June 9, 2023

The Week’s Biggest Winner & Loser

SoFi Technologies (SOFI)

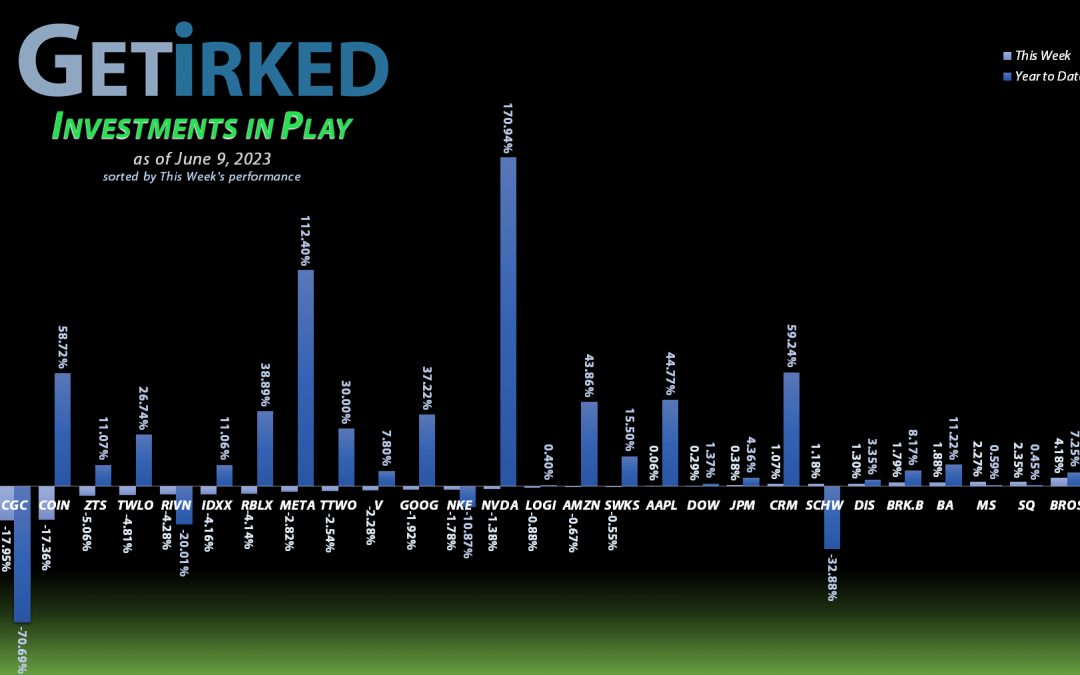

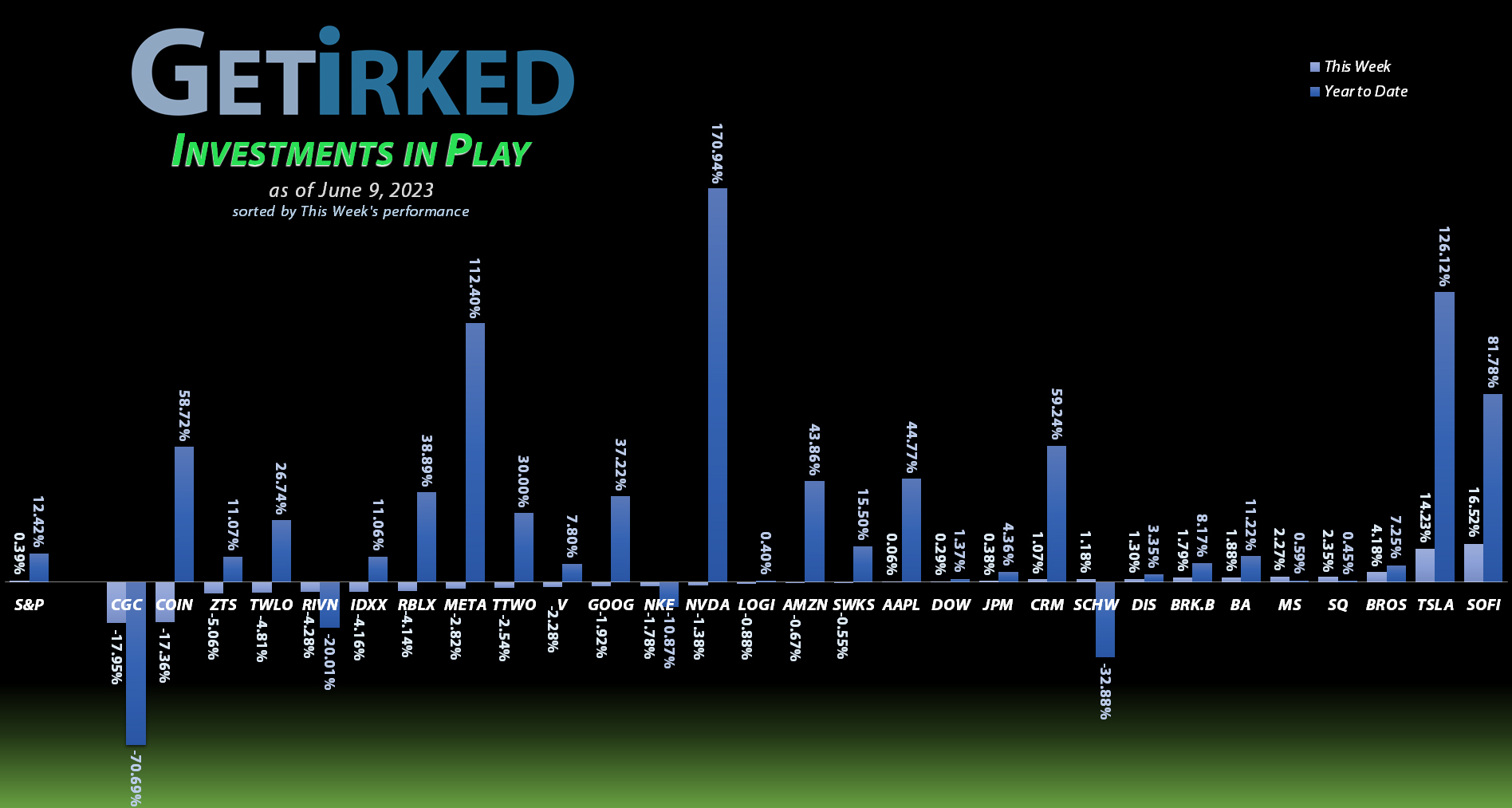

O.K. I’ve been doing Get Irked for nearly 5 years now so I’ve seen some really weird coincidences, but this week both Investments in Play and Speculation in Play have the exact same Winners & Losers they had last week.

I know. I can’t explain it either.

So, it’s Deja Vu all over again as the rally that SoFi Technologies (SOFI) saw last week continued throughout this week, adding another +16.52% to this outstanding fintech – an amazing achievement during a week when the S&P gained just +0.39% – and easily locking in SOFI as the Biggest Winner for the second week in a row.

Canopy Growth Corp (CGC)

It’s a damn good thing that stocks stop going down at zero because that’s exactly where Canopy Growth Corporation (CGC) and the rest of the cannabis sector seem to be headed in a big hurry.

Canopy continued to break down even more this week, digging the pits of all-time lows, dropping yet another -17.95% on what was an otherwise mild week in the markets.

As I’ve said repeatedly, I am not adding anything more to my position in CGC, and with it landing in the spot of the Week’s Biggest Loser over and over again, I am preparing myself to say goodbye to every dollar I put in this downtrodden mess of a company.

