January 27, 2023

The Week’s Biggest Winner & Loser

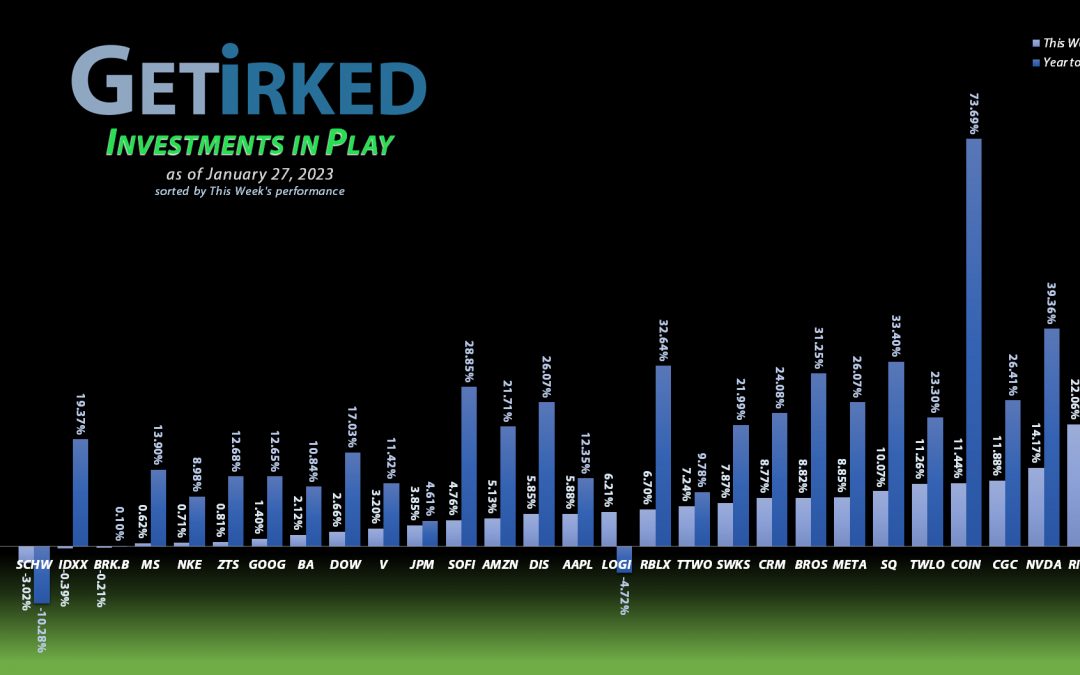

Tesla (TSLA)

The Bears really hate Tesla (TSLA) and its CEO Elon Musk, and, for the past several months, betting against Tesla has been a great trade… until this week’s earnings report where Tesla reported… the… best… earnings… it… ever… HAS.

As a result, the Bears had to cover their shorts while the Bulls raced back into the beleaguered stock, causing Tesla to jump a spectacular +33.31% in a matter of days.

Naturally, this also makes Tesla (TSLA) the biggest Winner of the Week.

Schwab (SCHW)

The dark cloud that was Schwab’s (SCHW) terrible earnings report last week continued to hang over the stock, causing it to drop -3.02% and earning it the worst kind of two-in-a-row… the losing kind. Yes, Schwab was once again the Week’s Biggest Loser.

