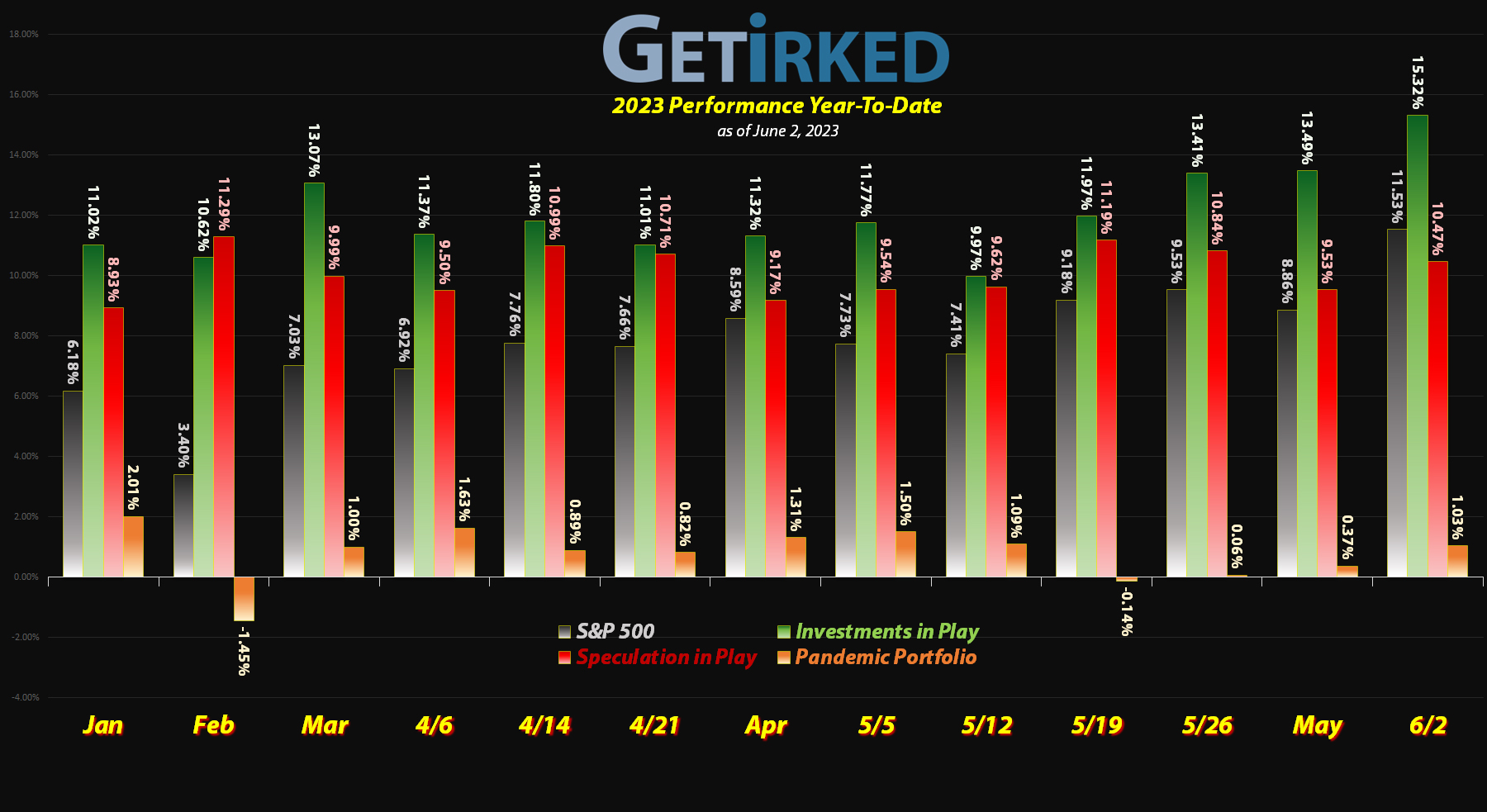

June 2, 2023

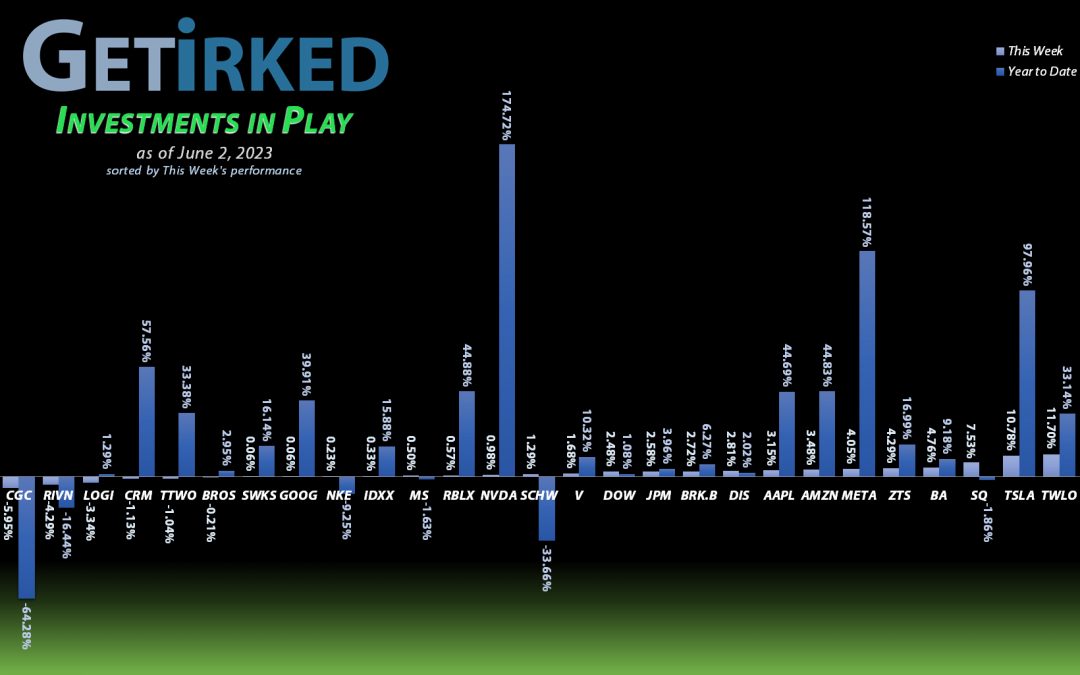

The Week’s Biggest Winner & Loser

SoFi Technologies (SOFI)

Given that SoFi Technologies’ (SOFI) main claim to fame was student loan consolidation, it’s no surprise that the stock skyrocketed +29.76% when the debt ceiling agreement included provisions to end the moratorium on student loan payments.

SOFI easily swung in to be the Biggest Winner of the Week, despite the fact that it was a big week for pretty much everything in the stock market… except cannabis, of course.

Canopy Growth Corp (CGC)

Even in a week that lifted nearly every stock in the market, Canopy Growth Corp (CGC) and the rest of the cannabis sector found no love.

Why not?

Because there’s no reason to love this space. Unlike SoFi and other student loan companies which saw some assistance come from the debt ceiling bill, there is still nothing on the table for pot stocks.

As a result, CGC sold off -5.95% this week and landed in the spot of the Week’s Biggest Loser for the second time in a row.

