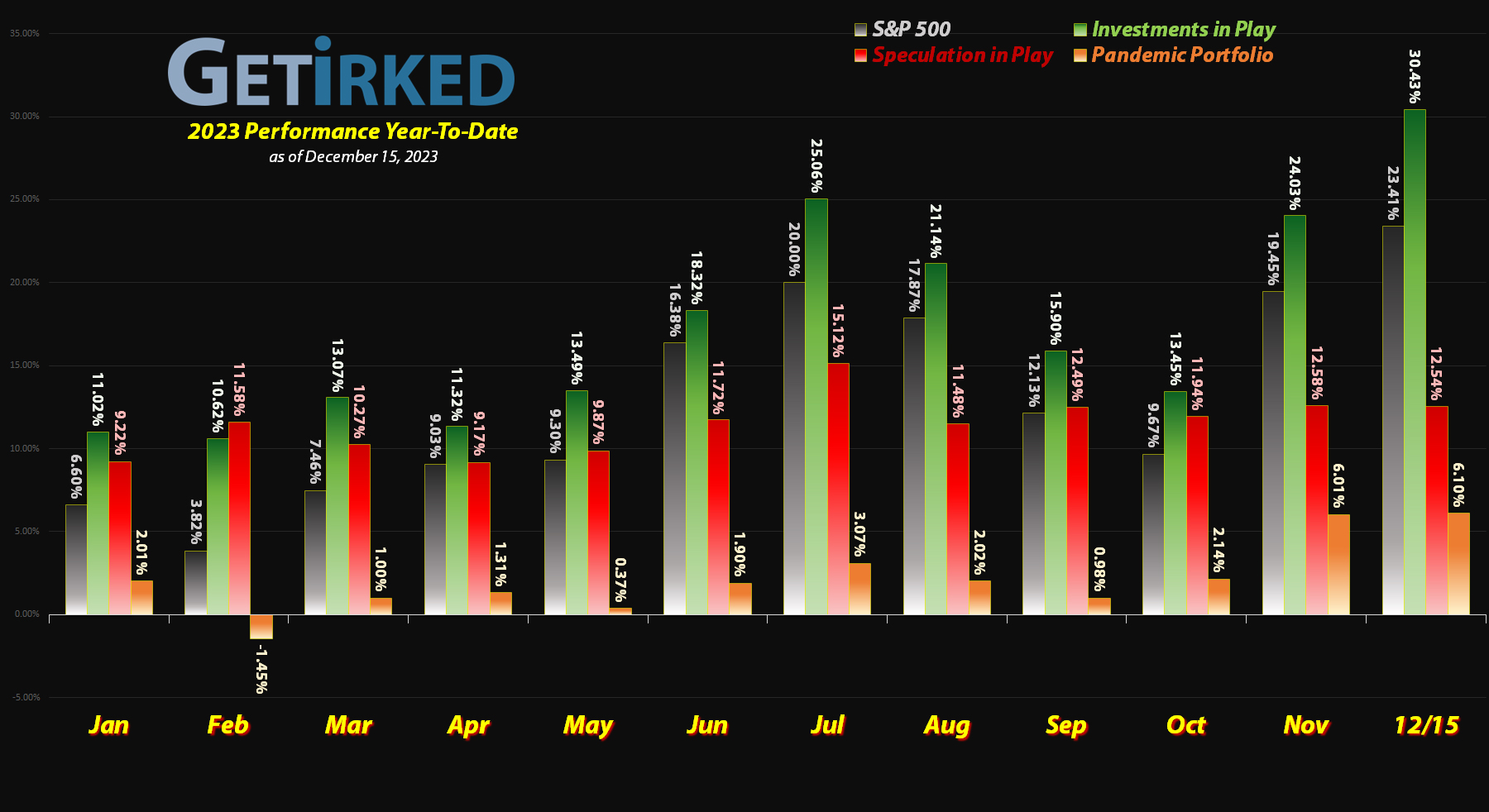

December 15, 2023

The Week’s Biggest Winner & Loser

Rivian (RIVN)