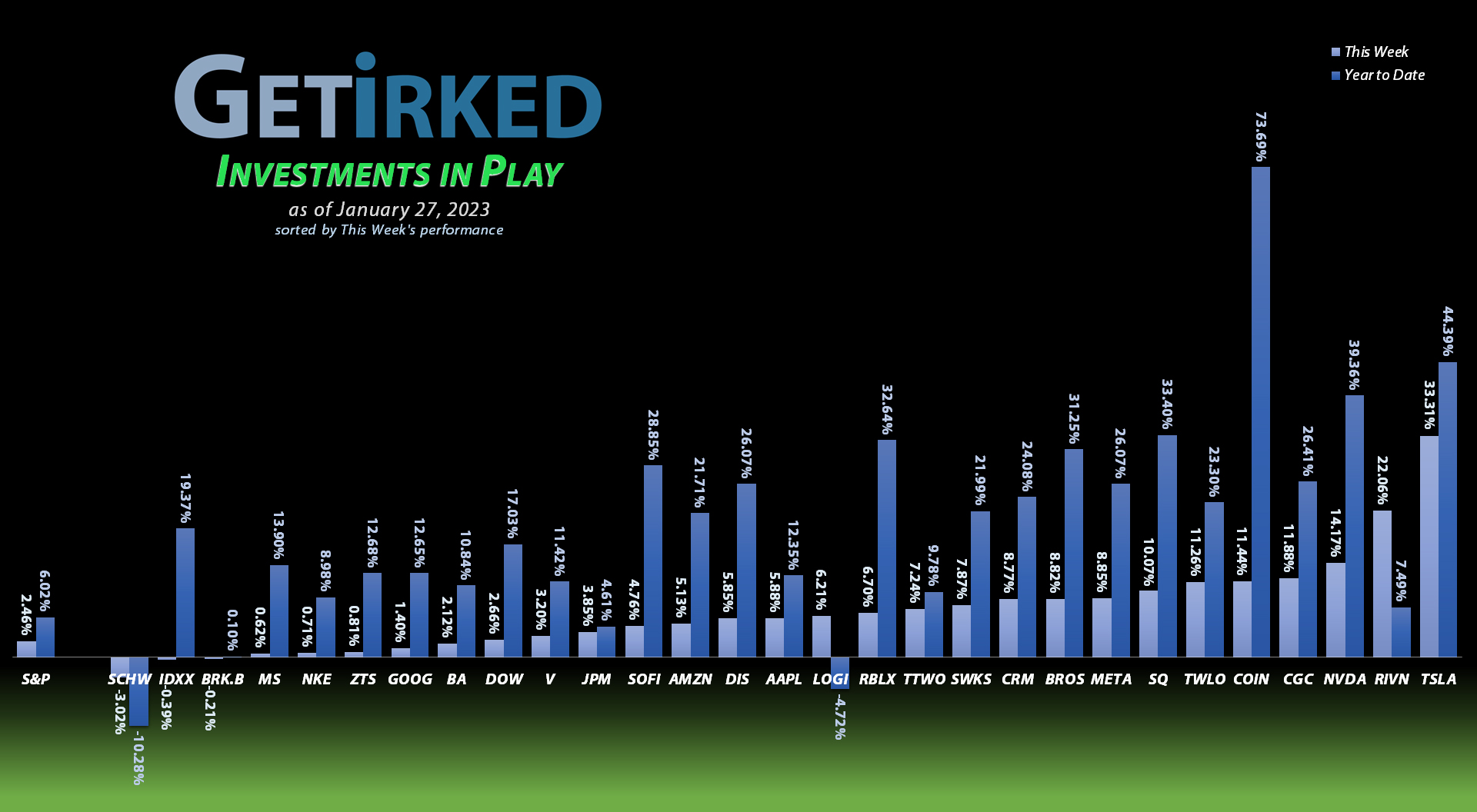

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Apple (AAPL)

+804.81%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.81)*

Nvidia (NVDA)

+762.10%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$13.45)*

Boeing (BA)

+684.94%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Block (SQ)

+587.00%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Nike (NKE)

+492.16%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.55)*

Tesla (TSLA)

+489.53%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$31.40)*

Logitech (LOGI)

+457.43%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $10.64

IDEXX Labs (IDXX)

+433.19%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Skyworks (SWKS)

+394.95%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$35.11)*

Disney (DIS)

+259.74%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+109.83%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $66.87

Dow (DOW)

+93.34%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $30.50

Take Two (TTWO)

+70.74%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+66.89%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Berkshire (BRK.B)

+64.66%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Morgan Stan (MS)

+47.99%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $65.45

Salesforce (CRM)

+43.37%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Amazon (AMZN)

+37.98%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $74.10

Visa (V)

+32.53%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.63

SoFi (SOFI)

+27.75%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.65

Zoetis (ZTS)

+11.05%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $148.75

Schwab (SCHW)

+8.56%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $71.40

Alphabet (GOOGL)

+2.50%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Dutch Bros (BROS)

+2.38%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $36.10

Roblox (RLBX)

-16.23%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $45.07

Rivian (RIVN)

-33.45%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Twilio (TWLO)

-36.66%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Canopy (CGC)

-45.73%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.40

Coinbase (COIN)

-68.81%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $196.75

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Dow (DOW): Profit-Taking

It was time for even more profit-taking in Dow (DOW) when it started to make a run for its 2023 highs with a sale that went through at $57.73 on Monday. The small sale reduced my per-share cost -1.29% from $30.90 to $30.50.

From here, my next sell target is $60.23, below the next level of resistance, and my next buy target is $44.12, around a key level of past resistance and quite a bit above DOW’s 2022 lows at $42.91.

DOW closed the week at $58.97, up +2.15% from where I took profits Monday.

Take Two Interactive (TTWO): Profit-Taking

Take Two Interactive (TTWO) rallied to a key point of resistance on Monday, triggering my next sell order which filled at $109.73. The sale locked in +19.64% in gains selling shares I bought for $91.72 on November 8, 2022, and lowered my per-share cost -13.74% from $77.61 to $66.95.

From here, my next sell target is much higher than here but below TTWO’s all-time highs at $207.60, and my next buy target is $90.01, right above TTWO’s 2022 low at $90.00.

TTWO closed the week at $114.31, up +4.18% from where I took profits Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.