August 4, 2023

The Week’s Biggest Winner & Loser

Amazon (AMZN)

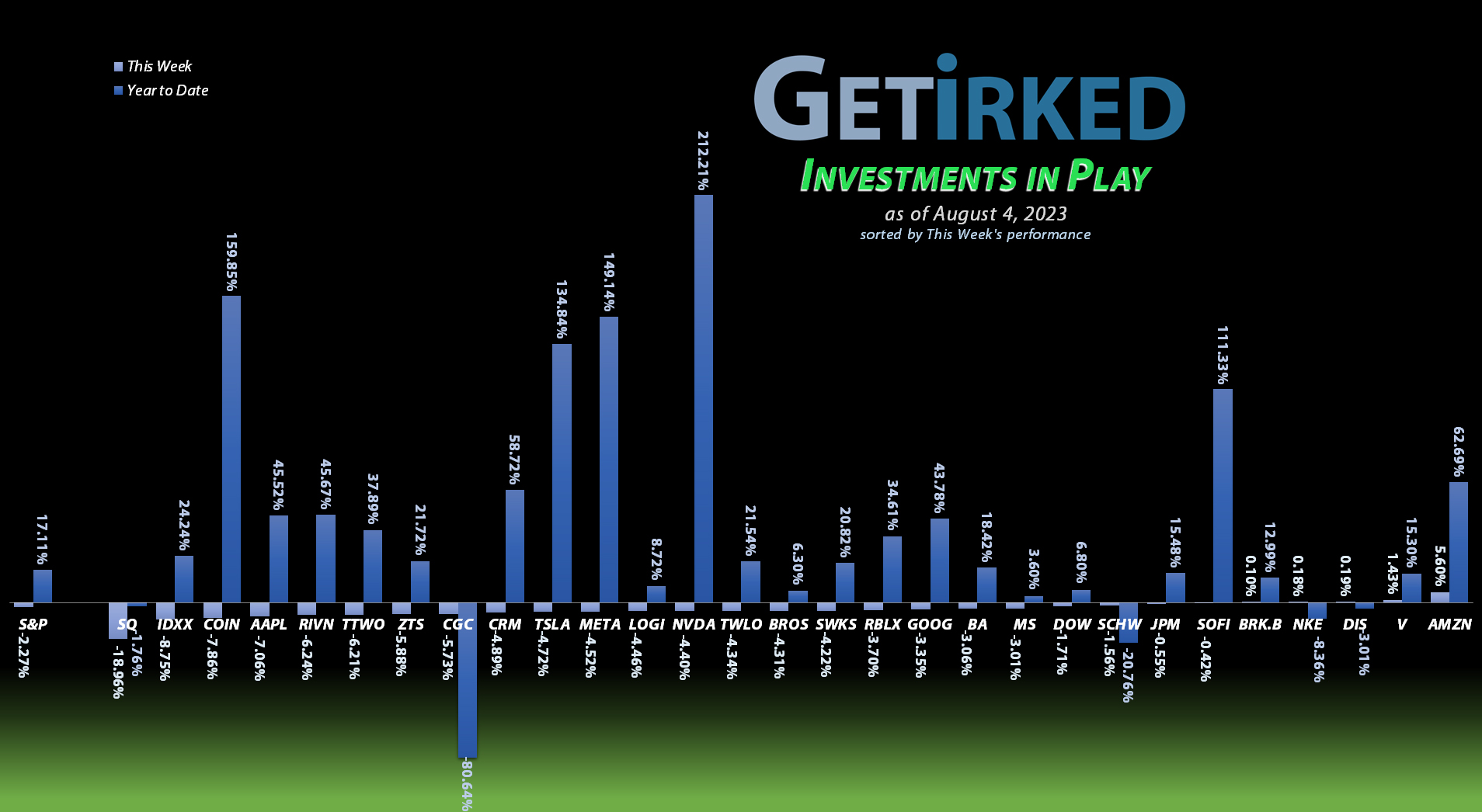

Amazon (AMZN) has been lagging the rest of its Big Tech brethren for most of 2023, but that all changed Thursday night when Amazon reported a blowout quarter. Not only did AMZN surprise to the upside on pretty much every metric, it also gave spectacular forward guidance for the remainder of the year. As a result, AMZN popped +5.60%, a remarkable feat when you consider the S&P 500 pulled back more than -2%, easily earning AMZN the spot of the Biggest Winner.

