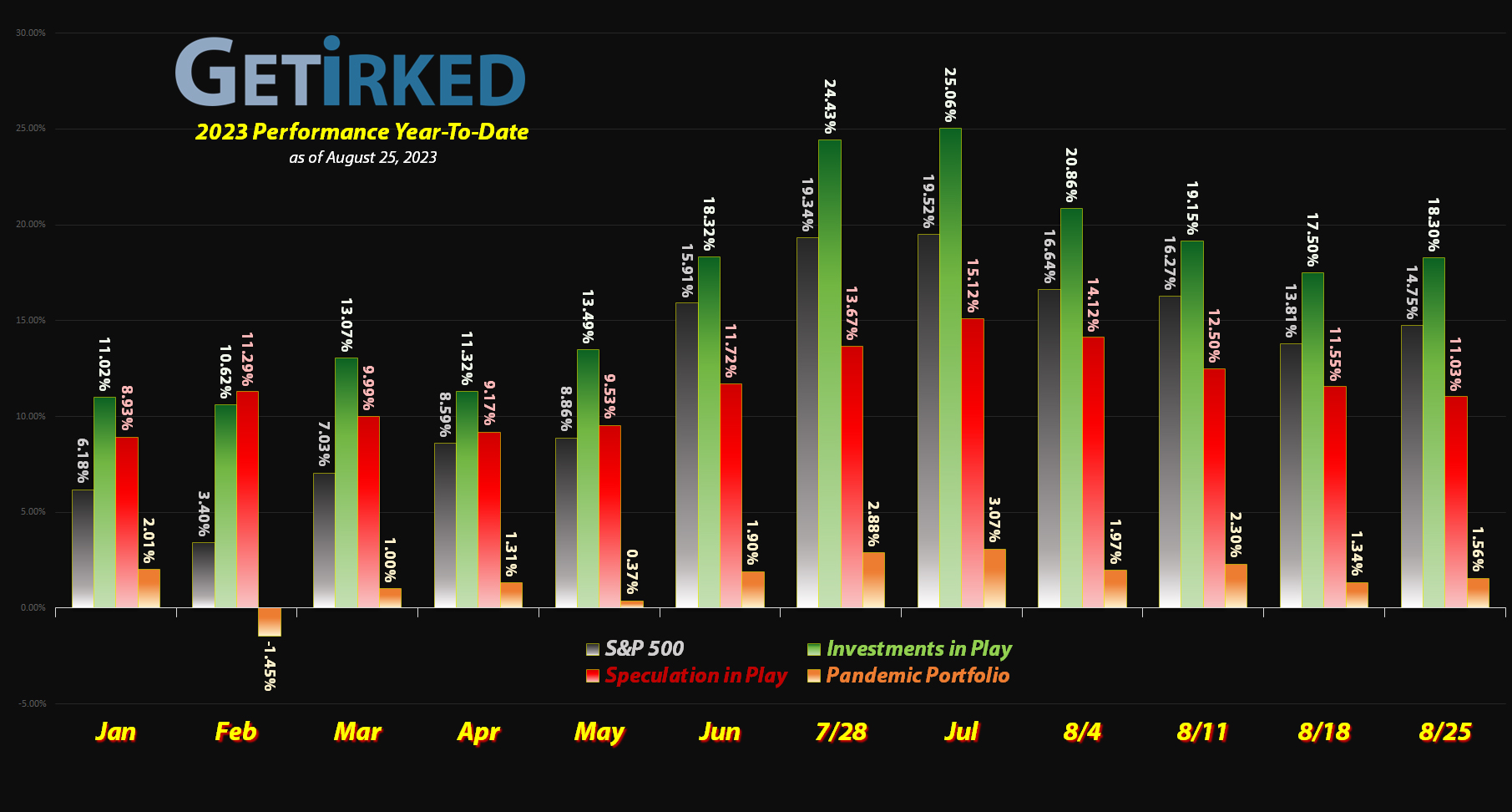

August 25, 2023

The Week’s Biggest Winner & Loser

Tesla (TSLA)

