visa (V)

+52.83%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.24

Brookfield (BN)

+30.12%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Schwab (SCHW)

+5.21%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $62.00

Roblox (RLBX)

-3.69%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.50

Dutch Bros (BROS)

-15.97%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-19.02%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-37.51%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $28.90

Coinbase (COIN)

-42.05%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $225.66

Canopy (CGC)

-88.54%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Disney (DIS): Dividend Reinvestment RETURNS!!

After four years, Disney (DIS) finally brought back its dividend, a tradition it had maintained for decades prior to the pandemic giving the company the excuse to cut its dividend altogether.

While not huge at this point, any dividend is better than none, and, after reinvestment, the payout raised my per-share “cost” +$0.01 from -$2.23 to -$2.22 (a negative per-share cost indicates all capital has been removed in addition to $2.22 per share added to the portfolio’s bottom line in addition to each share’s current value).

The reason reinvesting the dividend “raised” my per-share cost is since all of the capital and quite a bit of profit have been taken out of my Disney position, adding more shares means the same amount of profit is divided across more shares, thus making the amount of profit per-share “smaller.”

From here, my next buy target is $79.89, above the lows Disney saw a few months ago in 2023, and my next sell target is $103.80, just below a past point of resistance.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.