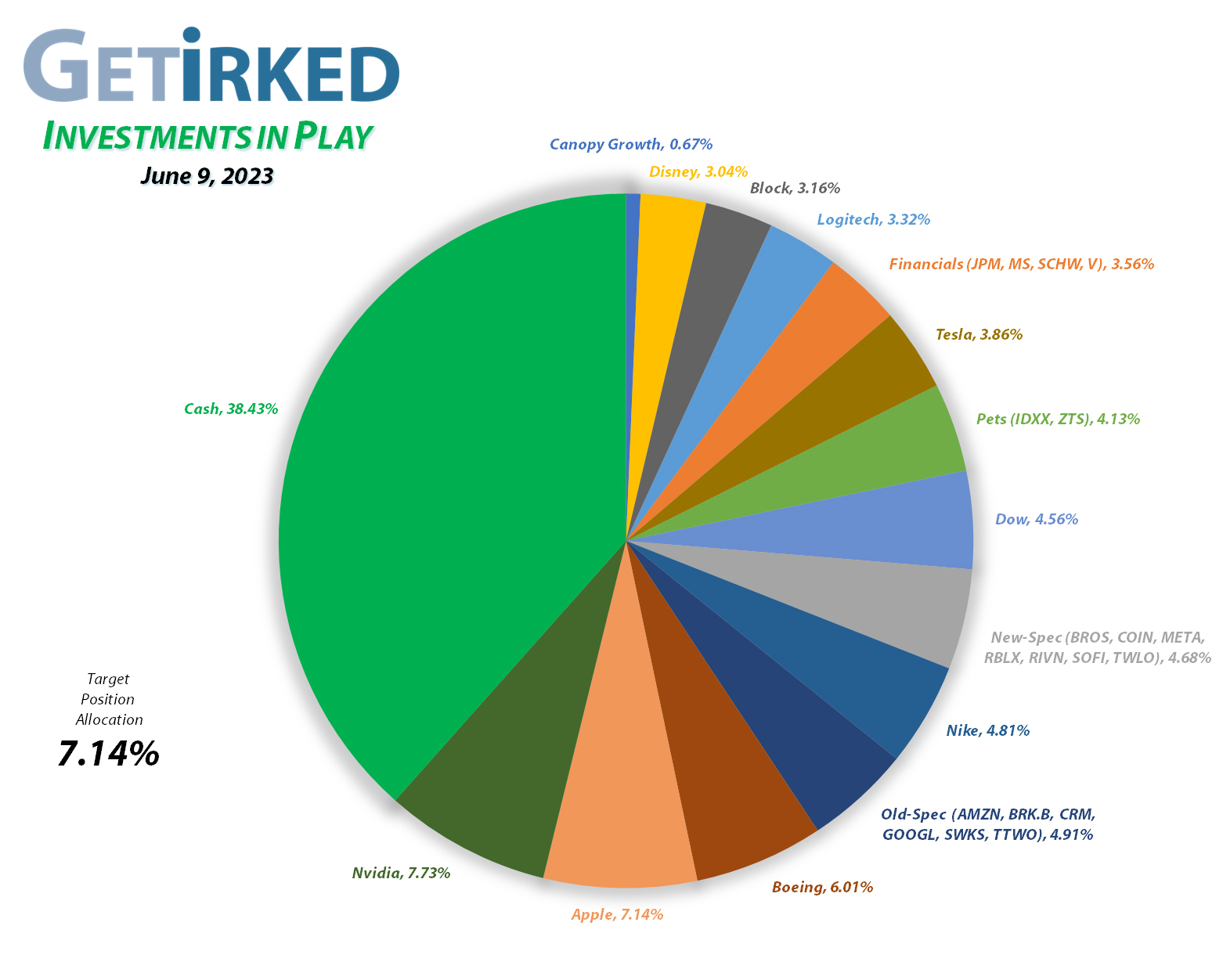

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1321.44%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$162.57)*

Apple (AAPL)

+942.84%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$68.60)*

Boeing (BA)

+695.72%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+632.03%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Logitech (LOGI)

+523.54%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($0.81)*

Block (SQ)

+517.28%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Skyworks (SWKS)

+474.39%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.93)*

Nike (NKE)

+415.96%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.52)*

IDEXX Labs (IDXX)

+411.13%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Disney (DIS)

+201.91%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

Salesforce (CRM)

+144.08%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

JP Morgan (JPM)

+113.90%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $65.92

Take Two (TTWO)

+100.22%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

SoFi (SOFI)

+94.77%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.20

Meta (META)

+90.89%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Amazon (AMZN)

+84.28%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $67.00

Berkshire (BRK.B)

+78.54%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Dow (DOW)

+74.47%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $29.66

Morgan Stan (MS)

+34.03%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.34

Alphabet (GOOGL)

+29.28%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $94.55

Visa (V)

+28.54%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.93

Zoetis (ZTS)

+14.48%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.46

Roblox (RLBX)

-13.85%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $44.90

Schwab (SCHW)

-14.00%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.95

Dutch Bros (BROS)

-16.05%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $34.70

Twilio (TWLO)

-29.31%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-53.45%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Coinbase (COIN)

-74.36%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-83.07%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

SoFi Technologies (SOFI): Profit-Taking

The run in SoFi Technologies (SOFI) didn’t stop this week, with the student loan consolidator, bank, and brokerage triggering my next sell order which filled at $8.18 on Thursday, locking in +91.12% in gains on some of the shares I bought for $4.28 back on December 28, 2022 and lowering my per-share cost -3.45% from $4.35 to $4.20.

As a result of now lowering my cost basis below SOFI’s all-time low, I have decided I will add back into the position at $4.46, slightly above SOFI’s selloff low in May (which, of course, will raise my cost basis). My next sell target is $10.32, slightly below a past point of resistance where I expect SOFI to pull back.

SOFI closed the week at $8.18, unchanged from where I took profits Thursday.

Visa (V): Dividend Reinvestment

Visa (V) paid out its quarterly dividend last Friday which, after reinvesting for compounding, lowered my per-share cost -0.20% from $174.27 to $173.93. From here, my next buy target is now $175.08, above a past level of support, and I have no sell targets at this time as Visa remains a very small part of the portfolio and I’m looking at building it up, not selling it off.

Zoetis (ZTS): Dividend Reinvestment

Zoetis (ZTS) paid out its quarterly dividend last Friday evening which, after reinvestment, lowered my per-share cost -0.27% from $142.85 to $142.86. From here, my next buy target is now $141.77, above a past level of support, and my next sell target is $201.05, under a past level of resistance.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.