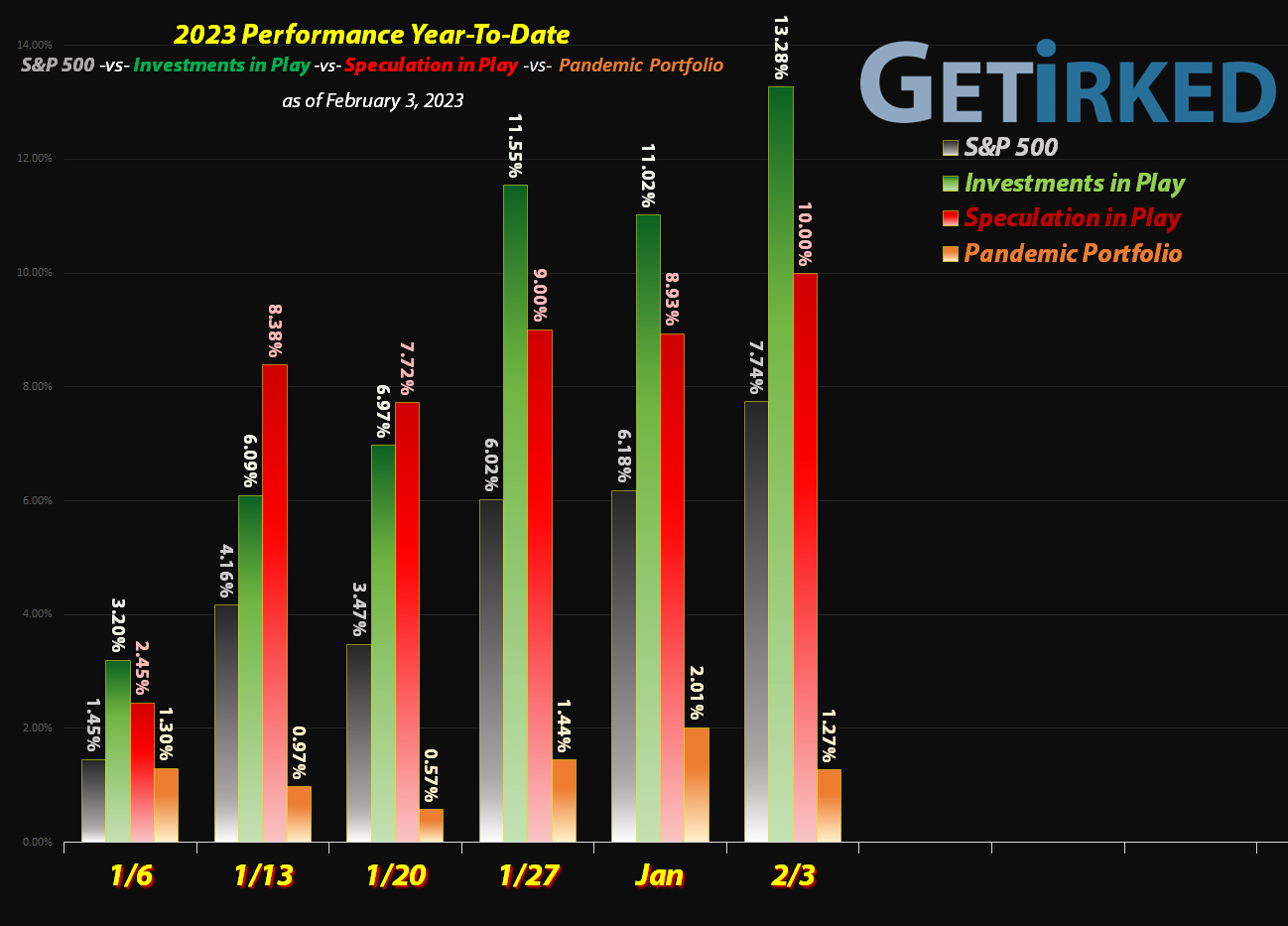

February 3, 2023

The Week’s Biggest Winner & Loser

SoFi Technologies (SOFI)