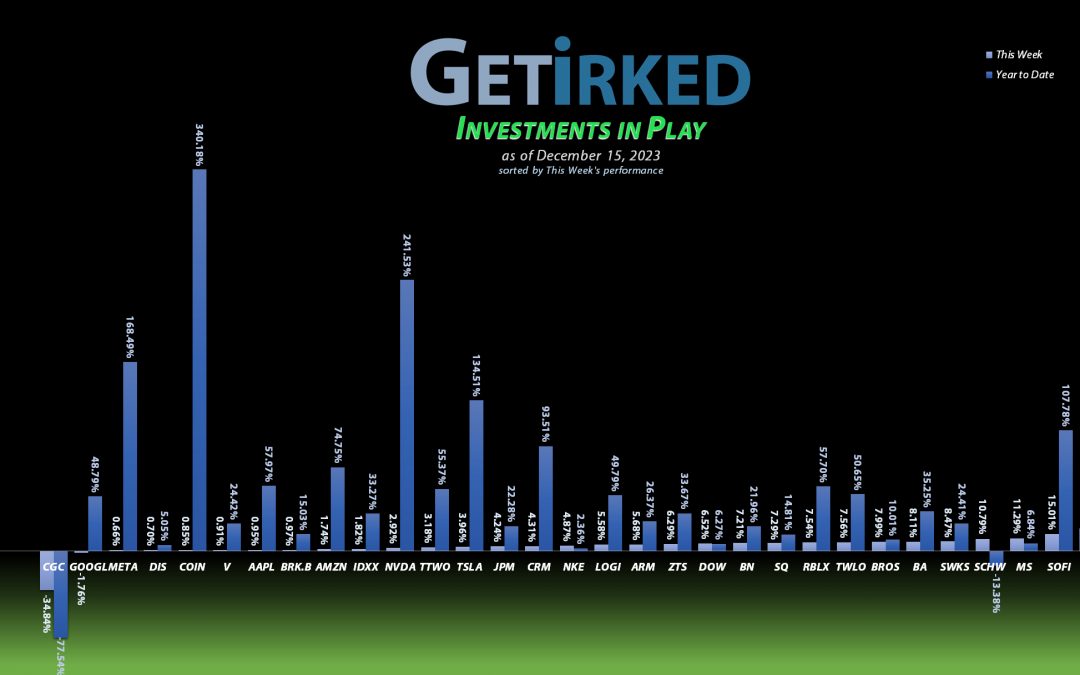

Anything interest-rate sensitive really rallied this week, and, in this portfolio, that meant EV-startup Rivian (RIVN). Rivian powered higher than any other position in the portfolio, locking in pole position as the week’s Biggest Winner with a gain of +19.91%.

Canopy Growth Corp (CGC)

The cannabis sector is so turned around that it doesn’t even know when to rally. After pulling higher a few weeks ago, the entire sector gave up the ghost despite being dependent on interest rates. Canopy Growth Corporation (CGC) which almost always seems to be the Biggest Loser in this portfolio, lost big this week, careening -34.84%… in a week.

