September 29, 2023

The Week’s Biggest Winner & Loser

Rivian (RIVN)

After another raving report from an analyst, Rivian (RIVN) revved to life (although I guess EVs don’t really “rev,” do they?). In a pretty dismal weak for the markets as a whole RIVN rallied +17.92%, pretty incredible, and easily became the Week’s Biggest Winner.

Canopy Growth Corp (CGC)

Despite news that Congress may soon be passing the SAFE Banking Act allowing cannabis companies to utilize major banks and accept credit cards, the entire sector got slammed. This was most likely due to the speculative nature of these investments as investors were selling when the markets started pulling back even further. As a result, Canopy Growth Corporation (CGC) dropped -6.80% this week, putting itself in the spot of the Biggest Loser.

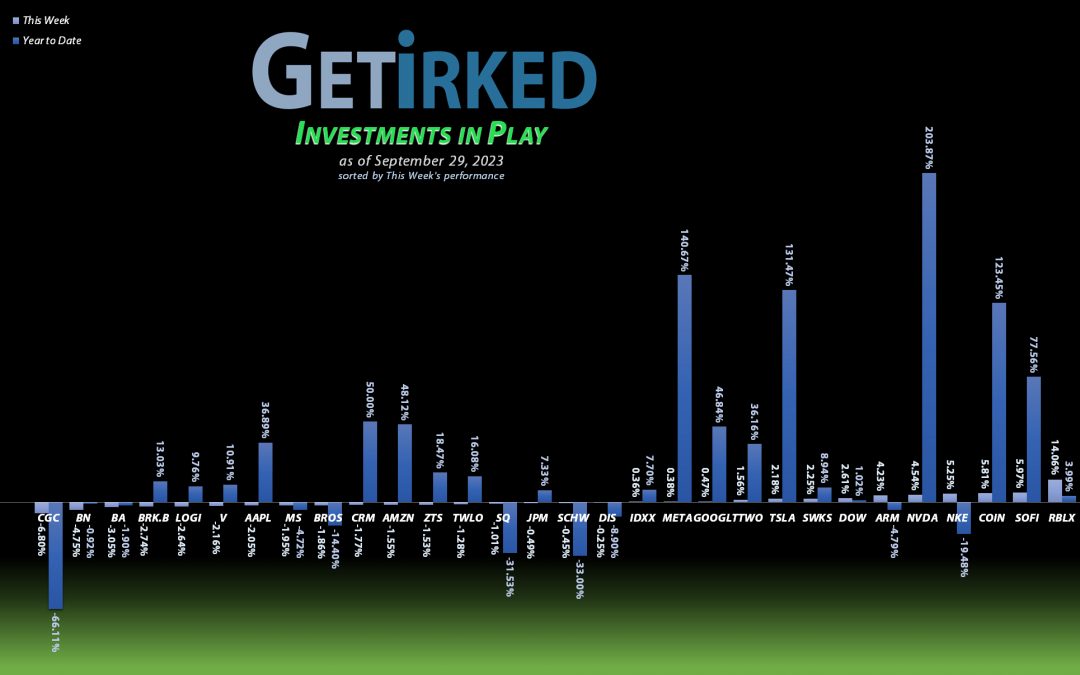

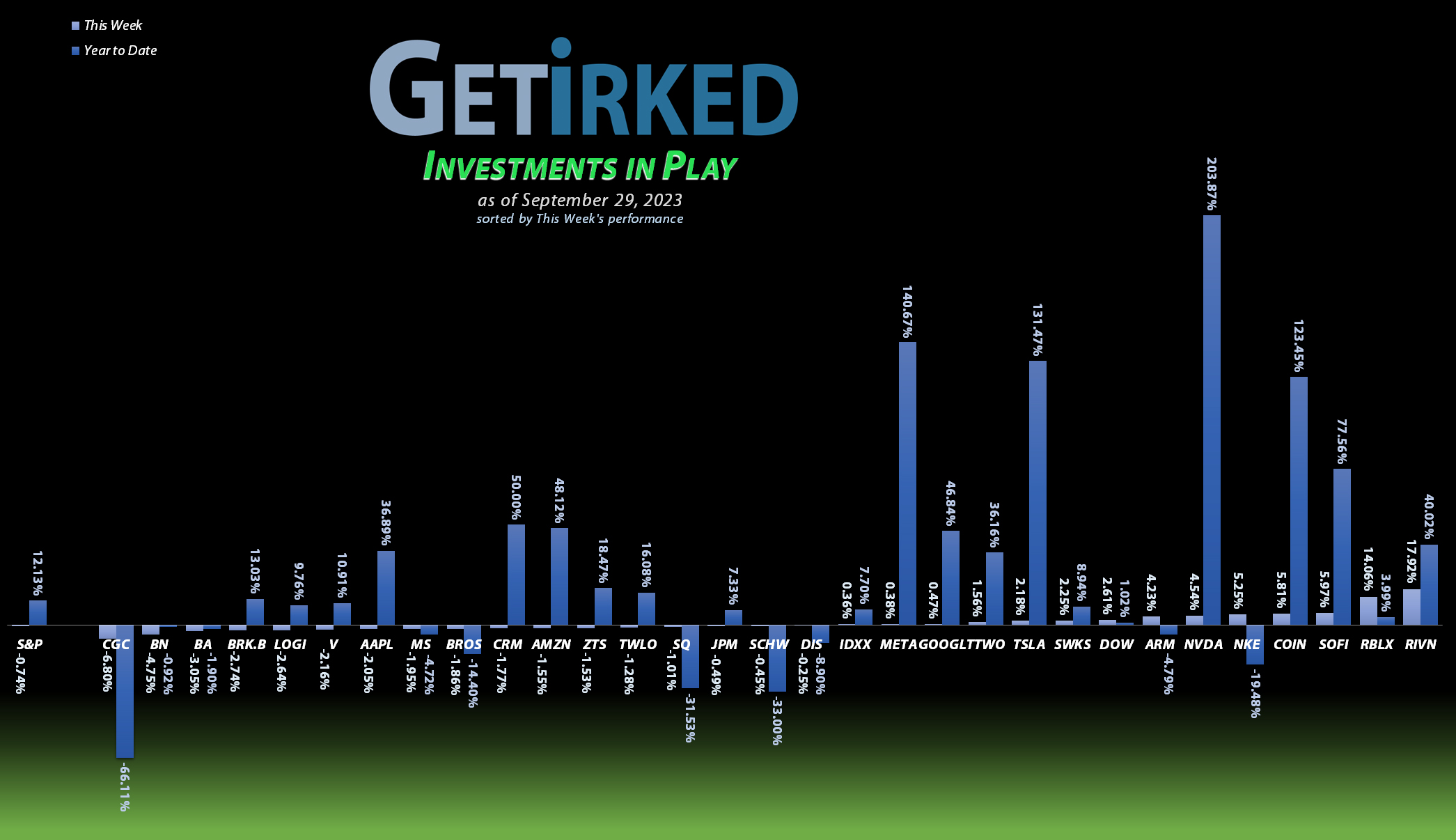

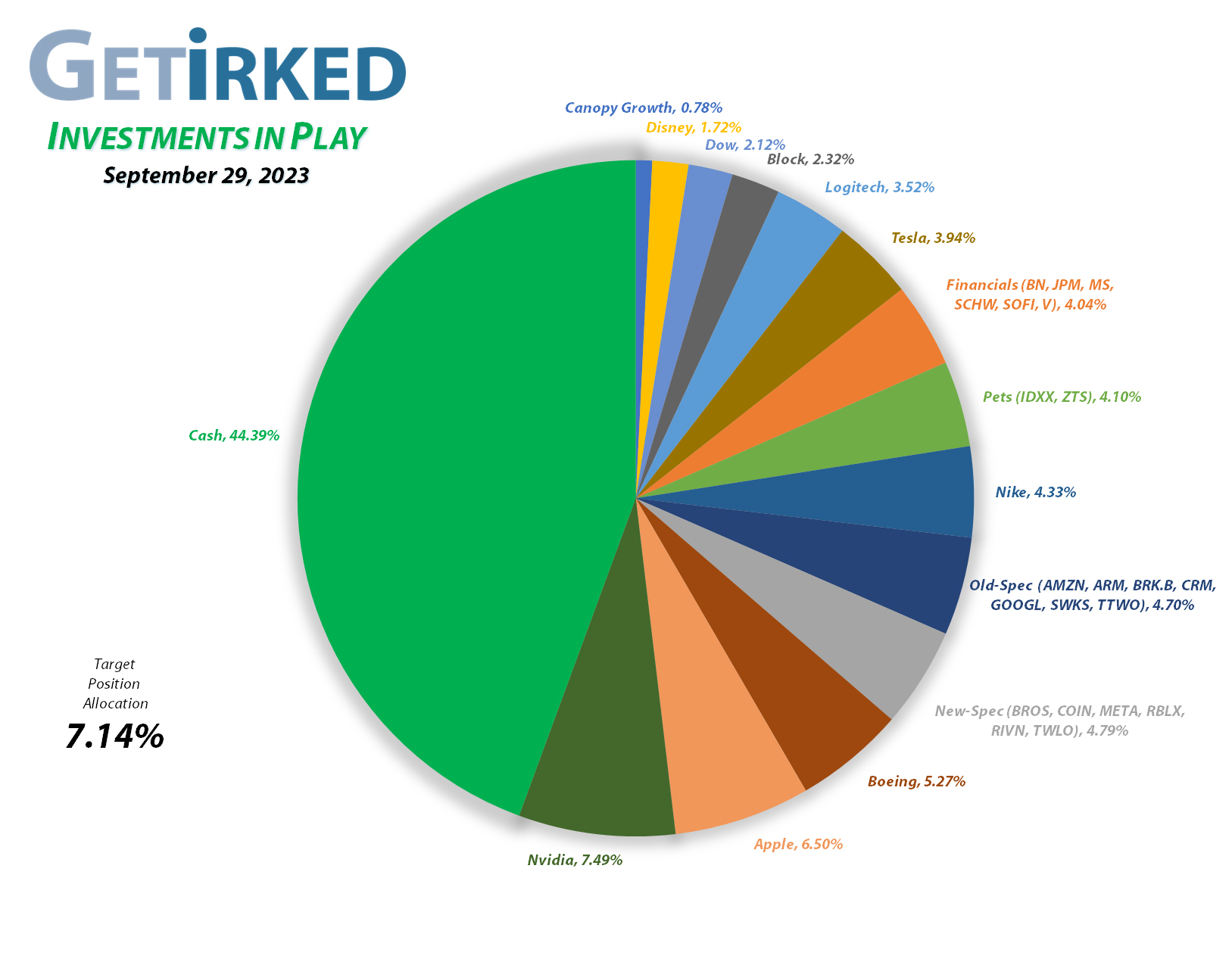

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1447.39%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$259.30)*

Apple (AAPL)

+909.45%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$77.48)*

Boeing (BA)

+650.76%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+644.60%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Logitech (LOGI)

+577.76%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($3.35)*

Skyworks (SWKS)

+458.49%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.48)*

Block (SQ)

+439.70%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.00)*

IDEXX Labs (IDXX)

+402.78%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+380.47%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

Dow (DOW)

+305.94%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.326)*

JP Morgan (JPM)

+191.64%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $49.73

Amazon (AMZN)

+159.43%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Disney (DIS)

+140.55%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.23)*

Salesforce (CRM)

+129.91%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

SoFi (SOFI)

+110.27%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Take Two (TTWO)