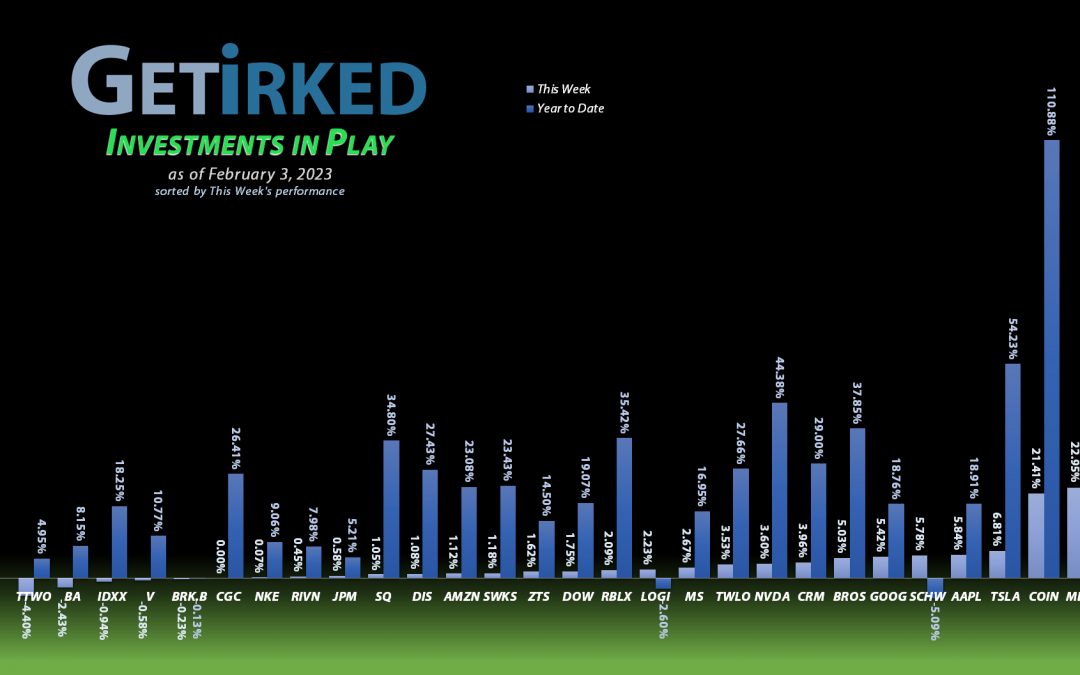

What happens when a beaten-up fintech startup from 2022 reports a surprise-to-the-upside, blowout earnings report? SoFi Technologies (SOFI), that’s what.

SOFI’s outstanding quarter gave them a +25.59% weekly gain and led them to come in second on the year with +61.82% year-to-date, easily earning them the spot of the Week’s Biggest Loser.

Take Two Interactive (TTWO)

All of the video game stocks took it on the nose this week, dropping in a week that saw most stocks rise. Take Two Interactive (TTWO) was no exception, dropping -4.40% to earn the spot of the Week’s Biggest Loser.