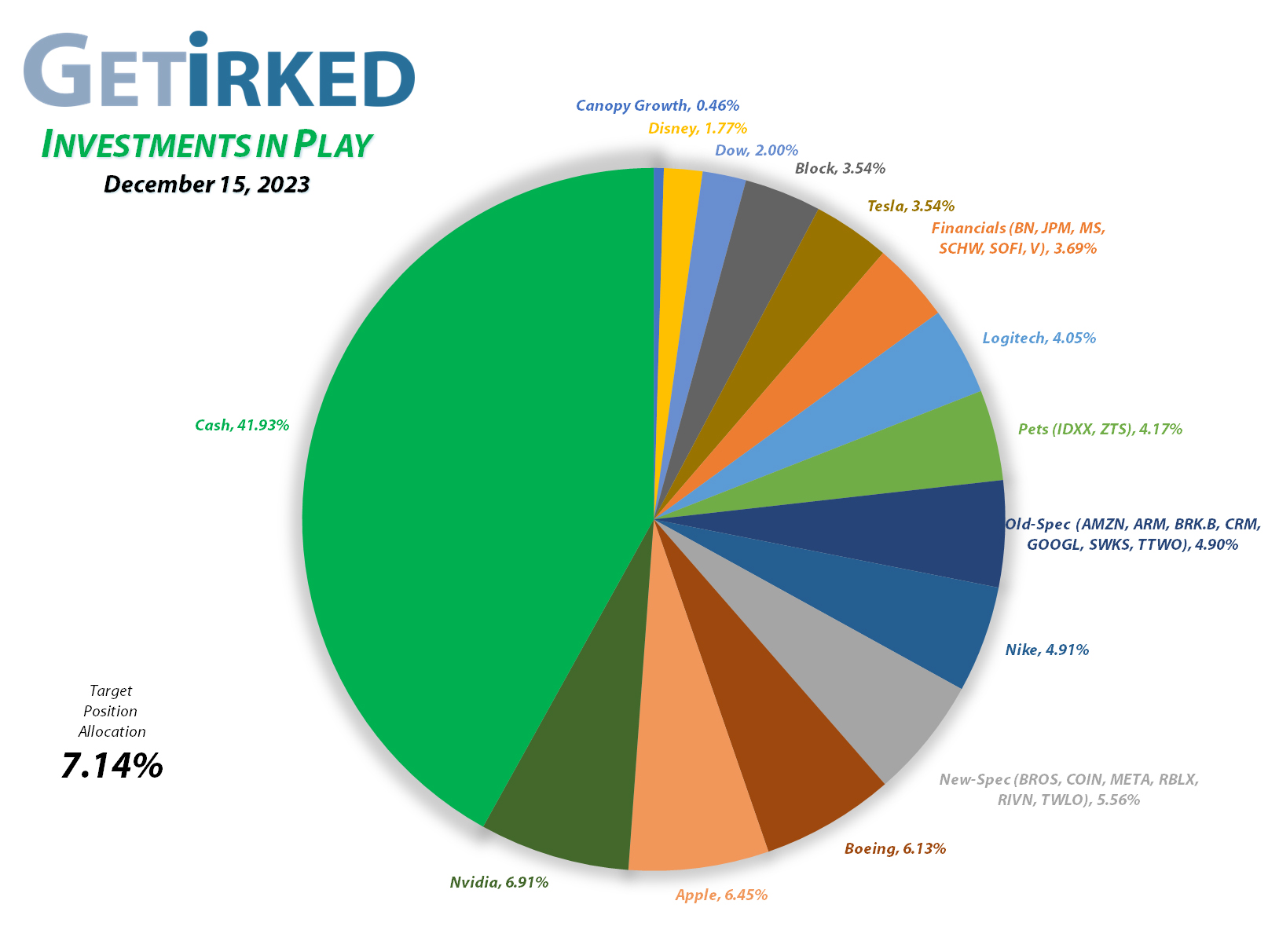

Portfolio Allocation

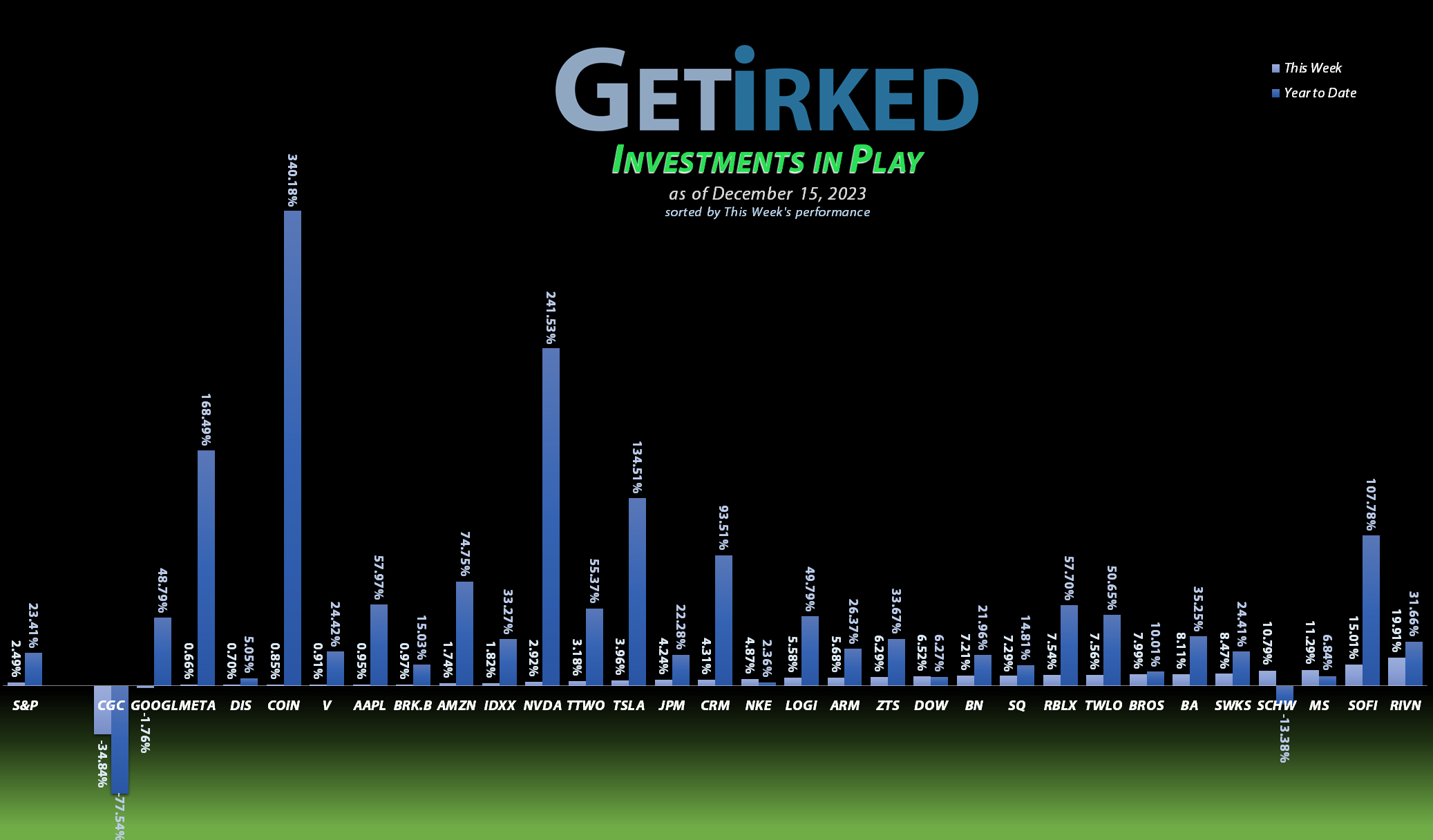

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1561.06%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$321.45)*

Apple (AAPL)

+1006.47%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$87.10)*

Logitech (LOGI)

+776.35%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+774.48%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Tesla (TSLA)

+651.68%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+562.23%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$63.41)*

JP Morgan (JPM)

+516.12%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $26.75

Skyworks (SWKS)

+509.20%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

Nike (NKE)

+474.71%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

IDEXX Labs (IDXX)

+466.30%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Dow (DOW)

+325.99%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+206.06%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+196.52%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+161.39%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.23)*

SoFi (SOFI)

+146.07%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Take Two (TTWO)

+139.29%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+101.70%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+89.54%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Alphabet (GOOGL)

+61.71%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Morgan Stan (MS)

+59.60%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $57.25

Zoetis (ZTS)

+51.45%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Visa (V)

+48.57%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.24

Arm Hldgs (ARM)

+42.77%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $49.75

Brookfield (BN)

+22.19%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $31.50

Schwab (SCHW)

+14.46%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $62.00

Roblox (RLBX)

+2.76%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.75

Dutch Bros (BROS)

-9.82%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-15.98%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-21.00%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $28.90

Coinbase (COIN)

-32.45%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $218.95

Canopy (CGC)

-86.85%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Apple (AAPL): Profit-Taking

Apple (AAPL) has rallied more than +18% since its October lows, and while that kind of move is commonplace in lesser stocks, Apple is one of the biggest companies in the entire stock market – that move is enormous! Because of this, even though Apple has not exceeded the target allocation size for the portfolio (it is the 2nd largest) and its nearing its all-time highs, I sold 3.44% of my position at $195.27 when it rallied ahead of the Fed meeting.

