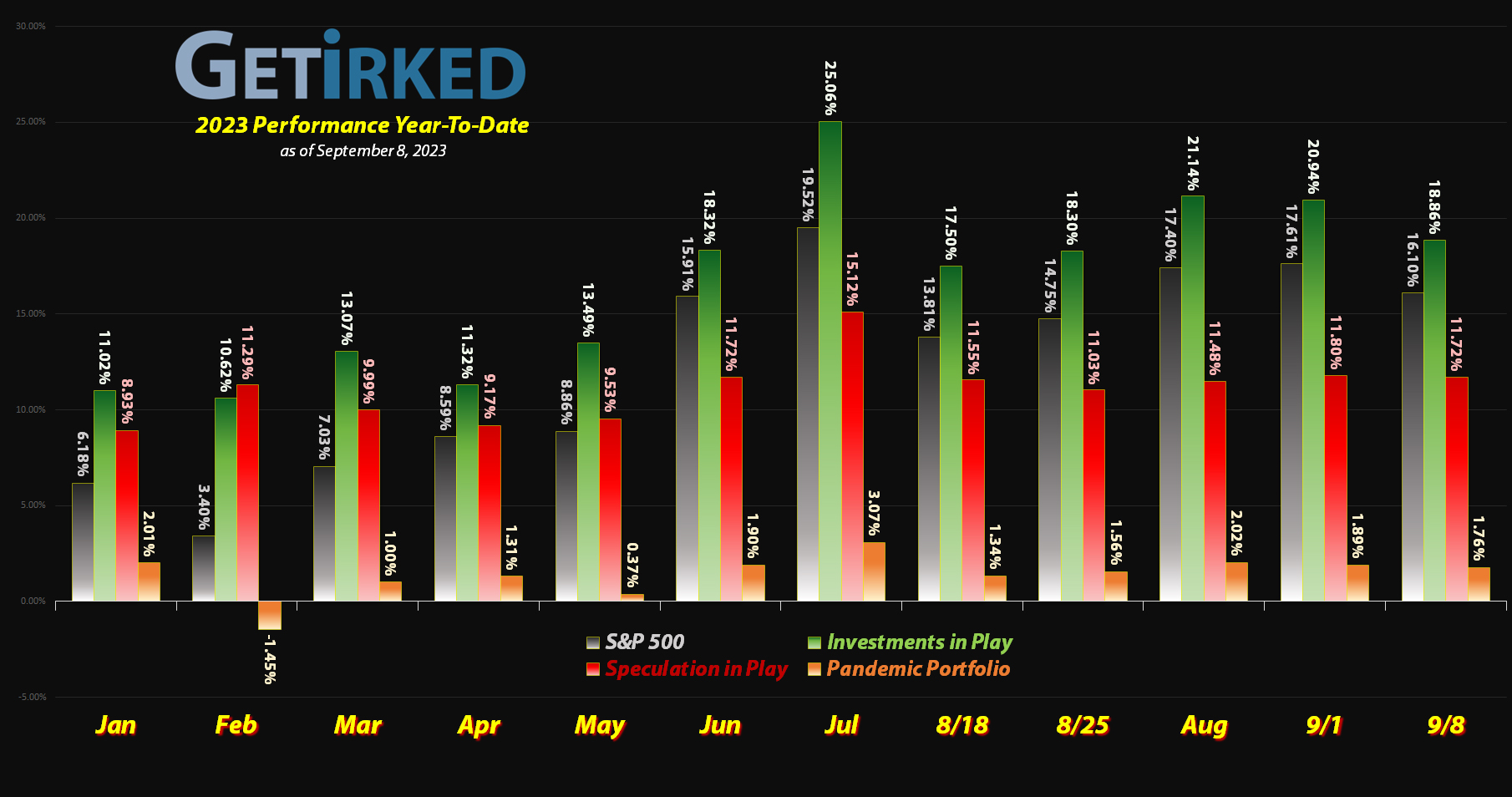

September 8, 2023

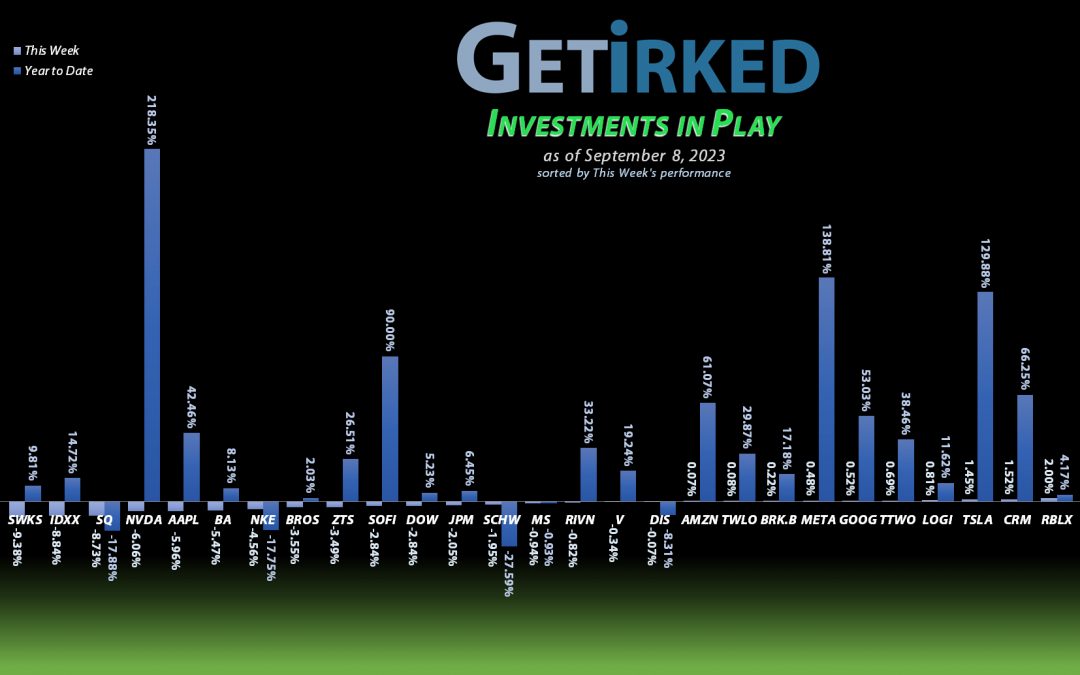

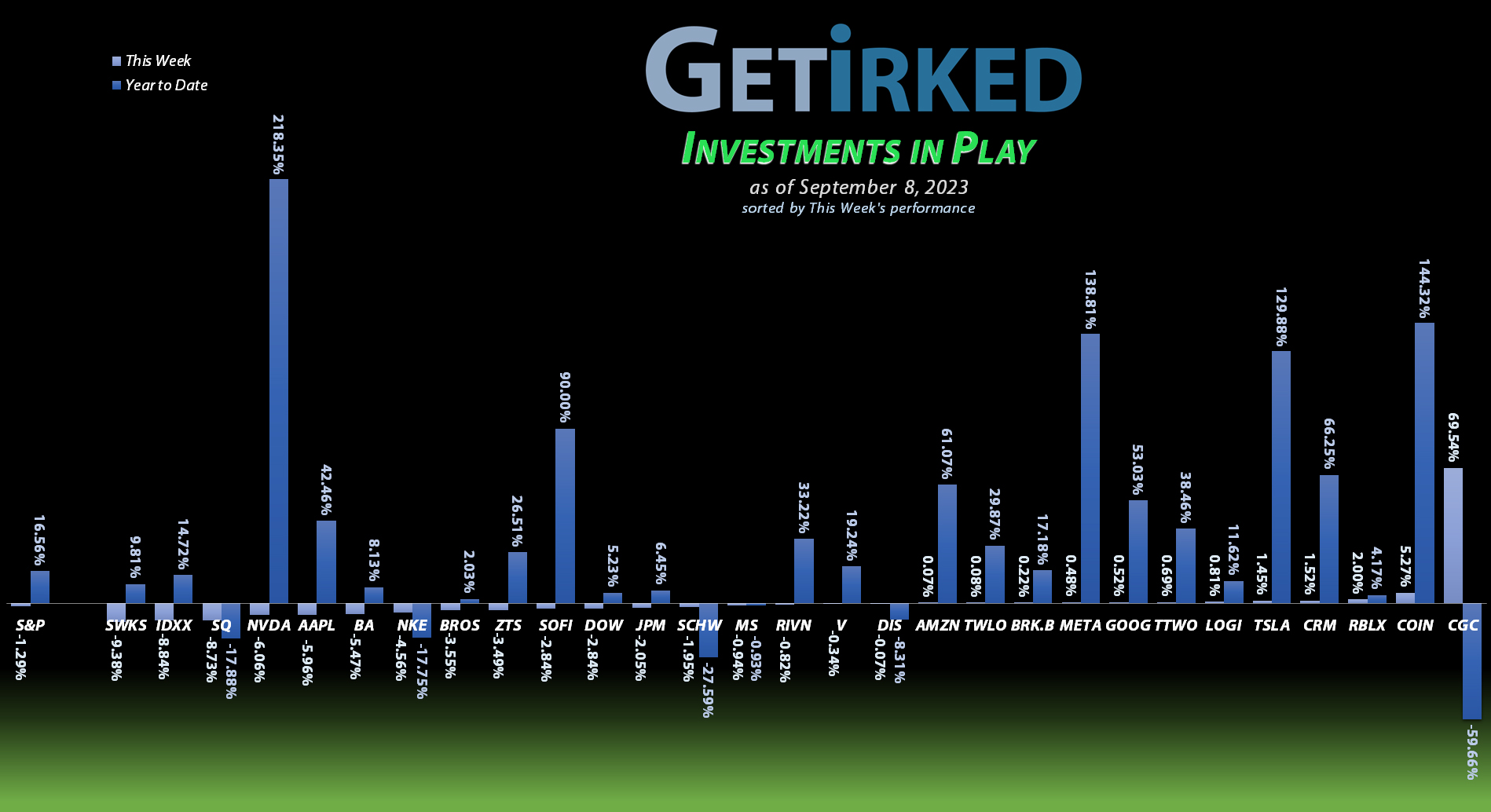

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

The market loves an underdog. Or, well, the market loves a penny cannabis stock with huge growth potential. Either way, Canopy Growth Corporation (CGC) blazed another win this week, rocketing another +65.54% on top of last week’s win, making CGC a two-timer Biggest Winner of the week for the first time in a long time.

Can Canopy and the rest of the cannabis sector keep up this run? I sure hope so considering I need this one to 10X off its low just to break even (wow, this one has been a stinker for some time, eh?)

Skyworks Solutions (SWKS)

Any semiconductor company that supplies chips to Apple’s (AAPL) iPhone got hit particularly hard this week when China announced a ban on any government or state-owned employee using iPhones.

Since Skyworks Solutions (SWKS) supplies the modems for Apple’s iPhone, the company got hit with a -9.38% loss this week, making it the Biggest Loser in the portfolio.

