December 29, 2023

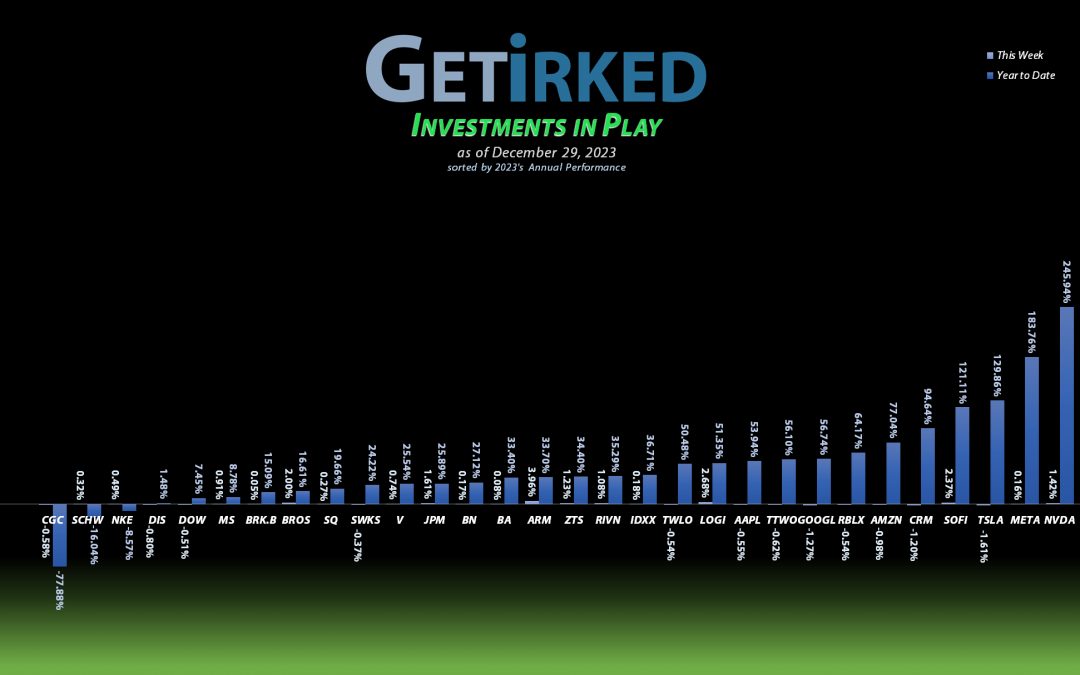

2023’s Best and Worst

Coinbase (COIN)

With all the talk of the “Magnificent Seven” this year, you’d be forgiven for assuming that one of the megacap tech stocks would end up winning the year in performance.

Of course, you’d be wrong.

This Year’s Biggest Winner wasn’t Tesla (TSLA) or Nvidia (NVDA). No, this Year’s Biggest Winner was Coinbase (COIN), the beaten-up Bitcoin and cryptocurrency exchange that entered the year positively destroyed only to turn it around and finish the year up an absolutely astounding +417.62%!!

Canopy Growth Corp (CGC)

The cannabis sector has been absolute grim death since its highs in 2021, but this year saw the entire sector plumb new lows. However, this year’s Biggest Loser spot is reserved for a special kind of trash. Not only was this contestant part of the most hated sector this year, it added on to the pain by reporting financial irregularities and pretty much doing anything and everything it could to destroy investor value.

Yes, you’re right. You know it. You hate it.

Ladies and Gentlemen, this Year’s Biggest Loser is Canopy Growth Corporation (CGC)! The P.O.S. company that is run by the gang who couldn’t shoot straight, positively destroying value with an astounding -77.88% annual loss.

As if that wasn’t enough, CGC entered the year weak, so this loss was just compounding injury upon injury. There was no insult. This stock is just 100% pure, unadulterated PAIN.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1573.23%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$321.45)*

Apple (AAPL)

+988.65%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$87.10)*

Logitech (LOGI)

+783.79%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+769.97%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Tesla (TSLA)

+640.84%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+575.25%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Skyworks (SWKS)

+508.61%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

IDEXX Labs (IDXX)

+474.85%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+428.11%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

Dow (DOW)

+329.70%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+210.08%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+198.40%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

SoFi (SOFI)

+161.86%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Disney (DIS)

+156.14%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.23)*

Take Two (TTWO)

+140.41%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

JP Morgan (JPM)

+131.40%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$11.15)*

Meta (META)