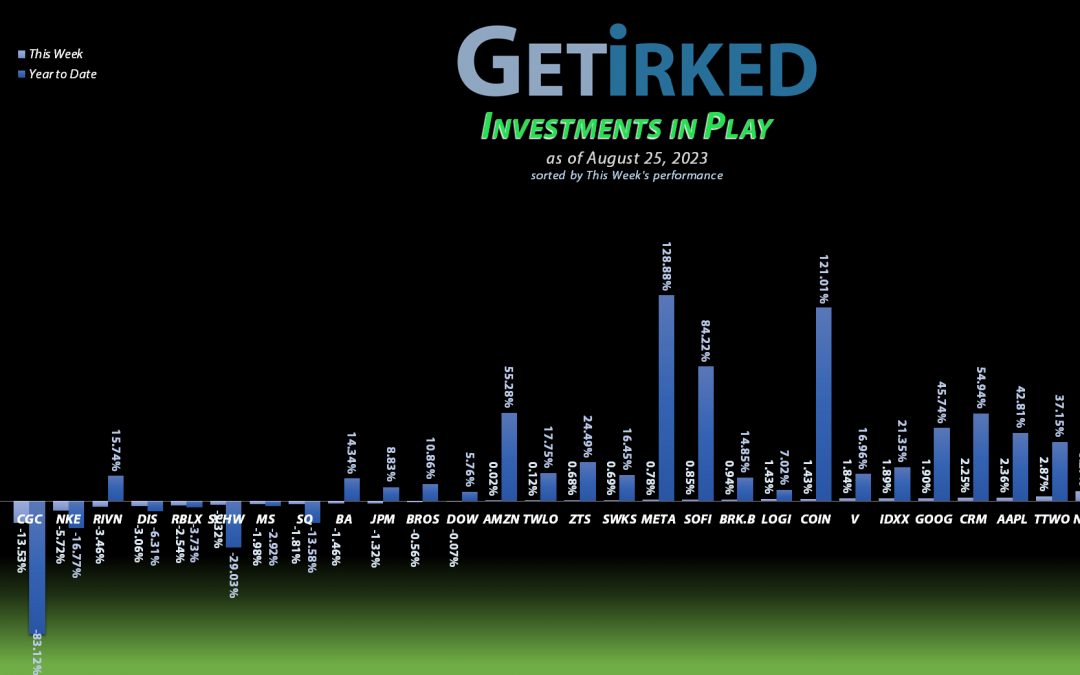

Tesla (TSLA) was the Week’s Biggest Winner on the back of… well… no news, really. TSLA just tends to be one of those cult stocks that gets driven up (pun intended) whenever the market rallies.

After having been a bit oversold over the past few weeks, Tesla gained +10.76% this week and that was enough to gain it the primo parking spot of Biggest Winner.

Canopy Growth Corp (CGC)

When Canopy Growth Corporation (CGC) was the Week’s Biggest Winner a few weeks ago, I warned that when a stock trades under a dollar that big moves can be given back just as quickly.

Well, that happened this week.

The cannabis sector is seeing no signs of life and continues to get pounded, and that was certainly the case this week with CGC dropping -13.53% finishing as the Week’s Biggest Loser and even lower than it was when it even started its run weeks ago, giving back all its gains and then some.

