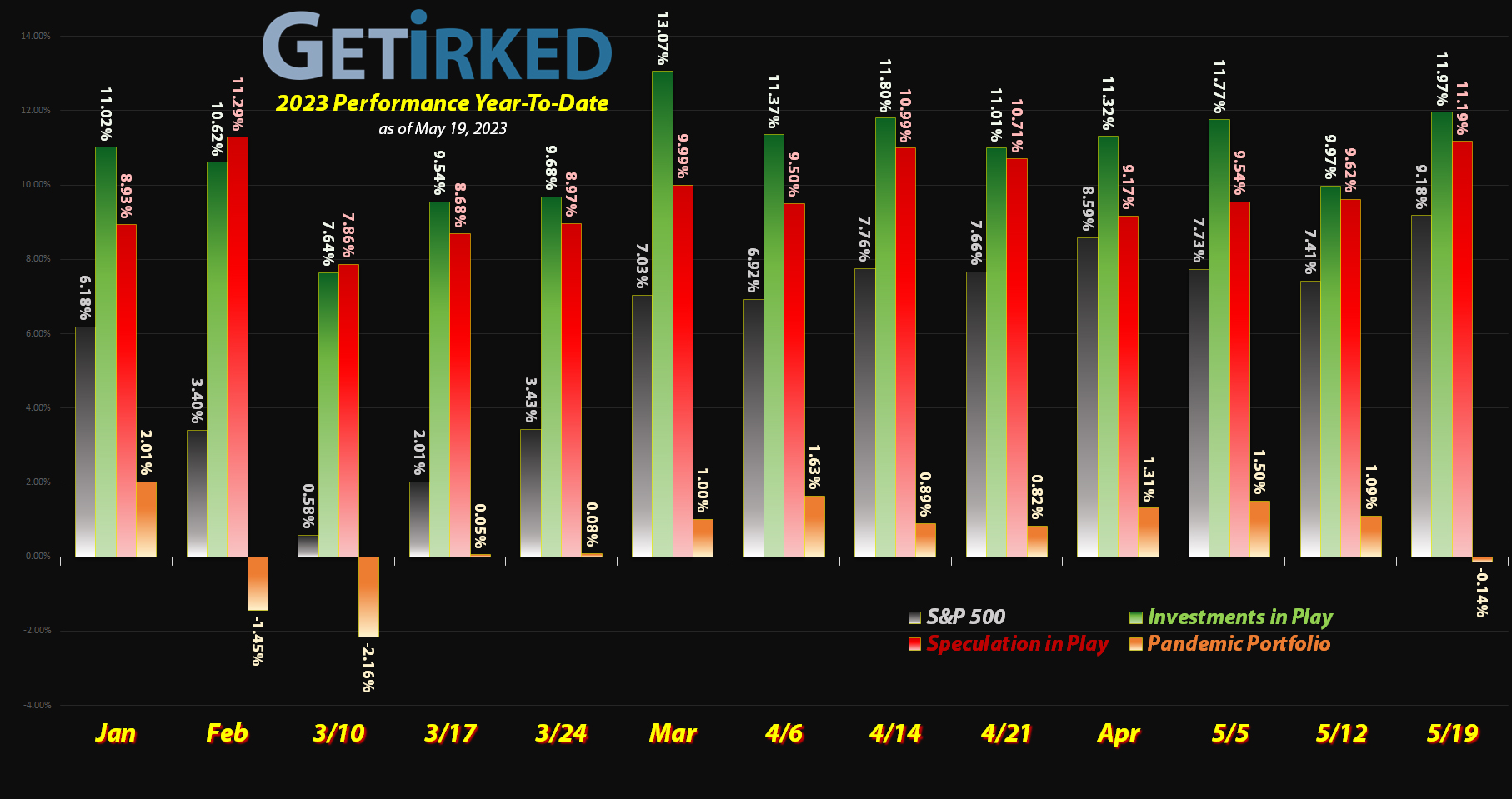

May 19, 2023

The Week’s Biggest Winner & Loser

Twilio (TWLO)

