May 12, 2023

The Week’s Biggest Winner & Loser

Roblox (RBLX)

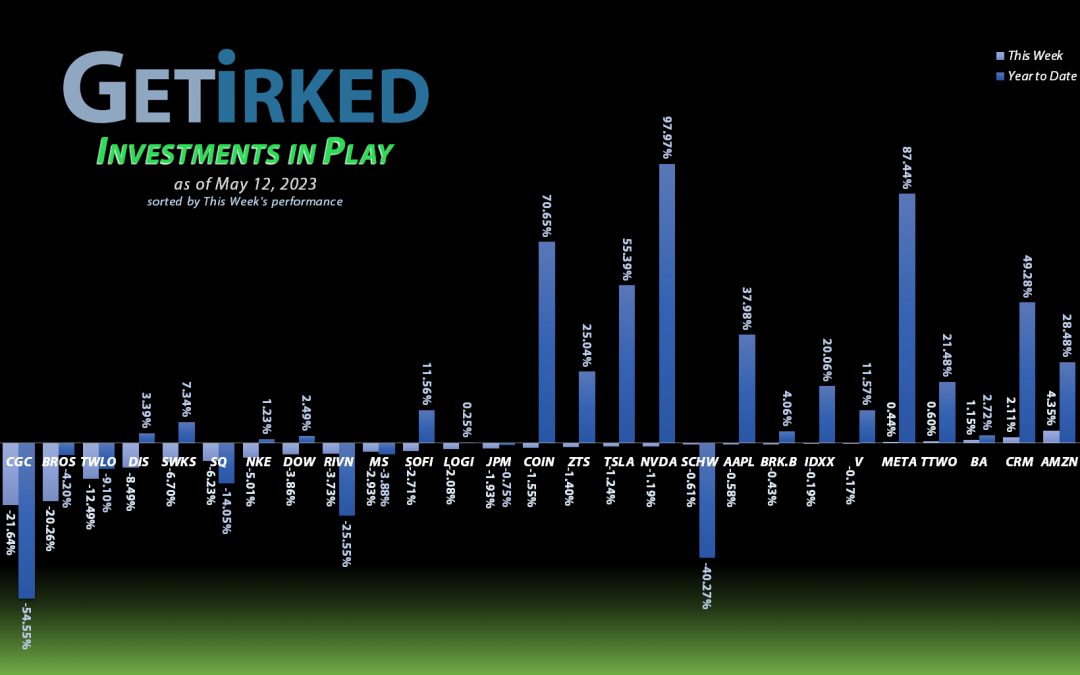

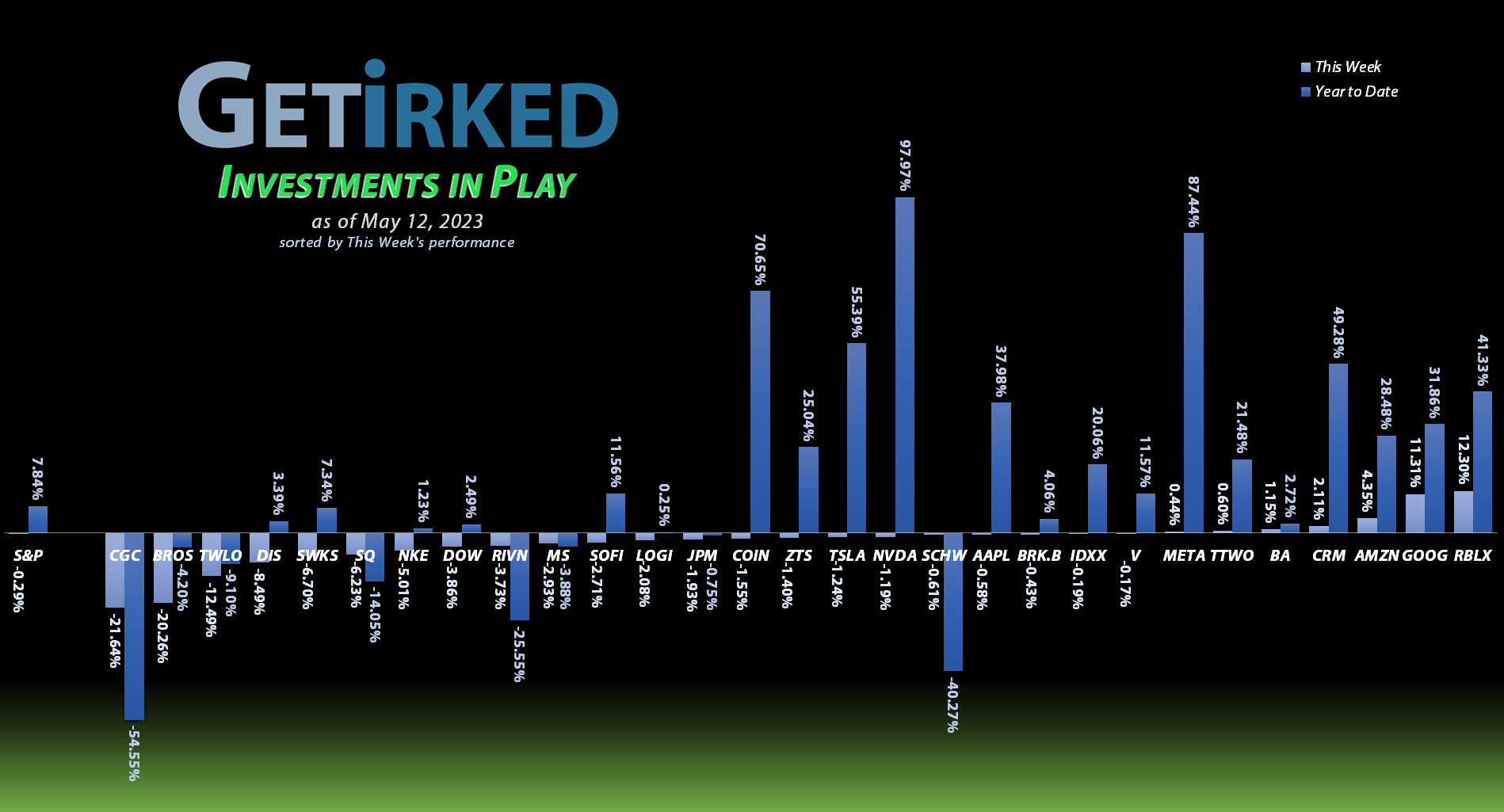

Roblox (RBLX) surprised the markets with a better-than-feared earnings report, particularly after disappointing with April’s monthly user numbers a few weeks ago. As a result, RBLX popped +12.30% on the week, locking in the Week’s Biggest Winner spot.

Canopy Growth Corp (CGC)

The cannabis sector has been notoriously bad lately, but Canopy Growth Corporation (CGC) made a bad situation worse when news broke that the company had been… generous… in calculating its forward revenue guidance. Once reality set in, CGC dropped another -21.64%, landing in the well-deserved spot of the Week’s Biggest Loser.