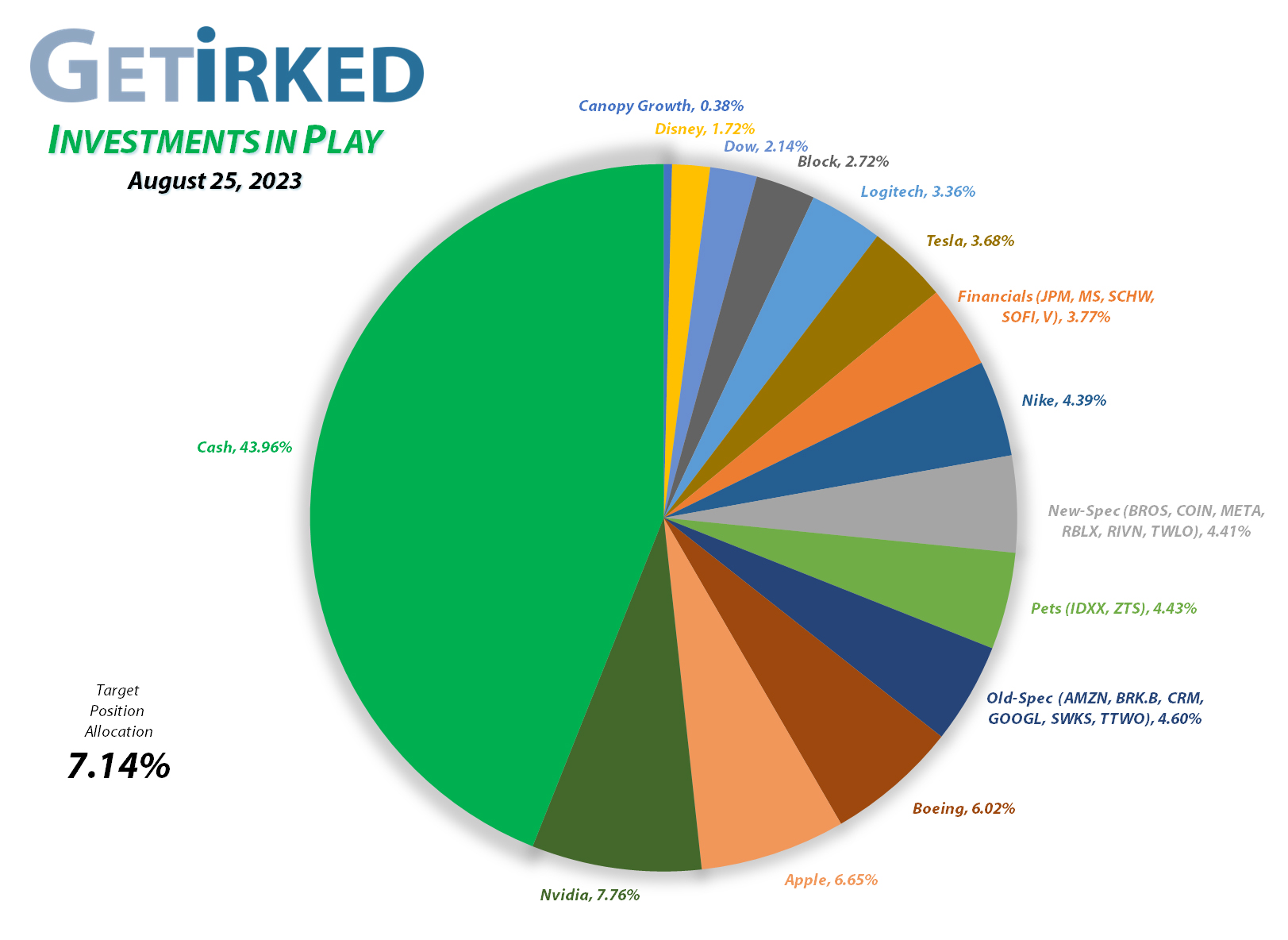

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

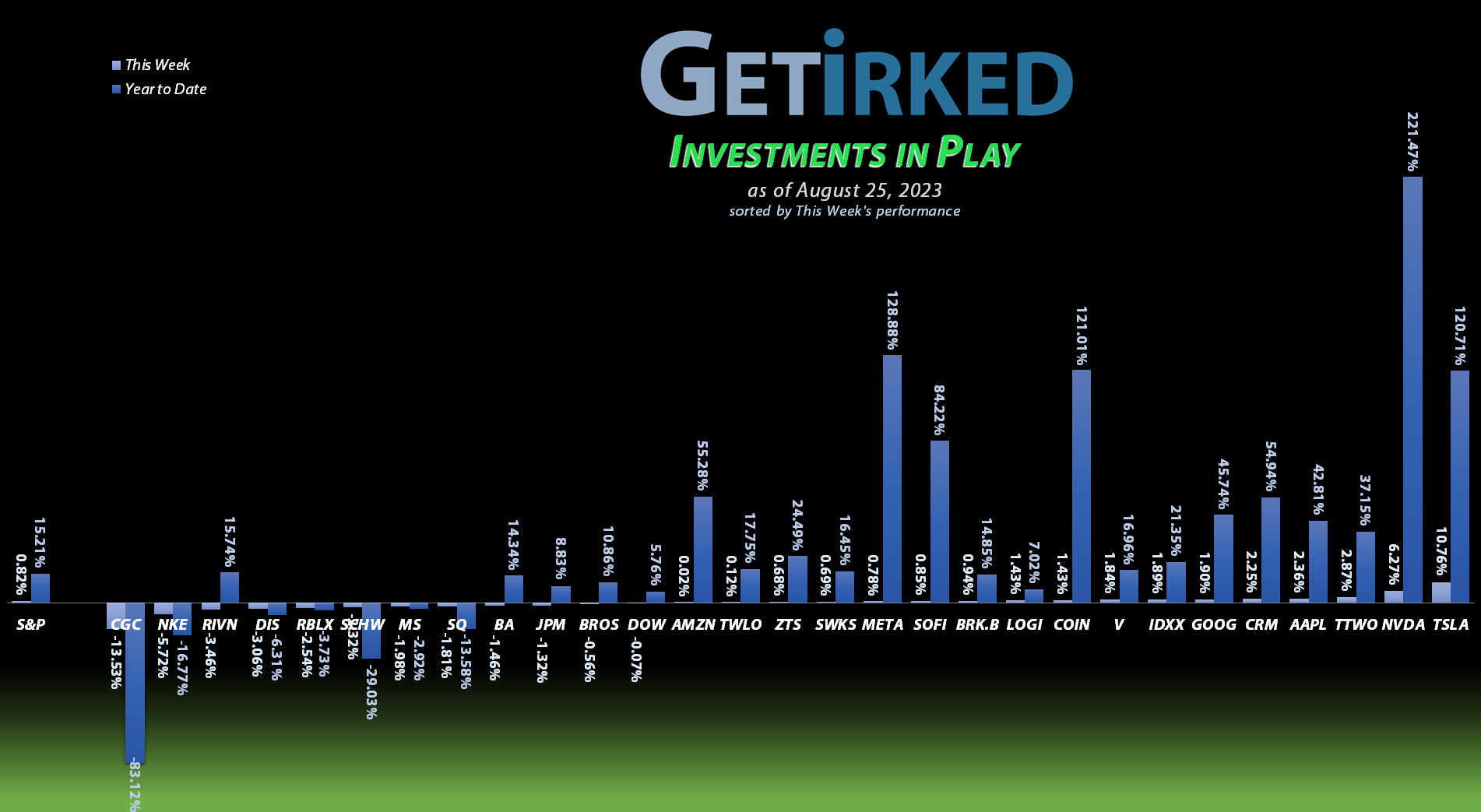

Nvidia (NVDA)

+1499.90%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$259.30)*

Apple (AAPL)

+936.51%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$77.48)*

Boeing (BA)

+706.42%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+619.48%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Logitech (LOGI)

+557.84%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($2.57)*

Block (SQ)

+483.95%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.87)*

Skyworks (SWKS)

+479.41%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.72)*

IDEXX Labs (IDXX)

+436.69%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+392.09%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

Dow (DOW)

+316.19%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.33)*

JP Morgan (JPM)

+195.72%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $49.73

Amazon (AMZN)

+171.96%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Disney (DIS)

+144.41%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.87)*

Salesforce (CRM)

+137.65%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

SoFi (SOFI)

+118.17%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Take Two (TTWO)

+111.24%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+94.06%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+89.57%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Alphabet (GOOGL)

+58.39%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Visa (V)

+39.51%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.93

Morgan Stan (MS)

+30.64%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $63.71

Zoetis (ZTS)

+28.33%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.46

Schwab (SCHW)

-9.04%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.95

Dutch Bros (BROS)

-13.21%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $34.70

Rivian (RIVN)

-32.64%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Twilio (TWLO)

-34.34%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Roblox (RLBX)

-39.02%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $43.95

Coinbase (COIN)

-64.30%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-90.12%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Alphabet / Google (GOOGL): Profit-Taking

