April 6, 2023

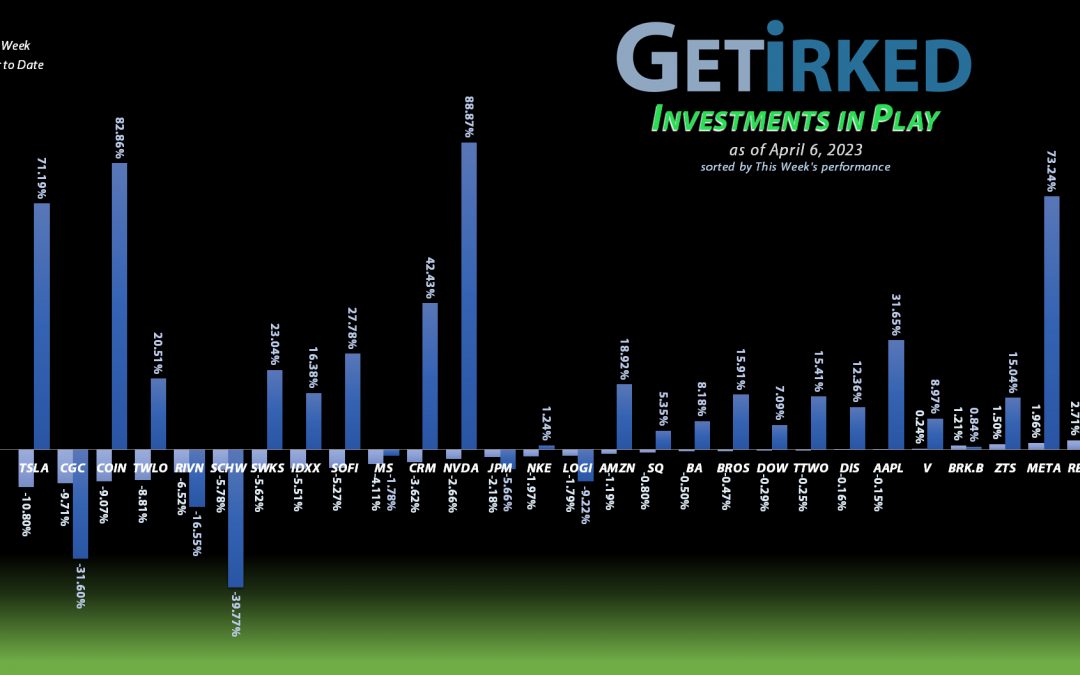

The Week’s Biggest Winner & Loser

Alphabet (GOOGL)

Alphabet (GOOGL) finally seemed to get off the mat this week, announcing that its AI supercomputer outperforms Nvidia’s (NVDA) [last-generation] Artificial Intelligence Processor. Despite the decidedly poor comparison choice on GOOGL’s part since NVDA has a much faster, newer AI processor available, the market was happy to see there might still be intelligent life left in Google with the stock popping +4.52% and earning the spot of the Week’s Biggest Winner.

Tesla (TSLA)

Tesla (TSLA) reported its vehicle production numbers and deliveries last weekend, and, well, let’s just the say the report left a lot to be desired. As a result of disappointing the street expectations, TSLA dropped -10.80% this week, earning itself the spot of the Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+989.75%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$55.69)*

Apple (AAPL)

+878.69%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.72)*

Boeing (BA)

+685.29%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Block (SQ)

+528.97%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Tesla (TSLA)

+503.89%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Skyworks (SWKS)

+497.59%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.93)*

Nike (NKE)

+467.29%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.52)*

Logitech (LOGI)

+436.09%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $10.64

IDEXX Labs (IDXX)

+424.35%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Disney (DIS)

+228.31%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+91.98%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $66.40

Dow (DOW)

+84.32%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $29.66

Meta (META)

+83.34%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Take Two (TTWO)

+77.75%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Salesforce (CRM)

+67.80%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Berkshire (BRK.B)

+66.44%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Amazon (AMZN)

+37.74%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $74.10

SoFi (SOFI)

+30.68%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.40

Visa (V)

+29.68%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.27

Morgan Stan (MS)

+29.63%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.94

Zoetis (ZTS)

+13.83%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $148.42

Alphabet (GOOGL)

+11.83%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Roblox (RLBX)

+2.54%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $45.05

Dutch Bros (BROS)

-11.30%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $35.50

Schwab (SCHW)

-23.19%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $64.25

Twilio (TWLO)

-36.28%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Rivian (RIVN)

-51.44%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Canopy (CGC)

-64.89%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.50

Coinbase (COIN)

-70.46%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Nike (NKE): Dividend Reinvestment

Nike (NKE) paid out its quarterly dividend on Tuesday which, after reinvesting, raised my per-share cost +0.28% from -$10.55 to -$10.52 (a negative per-share cost indicates all capital has been removed in addition to $10.52 per share added to the portfolio’s bottom line in addition to each share’s current value).

The fact that my cost basis increased might seem counterintuitive, but it’s actually just basic math: since I reinvest the dividends so they compound, there are more shares in the position; the position is now worth more, but the cost basis is increased since there are more shares in the position to divide the profit among.

From here, my next buy target is $82.55, slightly above NKE’s 2022 low and my next sell target is $161.35, slightly below a past level of resistance.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.