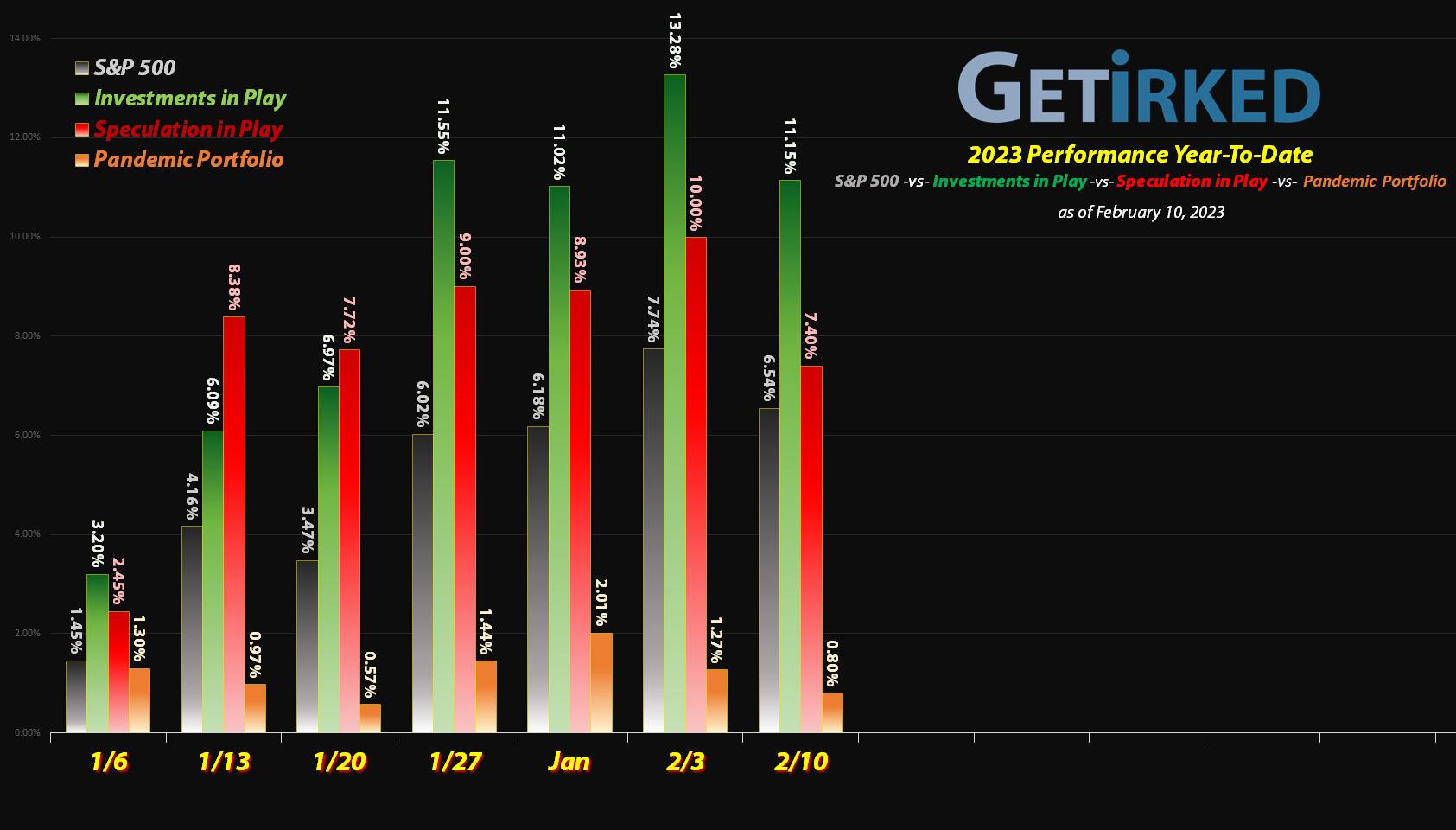

February 10, 2023

The Week’s Biggest Winner & Loser

Skyworks Solutions (SWKS)

