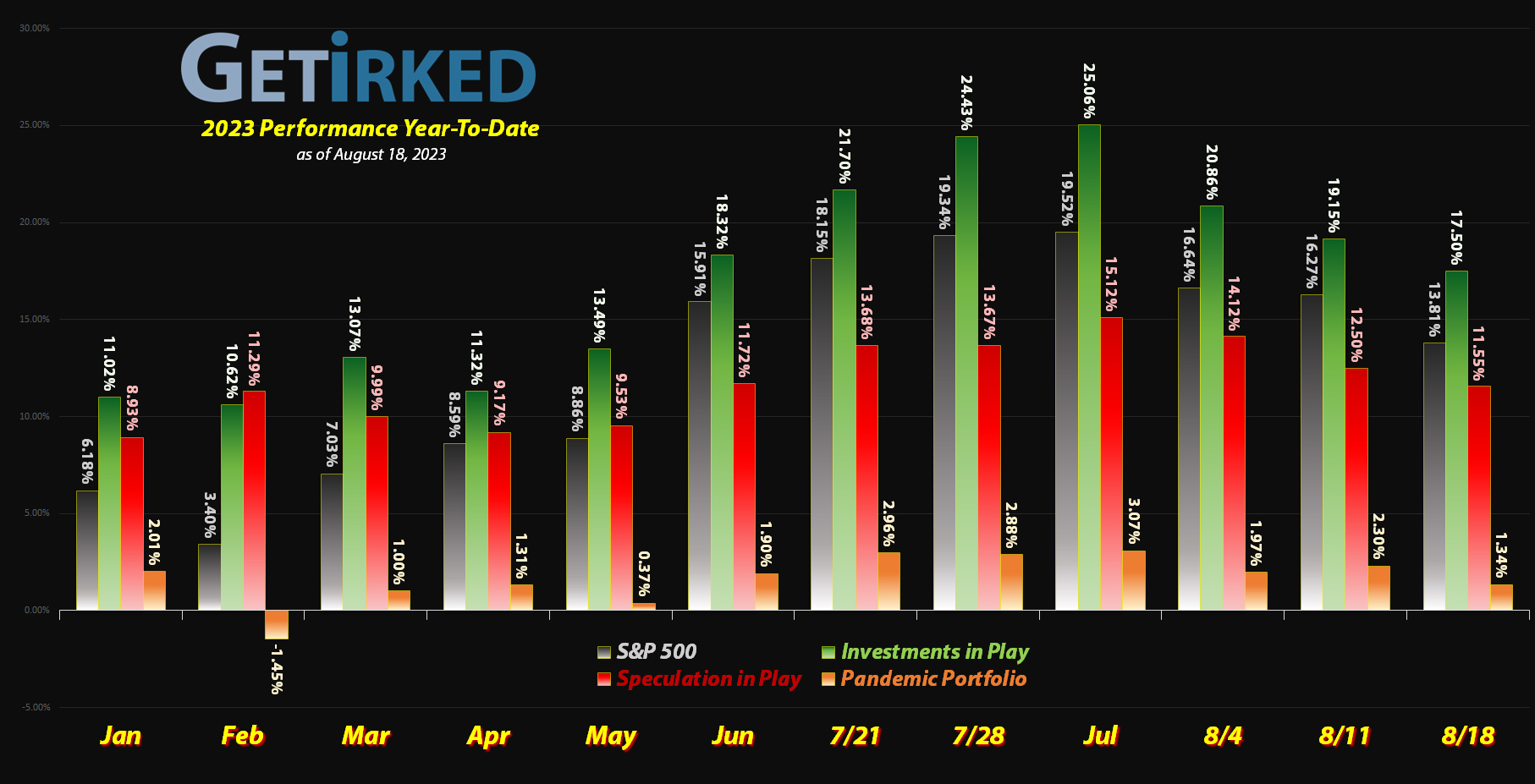

August 18, 2023

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

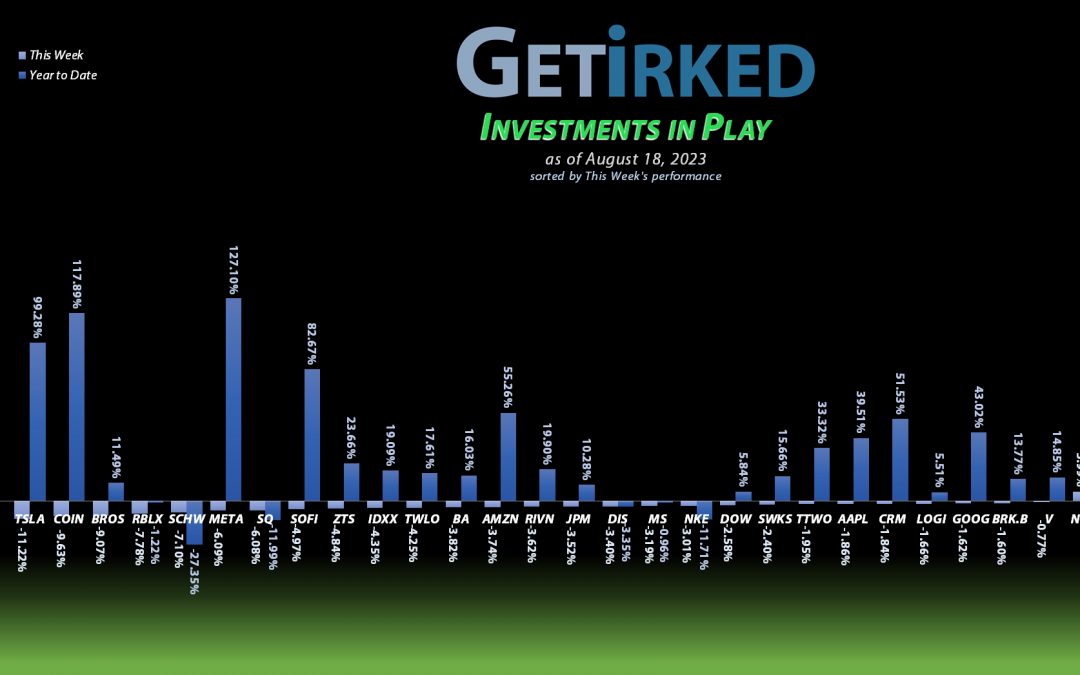

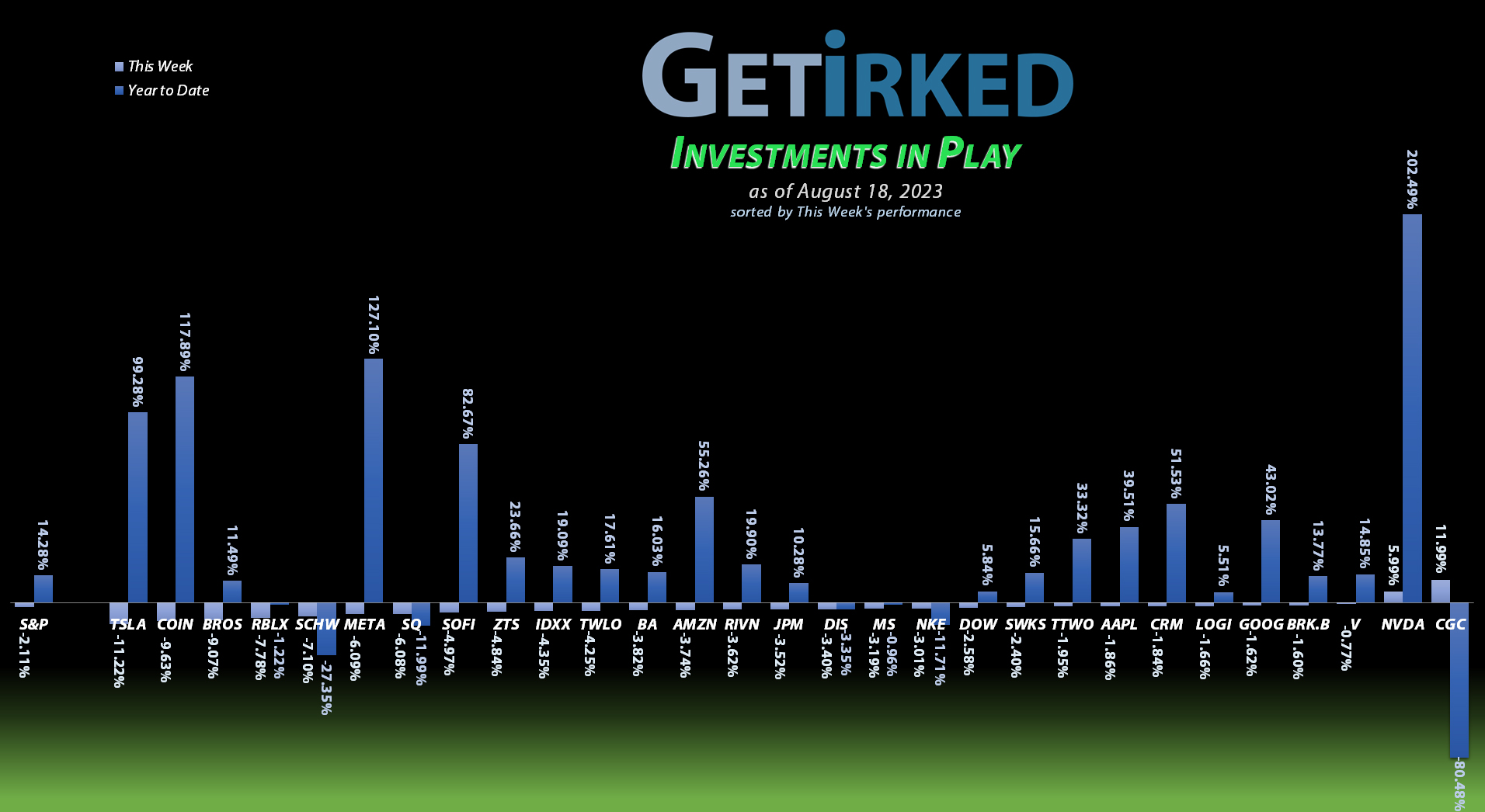

Long-time readers may remember that, a few weeks ago, I didn’t recognize Canopy Growth Corporation (CGC) as the week’s winner since it had only bounced off a low and didn’t really have fundamental news. This week, CGC gets to be the Biggest Winner as it did actually have fundamental news – Canopy sold one of its bigger assets, a campus in North Carolina, which added some desperately needed funds to its coffers.

While there are no promises this penny stock will survive, the cash injection thanks to the sale caused CGC to pop +11.99% this week, a pretty significant move considering almost every other position in the portfolio was down this week (except Nvidia (NVDA), of course, because those buyers are crazy).

Tesla (TSLA)

Tesla (TSLA) plunged more than the rest of the Investments in Play portfolio after the company announced even more price cuts on its models selling into China.

Thanks to an economy that is seemingly in a deflationary death spiral, China’s consumers simply aren’t buying the EVs Tesla’s selling, so CEO Elon Musk has once again announced price cuts to try to undermine the competition and get a foothold in the world’s second largest economy.

TSLA dropped -11.22% this week, easily parking itself in the spot of the Week’s Biggest Loser.