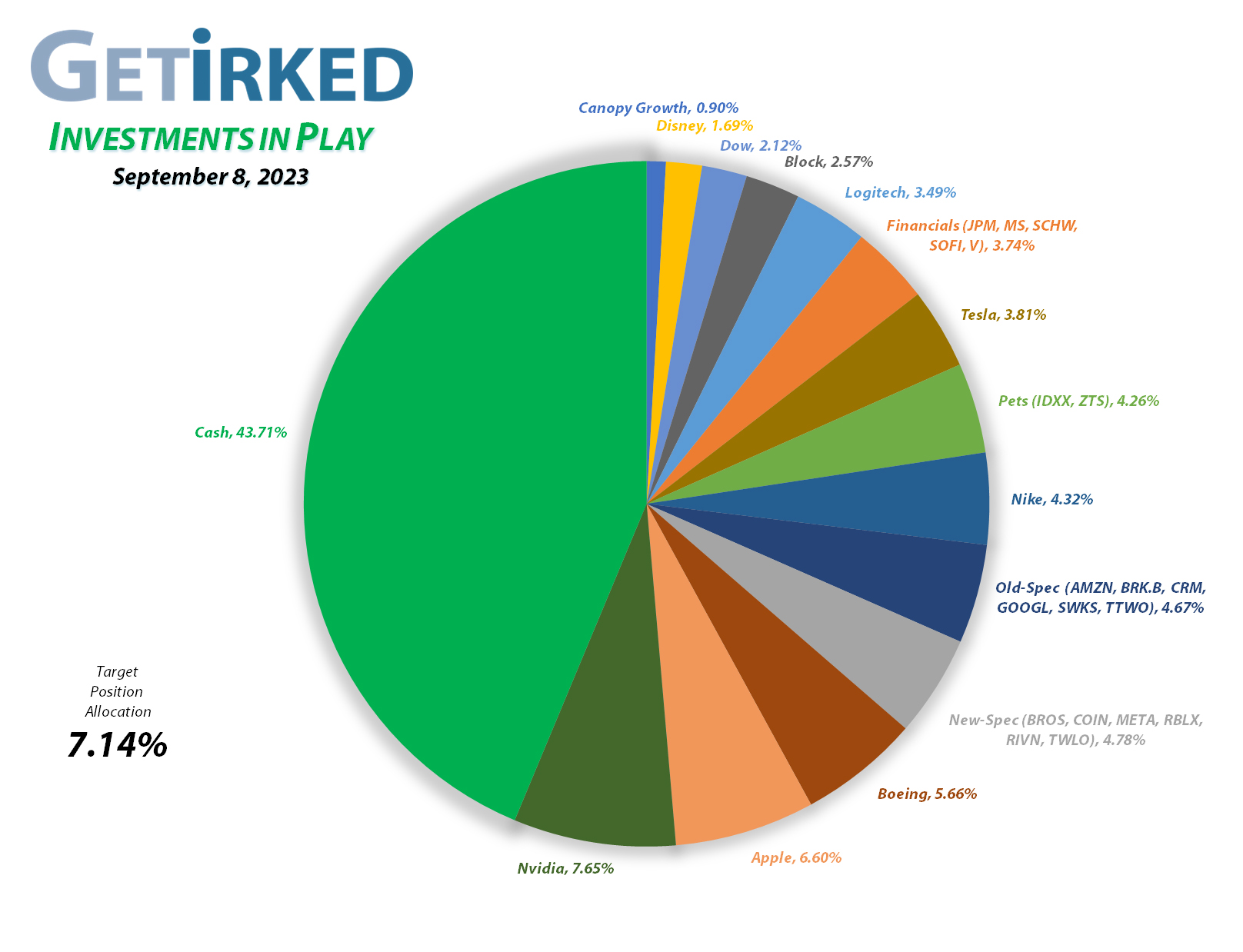

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1490.60%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$259.30)*

Apple (AAPL)

+934.93%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$77.48)*

Boeing (BA)

+685.13%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+640.88%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Logitech (LOGI)

+580.94%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($2.57)*

Block (SQ)

+473.38%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.87)*

Skyworks (SWKS)

+458.85%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.72)*

IDEXX Labs (IDXX)

+420.23%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+387.97%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

Dow (DOW)

+314.62%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.33)*

JP Morgan (JPM)

+189.28%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $49.73

Amazon (AMZN)

+182.10%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+154.88%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+141.44%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.23)*

SoFi (SOFI)

+125.01%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Take Two (TTWO)

+113.26%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+95.98%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+93.41%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Alphabet (GOOGL)

+66.32%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Visa (V)

+42.48%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.60

Morgan Stan (MS)

+33.32%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $63.71

Zoetis (ZTS)

+30.66%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.19

Schwab (SCHW)

-6.88%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.68

Dutch Bros (BROS)

-18.98%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $34.20

Rivian (RIVN)

-22.47%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Twilio (TWLO)

-27.57%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Roblox (RLBX)

-34.02%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $43.95

Coinbase (COIN)

-60.53%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-76.39%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Dutch Bros (BROS): Added to Position

On Thursday, Dutch Bros (BROS) announced a $300 million equity offering to raise funds which caused the stock to have a very sudden selloff followed by a full recovery within minutes of the market open. BROS triggered my next buy which added 5.88% to my position at $25.70.

The buy lowered my per-share cost -1.44% from $34.70 to $34.20. From here, my next buy target is $24.70, the low BROS saw during Thursday’s selloff, and my next sell target is $38.45, under a point of resistance Dutch Bros has seen several times in the past.

BROS closed the week at $27.71, up +7.82% from where I added Thursday.

Visa (V): Dividend Reinvestment

Visa (V) paid out its quarterly dividend on Tuesday which, after reinvesting, lowered my per-share cost -0.19% from $173.93 to $173.60. From here, I’ve raised my next buying price target up to $179.44, slightly above a key level of support Visa made in 2022.

Having just opened this position in May 2022, Visa is still relatively new in the portfolio so I’m willing to wait a while before taking anything out of the position.

Zoetis (ZTS): Dividend Reinvestment

Zoetis (ZTS) paid out its quarterly dividend on Tuesday which, after reinvesting, lowered my per-share cost -0.19% from $142.46 to $142.19. From here, my next buying price target is $142.27, slightly above a key level of support Zoetis made in 2022.

My next sell target is $199.78, just below a past point of resistance. Despite opening Zoetis relatively recently in June 2022, it’s been quite volatile so I definitely will take profits if it keeps rallying with the force it’s seen recently.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.