The sale locked in 311.70% in gains on shares I bought for $47.43 on November 14, 2018, and lowered my per-share “cost” -$9.72 from -$77.38 to -$87.10 (a negative per-share cost indicates all capital has been removed in addition to $87.10 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $240.16, a price calculated using the Fibonacci Method and where Apple will have outgrown the target allocation size for the portfolio. My next buy target is $155.43, above a key point of support Apple has seen in the past.

AAPL closed the week at $197.57, up +1.18% from where I took profits Wednesday.

Dow Chemical (DOW): Dividend Reinvestment

Dow Chemical (DOW) paid out its sizable quarterly dividend on Monday, which, after reinvestment, raised my per-share “cost” +1.23% from -$0.326 to -$0.322 (a negative per-share cost indicates all capital has been removed in addition to $0.322 per share added to the portfolio’s bottom line in addition to each share’s current value).

Why did a dividend payout raise my per-share cost?

The reason my per-share cost went up is because the amount of profit I’ve taken out of this position remain static. That profit now has to be shared across more shares since I reinvest dividends instead of taking the cash payout.

From here, my next buy target remains at $43.19 where I will only add a small amount of the profits I’ve taken out of the position back in – my discipline requires that I never turn a winner into a loser by adding capital back into a position where all capital has been removed.

Additionally, I will take more profits if Dow makes an attempt at the key resistance of the $60.00 mark with my next sell target at $60.59.

JPMorgan Chase (JPM): Profit-Taking

The financial sector continued its rally this week with JPMorgan Chase (JPM) crossing through my next sell target on Tuesday. My sell order filled at $159.37, selling 9.58% of my position and locking in +20.15% in gains on shares I bought for $132.64 way back on January 24, 2020.

The buy lowered my per-share cost -32.19% from $39.45 to $26.75. From here, my next sell target is $166.90, just under a past point of resistance, and my next buy target is $101.94, just above JPM’s low from 2022.

JPM closed the week at $165.23, up +3.68% from where I took profits Tuesday.

Logitech (LOGI): Profit-Taking

Logitech’s (LOGI) rally since June has been positively jaw-dropping. The stock is up nearly +75% in less than 5 months! Accordingly, it was time for me to take profits once more when stocks rallied ahead of the Fed meeting on Wednesday with a sell order that filled at $93.22 and sold 2.63% of my position.

The sale locked in +110.79% in gains from a few of the shares I bought for $44.23 back on October 2, 2018 and lowered my per-share “cost” -$2.67 from -$5.63 to -$8.30 (a negative per-share cost indicates all capital has been removed in addition to $8.30 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $104.94, below a past point of resistance, and my next buy target is $54.56, above Logitech’s June low.

LOGI closed the week at $94.08, up +0.92% from where I took profits Wednesday.

Morgan Stanley (MS): Profit-Taking x2

After selling off further than I anticipated in October only to rebound nearly 20% to its current levels, I decided it was time to trim some profits in Morgan Stanley (MS) by selling the shares I bought for $75.11 on October 18, 18.91% of the position, when Morgan Stanley tested $82.48 again on Monday.

The sale locked in just a +9.81% gain on those shares, which isn’t bad in less than two months. Additionally, I felt profit-taking would be prudent as MS is reaching overbought territory and I believe the first quarter of 2024 could be pretty volatile. The sale lowered my per-share cost -4.95% from $68.02 to $64.65.

On Thursday, when Morgan Stanley rocketed higher, I decided it was time to trim even more of my position, selling 23.32% at $88.99, giving me an average selling price of $85.74, and locking in +13.10% in gains on shares I bought for $78.68 on October 16. This sale lowered my per-share cost an additional -11.45% from $64.65 to $57.25, a total reduction of -15.83% from where my position started the week.