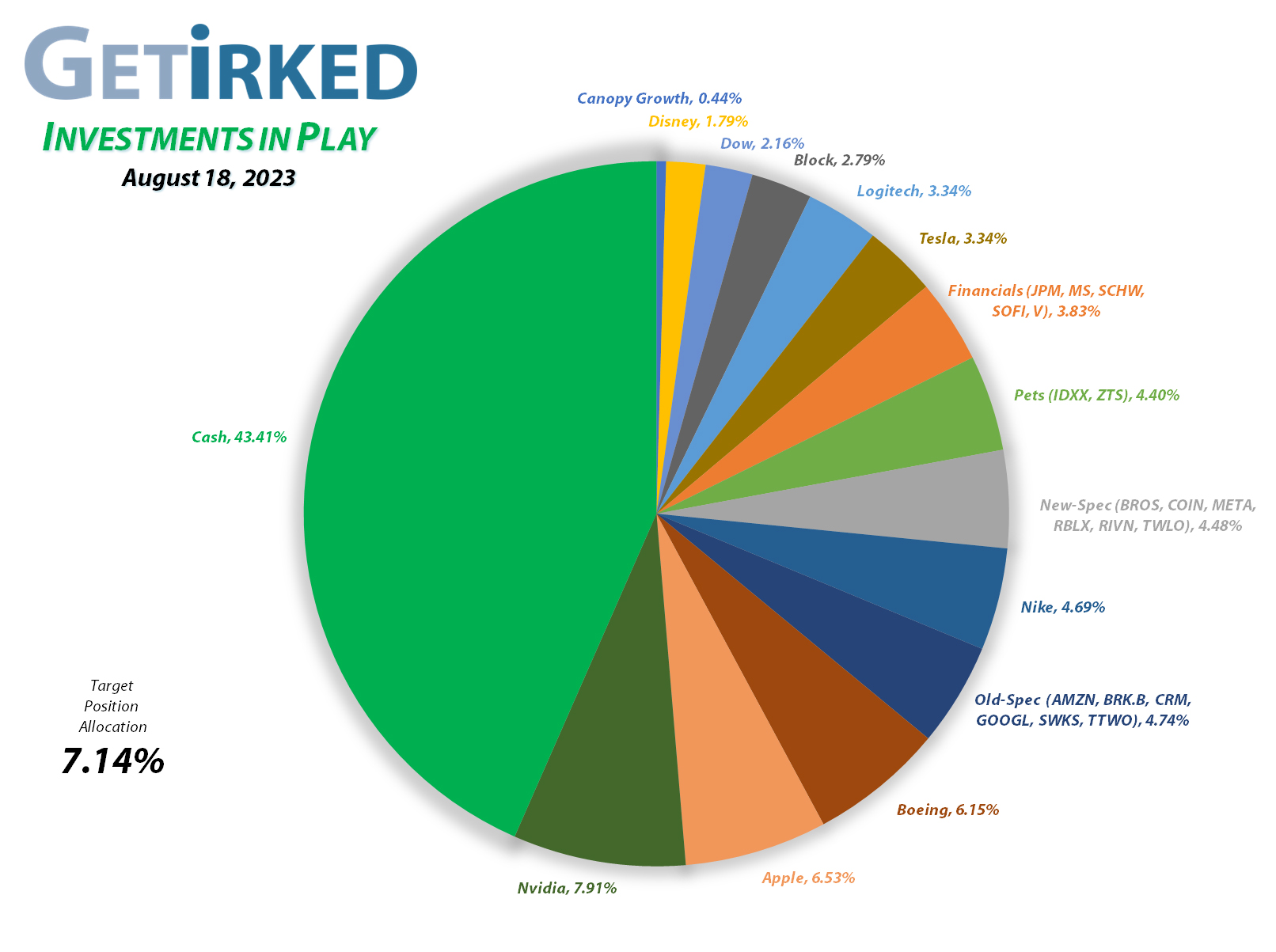

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1431.01%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$204.95)*

Apple (AAPL)

+920.56%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$77.58)*

Boeing (BA)

+712.21%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+569.60%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Logitech (LOGI)

+550.25%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($2.57)*

Block (SQ)

+487.78%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.87)*

Skyworks (SWKS)

+476.95%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.72)*

IDEXX Labs (IDXX)

+431.08%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+413.43%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

Dow (DOW)

+316.43%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.33)*

JP Morgan (JPM)

+199.66%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $49.73

Amazon (AMZN)

+171.92%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Disney (DIS)

+148.78%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.87)*

Salesforce (CRM)

+132.27%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

SoFi (SOFI)

+116.33%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Take Two (TTWO)

+105.34%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+93.72%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+87.79%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Visa (V)

+36.94%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.93

Alphabet (GOOGL)

+34.81%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $94.55

Morgan Stan (MS)

+33.26%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $63.71

Zoetis (ZTS)

+27.46%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.46

Schwab (SCHW)

-6.91%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.95

Dutch Bros (BROS)

-12.74%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $34.70

Rivian (RIVN)

-30.26%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Twilio (TWLO)

-34.40%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Roblox (RLBX)

-37.41%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $43.95

Coinbase (COIN)

-64.80%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-88.57%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Block (SQ): Added to Position

Block (SQ) broke down even further with the rest of the market on Friday, triggering my next buy order which added 2.70% to the position, filling at $54.97. The buy locked in a -22.66% discount, replacing shares I sold for $71.08 on November 14, 2022.

The buy raised my per-share “cost” +4.56% from -$75.30 to -$71.87 (a negative per-share cost indicates all capital has been removed in addition to $71.87 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $48.01, above a past point of support from during the pandemic selloff, and my next sell target is $88.19, just under Block’s high from earlier in 2023.

SQ closed the week at $56.88, up +3.47% from where I added Friday.

Morgan Stanley (MS): Dividend Reinvestment

Morgan Stanley (MS) paid out its quarterly dividend which, after reinvestment on Wednesday, lowered my per-share cost -0.98% from $64.34 to $63.71. Morgan Stanley has been an absolutely excellent position since I initially opened it on April 25, 2022, so waiting for it to sell off before I add more has been nearly excruciating.

However, I remain patient, so my next buy target is $76.78, above a past point of key support. Additionally, if MS decides to rally once more, I am targeting trimming even more profits off this position if it makes an attempt to break its all-time at $109.73.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.