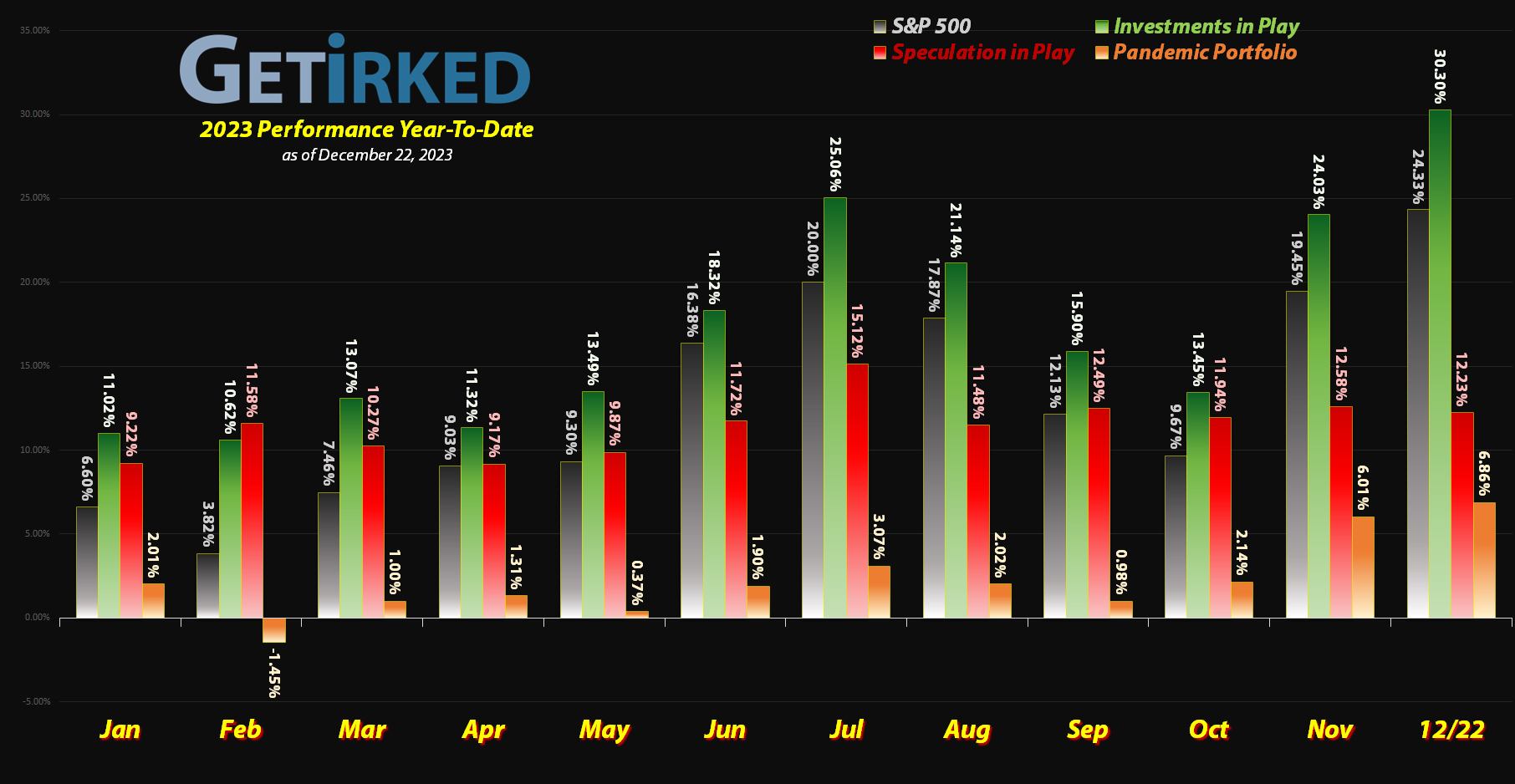

December 22, 2023

The Week’s Biggest Winner & Loser

Coinbase (COIN)