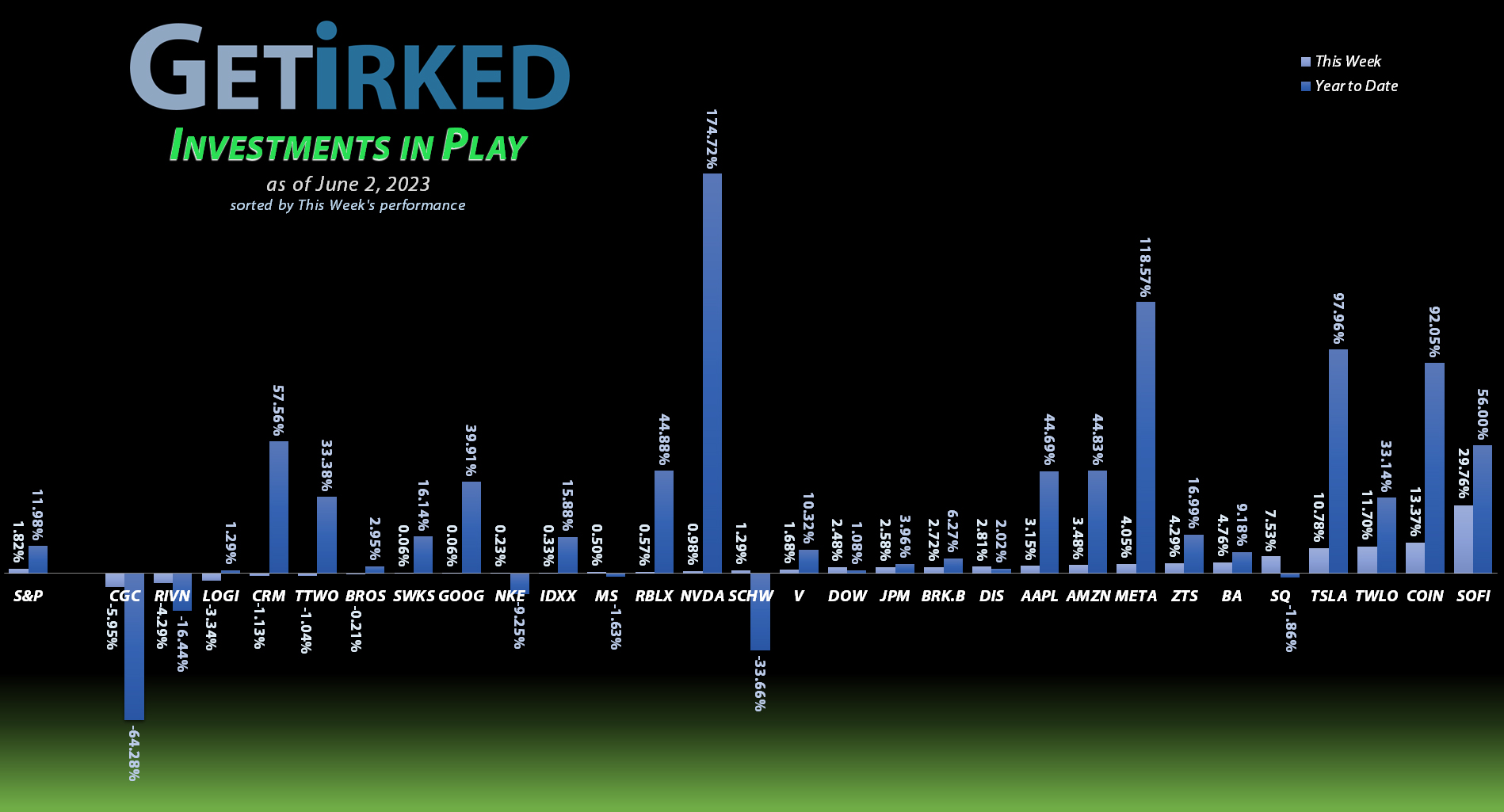

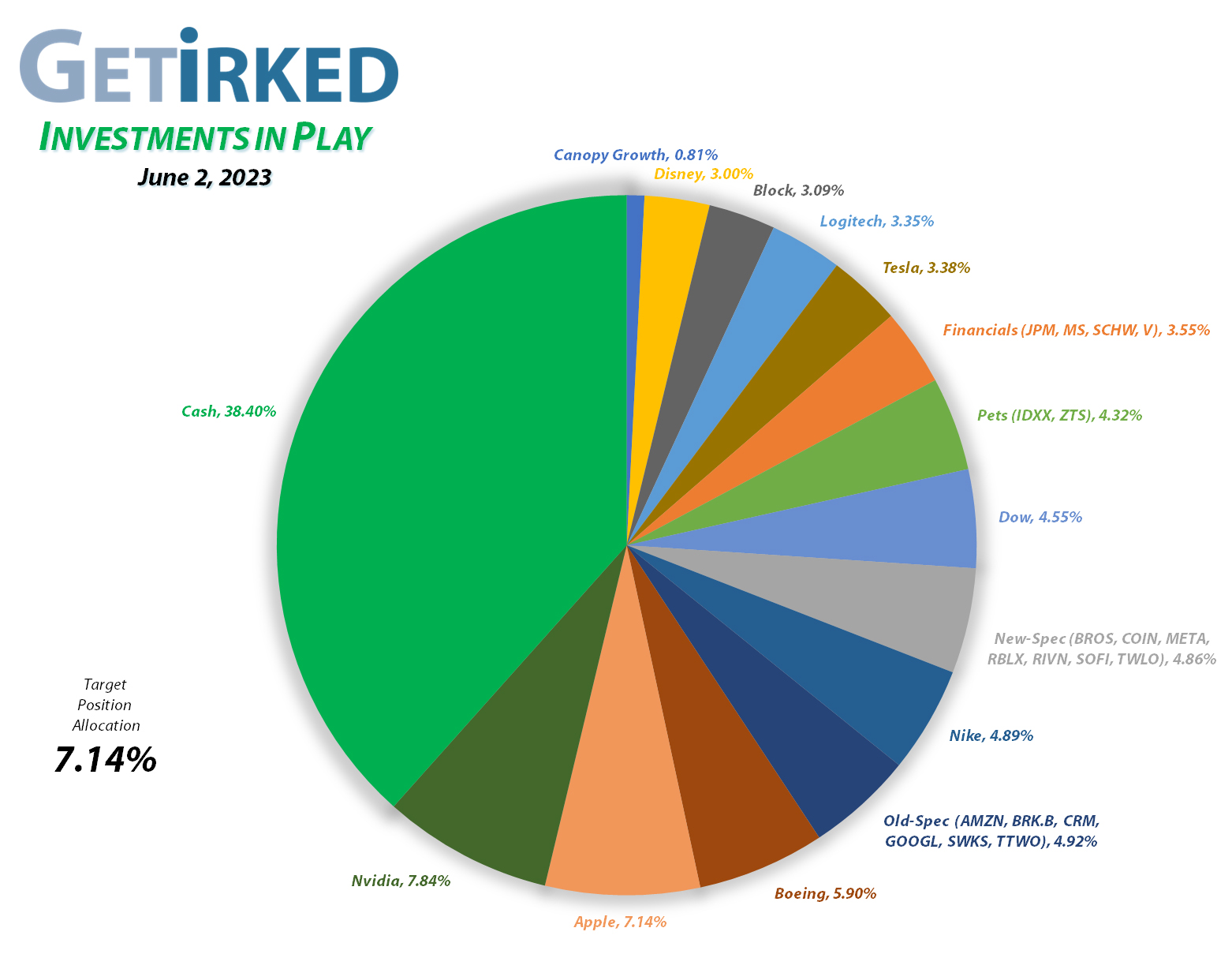

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1334.82%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$162.57)*

Apple (AAPL)

+942.80%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$68.60)*

Boeing (BA)

+688.71%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+566.32%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Logitech (LOGI)

+528.13%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($0.81)*

Block (SQ)

+511.86%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Skyworks (SWKS)

+476.36%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.93)*

IDEXX Labs (IDXX)

+423.11%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+422.82%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.52)*

Disney (DIS)

+198.10%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

Salesforce (CRM)

+141.53%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

JP Morgan (JPM)

+113.08%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $65.92

Take Two (TTWO)

+105.43%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+92.07%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Amazon (AMZN)

+85.46%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $67.00

Berkshire (BRK.B)

+75.47%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Dow (DOW)

+74.03%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $29.66

SoFi (SOFI)

+61.61%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.35

Alphabet (GOOGL)

+31.86%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $94.55

Visa (V)

+31.29%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.27

Morgan Stan (MS)

