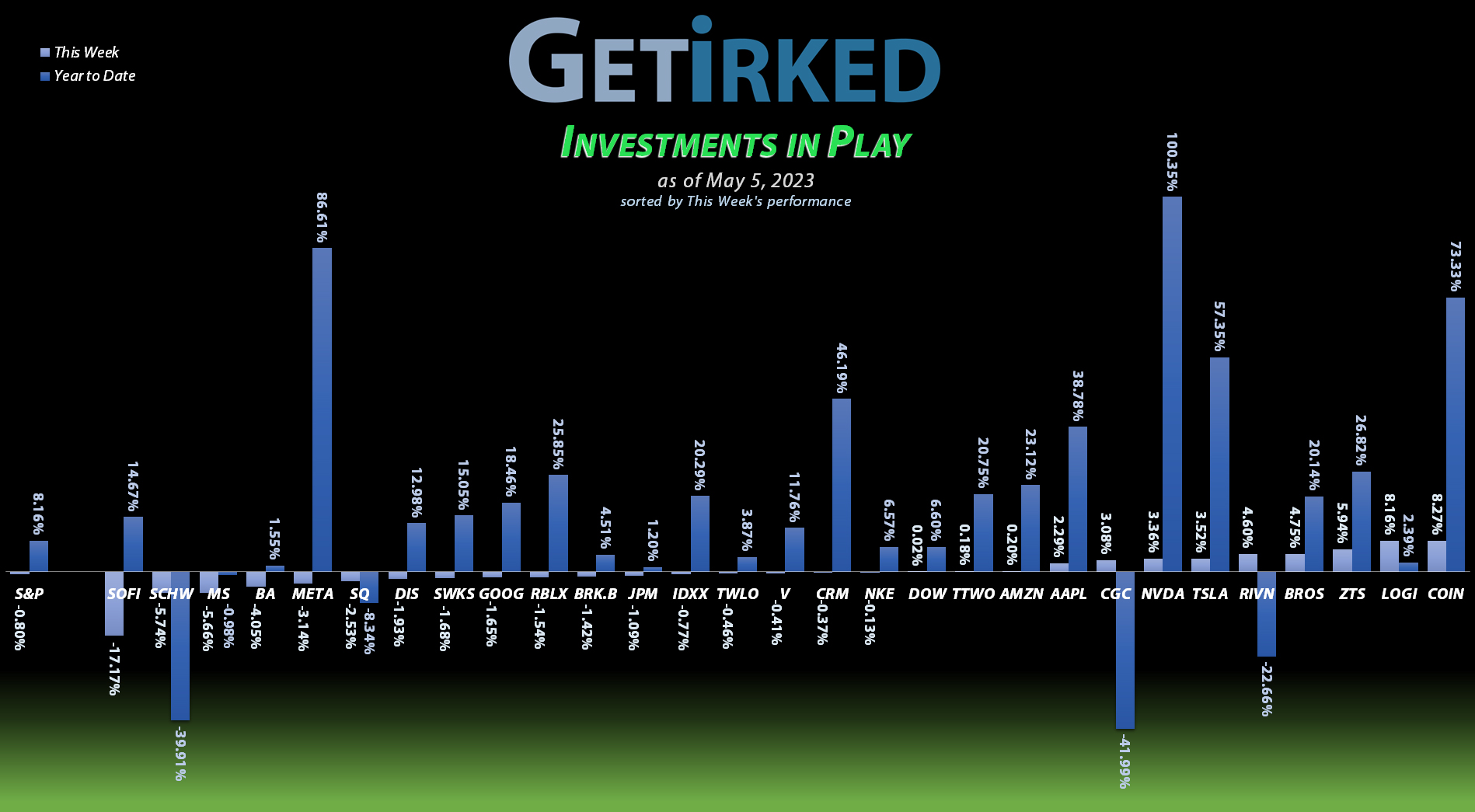

May 5, 2023

The Week’s Biggest Winner & Loser

Coinbase (COIN)

Coinbase (COIN) surprised analysts to the upside, reporting a stellar earnings report with excellent revenue generation thanks, in part, to Bitcoin’s rally to $30K. COIN popped +8.27% on the week which was enough given the volatile price action to lock in the spot of the Week’s Biggest Winner.