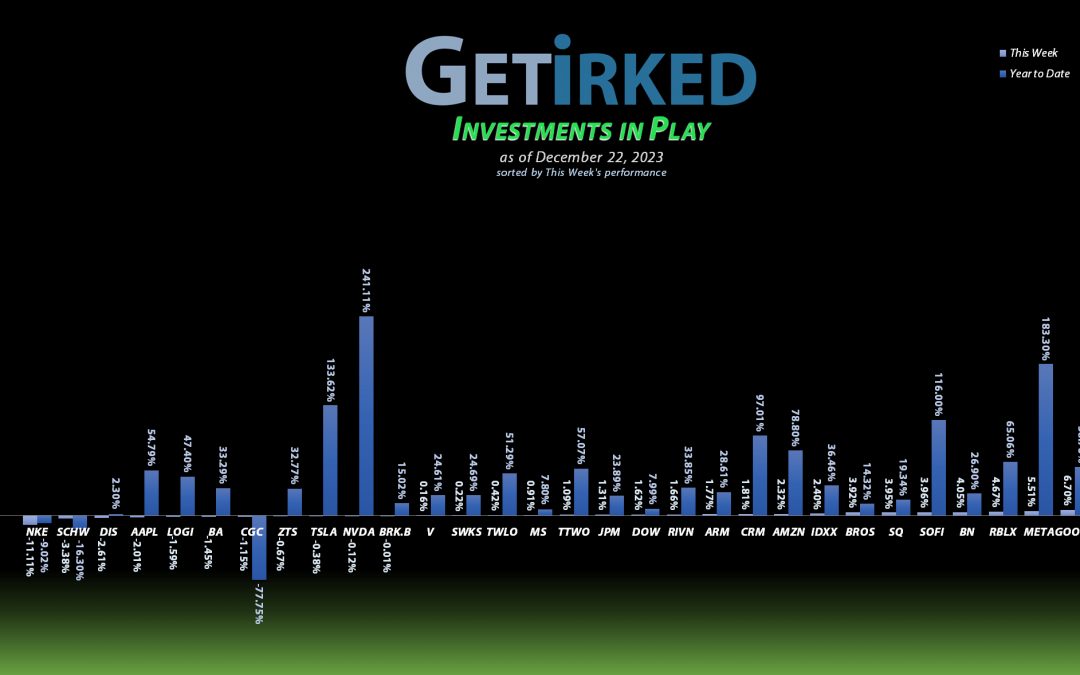

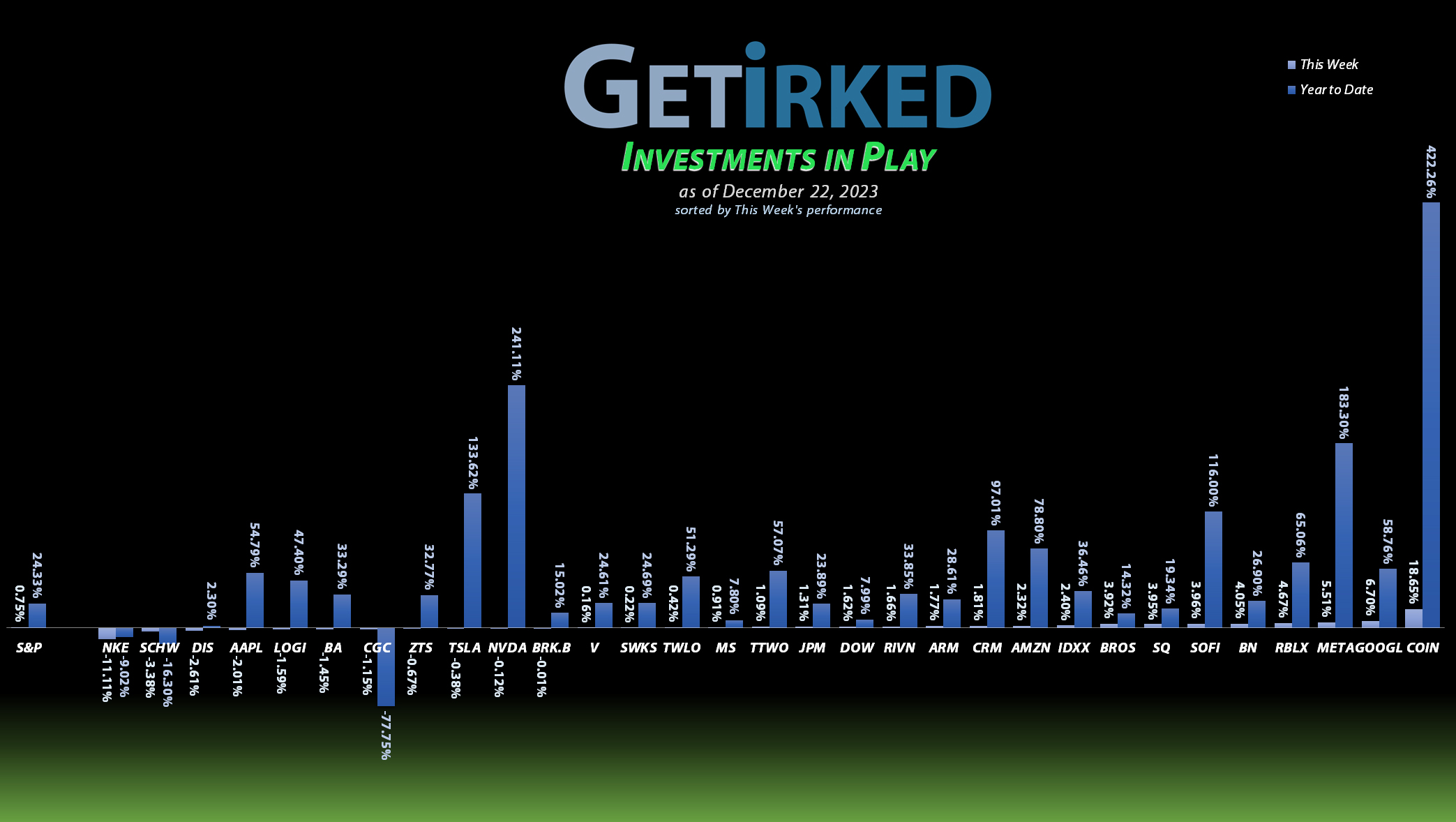

With all the talk given to artificial intelligence stocks this year as everyone talks about Nvidia’s (NVDA) “incredible” +241% gain, it seems no one was paying attention to Bitcoin exchange Coinbase (COIN), which has rallied an astounding +422.26% this year. In fact, COIN rallied another +18.65% this week alone, making it the Biggest Winner in the portfolio.

Nike (NKE)

Earnings disappointments are never a good thing, and Nike (NKE) fumbled its report when it announced a multibillion-dollar cost-cutting program… to be implemented in the next six months.

Normally, cost-cutting is a good thing for shareholders, but for Nike to be executing such a massive program in such a short time, investors got spooked that Nike sees something bad coming that the rest of us don’t.

Nike collapsed -11.11% on Friday alone, one of its all-time worst in the history of the stock, easily tripping in as the week’s Biggest Loser.