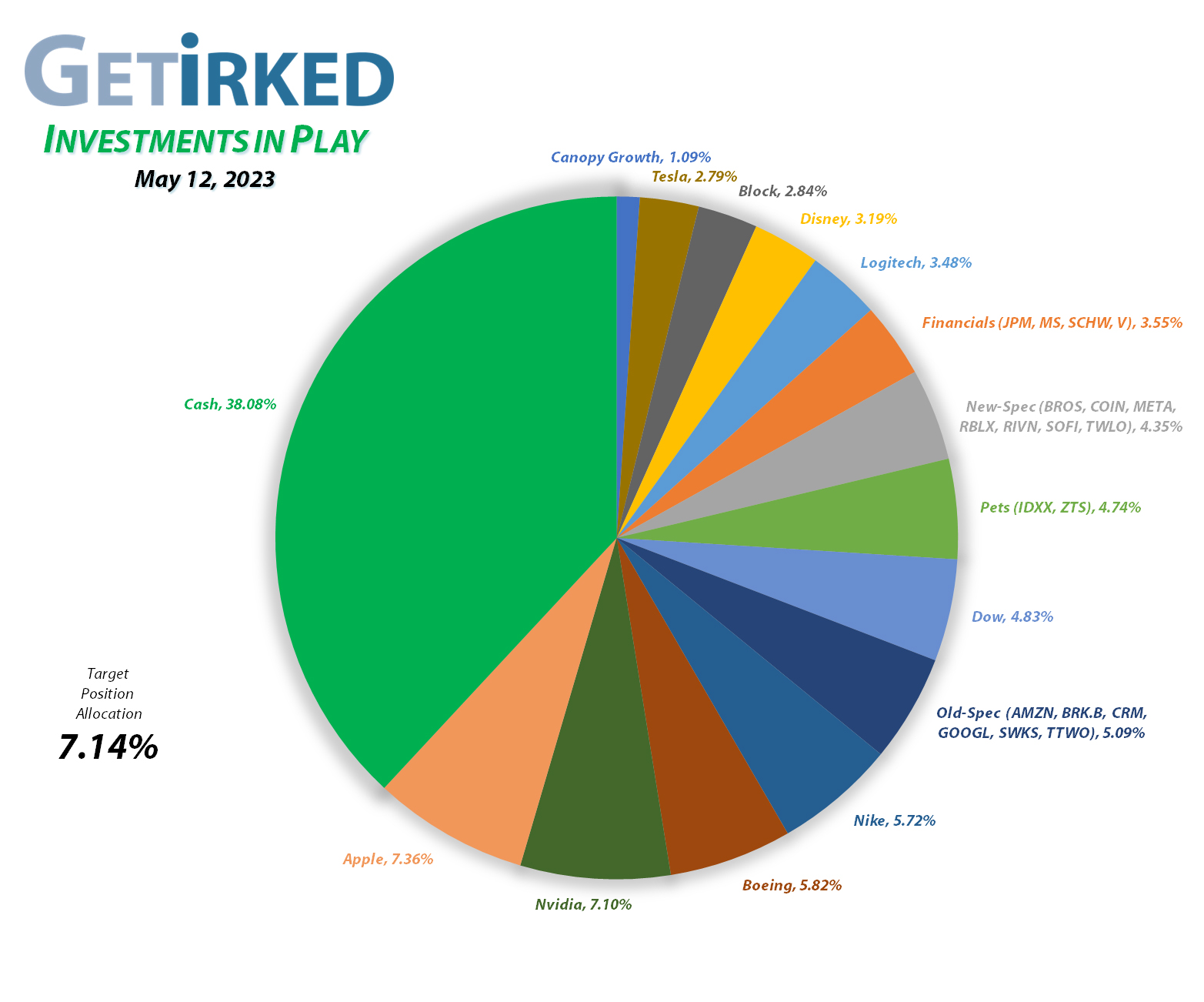

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1030.37%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$74.75)*

Apple (AAPL)

+909.53%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.72)*

Boeing (BA)

+666.57%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Logitech (LOGI)

+522.81%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($0.81)*

Block (SQ)

+482.72%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Nike (NKE)

+467.25%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.52)*

Tesla (TSLA)

+467.01%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Skyworks (SWKS)

+449.25%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.93)*

IDEXX Labs (IDXX)

+433.50%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Disney (DIS)

+202.10%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+103.41%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $65.92

Take Two (TTWO)

+87.10%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+86.07%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Dow (DOW)

+76.39%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $29.66

Salesforce (CRM)

+75.87%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Berkshire (BRK.B)

+71.75%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Amazon (AMZN)

+64.57%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $67.00

Visa (V)

+32.77%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.27

Zoetis (ZTS)

+28.54%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.85

Morgan Stan (MS)

+26.86%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.94

Alphabet (GOOGL)

+24.28%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $94.55

SoFi (SOFI)

+14.09%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.40

Roblox (RLBX)

-12.34%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $44.90

Dutch Bros (BROS)

-25.01%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $34.70

Schwab (SCHW)

-23.83%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $64.25

Twilio (TWLO)

-49.30%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-56.67%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Coinbase (COIN)

-72.43%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-73.75%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Canopy Growth (CGC): **Final Buy**

Canopy Growth Corporation (CGC) returned to its selloff when analyst reports showed that the company’s forecasts for future revenue were likely too positive, throwing the already-beaten down stock into a further tailspin.

Canopy Growth Corporation (CGC) triggered my next – and final – buy on Friday which filled at $1.03. To be clear, this is the last purchase I’m making in Canopy. No matter how low it goes from here, I will not add more. I have locked in the maximum amount I am willing to lose, so, from here, Canopy either recovers or goes bankrupt. Yikes.