Block (SQ)

Block (SQ) actually reported a decent quarter Thursday night beating on revenue and earnings, however slowing growth combined with poor forward guidance were not the stories investors wanted to hear from this once-darling growth tech stock.

As a result, SQ collapsed -18.96% making it the Week’s Biggest Loser. Yowtch!

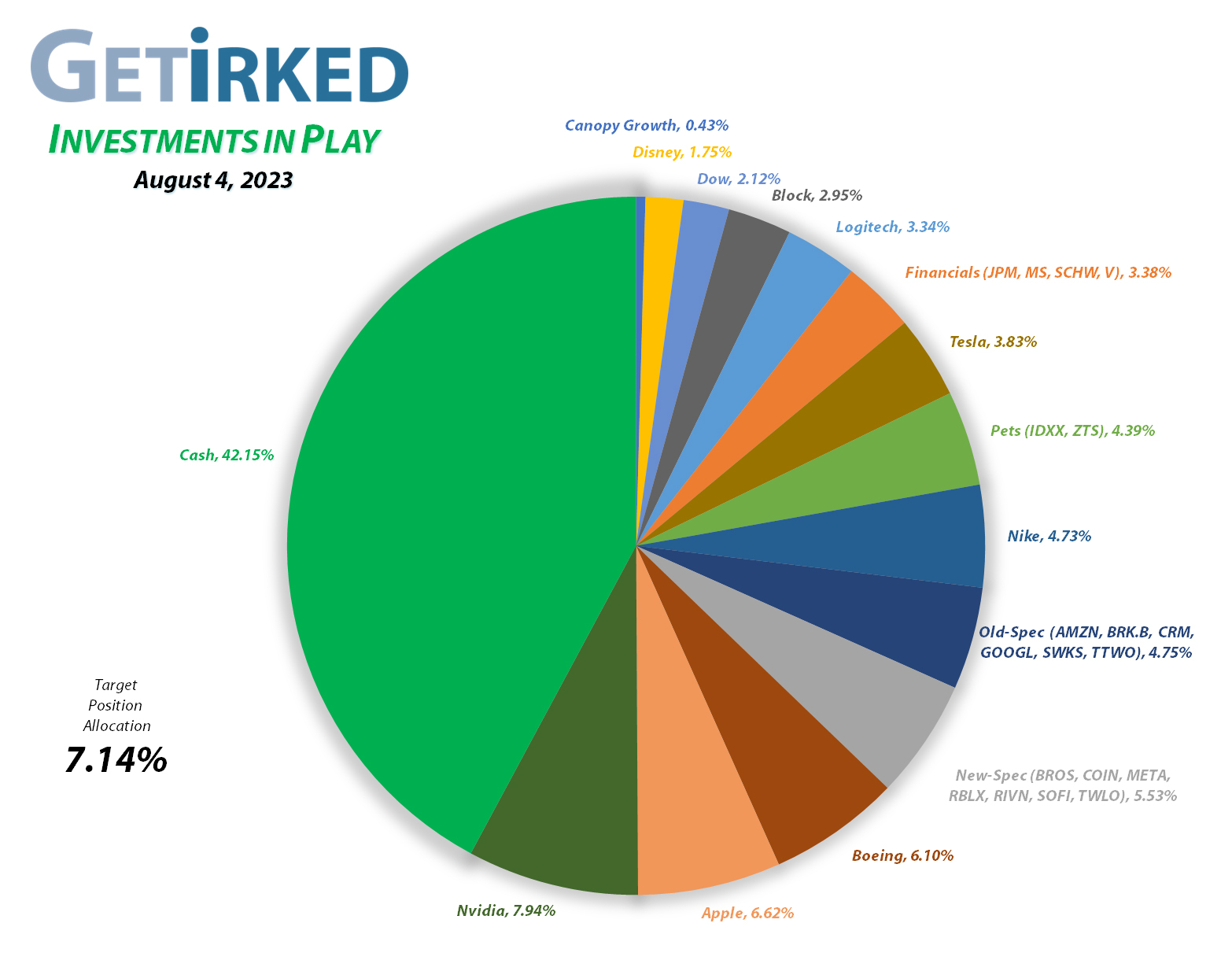

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1461.99%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$204.95)*

Apple (AAPL)

+947.95%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$77.58)*

Boeing (BA)

+720.34%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+652.46%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Logitech (LOGI)

+566.40%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($2.57)*

Block (SQ)

+512.08%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Skyworks (SWKS)

+492.79%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.72)*

IDEXX Labs (IDXX)

+443.87%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+427.77%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

Dow (DOW)

+319.28%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.33)*

JP Morgan (JPM)

+213.76%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $49.73

Amazon (AMZN)

+184.83%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

SoFi (SOFI)

+150.01%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Disney (DIS)

+149.35%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.87)*

Salesforce (CRM)

+143.30%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Take Two (TTWO)

+112.37%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+97.96%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+86.40%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Morgan Stan (MS)

+38.04%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.34

Visa (V)

+37.41%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.93

Alphabet (GOOGL)

+35.49%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $94.55

Zoetis (ZTS)

+25.39%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.46

Schwab (SCHW)

+1.52%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.95

Rivian (RIVN)

-15.23%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Roblox (RLBX)

-16.43%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $44.85

Dutch Bros (BROS)