+104.65%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Arm Hldgs (ARM)

+99.27%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $37.73

Berkshire (BRK.B)

+90.00%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Alphabet (GOOGL)

+70.35%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Morgan Stan (MS)

+62.89%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $57.25

Zoetis (ZTS)

+52.48%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Visa (V)

+50.33%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.24

Brookfield (BN)

+32.85%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.20

Schwab (SCHW)

+10.97%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $62.00

Roblox (RLBX)

+7.65%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.50

Dutch Bros (BROS)

-4.46%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-16.10%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-18.82%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $28.90

Coinbase (COIN)

-22.93%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $225.66

Canopy (CGC)

-87.05%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Arm Holdings (ARM): Profit-Taking

Arm Holdings (ARM) has been both incredibly volatile in its less than three months since returning to public markets, pulling back more than -17% from where it initially became available to the public before rocketing nearly +61% from its October lows just a little more than two months ago.

So, despite ARM being a relatively-new, relatively-small position in my portfolio, I positively had to capitalize on the near-parabolic move using a stop-limit order which filled on Wednesday, selling 1/3 of my position at $73.83, locking in +46.37% in gains on shares I bought for $50.44 on October 13.

The sale lowered my per-share cost -24.20% from $49.75 to $37.71. From here, I will actually remove all remaining investment capital from this position if it makes a try for the even-number psychological resistance at $100.00 with my next sell target at $99.92, and I will actually buy above my cost basis if it tests the lows it last saw at the end of October with my next buy target at $47.29.

ARM closed the week at $75.15, up +1.79% from where I took profits Wednesday.

Brookfield (BN): Profit-Taking

Alternative asset-manager Brookfield (BN) has only been a position in my Investments in Play for about two months, and it’s already proven to be an incredibly volatile position, rallying more than 40% in less than two months off of its October lows.

Accordingly, I took more profits on Wednesday with a sell order that sold 12.50% of my position at $40.60, locking in +34.30% in gains on some of the shares I bought for $30.23 on October 2. The sale lowered my per-share cost -4.13% from $31.50 to $30.20.

From here, my next sell target is $44.00, slightly under a high Brookfield last saw in August 2022, and my next buy target is $29.07, a bit above the lows Brookfield saw just a little more than two months ago.

BN closed the week at $40.12, down -1.18% from where I took profits Wednesday.

JPMorgan (JPM): Profit-Taking

JPMorgan (JPM) and the rest of the financial sector continued rallying this week, demonstrating pretty epic strength. Given that JPM shares an allocation in my Financial Basket and is dramatically overweight comparative to its compatriots, I decided it was finally time to remove all of my remaining investment capital from the venerable JPMorgan on Wednesday, selling 11.84% of my position at $168.68.

The sale locked in +64.89% in gains on some of the shares I bought for $102.30 when I initially opened this position on October 26, 2017. As I mentioned, the sale removed the last of my capital, lowering my per-share cost -$21.30 from $10.15 to -$11.15 (a negative per-share cost indicates all capital has been removed in addition to $11.15 per share added to the portfolio’s bottom line in addition to each share’s current value).

I will take even more profits out of JPM relatively soon as it is rapidly approaching its all-time high of $172.96. My next sell target is $173.12, just slightly higher than the all-time high as I think the momentum seen in the space could cause a bit of a blow-off top before JPM retreats.

Despite JPM’s demonstrated strength, I will remain steadfast in my buying target down near its 2022 lows of $101.28 with my next target at $101.89. Of course, with all of the capital removed, my investing discipline will only allow me to put profits back into this position as I will never turn a winner into a loser by putting investment capital back in once it has been fully removed.

JPM closed the week at $170.10, up +0.84% from where I took profits Wednesday.

Roblox (RBLX): Profit-Taking

Roblox (RBLX) really popped on Tuesday, triggering my next sell order which sold 6.67% of my position at $46.25, locking in +47.53% in gains on shares I bought for $31.35 back on August 9. Roblox would make a truly incredible trading vehicle if one was so inclined as it regularly sells off to the mid-20s and then rallies to the mid-40s, however, since I’m a long-term investor, I simply add when it sells off and take profits when it rallies.

The sale lowered my per-share cost -0.58% from $42.75 to $42.50. From here, my next sell target is $50.30, just under the next point of resistance that Roblox saw back in 2022, and my next buy target is $26.50, a bit higher than the low it saw in September.

RBLX closed the week at $45.72, down -1.15% from where I took profits Tuesday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.