+31.11%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.34

Zoetis (ZTS)

+20.27%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.85

Roblox (RLBX)

-10.16%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $44.90

Schwab (SCHW)

-14.98%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.95

Dutch Bros (BROS)

-19.42%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $34.70

Twilio (TWLO)

-25.74%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-51.40%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Coinbase (COIN)

-68.97%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-79.37%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Apple (AAPL): Profit-Taking

Apple (AAPL) popped on Tuesday along with the rest of the tech stocks, triggering my next sell order which filled at $178.04. Although Nvidia (NVDA) seems to have taken the hearts and minds of investors lately, Apple has been on quite the rally, too, and just like Nvidia, it has outgrown the target allocation size for this portfolio by enough of a margin that it was time to take profits to reduce the position size.

The sale locked in +31.16% in gains on shares I bought for $135.74 quite a while back on February 10, 2021 and lowered my per-share “cost” -$7.96 from -$60.64 to -$68.60 (a negative per-share cost indicates all capital has been removed in addition to $68.60 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $199.36, just under the key $200.00 point of psychological resistance, and my next buy target is $129.60, above a key level of support AAPL saw in 2022.

AAPL closed the week at $180.95, up +1.63% from where I took profits Tuesday.

Nvidia (NVDA): Profit-Taking

Nvidia’s (NVDA) inexhaustible rally continued on Tuesday when the company crossed over a market cap of a trillion dollars. I decided to take even more profits, a near weekly occurrence now, with a sell order which filled at $413.53. Even after the sale, Nvidia was 8.25% of the portfolio where the maximum target is set to 7.14%.

The sale locked in +2,538.36% in gains on shares I bought for $15.67 when I originally opened the position on September 6, 2016. The sale lowered my per-share “cost” -$35.67 from -$126.90 to -$162.57 (a negative per-share cost indicates all capital has been removed in addition to $162.57 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell order is $449.97, a price calculated using Fibonacci Method where NVDA will remain excessively large. My next buy target is $264.12, above a key level of support, and more than -35% lower than where I took profits… yeesh.

NVDA closed the week at $393.27, down -4.90% from where I took profits Tuesday.

Salesforce (CRM): Profit-Taking

Salesforce (CRM) rallied into its earnings report on Wednesday, so I decided the prudent thing to do would be to take profits. Salesforce has a tendency to move dramatically either direction after earnings, and since I had been earlier than I would have liked in adding to my Salesforce position in 2022, I wanted to be a little risk-adverse.

My sale went through at $220.95, locking in +22.25% in gains on shares I bought for $180.73 back on April 21, 2022 and lowering my per-share cost -23.14% from $114.75 down to $88.20.

From here, my next buy target is $127.20, just above Salesforce’s 2022 lows, and my next sell target is $275.10, just under a past point of resistance.

CRM closed the week at $213.03, down -3.58% from where I took profits Wednesday.

Schwab (SCHW): Dividend Reinvestment

Schwab (SCHW) paid out its quarterly dividend on Tuesday which, after reinvesting, lowered my per-share cost -0.47% from $64.25 to $63.95. Despite being a brokerage which typically have subpar dividends, Schwab’s yield is more than 1.8% annually currently, which isn’t half bad.

From here, my next buy target is $46.56, around a recent level of support, and my next sell target is $75.93, below a past point of resistance.

SoFi Technologies (SOFI): Profit-Taking

While also a bank and investment broker, SoFi Technologies (SOFI) got its start by helping consolidate student loans. When the debt ceiling agreement increased the restarting of student loan payments, SOFI saw a significant rally throughout the week.

On Thursday, SOFI triggered my next sell order which went through at $7.05, locking in a gain of +64.72% selling some of the shares I bought for $4.28 on December 28, 2022 and lowering my per-share cost -1.14% from $4.40 to $4.35.

From here, my next buy target is $4.07, a bit below SOFI’s all-time low, and my next sell target is $8.18, slightly below its 2023 high.

SOFI closed the week at $7.03, down -0.28% from where I took profits Thursday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.