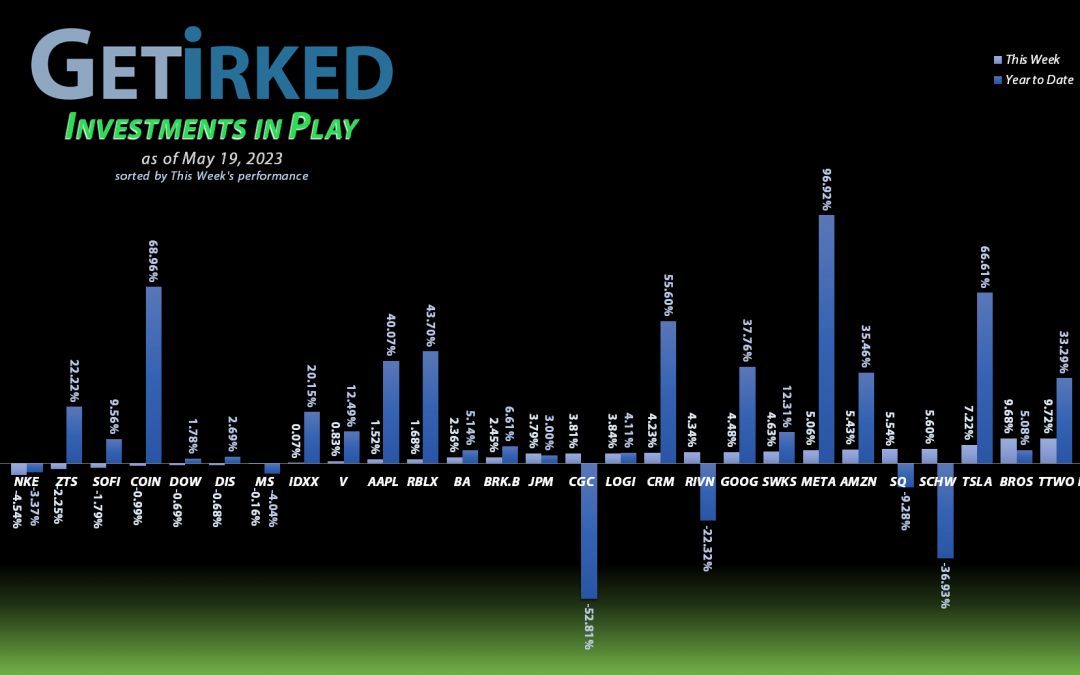

Remember how last week cloud computing was supposed to be dead? Rumors of its demise were overstated as Twilio (TWLO) and the rest of the cloud cohort rocketed, well, into the clouds (Sorry) this week seeing as how all of this Artificial Intelligence (AI) processing will need to be done SOMEWHERE. Twilio popped +11.76% and earned itself the spot of the Biggest Winner.

Nike (NKE)

What with Home Depot (HD), Target (TGT), and Walmart (WMT) all agreeing that consumers are pulling back on discretionary spending combined with rumors that China may becoming more aggressive about invading Taiwan, this week proved to be a double gut-punch for Nike (NKE) who’s shoes are pretty much the definition of “discretionary” and who also relies on China for both production of its shoes as well as the populace for being some of Nike’s biggest customers. As a result, Nike got slapped for -4.54% and fell into the spot of the Week’s Biggest Loser.