-16.89%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $34.70

Twilio (TWLO)

-32.21%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Coinbase (COIN)

-58.02%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-88.67%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Amazon (AMZN): Profit-Taking

Amazon (AMZN) surprised to the upside and gave excellent forward guidance when it reported earnings Thursday night causing the stock to pop and hit my next sell target on Friday morning.

My order sold 24.32% of the position and filled at $141.00, locking in +64.01% in gains on shares bought for $85.97 on November 9, 2022 and lowering the per-share cost -26.87% from $67.00 to $49.00.

From here, my next sell target is $167.26, right around Amazon’s next point of resistance and my next buy target is $88.61, a bit above AMZN’s low in March.

AMZN closed the week at $139.57, down -1.01% from where I took profits Friday.

JP Morgan Chase (JPM): Dividend Reinvestment

JP Morgan Chase (JPM) paid out its quarterly dividend, which after reinvestment Monday evening, lowered my per-share cost -0.74% from $50.10 to $49.73.

Despite being an excellent long-term investment for the portfolio, JPM remains overweight in the Financial Basket, so my next buying price target isn’t until it tests its 2022 lows down at $101.92.

Additionally, as it is overweight, I will take more profits if JP Morgan makes a run at its next higher level of resistance with a sell target at $167.04.

SoFi Technologies (SOFI): Profit-Taking

SoFi Technologies (SOFI) rocketed higher after blowing away analyst expectations by posting a gain thanks to surprising revenue generation when the street was expecting a loss. The stock popped nearly 20% on Monday and triggered my next sell target which filled at $11.29.

The sale took profits on 4.00% of the position, locking in +135.21% in gains selling some of the shares I bought when I initially opened the position for $4.80 way back on November 22, 2022 and lowered my per-share cost -7.32% from $4.10 to $3.80.

From here, my next sell target is $13.00, right around SoFi’s next key point of resistance, and my next buy target is $4.65, quite a bit above the low SoFi saw in May.

SOFI closed the week at $9.50, down -15.85% from where I took profits Monday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.