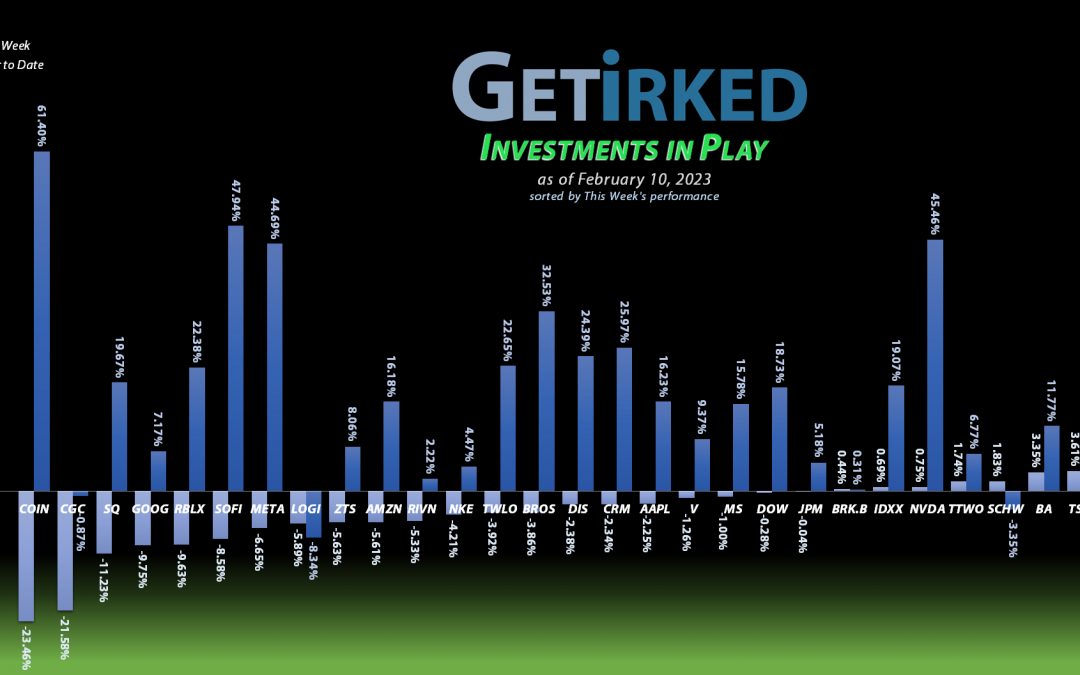

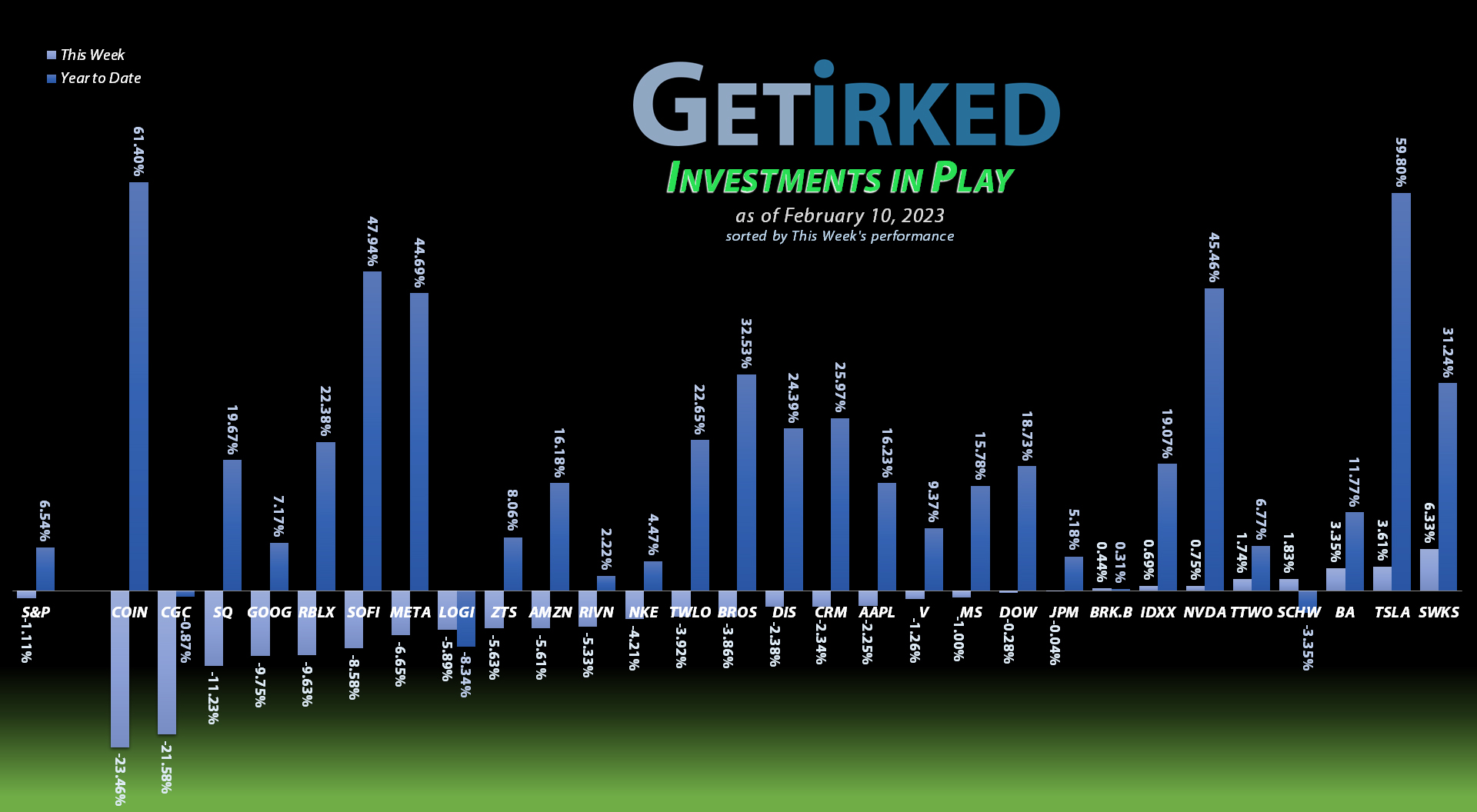

Skyworks Solutions (SWKS) hit a homerun with its outstanding earnings report this week, causing the stock to pop +6.33% in an otherwise negative market and winning itself the spot of the Week’s Biggest Winner.

Coinbase (COIN)

The SEC started cracking down on crypto firms this week (see the feature below). As a result, Coinbase (COIN), this year’s high-flyer, got dropped -23.46% for the week and while that earned COIN the spot of the Week’s Biggest Loser, it’s still up a whopping +61.40% Year-to-Date!