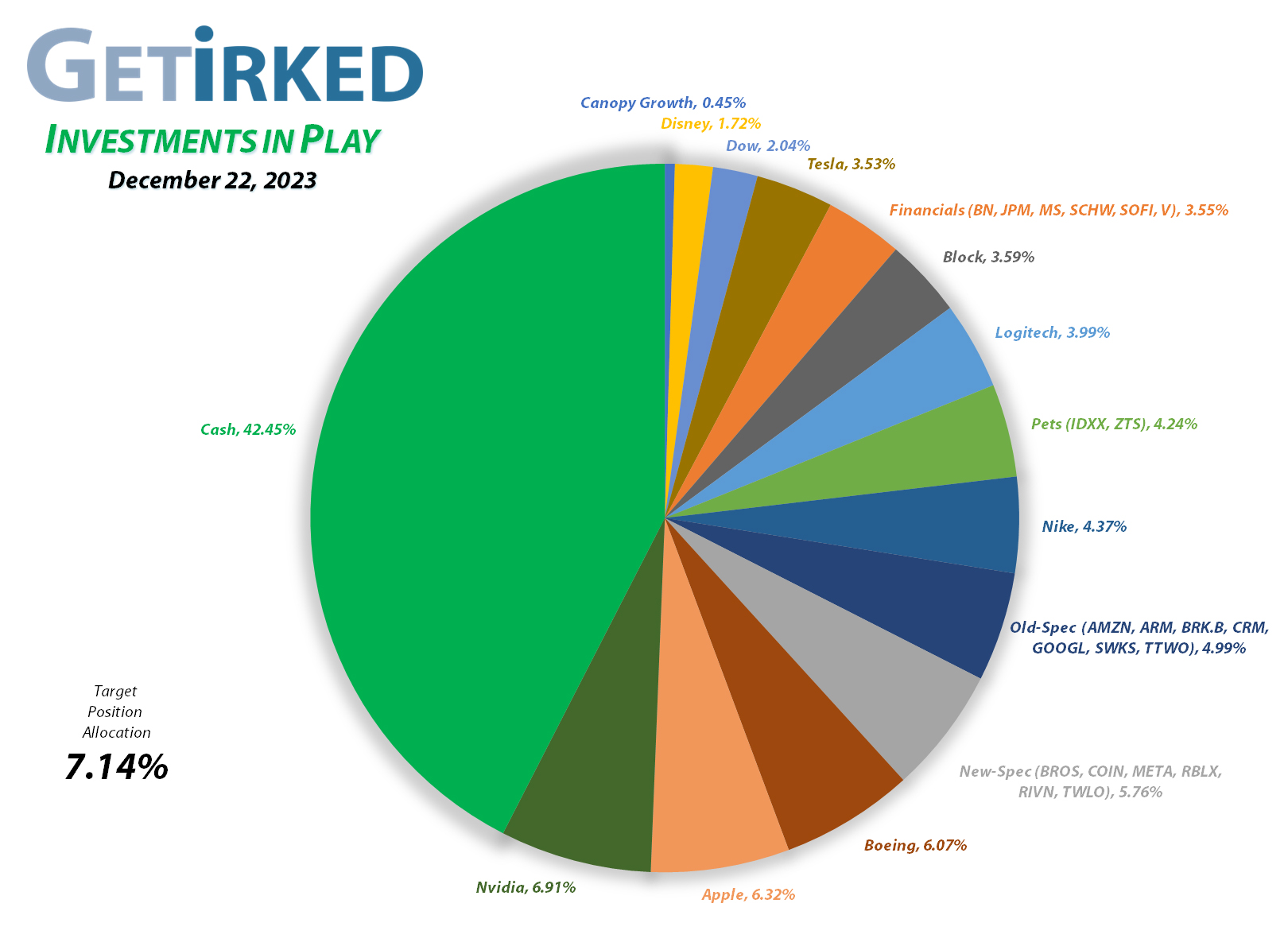

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1559.90%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$321.45)*

JP Morgan (JPM)

+1549.35%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $10.15

Apple (AAPL)

+992.43%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$87.10)*

Boeing (BA)

+769.44%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Logitech (LOGI)

+764.98%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Tesla (TSLA)

+649.81%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+574.41%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Skyworks (SWKS)

+510.06%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

IDEXX Labs (IDXX)

+474.24%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+426.39%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

Dow (DOW)

+331.37%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+213.10%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+201.97%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+157.37%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.23)*

SoFi (SOFI)

+155.54%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Take Two (TTWO)

+141.90%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+104.56%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+89.85%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Alphabet (GOOGL)

+72.55%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Morgan Stan (MS)

+61.42%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $57.25

Zoetis (ZTS)

+50.62%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Visa (V)

+49.17%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.24

Arm Hldgs (ARM)

+45.31%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $49.75

Brookfield (BN)

+27.14%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $31.50

Schwab (SCHW)

+10.62%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $62.00

Roblox (RLBX)

+7.53%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.75

Dutch Bros (BROS)

-6.33%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-15.62%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-19.69%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $28.90

Coinbase (COIN)

-22.24%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $225.66

Canopy (CGC)

-86.97%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Block (SQ): Profit-Taking

Long-time readers of my blog and viewers of my YouTube channel probably have heard me say, “Buy on Red, Sell On Green” as one of my key mantras, so it might strike some as odd that I took profits in Block (formerly Square) (SQ) on Friday when it started to weaken.