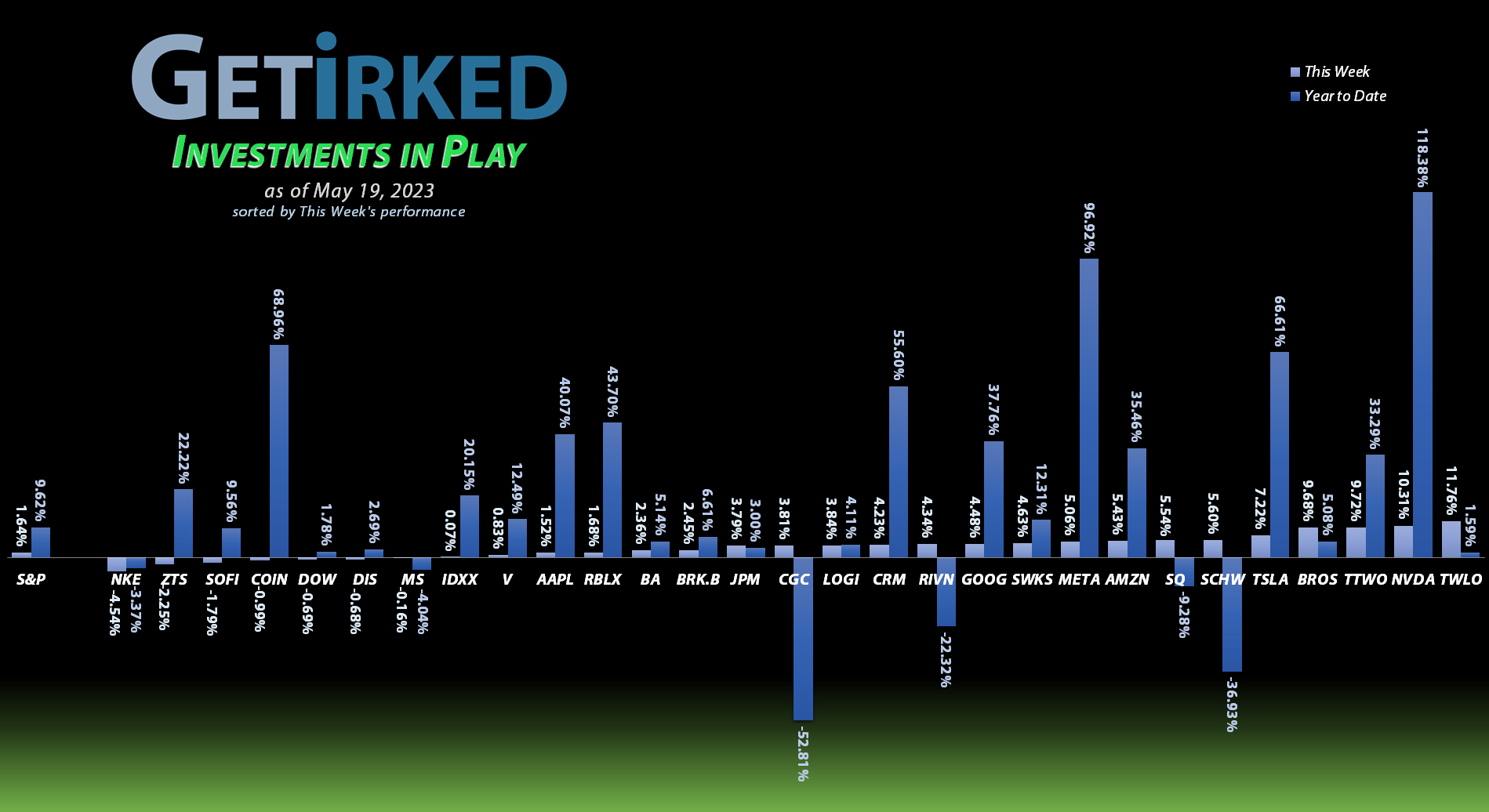

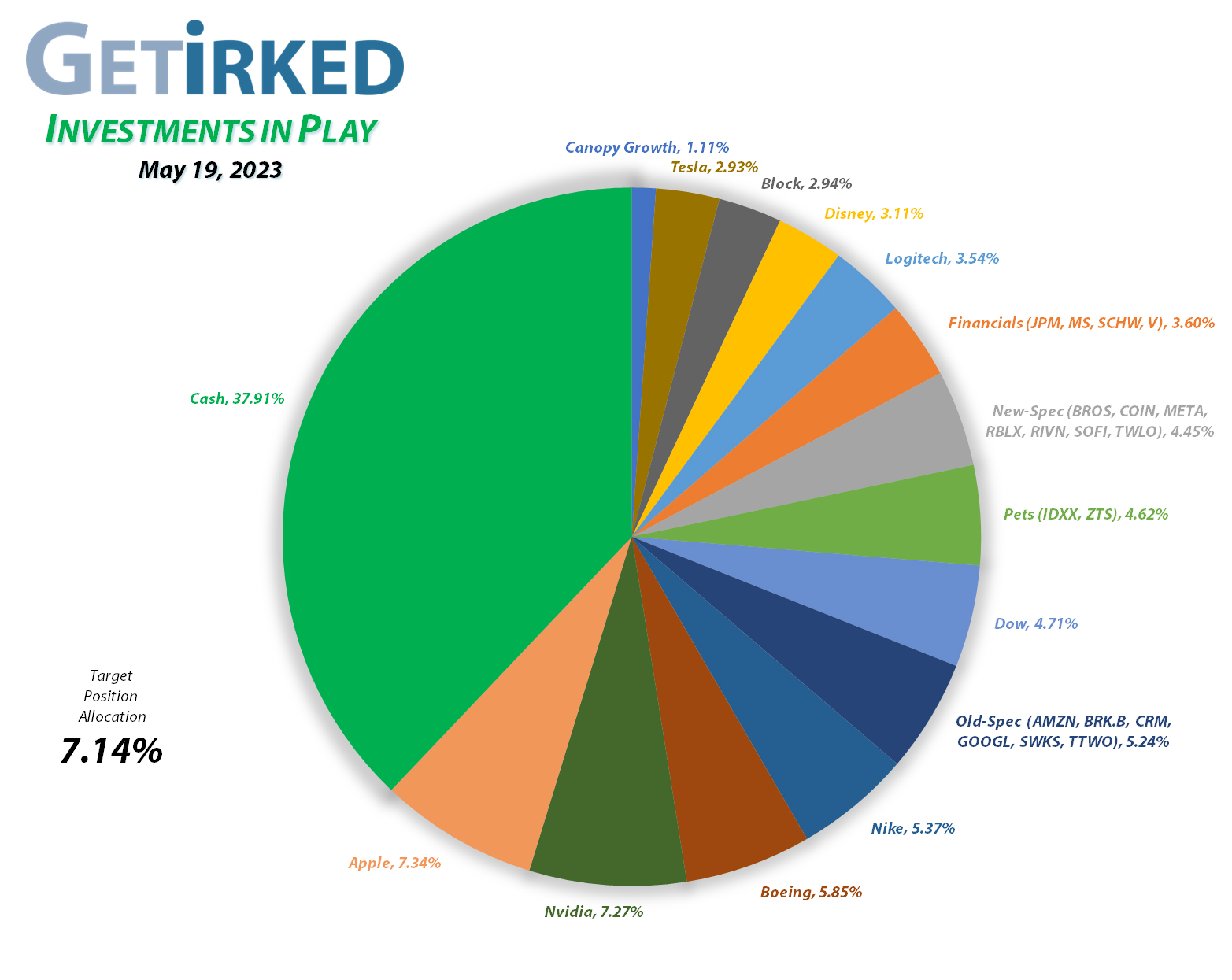

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1115.27%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$97.65)*

Apple (AAPL)

+919.75%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.72)*

Boeing (BA)

+674.89%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Logitech (LOGI)

+542.64%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($0.81)*

Block (SQ)

+494.08%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Tesla (TSLA)

+493.20%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Skyworks (SWKS)

+464.56%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.93)*

Nike (NKE)

+447.74%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.52)*

IDEXX Labs (IDXX)

+433.71%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Disney (DIS)

+200.03%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+111.12%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $65.92

Take Two (TTWO)

+105.29%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+87.90%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Salesforce (CRM)

+83.31%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Berkshire (BRK.B)

+75.96%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Dow (DOW)

+75.16%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $29.66

Amazon (AMZN)

+73.51%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $67.00

Visa (V)

+33.87%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.27

Alphabet (GOOGL)

+29.85%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $94.55

Morgan Stan (MS)

+27.86%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.34

Zoetis (ZTS)

+25.64%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.85

SoFi (SOFI)

+12.05%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.40

Roblox (RLBX)

-10.88%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $44.90

Dutch Bros (BROS)

-17.75%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $34.70

Schwab (SCHW)