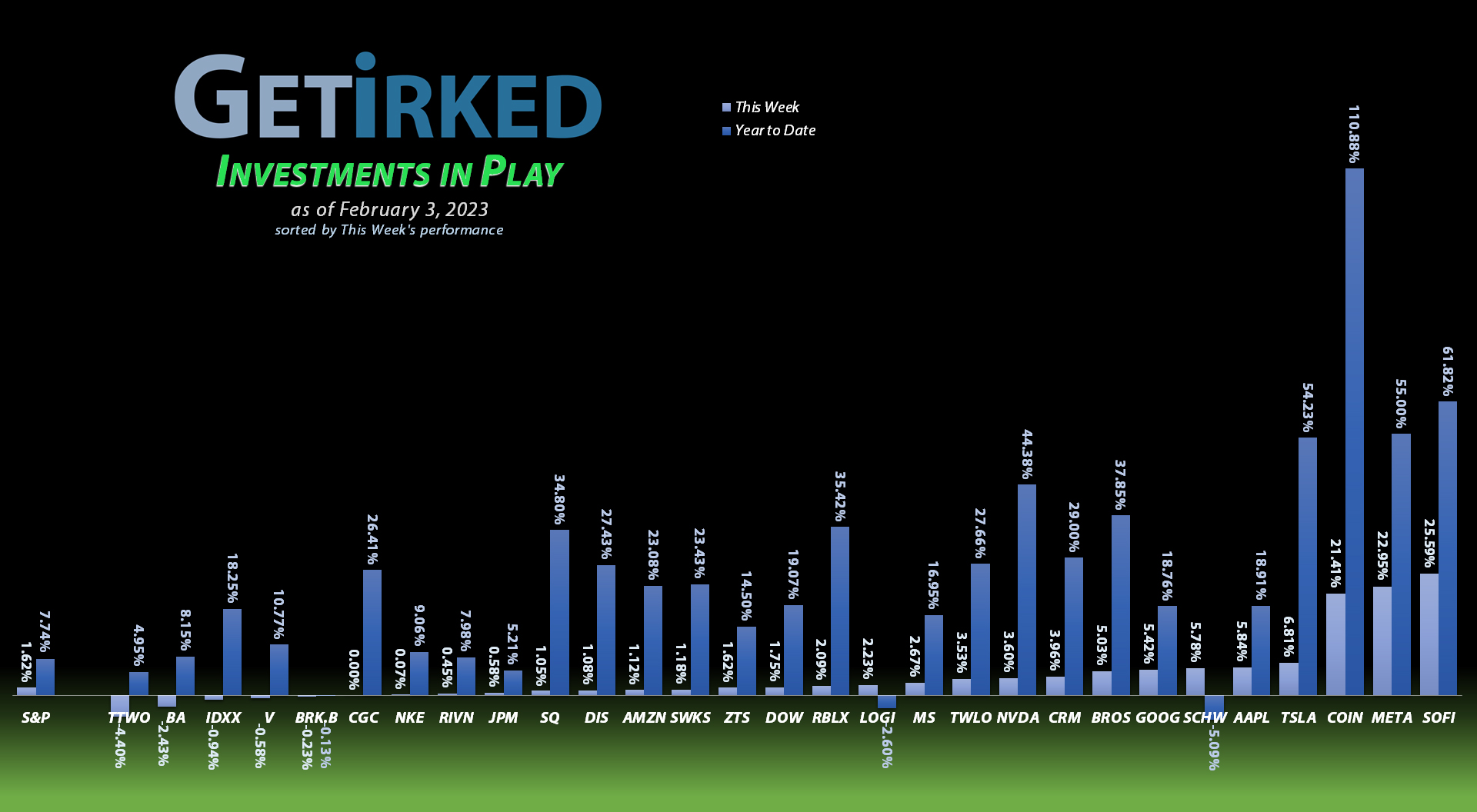

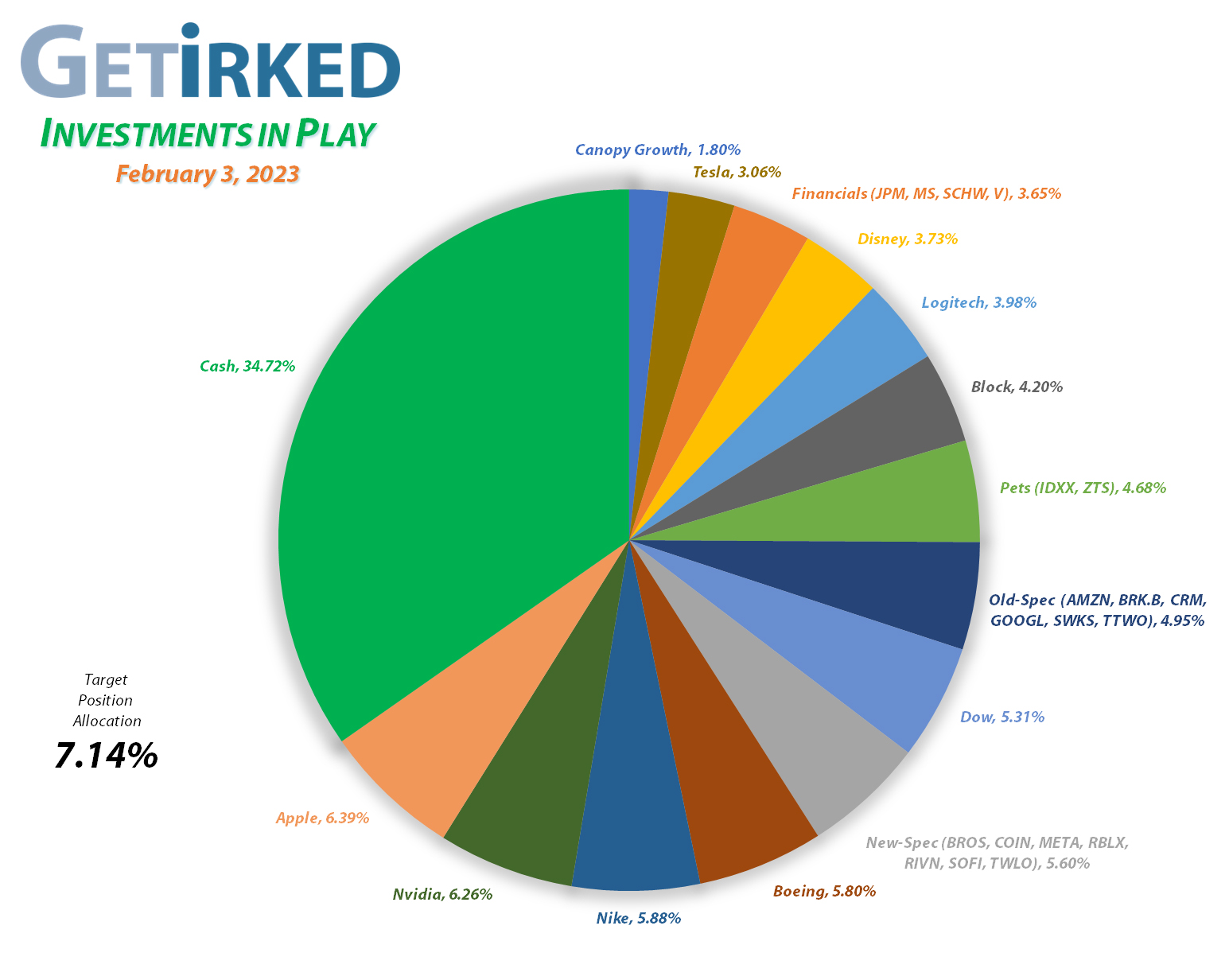

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Apple (AAPL)

+838.18%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.81)*

Nvidia (NVDA)

+787.90%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$13.45)*

Boeing (BA)

+675.90%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Block (SQ)

+590.21%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Tesla (TSLA)

+514.51%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Nike (NKE)

+492.48%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.55)*

Logitech (LOGI)

+470.03%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $10.64

IDEXX Labs (IDXX)

+430.40%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Skyworks (SWKS)

+399.41%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$35.11)*

Disney (DIS)

+263.53%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+112.50%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $66.40

Dow (DOW)

+99.67%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $30.05

Meta (META)

+77.64%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

SoFi (SOFI)

+69.55%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.40

Berkshire (BRK.B)

+64.35%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Take Two (TTWO)

+63.23%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Morgan Stan (MS)

+51.92%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $65.45

Salesforce (CRM)

+49.04%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Amazon (AMZN)

+39.53%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $74.10

Visa (V)

+31.76%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.63

Schwab (SCHW)

