February 17, 2023

The Week’s Biggest Winner & Loser

Twilio (TWLO)

Cloud data provider, Twilio (TWLO), nearly flew into the clouds this week, rocketing +17.69% on the back of a surprisingly good quarter. As a result Twilio floats into the top spot this week as the Week’s Biggest Winner.

Skyworks Solutions (SWKS)

The markets fell out of love with semiconductors this week in light of inflation data that could indicate a future weakness in demand. As a result, Skyworks Solutions (SWKS) dipped -3.14% on the week and that loss was enough to land it in the spot of the Week’s Biggest Loser.

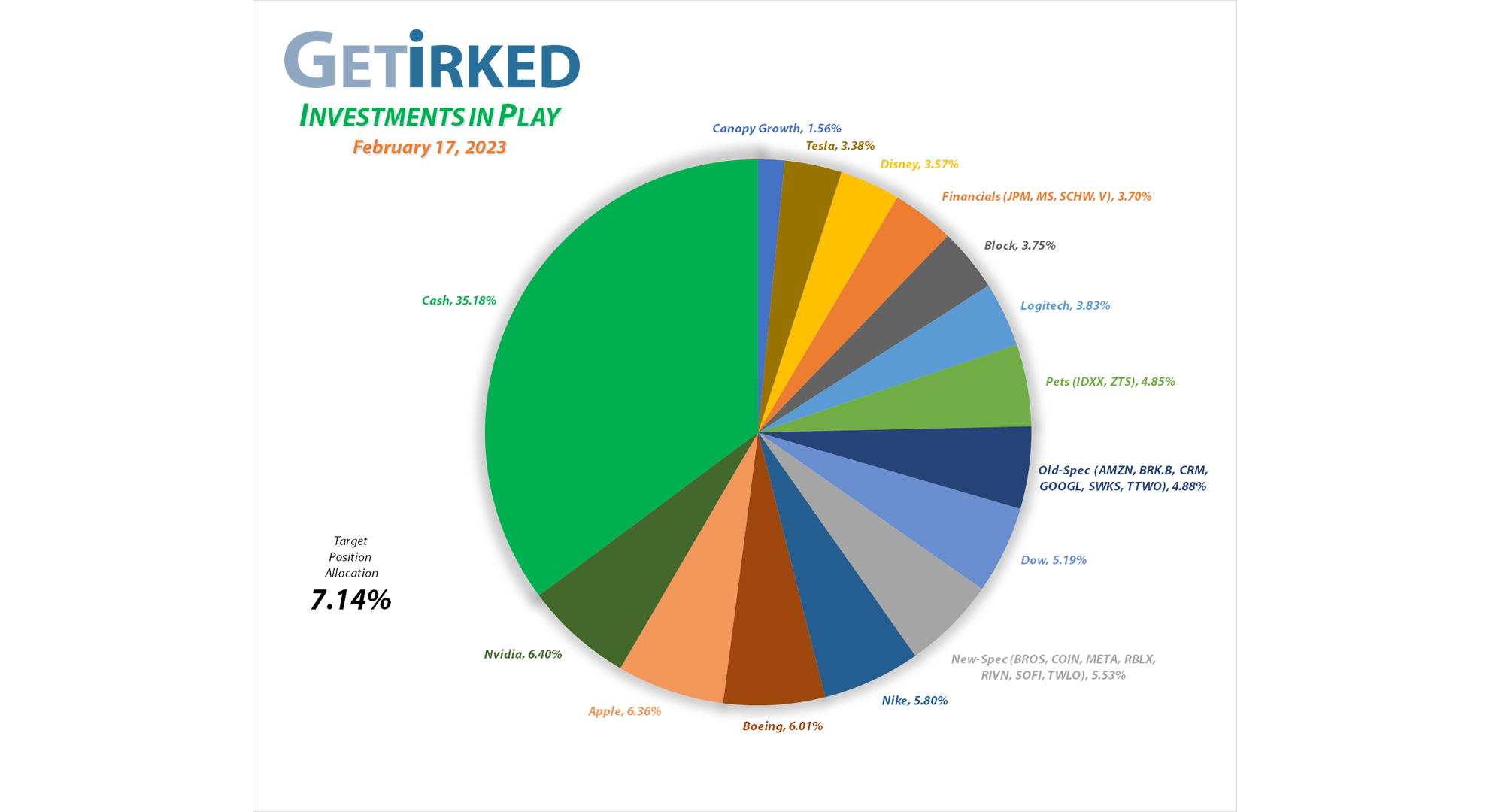

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Apple (AAPL)

+830.58%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.81)*

Nvidia (NVDA)

+798.01%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$13.45)*

Boeing (BA)

+685.80%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Block (SQ)

+554.50%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Tesla (TSLA)

+554.10%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Skyworks (SWKS)

+510.77%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$35.11)*

Nike (NKE)

+482.57%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.55)*

Logitech (LOGI)

+443.70%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $10.64

IDEXX Labs (IDXX)

+439.00%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Disney (DIS)

+245.55%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+114.23%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $66.40

Dow (DOW)

+93.44%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $30.05

Meta (META)

+73.42%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Take Two (TTWO)

+68.06%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Berkshire (BRK.B)

+64.16%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Morgan Stan (MS)

+53.22%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.94

SoFi (SOFI)

+50.45%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.40

Salesforce (CRM)

+43.94%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Amazon (AMZN)

+31.18%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $74.10

Visa (V)

+28.02%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.63

Schwab (SCHW)

+16.75%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $71.40

Zoetis (ZTS)

+15.65%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $148.75

Dutch Bros (BROS)

+7.26%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $35.95

Alphabet (GOOGL)

-2.68%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Roblox (RLBX)

-9.26%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $45.05

Twilio (TWLO)

-25.88%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Rivian (RIVN)

-32.14%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Canopy (CGC)

-53.51%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.40

Coinbase (COIN)

-68.65%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Roblox (RBLX): Profit-Taking

Roblox (RBLX) roared higher on Wednesday following a blowout earnings report. The stock shot more than +20% in morning trading, triggering my next sell order which filled at $45.33, locking in an astounding +54.55% in gains on shares I bought for $29.33 just two months ago on December 15, 2022.

While the sale only lowered my per-share cost -$0.02 from $45.07 to $45.05, it served the more important purpose of releasing capital for use at lower levels should RBLX sell off once more. From here, my next sell target is $49.55, below a key point of resistance, and my next buy target is $27.95, above a key point of past support.

RBLX closed the week at $40.88, down -9.82% from where I took profits Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.