June 21, 2019

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)*

+537.59%

1st Buy 2/14/2012 @ $79.58

Current Per-Share Cost: $0.00*

Square (SQ)*

+524.24%

1st Buy 8/5/2016 @ $11.10

Current Per-Share Cost: $0.00*

Nvidia (NVDA)

+414.76%

1st Buy 9/6/2016 @ $63.10

Current Per-Share Cost: $29.48

Apple (AAPL)*

+392.09%

1st Buy 4/18/2013 @ $56.38

Current Per-Share Cost: $0.00*

Nike (NKE)*

+321.62%

1st Buy 2/14/2012 @ $26.71

Current Per-Share Cost: $0.00*

Disney (DIS)*

+279.27%

1st Buy 2/14/2012 @ $41.70

Current Per-Share Cost: $0.00*

IDEXX Labs (IDXX)

128.28%

1st Buy 7/26/2017 @ $167.29

Current Per-Share Cost: $120.00

Canopy Growth (CGC)

+121.04%

1st Buy 5/24/2018 @ $29.53

Current Per-Share Cost: $17.50

GW Pharma (GWPH)

+56.38%

1st Buy 7/25/2018 @ $142.28

Current Per-Share Cost: $111.03

Salesforce.com (CRM)

+30.59%

1st Buy 6/11/2018 @ $134.05

Current Per-Share Cost: $120.10

Amazon (AMZN)

+18.28%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share Cost: $1,615.85

Logitech (LOGI)

+17.73%

1st Buy 11/11/2016 @ $24.20

Current Per-Share Cost: $33.01

IBM (IBM)

+16.75%

1st Buy 11/6/2018 @ $120.87

Current Per-Share Cost: $119.23

Citigroup (C)

+11.38%

1st Buy 10/26/2017 @ $74.06

Current Per-Share Cost: $61.02

JP Morgan (JPM)

+7.58%

1st Buy 10/26/2017 @ $102.30

Current Per-Share Cost: $101.47

Pfizer (PFE)

+9.27%

1st Buy 1/28/2019 @ $40.50

Current Per-Share Cost: $39.97

Take Two Inter (TTWO)

+4.47%

1st Buy 7/30/2018 @ $120.99

Current Per-Share Cost: $107.82

Xilinx (XLNX)

+4.43%

1st Buy 5/13/2019 @ $111.57

Current Per-Share Cost: $107.39

3M (MMM)

+0.54%

1st Buy 5/1/2019 @ $188.97

Current Per-Share Cost: $172.42

Dow (DOW)

-3.23%

1st Buy 5/13/2019 @ $53.18

Current Per-Share Cost: $49.98

Kohl’s (KSS)

-3.96%

1st Buy 6/3/2019 @ $50.45

Current Per-Share Cost: $49.47

* Indicates a position where the capital investment was sold.

Divide position’s current price by gains to calculate initial buy price

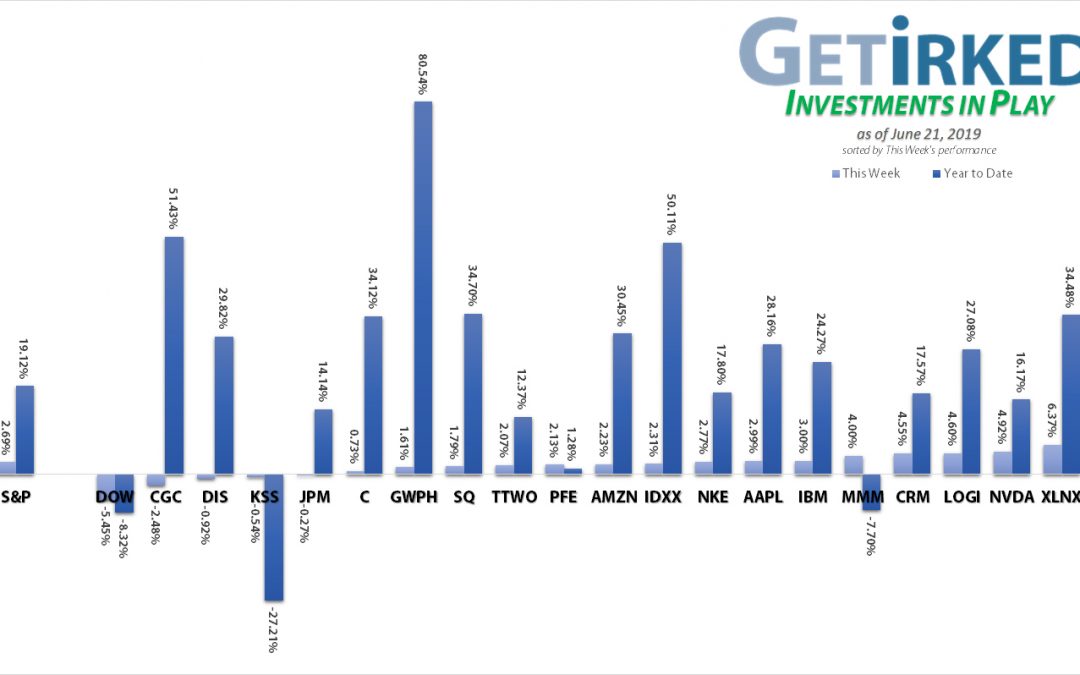

Highlights from the Week

Biggest Winner: Boeing (BA)

Boeing (BA) earned a +7.30% gain this week thanks to a new order for 200 of the 737-MAX series from International Airlines Group (IAG) at the Paris Air Show, perhaps indicating that the industry is beginning to process the two airline crashes in the past two years.

Although not the best overall performer Year-To-Date, Boeing is still up 17.81% for the year, and given the combination of company-specific woes and Trade War concerns with China, this performance is certainly not to be ignored.

Biggest Loser: Dow (DOW)

Dow (DOW) was actually up quite a bit this week before pulling back dramatically due to Trade War concerns and closing out the week -5.45%, earning it the spot as this week’s Weekly Loser.

We view Dow as a long-term investment as its chemical products put it squarely as a commodity play seeing risk from both Trade War and macroeconomics concerns. Its 5.79% dividend yield at these levels make its -8.32% YTD performance a little easier to swallow.

This Week’s Moves

No Moves This Week

Although the market continued to rocket higher this week, we’re comfortable with our current portfolio allocations, so we didn’t make any moves.

The market is far too frothy to add to existing positions and our current positions aren’t anywhere we think we need to take any off the table.

Sometimes, the best thing to do is to do nothing at all.

We are eyeing our biggest positions – Nike (NKE) and Square (SQ) – for potential profit-taking if the market continues its upward climb.

We also have a target sell order for about 10% of our IDEXX Labs (IDEXX) position if it reaches the high $280s before the end of June as those levels indicate significant overbought conditions on the Weekly RSI and also hits a historical trendline top.

Want Further Clarification?

As always, if you have questions about any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.