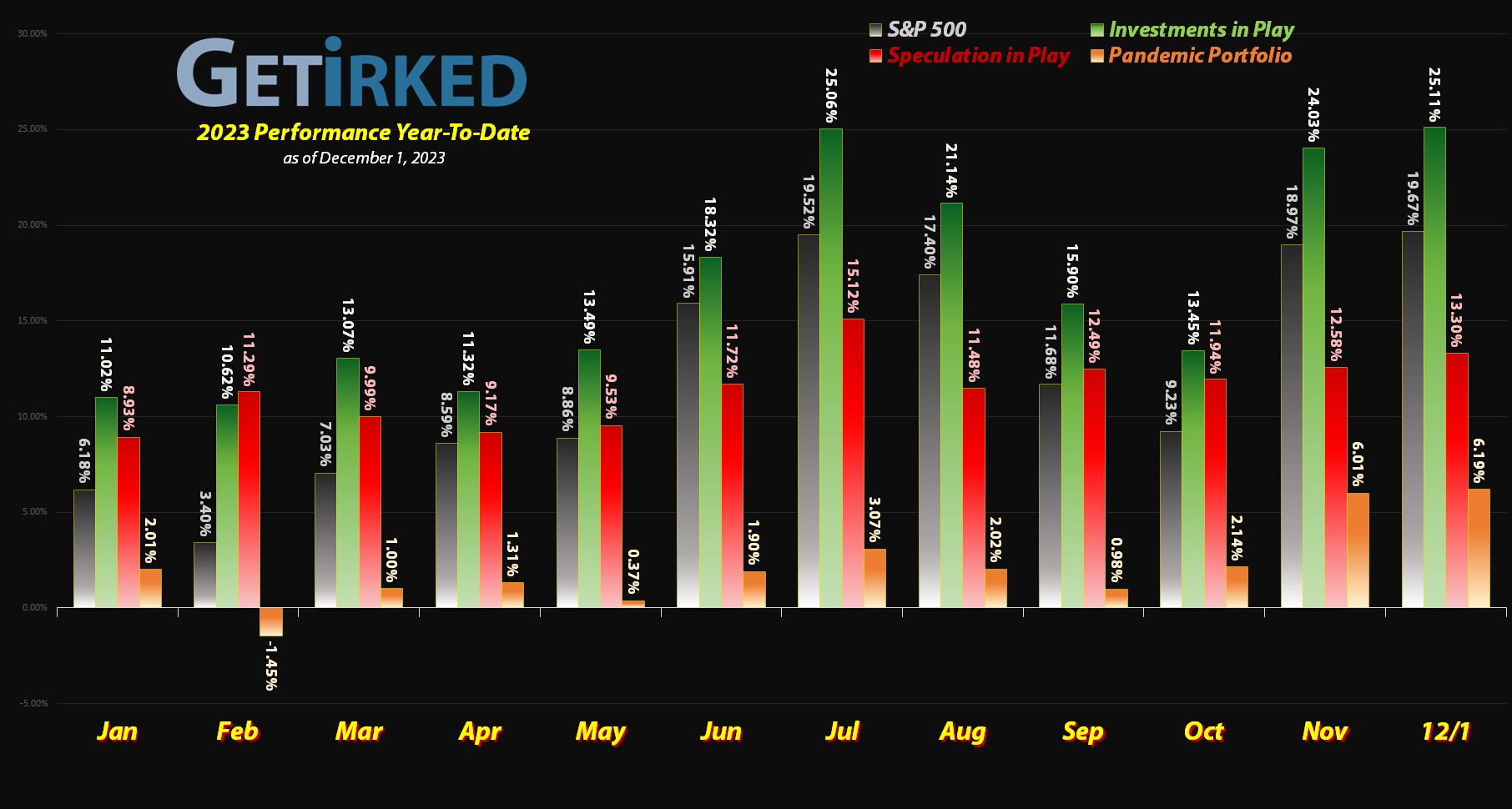

December 1, 2023

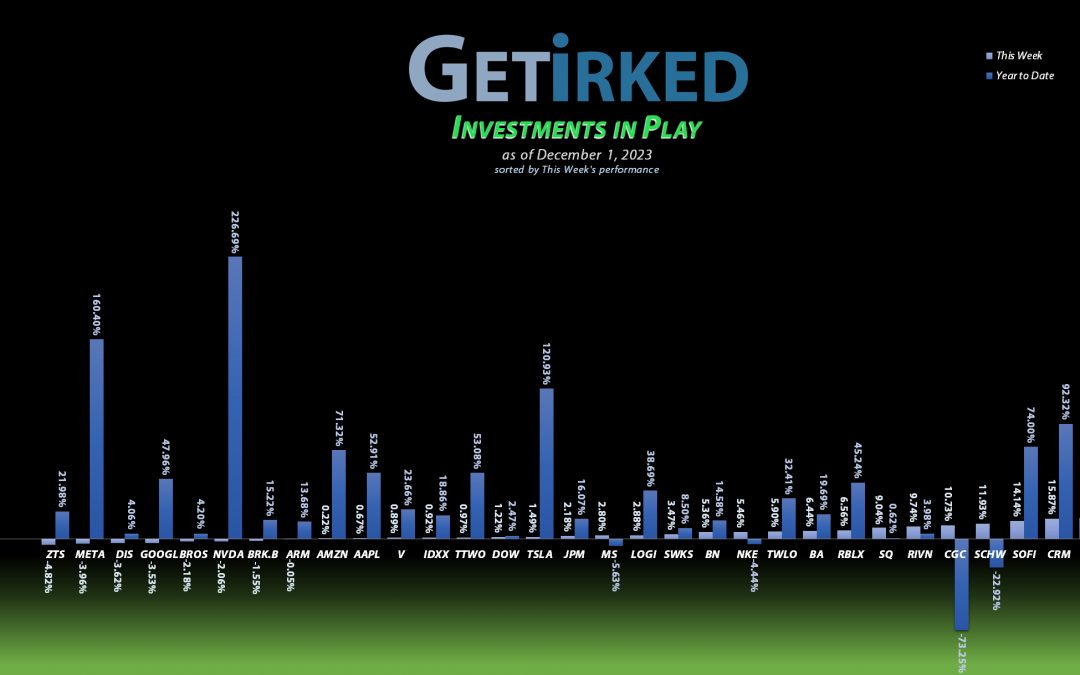

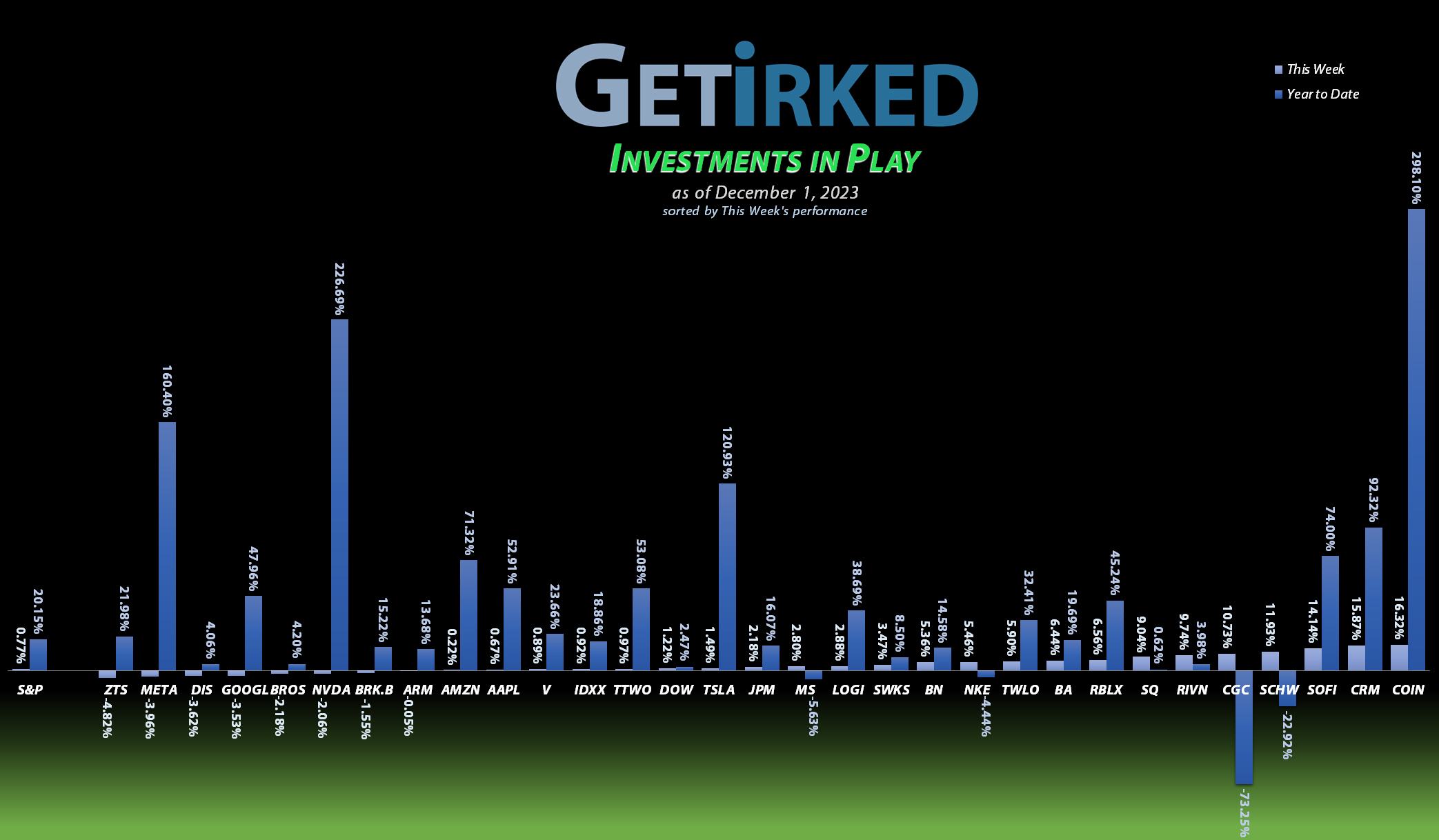

The Week’s Biggest Winner & Loser

Coinbase (COIN)

Between FTX and Binance being taken out of the race and Bitcoin rallying to new highs, the past few weeks have really been Coinbase’s (COIN) time to shine!

More investors piled into the world’s most reputable crypto exchange this week, causing Coinbase to ring the register with a +16.23% gain and swing in as the portfolio’s Biggest Winner.

Zoetis (ZTS)

Insiders only buy shares for one reason – they believe the stock’s headed higher – but they can sell for many reasons, most of them not good. This week, Zoetis (ZTS) got hit after news broke that an insider sold $2,298,856 worth of shares on Friday following a different insider selling more than $150K worth the day prior. As a result, Zoetis pulled back -4.82% on the week which was enough to put it in the doghouse as the portfolio’s Biggest Loser.

