November 24, 2023

The Week’s Biggest Winner & Loser

Arm Holdings (ARM)

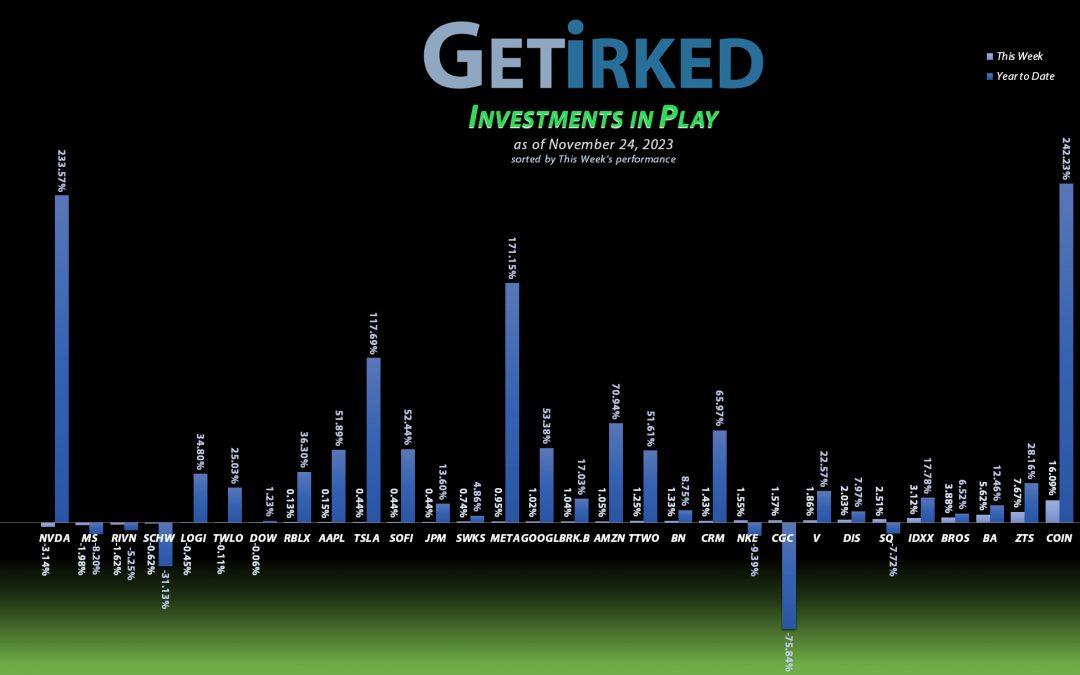

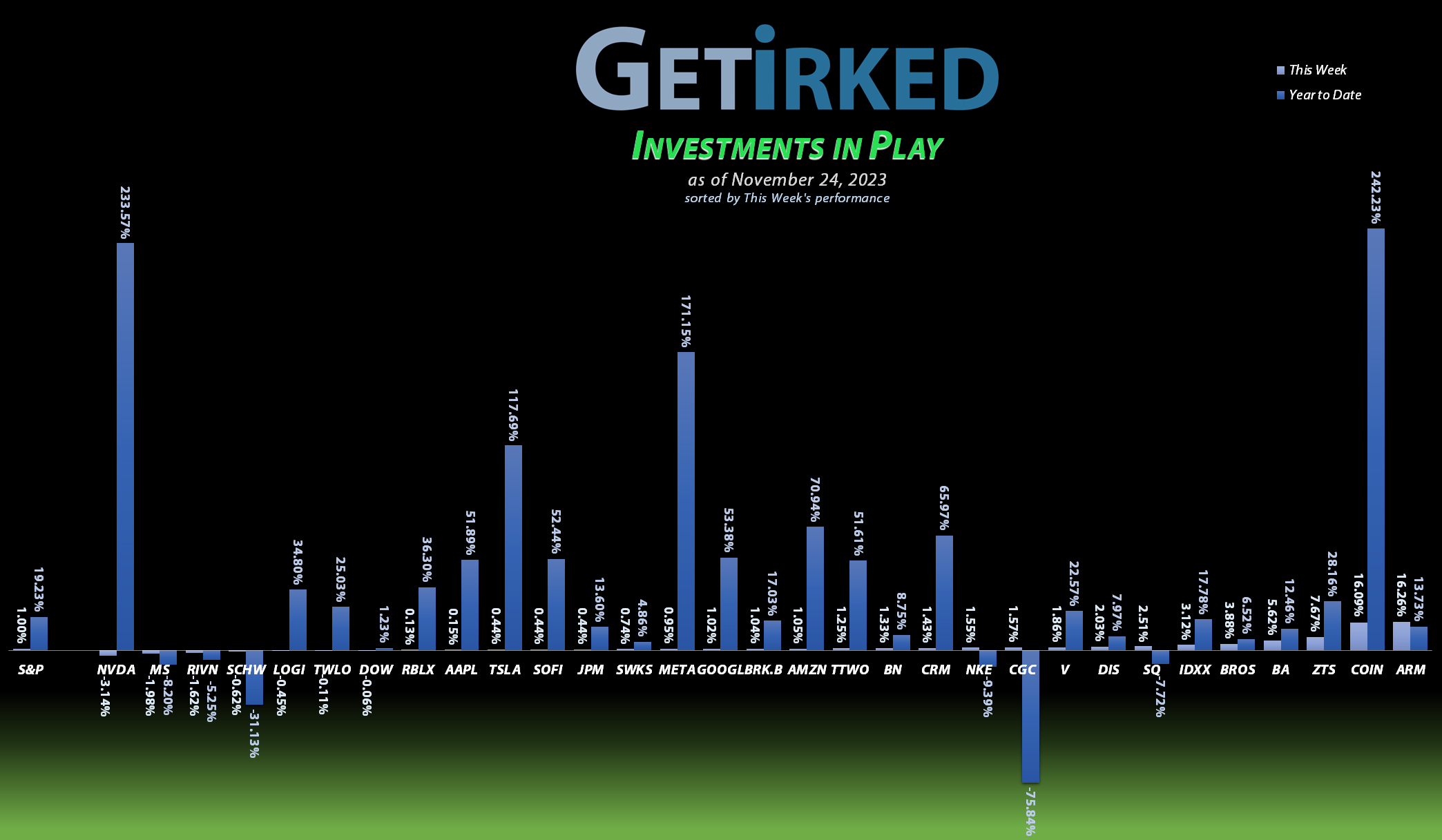

Recent IPO and artificial intelligence play, Arm Holdings (ARM), received a big pop this past week when analysts issued new coverage on the stock and gave sky-high price targets. As a result, ARM jumped +16.26% this week and swung in as the portfolio’s Biggest Winner.

Nvidia (NVDA)

It was a tale of two AI stocks this week as Nvidia (NVDA) reported a blowout quarter. However, NVDA basically didn’t exceed the consensus expectations after giving us two blowout quarters back-to-back.

Then, to make matters worse, Nvidia’s CFO warned that China represents more than 20% of the company’s revenue and the recent U.S. ban on exporting AI chips will definitely ding the company’s bottom line, and, even worst, they have no idea how bad it could end up being.

Combine all of this with the fact that Nvidia was hugely-overbought going into the quarter and there’s no real incremental buyer out there who wants in and isn’t, NVDA sold off -3.14% this week, making it the Biggest Loser in the portfolio for the first time in a very, very long time.