From here, my next sell target is $95.13, just under the next key level of resistance and my next buy target is $69.69, just above Morgan Stanley’s October lows.

MS closed the week at $91.58, up +6.81% from my $85.74 average sale price.

Roblox (RBLX): Profit-Taking

Roblox (RBLX) is truly one of the most volatile stocks I’ve ever been involved with, and I’ve been in the markets for more than 25 years and have held some of the most insane stocks on the planet. Just how volatile is Roblox? It’s rallied more than +75% since its lows less than three months ago in September!

On Wednesday, Roblox crossed over my cost basis, so it was time to lock in +70.45% in gains on the shares I bought for $25.55 on September 21. The sale filled at $43.55 and sold 6.25% of my position. While it only lowered my per-share cost -0.12% from $42.80 to $42.75, the more important discipline here is reducing exposure from a stock that has had an undeniably explosive rally.

From here, my next sell target is $46.25, just under a point of resistance Roblox has seen in the past, and my next buy target is $25.15, above the low RBLX saw in September.

RBLX closed the week at $43.92 up +0.85% from where I took profits Wednesday.

Schwab (SCHW): Profit-Taking

Schwab (SCHW) and the rest of the smaller financials saw significant gains once Fed Chair Powell indicated that the Fed was done with the tightening cycle and expected three rate cuts in 2024. On Thursday, Schwab rocketed through my next sell order which filled at $68.70, selling 19.42% of my position and locking in +14.90% in gains on shares I bought for $59.79 on March 10.

Despite opening the position relatively recently in April 2022, Schwab has proven to be extremely volatile, so I’m taking the more conservative tactic of trimming profits when we see such explosive rallies in the broad market.

The sale lowered my per-share cost -2.05% from $63.30 to $62.00. From here, my next profit-taking target is $79.95, just under a past point of resistance, and my next buy target is $50.16, above a key point of support Schwab has tested in the past.

SCHW closed the week at $70.98, up +3.32% from where I took profits Thursday.

Skyworks Solutions (SWKS): Dividend Reinvestment

Skyworks Solutions (SWKS) paid out its quarterly dividend on Wednesday which, after reinvested, raised my per-share cost +0.61% from -$34.48 to -$34.27 (a negative per-share cost indicates all capital has been removed in addition to $34.27 per share added to the portfolio’s bottom line in addition to each share’s current value).

Why did a dividend payout raise my per-share cost?

Like Dow Chemical (DOW) above, the reason my per-share cost went up is because the amount of profit I’ve taken out of this position remain static. That profit now has to be shared across more shares since I reinvest dividends instead of taking the cash payout.

From here, my next buy target is at $76.40, above Skyworks’ 2022 low, and my next sell target is $123.12, slightly below the high Skyworks saw earlier in 2023.

Zoetis (ZTS): Profit-Taking

Zoetis (ZTS) one of two of my plays on the humanization-of-pets thesis (the other being IDEXX Laboratories (IDXX)) rallied more than 27% from its low set a little over a month ago at the beginning of November and triggered my next sell target which filled on Wednesday at $192.53, selling 19.72% of the position.

It may seem odd for me to take profits in a relatively new position, however this falls in line with my macro view for the markets. The rally we’ve seen since the CPI print in November has been stupendous, but I feel that the higher stocks rally into the end of 2023, the more likely we’ll see a significant pullback early in 2024 as firms lock in gains.

Even if the pullback doesn’t happen and we truly are at the start of another bull market, I still have a sizable position in Zoetis, so I’m not concerned about making it a bit smaller in an effort to remain prudent and disciplined.

The sale locked in +22.22% in gains on some of the shares I bought when I initially opened the position for $157.55 on June 13, 2022 and lowered my per-share cost -8.77% from $141.89 to $129.45. From here, my next sell target is just under Zoetis’ all-time high at $246.74 and my next buy target is $142.12, above my new cost basis but also above a key level of support Zoetis has seen in the past.

ZTS closed the week at $196.29, up +1.95% from where I took profits on Wednesday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.