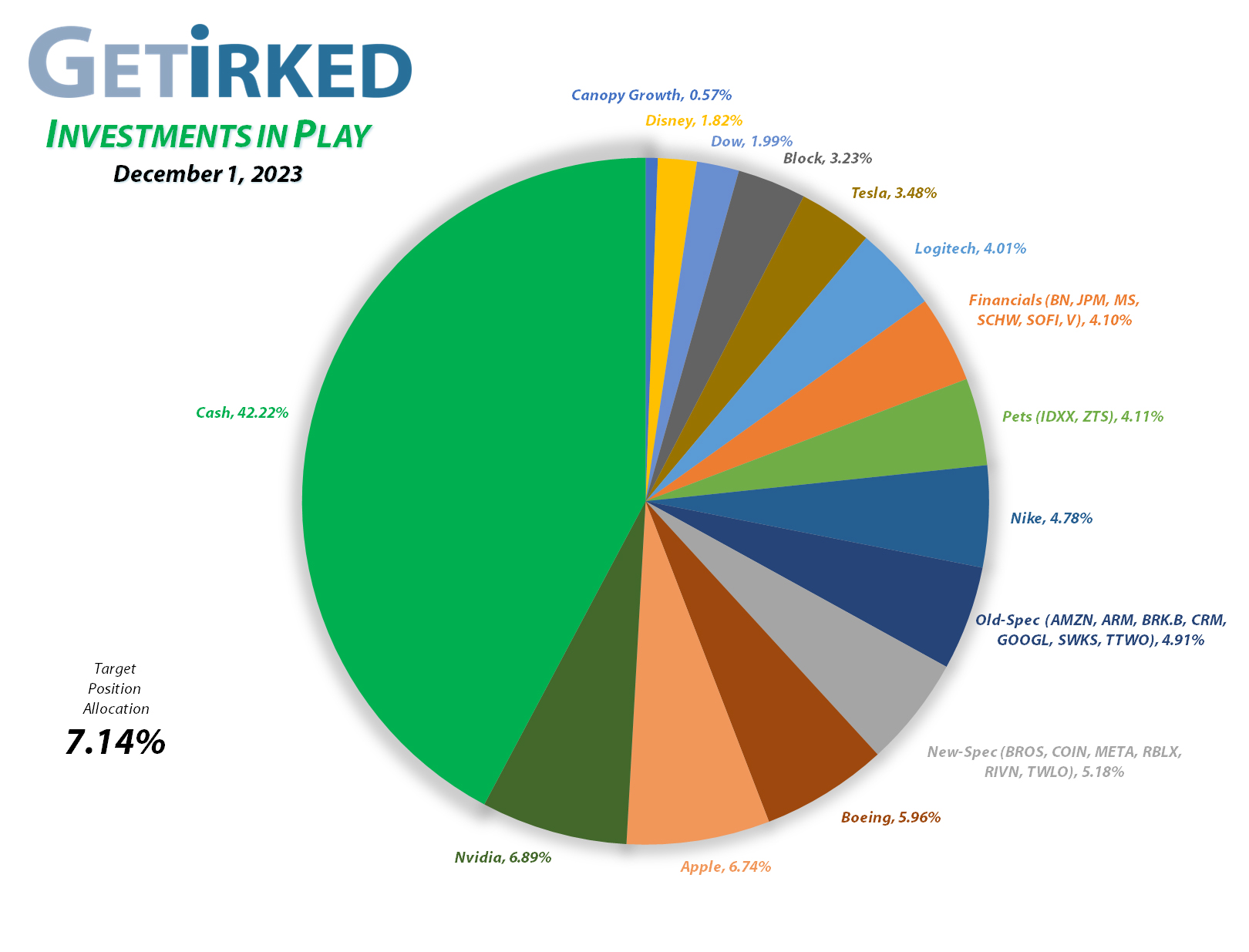

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1520.12%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$321.45)*

Apple (AAPL)

+983.58%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$77.38)*

Logitech (LOGI)

+722.25%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($5.63)*

Boeing (BA)

+724.71%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+620.00%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+525.00%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$63.41)*

Skyworks (SWKS)

+457.11%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.48)*

Nike (NKE)

+445.96%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

IDEXX Labs (IDXX)

+430.52%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Dow (DOW)

+310.31%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

JP Morgan (JPM)

+297.80%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $39.45

Amazon (AMZN)

+200.06%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+194.77%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+159.96%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.23)*

Take Two (TTWO)

+135.77%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

SoFi (SOFI)

+106.06%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Meta (META)

+100.14%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+90.18%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Alphabet (GOOGL)

+60.80%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Visa (V)

+48.07%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.60

Arm Hldgs (ARM)

+28.44%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $49.75

Zoetis (ZTS)

+25.98%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.19

Morgan Stan (MS)

+18.93%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $68.02

Brookfield (BN)

+14.76%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $31.50

Schwab (SCHW)

-0.38%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.40

Roblox (RLBX)

-5.47%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.80

Dutch Bros (BROS)

-14.65%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-26.15%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-37.61%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $28.90

