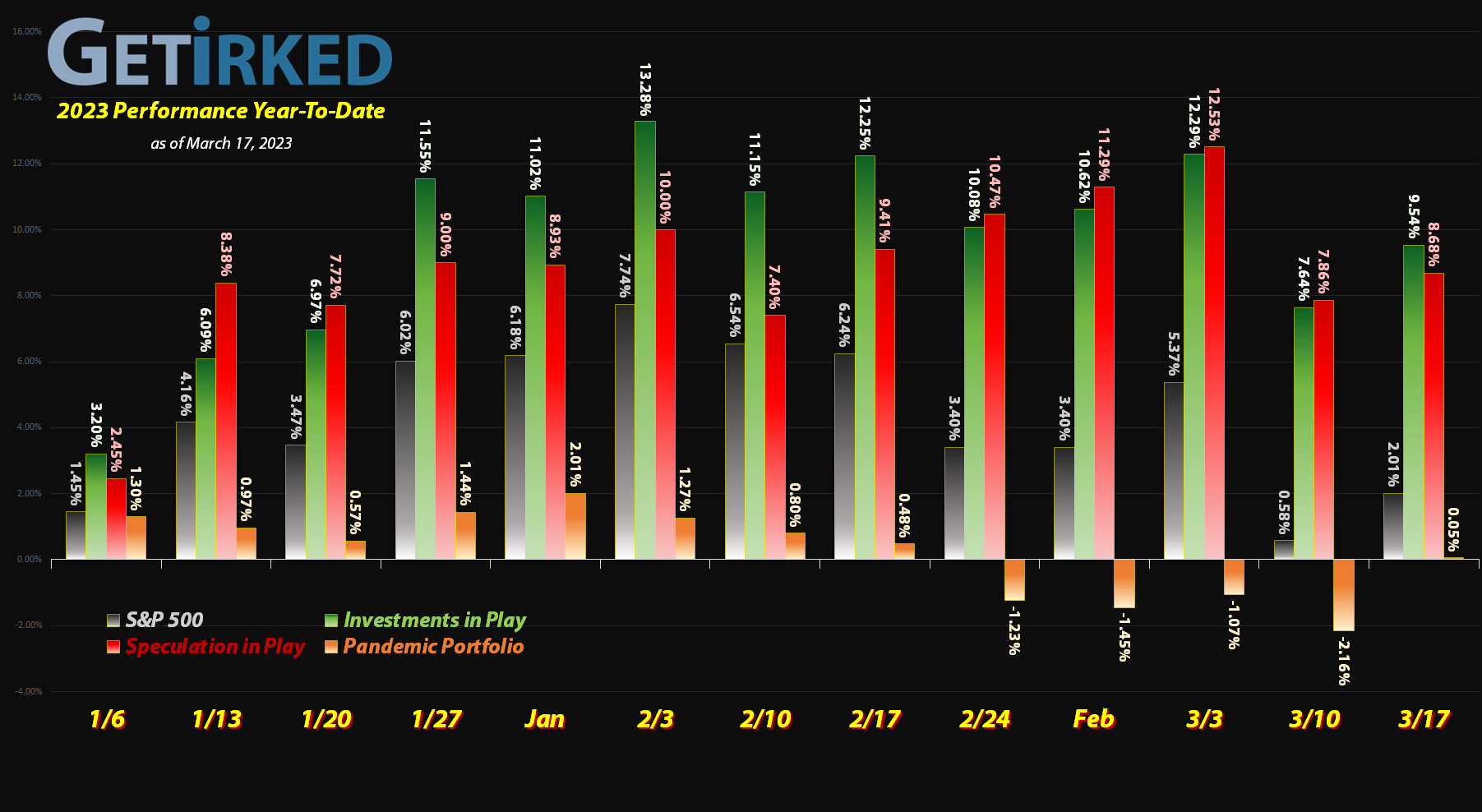

March 17, 2023

The Week’s Biggest Winner & Loser

Coinbase (COIN)