-19.56%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $64.25

Twilio (TWLO)

-43.34%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-54.79%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Coinbase (COIN)

-72.71%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-72.75%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Morgan Stanley (MS): Dividend Reinvestment

Investment bank Morgan Stanley (MS) paid out its ample dividend (currently more than 3.75% annually) on Tuesday which I reinvested into my position. The dividend lowered my per-share cost -0.92% from $64.94 to $64.34.

From here, my next buy target is $76.78, above a past point of support, and my next sell target is $98.99, just below a past level of resistance.

Nvidia (NVDA): Profit-Taking

On Thursday, Nvidia (NVDA) continued its never-ending climb through my next sell target which filled at $318.03, locking in +1,929.55% in gains on shares I purchased for $15.67 when I originally opened the position on September 6, 2016.

The sale lowered the per-share “cost” -$22.90 from -$74.75 to -$97.65 (a negative per-share cost indicates all capital has been removed in addition to $97.65 per share added to the portfolio’s bottom line in addition to each share’s current value).

It’s worth noting that even after the sale, Nvidia remains the largest position in the portfolio and still exceeds the target allocation size. The fervor over artificial intelligence is seemingly never-ending, but surely must be reaching a peak, so I plan to take more profits if NVDA tests its all-time at $346.47.

My next buy target is $208.21 which might seem ludicrous as that represents a nearly -35% drop from its current levels, however Nvidia has repeatedly sold off by 30-50% over the seven years I have owned it so I have no reason to anticipate this cycle will change, despite the recent popularity of AI.

NVDA closed the week at $312.61, down -1.70% from where I took profits Thursday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.