December 8, 2023

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

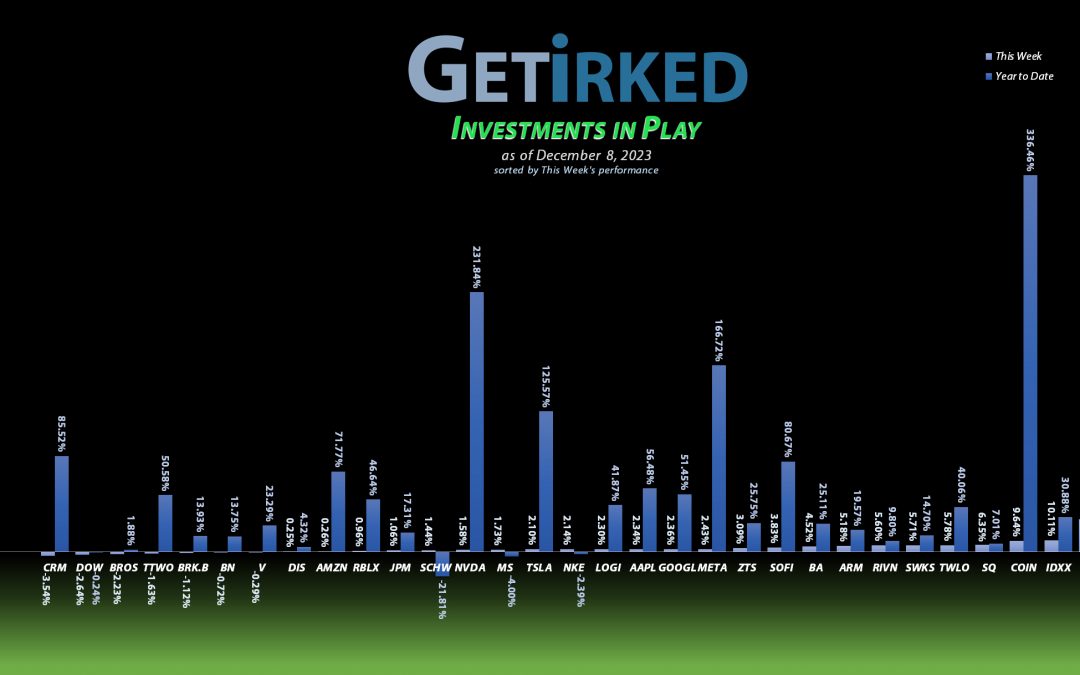

Whenever there’s the hint of a rumor of an idea of a glint in a Congressperson’s idea that cannabis legislation might make its way back on the table, all of the cannabis sector popped. As a result, despite a great week for most stocks, the Biggest Winner of the Investments in Play portfolio is Canopy Growth Corporation (CGC) which rallied +28.85% this week. We’ll just ignore the fact that it’s still the biggest loser for the year.

Salesforce (CRM)

Despite its partnerships with Amazon (AMZN) and Nvidia (NVDA), Salesforce (CRM) got no love this week when the artificial intelligence cloud plays saw rallies. In fact, Salesforce sold off -3.54%, not a huge drop, but enough to make CRM the Biggest Loser this week.