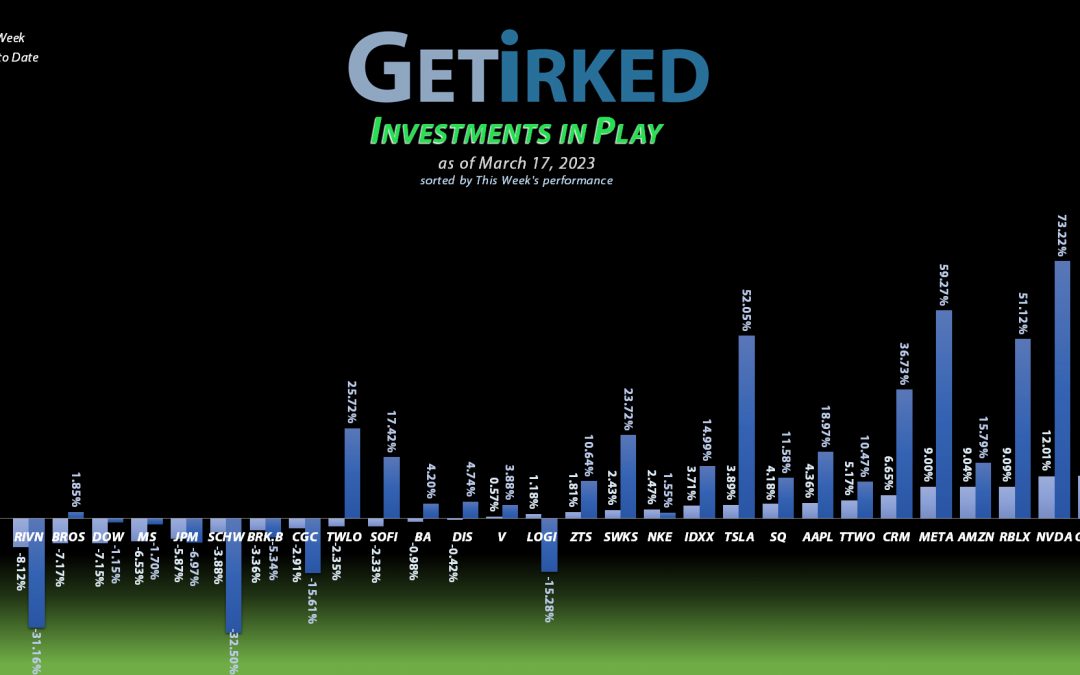

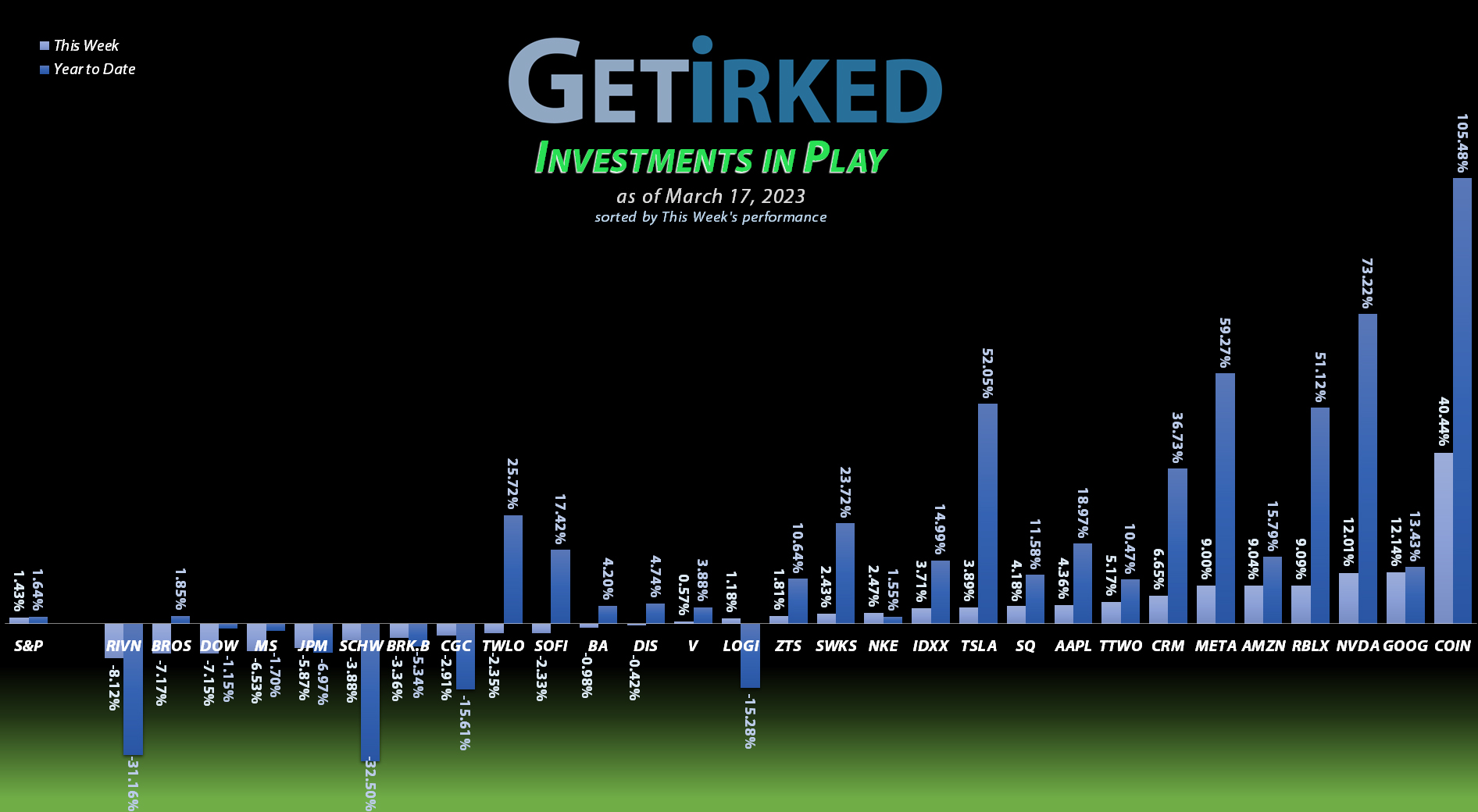

With Bitcoin’s seemingly never-ending rally taking it through the $27K mark this week, Coinbase (COIN) followed suit, rocketing an incredible +40.44% during a week that saw traditional financials get positively destroyed. This epic run cemented COIN’s spot as the Week’s Biggest Winner.

Rivian (RIVN)