Alphabet (GOOGL) broke through some upside resistance on Wednesday, and with behemoth Nvidia (NVDA) reporting earnings after the bell, I decided it would be prudent to take some profits with a sell order which filled at $132.20, locking in +40.85% in gains on shares I bought for $93.86 on October 27, 2022.

The sale lowered my per-share cost -13.27% from $94.55 to $82.00. From here, my next sell target is $150.60, slightly under GOOGL’s all-time high of $151.55, and my next buy target is $92.40, a bit above a key point of support Alphabet saw in its selloff in October 2022.

GOOGL closed the week at $129.88, down -1.75% from where I took profits Wednesday.

Apple (AAPL): Dividend Reinvestment

Apple (AAPL) paid out its quarterly dividend last Friday evening which, after reinvesting, raised my per-share “cost” +0.13% from -$77.58 to -$77.48 (a negative per-share cost indicates all capital has been removed in addition to $77.48 per share added to the portfolio’s bottom line in addition to each share’s current value).

Despite Apple being a core holding (pun intended), it remains the second largest in the portfolio so I am patiently waiting a bigger pullback before adding back to the position with my next buy target now $145.39. My next sell target is $220.08, higher than Apple’s all-time high but within the price targets most analysts have on the stock.

Nvidia (NVDA): Profit-Taking

Nvidia (NVDA) reported yet another blowout quarter on Wednesday, and despite my reluctance to make moves in after-hours trading, I decided I had to take the opportunity to take more profits with a sale that filled at $510.01.

The sale locked in +3,154.69% in gains on shares I bought for $15.67 when I opened the position on September 6, 2016 and lowered my per-share “cost” -$54.35 from -$204.95 to -$259.30 (a negative per-share cost indicates all capital has been removed in addition to $259.30 per share added to the portfolio’s bottom line in addition to each share’s current value).

Since Nvidia continues to skyrocket, it remains overweight in the portfolio and is the largest position. Accordingly, my next sell target is $599.95, below the psychological resistance of $600, and my next buy target is $330.90, right in the middle of a potential gap fill that Nvidia created after its last report.

NVDA closed the week at $460.18, down -9.77% from where I took profits Wednesday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.