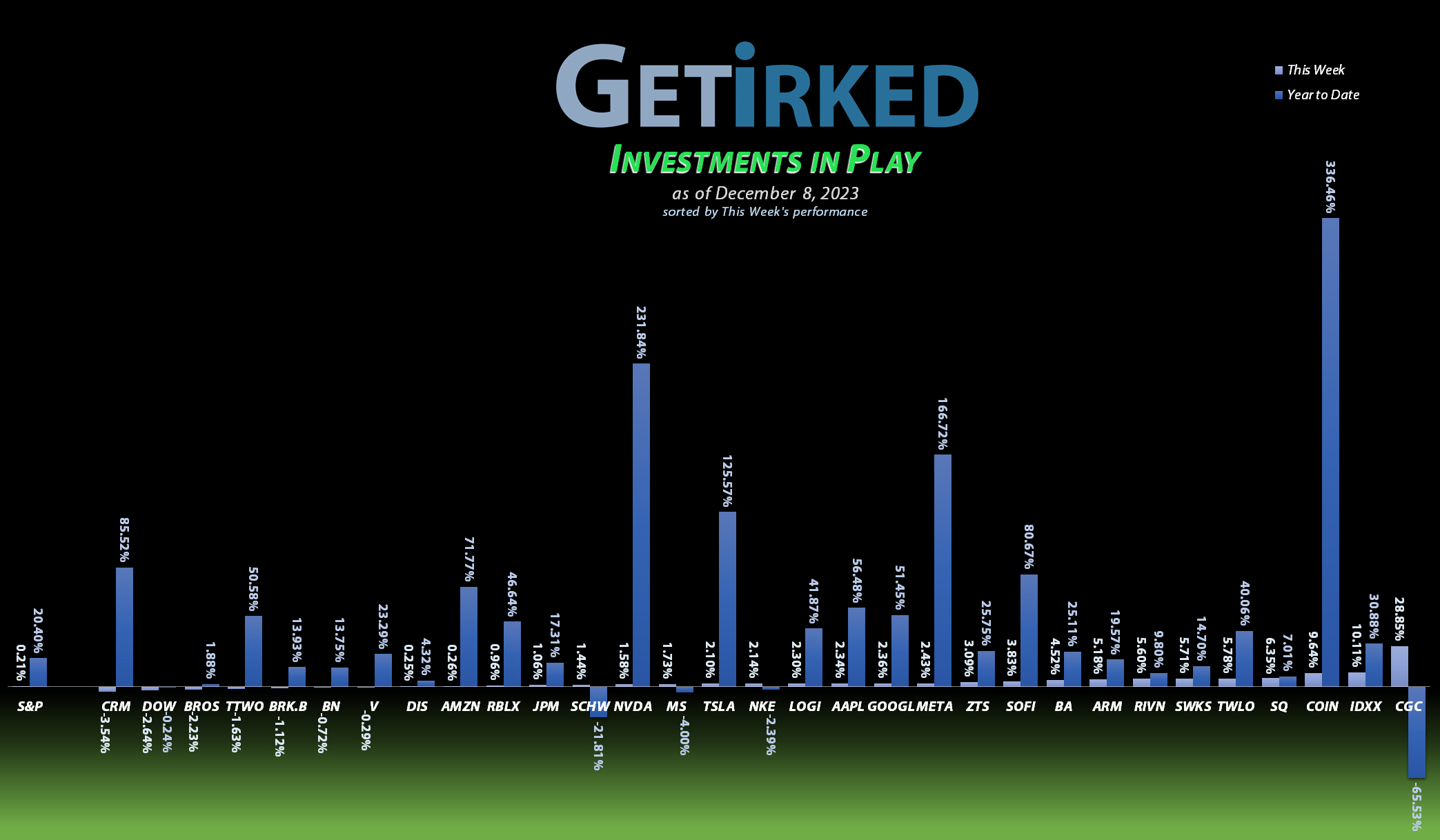

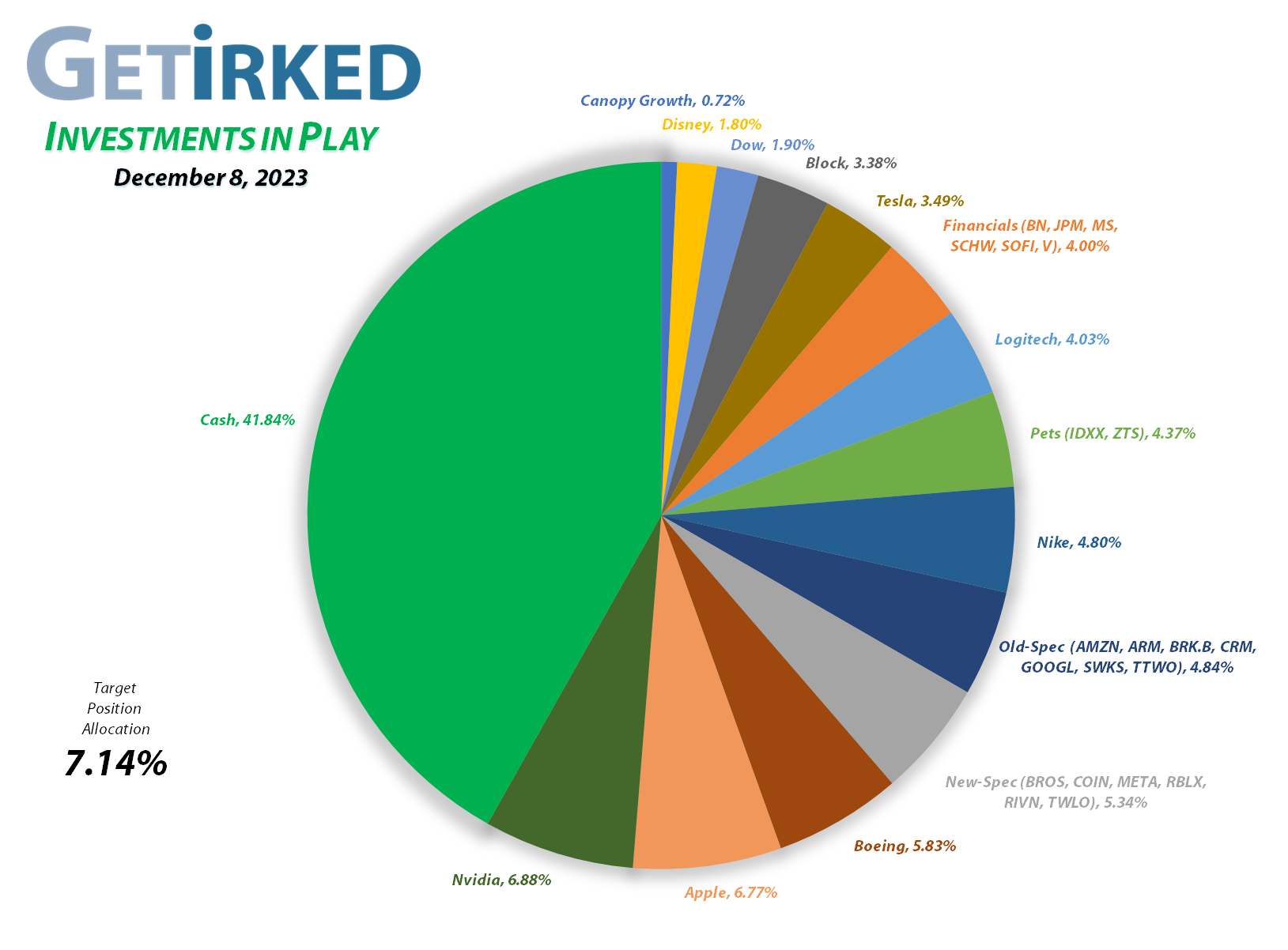

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1534.39%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$321.45)*

Apple (AAPL)

+999.95%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$77.38)*

Boeing (BA)

+743.15%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Logitech (LOGI)

+737.83%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($5.63)*

Tesla (TSLA)

+630.82%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+541.92%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$63.41)*

Skyworks (SWKS)

+476.44%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.48)*

IDEXX Labs (IDXX)

+460.38%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+454.71%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

Dow (DOW)

+302.14%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

JP Morgan (JPM)

+301.83%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $39.45

Amazon (AMZN)

+200.85%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+184.37%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+160.41%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.23)*

Take Two (TTWO)