Investors fled from cyclicals, financials, and nonprofitable startups this week, leaving Rivian (RIVN) very much in reverse. Already beaten up going into the week, RIVN lost another -8.12% and locked itself in the spot of the Week’s Biggest Loser.

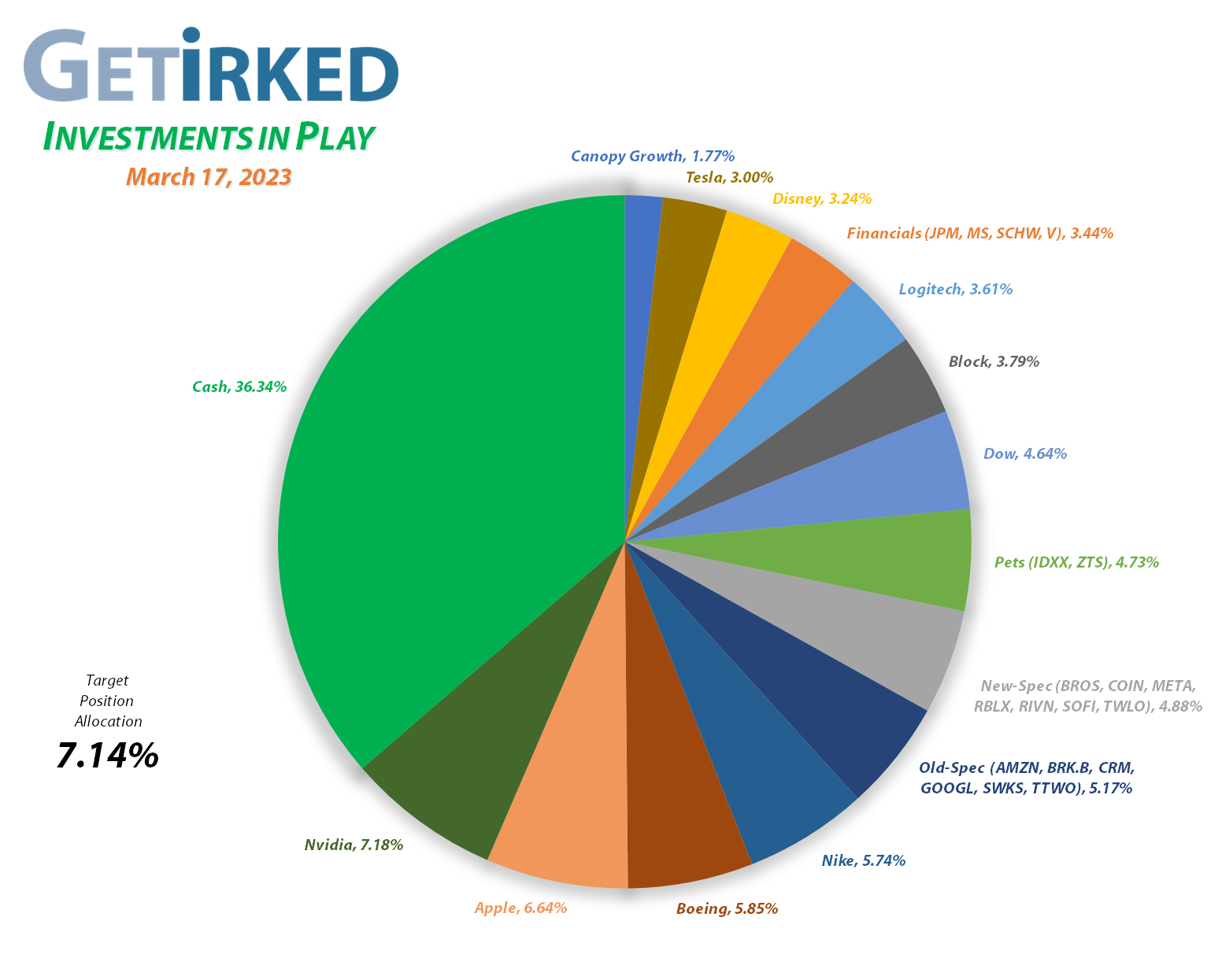

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+947.08%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$39.32)*