Coinbase (COIN)

-38.91%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $218.95

Canopy (CGC)

-84.34%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Arm Holdings (ARM): Profit-Taking

Despite only having returned to the public markets a little more than two months ago, Arm Holdings (ARM) has proven to be an incredibly volatile stock. Accordingly, I’ve decided to be a little more nimble with this position even though it remains a long-term holding for me.

When ARM rallied on the back of great analyst coverage, I decided to sell a full 25.00% of my holdings on Thursday with a sale which filled at $63.35. The sale locked in +33.09% in gains on shares I bought a little over a month ago for $47.60 on October 20. The sale lowered my per-share cost -6.40%, down from $53.15 to $49.75.

From here, my next sell target is $99.25, wildly higher from these levels and just under the psychological resistance of $100.00. I will start buying if ARM tests its lows with my next buy target at $47.35 a bit above the low ARM saw at the end of October.

ARM closed the week at $63.90, up +0.87% from where I took profits Thursday.

Brookfield (BN): Profit-Taking

Brookfield (BN), a Class of 2023 Position for the portfolio, has been proven to be both volatile and an excellent investment, however, when BN rallied nearly 25% in about a month, it was time for me to take some off the table. My sale filled on Friday at $35.54, selling 11.11% of my position and locking in +17.57% in gains on some of the shares I bought for $30.23 on October 2.

The sale lowered my per-share cost -1.41% from $31.95 to $31.50. From here, my next buy target is $29.00, above the low Brookfield saw at the end of October, and my next sell target is $43.75, slightly below a key high BN saw in the past.

BN closed the week at $36.15, up +1.72% from where I took profits Friday.

Schwab (SCHW): Dividend Reinvestment

Charles Schwab (SCHW) paid out its quarterly dividend on Monday, which, after reinvestment, lowered my per-share cost -0.44% from $63.68 to $63.40.

Given how Schwab has seen consistent support at a key level, my buying price target is $49.82. Conversely, Schwab has seen regular resistance above here, so my next sell target is $67.26.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.