+132.00%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

SoFi (SOFI)

+113.96%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Meta (META)

+101.37%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+88.04%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Alphabet (GOOGL)

+64.62%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Visa (V)

+47.62%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.24

Arm Hldgs (ARM)

+35.14%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $49.75

Zoetis (ZTS)

+30.15%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $141.89

Morgan Stan (MS)

+20.96%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $68.02

Brookfield (BN)

+13.97%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $31.50

Schwab (SCHW)

+1.22%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.30

Roblox (RLBX)

-4.60%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.80

Dutch Bros (BROS)

-16.56%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-21.89%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Coinbase (COIN)

-33.03%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $218.95

Rivian (RIVN)

-34.12%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $28.90

Canopy (CGC)

-79.73%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Boeing (BA): Profit-Taking

Boeing (BA) has been on a mind-blowing run since it bottomed in late October, up more than +36% as of Friday. On Friday, Boeing triggered my next buy order which sold 4.76% of my position at $237.68, locking in +37.66% in gains on shares I bought for $172.66 back on March 7, 2022.

Why did I take profits in Boeing even though it hasn’t exceeded my allocation target?

Boeing has proven to be incredibly volatile since the two tragic 737-Max crashes in 2018 and 2019. As a result, the stock has been trading in a pretty solid range between $89 and $280. Accordingly, when it reached $240 on Friday, I felt it was time to trim the position so I could free up capital to put back to work if Boeing sells off.

The sale lowered my per-share cost -$20.85 from -$179.40 to -$200.25 (a negative per-share cost indicates all capital has been removed in addition to $200.25 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $176.77, above Boeing’s low from October, and my next sell target is $277.68, below the high Boeing saw back in 2021.

BA closed the week at $244.70, up +2.95% from where I took profits Friday.

Schwab (SCHW): Profit-Taking

Schwab (SCHW) and the rest of the financial sector have positively exploded since bottoming in October with Schwab catapulting nearly +32% in about a month and half. Accordingly, I decided to trim my position on Friday, selling 16.26% of my allocation at $63.91 and locking in +25.14% in gains on shares I bought for $51.07 on March 13. The sale lowered my per-share cost only -0.16% from $63.40 to $63.30, but, for me, it was important to lock in gains on what has proven to be a very volatile stock as of late.

From here, my next sell target is much higher at $81.14, slightly below a level of resistance Schwab saw before the regional banking crisis earlier this year. My next buying target is $50.08, above a key level of support Schwab has seen throughout 2023.

SCHW closed the week at $64.07, up +0.25% from where I took profits Friday.

Visa (V): Dividend Reinvestment

Visa (V) paid out its quarterly dividend this week which, after reinvestment on Monday, lowered my per-share cost -0.21% from $173.60 to $173.24. Visa has demonstrated such incredible strength since I initially opened the position in May 2022, that I must concede the possibility that – despite a credit event – it may not sell off to my cost basis.

Accordingly, I have raised my next buy order up to $196.89, above a point of support Visa has seen in the past. Additionally, since it has performed so well, I have no intention of taking any additional profits in, letting my remainder run.

Zoetis (ZTS): Dividend Reinvestment

Zoetis (ZTS) paid out its quarterly dividend this week which, after reinvestment on Monday, lowered my per-share cost -0.21% from $142.19 to $141.89. Zoetis and IDEXX Labs (IDXX), my two humanization-of-pets plays, have been shockingly volatile for the entirety of the time I’ve held them.

Despite Zoetis providing significant strength since I initially opened the position in June 2022, I do believe the potential for a significant selloff is still out there, so I have no interest in adding to my position until ZTS is under my cost basis, however I won’t wait long with my next buy target at $141.64, slightly above a key point of support it’s seen in the past.

If Zoetis makes a try for its year-to-date highs, I will take profits in my position with my next sell target at $194.37, slightly below the high Zoetis last saw in August.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.