Apple (AAPL)

+841.03%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.72)*

Boeing (BA)

+667.19%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Block (SQ)

+550.66%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Skyworks (SWKS)

+504.79%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$35.11)*

Tesla (TSLA)

+493.24%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Nike (NKE)

+466.71%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.55)*

IDEXX Labs (IDXX)

+423.64%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Logitech (LOGI)

+400.45%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $10.64

Disney (DIS)

+206.08%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+89.48%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $66.40

Meta (META)

+80.17%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Take Two (TTWO)

+73.69%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Dow (DOW)

+68.67%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $29.66

Salesforce (CRM)

+61.09%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Berkshire (BRK.B)

+56.32%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Amazon (AMZN)

+33.54%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $74.10

Morgan Stan (MS)

+29.62%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.94

SoFi (SOFI)

+24.09%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.40

Visa (V)

+24.74%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.27

Zoetis (ZTS)

+10.82%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $148.42

Alphabet (GOOGL)

+4.82%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Roblox (RLBX)

-3.02%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $45.05

Schwab (SCHW)

-12.20%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $64.25

Dutch Bros (BROS)

-17.89%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $35.50

Twilio (TWLO)

-34.07%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Canopy (CGC)

-55.55%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.50

Rivian (RIVN)

-56.34%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Coinbase (COIN)

-63.95%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Dutch Bros (BROS): Added to Position

Dutch Bros (BROS) got hit particularly hard during Friday’s selloff, breaking down through the $30.00 mark where it triggered my next buy order at $29.20. The buy locked in a -23.56% discount on shares I sold for $38.20 on January 30, and lowered my per-share cost -1.25% from $35.95 to $35.50.

From here, my next small buy is at $27.50, just above a key level of past support, and my next sell target is $41.10, just under BROS’ high for 2023.

BROS closed the week at $29.15, down -0.17% from where I added Friday.

Meta (META): Profit-Taking

When Meta (META) rocketed higher after announcements the company would be laying off an additional 10,000 employees, I decided that it was time to take profits – I just don’t think layoffs are really good news given the macroeconomic and geopolitical environment the world is in right now.

My sale went through at $193.80 on Wednesday, locking in +14.32% in gains on shares I bought for $166.05 on June 13, 2022, and lowered my per-share “cost” -$258.40 from -$64.60 to -$323.00 (a negative per-share cost indicates all capital has been removed in addition to $323.00 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $377.00, just under Meta’s all-time highs at a previous point of resistance, and my next buy target is $115.50, slightly above a key point of support from Meta’s selloff in 2022.

META closed the week at $195.61, up +0.93% from where I took profits Wednesday.

Nvidia (NVDA): Profit-Taking

Nvidia’s (NVDA) epic post-AI rally continued this week with the stock once again dramatically outgrowing my portfolio’s allocation target which necessitated more profit-taking on Friday with a sale that went through at $260.00.

The sale locked in +11.04% in gains on shares I bought for $234.16 on January 21, 2022, and lowered my per-share “cost” -$14.15 from -$25.17 to -$39.32 (a negative per-share cost indicates all capital has been removed in addition to $39.32 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, I’m going to let the position “run hot,” exceeding my portfolio’s allocation target by quite a margin, with my next sell target at $288.67, just under NVDA’s 2022 high, and my next buy target is $145.13, above a key level of past support.

NVDA closed the week at $257.25, down -1.06% from where I took profits Friday.

Schwab (SCHW): Added to Position

Schwab’s (SCHW) epic freefall continued on Monday as the company has offered absolutely no insights into why its stock is positively collapsing. SCHW crashed through my next buy target which filled at $51.07 on Monday, locking in a -31.81% discount on shares I sold for $74.89 back on October 27, 2022.

The buy lowered my per-share cost -3.89% from $66.85 to $64.25. I should note that I’m adding very slowly in very small quantities to this position since we have absolutely no idea if something existential is happening to the company.

From here, my next buy target is $46.59, above a past point of support, and my next sell target is $85.78, just under Schwab’s 2023 high from just a few weeks ago.

SCHW closed the week at $56.41, up +10.46% from where I added Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.