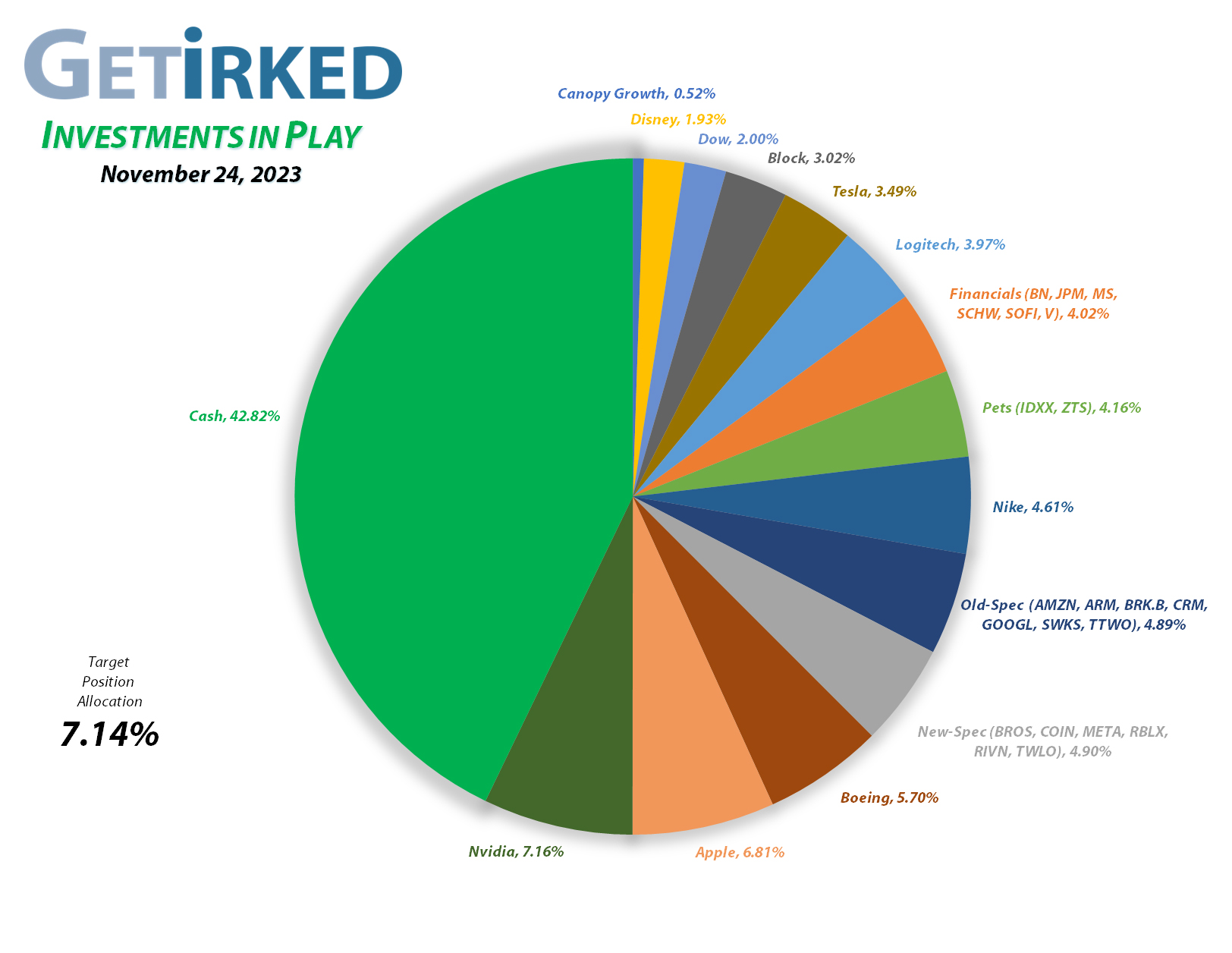

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1539.04%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$321.45)*

Apple (AAPL)

+978.64%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$77.38)*

Logitech (LOGI)

+703.25%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($5.63)*

Boeing (BA)

+700.35%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+612.49%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+502.92%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$63.41)*

Skyworks (SWKS)

+445.78%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.48)*

IDEXX Labs (IDXX)

+427.82%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+424.44%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

Dow (DOW)

+306.59%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

JP Morgan (JPM)

+288.50%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $39.45

Amazon (AMZN)

+199.18%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Disney (DIS)

+165.80%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.23)*

Salesforce (CRM)

+154.40%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Take Two (TTWO)

+133.50%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+102.14%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+93.16%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

SoFi (SOFI)

+80.54%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Alphabet (GOOGL)

+66.70%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Visa (V)

+46.42%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.60

Zoetis (ZTS)

+26.74%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.19

Arm Hldgs (ARM)

+20.28%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $53.15

Morgan Stan (MS)

+15.63%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $68.02

Brookfield (BN)

+7.42%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $31.95

Roblox (RLBX)

-11.21%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.80

Schwab (SCHW)

-11.39%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.68

Dutch Bros (BROS)

-13.27%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-30.27%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-43.46%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $28.90

Coinbase (COIN)

-47.48%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $218.95

Canopy (CGC)

-85.86%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Apple (AAPL): Dividend Reinvestment

Apple (AAPL) paid out its quarterly dividend on Friday evening, which, after reinvestment, raised my per-share “cost” +0.13% from -$77.48 up to -$77.38 (a negative per-share cost indicates all capital has been removed in addition to $77.38 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target in AAPL is $144.31, above a key level of support it saw during the 2022 Bear Market, and my next sell target is $198.08, just below Apple’s current all-time high.

Coinbase (COIN): Profit-Taking

When news broke Tuesday that the CEO and Founder of crypto exchange competitor, Binance, would be stepping down, more than $1.5 billion in customer funds were withdrawn from Binance. While unconfirmed where the funds went, many investors believed it would flow into Coinbase (COIN).

As a result, Coinbase’s stock roared to life and triggered my next sell order on Wednesday, selling 10.00% of my allocation at $109.45 and locking in a double (+100% gain) on shares I bought for $54.72 on May 11, 2022.

Rather counter-intuitively, this sale raised my cost basis +5.26% from $208.00 to $218.95.

Why did I sell under my cost basis?

Coinbase didn’t just sell off a little during the 2022 bear market, Coinbase imploded, crashing -87.69% from where it opened 2022 down to its all-time low at $31.55, a total drop of -91.72% from where it originally opened for public trading at $381.00 and a staggering -92.65% from its all-time high set the same day at $429.54.

Without question, Coinbase has been an absolutely epic destroyer of value.

Accordingly, I’ve decided I need to lock in gains when buys have doubled or more from where I added them, even if that means raising my cost basis. I do believe that, over the very long term, Coinbase may define itself as the leader and may regain its all-time highs, however, I think the volatility over that time period could continue to be dramatic given how dramatic the price action in the cryptocurrency sector remains.

From here, my next buy target is $47.90, above the low Coinbase made earlier in 2023, and my next sell target is $156.55, near a key Fibonacci Retracement level.

COIN closed the week at $115.00, up +5.07% from where I took profits Wednesday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.