SoFi Technologies (SOFI)

Fintech bank, SoFi Technologies (SOFI), actually reported decent earnings, however, the company also released figures showing an increase in short-term loans from its customers. In a credit tightening environment, it’s hard to be excited about a financial that’s making loans that might not get paid back. As a result, SOFI dropped a pretty substantial -17.17% on the week, landing in the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1039.62%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$55.69)*

Apple (AAPL)

+913.43%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.72)*

Boeing (BA)

+662.44%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Logitech (LOGI)

+533.95%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($0.81)*

Block (SQ)

+496.33%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Nike (NKE)

+490.05%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.52)*

Skyworks (SWKS)

+472.99%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.93)*

Tesla (TSLA)

+471.56%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

IDEXX Labs (IDXX)

+434.12%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Disney (DIS)

+230.12%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+107.42%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $65.92

Take Two (TTWO)

+85.98%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+85.91%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Dow (DOW)

+83.46%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $29.66

Berkshire (BRK.B)

+72.49%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Salesforce (CRM)

+72.19%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Amazon (AMZN)

+57.70%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $67.00

Morgan Stan (MS)

+30.70%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.94

Visa (V)

+33.00%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.27

Zoetis (ZTS)

+30.37%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.85

SoFi (SOFI)

+17.27%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.40

Alphabet (GOOGL)

+11.66%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $94.55

Dutch Bros (BROS)

-8.08%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $35.50

Roblox (RLBX)

-21.94%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $44.90

Schwab (SCHW)

-23.36%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $64.25

Twilio (TWLO)

-45.08%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Rivian (RIVN)

-54.99%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Canopy (CGC)

-69.54%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.40

Coinbase (COIN)

-72.00%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Canopy Growth Corp (CGC): Added to Position

After the briefest of respites last week when news broke that Congress was reopening the SAFE Banking Act, the cannabis sector returned to selling off this week with Canopy Growth Corporation (CGC) triggering my next buy order which filled on Tuesday at $1.20, a buy which lowered my per-share cost -2.22% from $4.50 to $4.40.

Long-time readers and viewers of Get Irked may remember me saying that my “last buy” was at $1.09. However, when the SAFE Banking Act was revitalized last week, I decided to split up my last buy into two, one at $1.20 and another now with a $1.06 price target.

These two buys still total the same capital outlay thanks to the division and will result in my same final target cost basis. From here, my next sell target is $4.55, slightly below Canopy’s 2022 highs.

CGC closed the week at $1.34, up +11.67% from where I added Tuesday.

JP Morgan Chase (JPM): Dividend Reinvestment

JP Morgan Chase (JPM) paid out its quarterly dividend on Monday, which, after reinvestment, lowered my per-share cost -0.72% from $66.40 to $65.92. From here, my next buy target is $101.96, slightly above its 2022 lows, and my next sell target is $154.60, slightly below a past point of resistance.

Logitech (LOGI): Profit-Taking

When Logitech (LOGI) continued last week’s tech rally into earnings on Monday and started to approach overbought levels on the Daily Relative Strength Index (RSI), I decided to take a chance and pull all of the remaining capital out of the position – a position I initially started at $24.20 back on November 11, 2016 – with a substantial sell order which filled at $61.49, locking in +154.09% in lifetime gains on those shares.

The sale lowered my per-share cost -$11.45 from $10.64 to -$0.81 (a negative per-share cost indicates all capital has been removed in addition to $0.81 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, I do intend to start adding back to the position if it tests its 2022 lows with a buy target at $42.48, and I will continue taking profits at $78.92, just below a past point of resistance Logitech has contend with in the past.

LOGI closed the week at $64.33, up +4.62% from where I took profits Monday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.