The reason is simple: Block has doubled in less than two months!

Accordingly, I sold just 2.44% of my position at $76.26 when it triggered a stop-loss limit order on Friday, locking in +89.42% in gains on shares I bought less than two months ago at $40.26 on October 27.

The buy lowered my per-share “cost” -5.50% from -$63.41 to -$66.90 (a negative per-share cost indicates all capital has been removed in addition to $66.90 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $98.85, just under the round-number psychological resistance presented by the $100.00 mark, and my next buy target is $39.70, a bit above Block’s low from back in October.

SQ closed the week at $77.14, up +1.15% from where I took profits Friday.

Canopy Growth Corp (CGC): Reverse 1:10 Split

While the uninitiated might think Canopy Growth Corporation (CGC) suddenly rallied +1,000% in a week, sadly, it’s simply the result of a reverse 1:10 split. In other words, for every 10 shares a shareholder owns, they will receive one share, instead, and the price of Canopy Growth is multiplied by a factor of 10.

This leaves me with a per-share cost of $39.45 (instead of $3.945) and an opening price of $295.33 when I first opened the position on May 24, 2018. Still the same -86.74% reduction in my cost basis and I am still down just as much, the reverse split just prevents Canopy Growth from being de-listed (for the moment) as the major exchanges won’t permit stocks under $1/share for very long.

Coinbase (COIN): Profit-Taking

When Bitcoin began to recover significantly from its lows around $40.5K to $41K on Wednesday, Coinbase (COIN) and the other crypto-related assets popped at the market open. COIN jumped through my next sell order which filled at $165.24, selling 11.11% of my position and locking in +111.17% in gains on shares I bought for $78.25 last year back on May 10, 2022.

Once again, this sale is significantly below my cost basis, however, given the parabolic rally Coinbase has seen up until this point, I needed to lock in the substantial gains I had on those shares purchased back in 2022. The sale raised my per-share cost +3.06% from $218.95 to $225.66.

From here, my next sell target is $205.81, once again under my cost basis, but we will be getting much closer. My next buy target remains much, much lower than here at $51.09. Many readers may think Coinbase will never return to those levels, and, if it doesn’t, that’s fine – what I have is what I have. However, I’ve been in this game for so long that I’ve learned the only thing I can know for certain is that I can’t know anything for certain.

If we see a significant market pullback next year, I believe we could see COIN test $50 and perhaps even test its all-time low at $31.55, but, if that doesn’t happen, that’s simply a high-quality problem. It’s all a matter of knowing your risk-return and sticking to it.

COIN closed the week at $175.48, up +6.20% from where I took profits Wednesday.

JPMorgan Chase (JPM): Profit-Taking

With the Fed pivot firmly in place and seemingly nothing but blue skies ahead for the stock market as a whole and financials, it was time for me to continue trimming the financials as the sector has been stuck in a bit of a wide trading pattern for years now.

The money-center banks, in particular, took off on Monday with JPMorgan Chase (JPM) triggering my next sell order at $166.90, selling 9.96% of my position. The sale locked in +63.15% in gains on shares I bought for $102.30 way back when I initially opened the position on October 16, 2017 and lowered my per-share cost a whopping -62.06% from $26.75 to $10.15.

From here, my next sell target is just under JPM’s all-time high at $171.29 where I will remove the last of the investment capital from this position. My next buy target remains down at $102.22, just above JP Morgan’s 2022 lows. I do believe if we see a credit event or other crisis in 2024, the banks will once again sell off significantly and test their lows.

JPM closed the week at $167.40, up +0.30% from where I took profits Monday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.