+14.86%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $71.40

Zoetis (ZTS)

+12.81%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $148.75

Dutch Bros (BROS)

+8.12%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $35.95

Alphabet (GOOGL)

+8.08%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Roblox (RLBX)

-14.42%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $45.07

Rivian (RIVN)

-33.21%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Twilio (TWLO)

-34.46%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Canopy (CGC)

-45.92%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.40

Coinbase (COIN)

-64.12%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Coinbase (COIN): Profit-Taking

I took “profits” in Coinbase (COIN) on Friday when the stock jumped through my $84.25 sell order. It may seem counter-intuitive for me to sell any of my Coinbase shares when my cost basis was much higher at $196.75, but here’s the thing: in a little over one month, Coinbase has leapt nearly +175% from its January 2023 lows… one month.

That kind of move obviously cannot be sustained much longer before a pretty epic correction will ensue. Additionally, I was able to lock in +106.09% in gains on shares I bought for $40.88 back on November 21, 2022.

So, even though I did raise my per-share cost +5.72% from $196.75 to $208.00, I also freed up capital I can put back to work in COIN if it does sell off. Even $208.00 represents a -49.82% reduction from where I initially opened the position at $414.54 back on April 14, 2021.

If COIN tests its August 2022 highs at $116.30, I believe it will break through to a key Fibonacci Retracement line above that high, so I do have another sell order in place at $125.20 which will sell shares I bought for $54.72 last May. My next buy target is $32.00, slightly above COIN’s all-time low.

COIN closed the week at $74.63, down -11.42% from where I took profits.

Dow (DOW): Profit-Taking

Dow (DOW) popped dramatically with the rest of the market following the Federal Reserve press conference, triggering my next sell order which filled at $60.23. The sale lowered my per-share cost -1.48% from $30.50 to $30.05.

From here, my next sell target is $62.59, below a past point of resistance, and my next buy target is $40.11, above a key level of support from 2020.

DOW closed the week at $60.00, down -0.38% from where I took profits Wednesday.

Dutch Bros (BROS): Profit-Taking

Dutch Bros (BROS) started the week off with a bang, popping on Monday’s open and triggering my next sell order which filled at $38.20.

While the small sale only lowered my per-share cost -0.42% from $36.10 to $35.95, it served the more important purpose of locking in +31.27% in gains on shares I bought a little over a month ago at $29.10 on December 19, 2022.

From here, my next sell target is $43.10, below a past point of resistance, and my next buy target is $29.20, above a key level of past support.

BROS closed the week at $38.87, up +1.75% from where I took profits Monday.

SoFi Technologies (SOFI): Profit-Taking

SoFi Technologies (SOFI) saw a huge pop on Thursday on the back of what many saw as dovish comments from Federal Reserve Chair Jerome Powell. SOFI shot through my next sell target which filled at $8.02, locking in a whopping +87.38% in gains selling some of the shares I bought for $4.28 on December 28, 2022.

The sale also lowered my per-share cost -5.38% from $4.65 to $4.40. From here, my next sell target is $10.35, a bit below a past point of resistance, and my next buy target is $4.26, a few cents higher than SOFI’s all-time low set in December.

SOFI closed the week at $7.46, down -6.98% from where I took profits Thursday.

Tesla (TSLA): Profit-Taking

Tesla (TSLA) triggered my next sell order when it popped on Thursday, with an order that filled at $171.49. The sale locked in +40.77% in gains on shares I bought about a month and a half ago for $121.82 on December 23, 2022.

The sale lowered my per-share cost -$16.88 from -$31.40 to -$48.28 (a negative per-share cost indicates all capital has been removed in addition to $48.28 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, I have no real sell targets as I wait to see where Tesla goes, so my next sell target is set at $412.96, just under TSLA’s all-time high. My next buy target is $101.85, right above the low of Tesla’s epic selloff at the end of 2022.

TSLA closed the week at $189.98, up +10.78% from where I took profits Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.