+109.70%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+96.34%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+86.56%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Alphabet (GOOGL)

+59.59%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Visa (V)

+32.49%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.60

Morgan Stan (MS)

+28.19%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $63.71

Zoetis (ZTS)

+22.36%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.19

Brookfield (BN)

-3.61%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $32.44

Arm Hldgs (ARM)

-6.56%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $57.28

Schwab (SCHW)

-13.79%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.68

Rivian (RIVN)

-18.51%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Dutch Bros (BROS)

-29.86%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Roblox (RLBX)

-32.34%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.80

Twilio (TWLO)

-35.25%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Coinbase (COIN)

-63.90%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-80.17%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Block (SQ): Added to Position

Block’s (SQ) relentless selloff along with PayPal (PYPL) and the rest of the market continued this week with SQ triggering my next buy order which added 2.51% to my position at $43.20.

This buy locked in a -59.23% discount, replacing shares I sold for $105.96 on June 26, 2020, and raised my per-share “cost” +4.07% from -$68.80 to -$66.00 (a negative per-share cost indicates all capital has been removed in addition to $66.00 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $36.50, slightly above a key level of support Block saw during the pandemic selloff in 2020, and my next sell target is $80.25, just under the high SQ saw in July

SQ closed the week at $44.26, up +2.45% from where I added Thursday.

Brookfield Corporation (BN): *New Position*

This week, Brookfield Corporation (BN), an alternative asset manager I’ve had my eye on for some time, pulled back on Monday and triggered my opening position which filled at $32.44 with a 24.35% allocation buy as part of financial basket along with JP Morgan (JPM), Morgan Stanley (MS), Schwab (SCHW), SoFi (SOFI) and Visa (V).

While normally, I’d start a new position with closer to a 50% allocation buy, however, given the precarious nature of the stock market lately, I decided to take a more conservative approach.

Brookfield Corporation is an alternative asset manager and REIT/Real Estate Investment Manager firm focuses on real estate, renewable power, infrastructure and venture capital and private equity assets. It manages a range of public and private investment products and services for institutional and retail clients. It typically makes investments in sizeable, premier assets across geographies and asset classes.

Additionally, it accesses the private equity and venture capital markets, focusing on acquisition, early ventures, control buyouts and financially distressed assets. It invests in both public debt and equity markets.

In private equity sectors, Brookfield focuses on business services including infrastructure, healthcare, road fuel distribution and marketing, construction and real estate; Industrials include manufacturers of automotive batteries, graphite electrodes, returnable plastic packaging, and sanitation management and development; and Residential/ infrastructure services. While not substantial, Brookfield does pack a small dividend currently paying out a yield of 0.85% at my buying price.

From here, my next buy target is $30.23, above the next level of support, and, while it is a brand-new investment, I will take profits if it starts to approach its all-time high with my first sell target at $50.08.

BN closed the week at $31.27, down -3.61% from where I opened it on Monday.

Dutch Bros (BROS): Added to Position

Dutch Bros (BROS) continued to sell off with the rest of the market this week, triggering my next buy order which filled on Thursday at $22.70, adding 2.18% to the position.

The buy lowered my per-share cost -1.63% from $33.70 to $33.15. From here, my next buy target is $20.50, slightly above BROS’ all-time low at $20.05, and my next sell target is $35.05, just under the high BROS reached in August 2023.

BROS closed the week at $23.25, up +2.42% from where I added Thursday.

Logitech (LOGI): Dividend Payout

Logitech (LOGI) paid out its quarterly dividend on Wednesday. Since Logitech is located abroad, the dividend must be taken as a straight payout and cannot be reinvested automatically. However, it did lower my per-share cost -30.35% from -$2.57 down to -$3.35 (a negative per-share cost indicates all capital has been removed in addition to $3.35 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $50.53, just above a point of support LOGI saw earlier in 2023, and my next sell target is $95.57, just below a point of resistance Logitech repeatedly hit throughout 2021-2022.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.