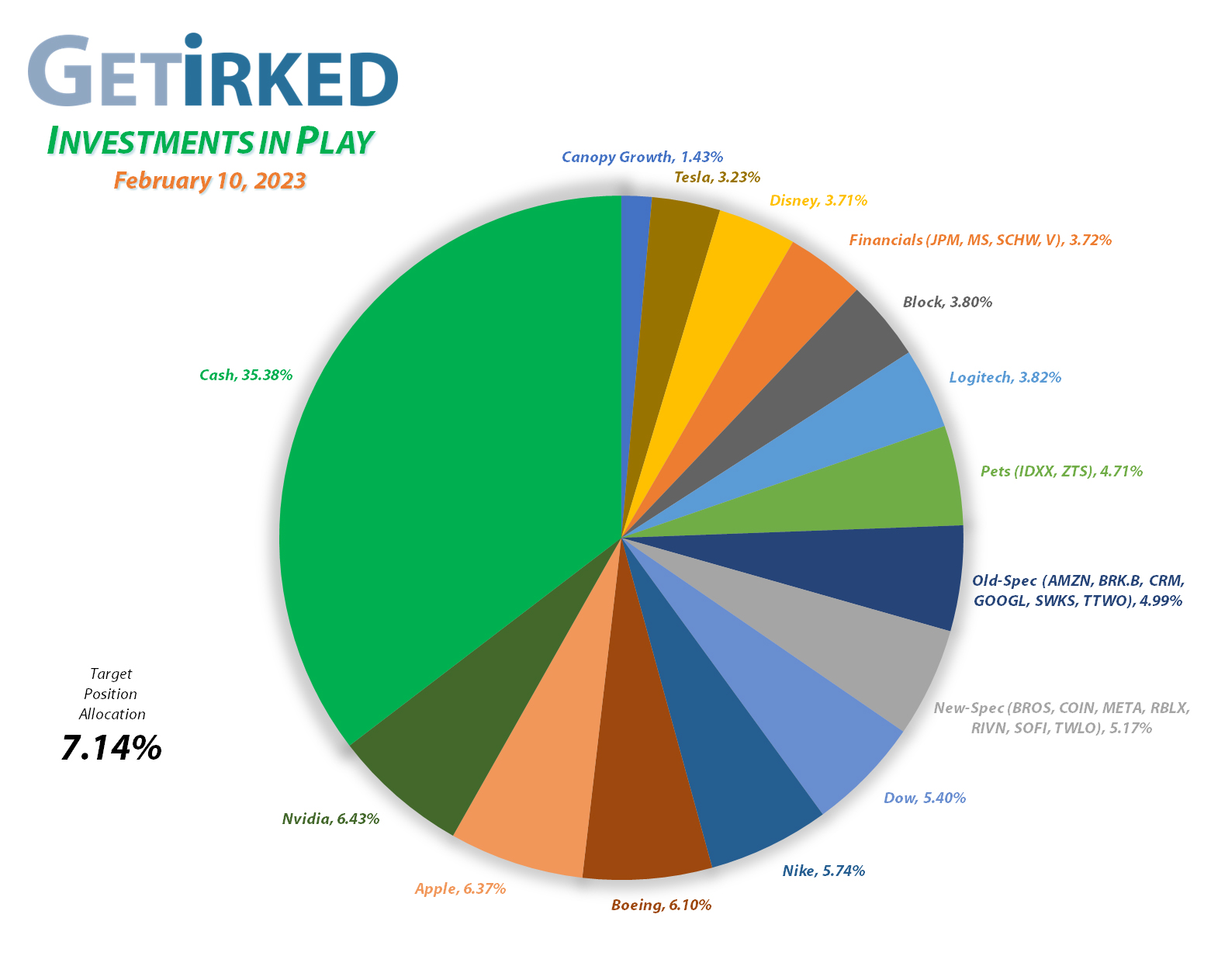

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Apple (AAPL)

+824.59%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.81)*

Nvidia (NVDA)

+793.69%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$13.45)*

Boeing (BA)

+687.95%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Block (SQ)

+555.28%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Tesla (TSLA)

+529.44%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Nike (NKE)

+473.30%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.55)*

Logitech (LOGI)

+436.46%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $10.64

IDEXX Labs (IDXX)

+432.45%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Skyworks (SWKS)

+423.54%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$35.11)*

Disney (DIS)

+254.88%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+112.42%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $66.40

Dow (DOW)

+99.07%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $30.05

Meta (META)

+73.81%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Berkshire (BRK.B)

+65.04%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Take Two (TTWO)

+65.95%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

SoFi (SOFI)

+54.77%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.40

Morgan Stan (MS)

+50.40%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $65.45

Salesforce (CRM)

+45.56%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Amazon (AMZN)

+31.73%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $74.10

Visa (V)

+30.10%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.63

Schwab (SCHW)

+16.95%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $71.40

Zoetis (ZTS)

+6.44%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $148.75

Dutch Bros (BROS)

+3.92%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $35.95

Alphabet (GOOGL)

-2.45%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Roblox (RLBX)

-22.74%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $45.07

Rivian (RIVN)

-36.74%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Twilio (TWLO)

-37.00%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Canopy (CGC)

-57.77%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.40

Coinbase (COIN)

-72.55%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

Points of Interest

The SEC Unleashes a Crypto Crackdown

The SEC smacked down the concept of crypto “staking” by requiring one of Coinbase’s (COIN) competitors, Kraken, to stop the process immediately. Staking is the concept of locking up your crypto for an amount of time to help the network, and, in return, the user receives interest on the staked crypto.

The SEC has determined this staking process to be similar enough to dividend payouts, making cryptos that offer it the equivalent of selling securities. Since none of the brokerages have listed any crypto tokens listed as securities, they are now in violation of SEC guidelines and must stop offering the service. Although the SEC hasn’t gone after Coinbase, yet, it’s expected they will do so in the coming days or weeks.

Additionally, this has brought up a lot of concerns regarding Ether (ETH), the second largest crypto after Bitcoin (BTC). The Ethereum Network, the network on which Ether operates as a token, recently switched from “proof-of-work” (i.e. mining using complicated math formulas similar to the creation of Bitcoin) to “proof-of-stake.”

The Ethereum Group switched to proof-of-stake as a way to reduce electricity use and make the entire network more green. However, the SEC’s new, aggressive stance may create significant headwinds for the Ethereum Network going forward. Although a relatively small risk currently, anyone holding Ether should be aware that there is a possibility the token could be invalidated entirely. Again, this risk is low, but it’s still possible.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.