The buy lowered my per-share cost -9.09% from $4.40 to $4.00. From here, my next sell target is $4.47, slightly under the high Canopy saw in its rally in December 2022.

CGC closed the week at $1.05, up -1.94% from where I added Friday.

Dutch Bros (BROS): Added to Position x 2

On Wednesday, Dutch Bros (BROS) sold off when its Tuesday evening quarterly report revealed revenues that missed the target. I remain confident in Dutch Bros as one of my best long-term investments as this company’s locations blow the doors off the place. While some analysts fear BROS may be growing a bit too fast, I believe its management will get the growth in-line.

My first small buy order filled Wednesday morning at $29.90 followed by a second small buy which filled on Thursday at $27.50, giving me an average buying price of $28.70. The combined buys lowered my per-share cost -2.25% from $35.50 to $34.70. From here, my next buy target is $24.72, around a past point of support. My next sell target is $40.30, quite a bit under BROS’ 2023 high of $41.44.

BROS closed the week at $26.02, down -9.33% from my $28.70 average buying price.

Nvidia (NVDA): Profit-Taking

On Monday, Nvidia (NVDA) made another run over $290.00, exceeding the allocation target for the portfolio by such a margin that I had to take profits to reduce its allocation size with a sale that went through at $290.20.

The sale locked in +1,751.95% in gains selling shares I bought for $15.67 back on September 6, 2016 and lowered my per-share “cost” -$19.06 from -$55.69 to -$74.75 (a negative per-share cost indicates all capital has been removed in addition to $74.75 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $323.17, right around past point of resistance where Nvidia will once again substantially exceed my portfolio’s allocation target, and my next buy target is $199.13, above a past point of support.

NVDA closed the week at $283.40, down -2.34% from where I took profits Monday.

Twilio (TWLO): Added to Position

Twilio (TWLO) sold off substantially following a disappointing earnings report and continued selling off later in the week triggering my next buy which filled on Friday at $45.85.

The buy locked in a -61.57% discount replacing some of the shares I sold for $119.32 back on January 21, 2020 and lowered my per-share cost -5.19% from $95.35 to $90.40. From here, my next buy target is $44.20, above a past point of support, and my next sell target is $79.60, just under its high from earlier in 2023.

TWLO closed the week at $45.83, down -$0.02 from where I added Friday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.