December 2, 2022

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

The cannabis cohort finally caught a bid this week after rumors that Congress might pass the SAFE Banking Act during the lame duck session. SAFE will allow cannabis operators like Canopy Growth Corporation (CGC) to open bank accounts, accept credit cards, and operate as “real” businesses in the eyes of the Feds. As a result, the cannabis sector popped with Canopy Growth Corp earning +17.21% on the week to swing in as the Week’s Biggest Winner.

Salesforce (CRM)

Salesforce (CRM) reported strong earnings this week and while its forward guidance was slightly weaker than hoped, the real bad news was the departure of Co-CEO Brett Taylor, a favorite who stood up against Elon Musk in his other role as Chairman of the Board at Twitter where he denied Musk’s attempt to lower the buyout price. Now CEO Marc Bennioff is co-founder of Salesforce and does a fantastic job, but Taylor is an undeniable loss, causing Salesforce to drop -5.73% this week and swing as the Week’s Biggest Loser.

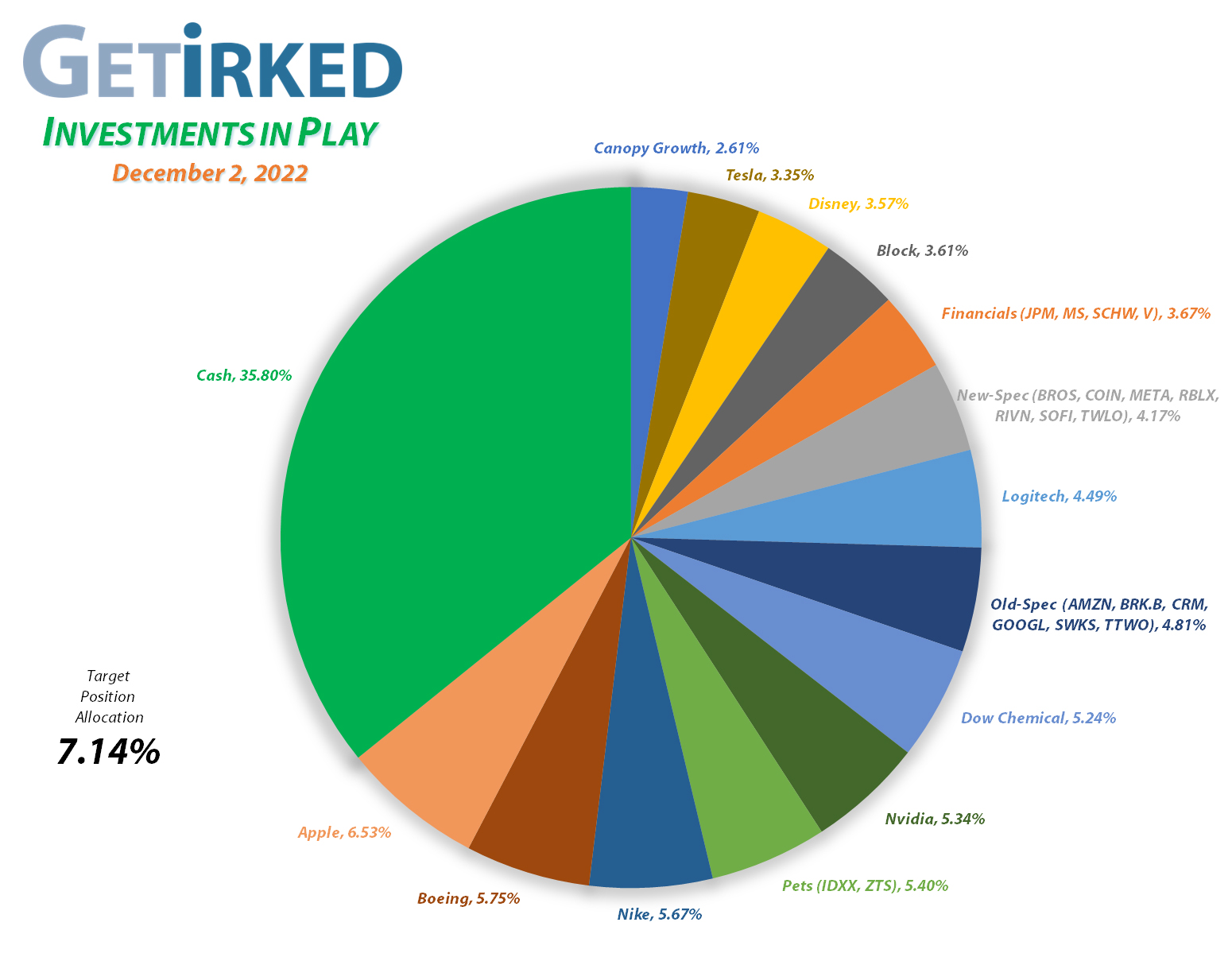

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

Current Position Performance

Apple (AAPL)

+812.13%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.81)*

Nvidia (NVDA)

+639.45%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$13.45)*

Boeing (BA)

+634.19%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$162.30)*

Block (SQ)

+529.16%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Tesla (TSLA)

+516.13%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$44.15)*

Logitech (LOGI)

+435.66%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $11.71

Nike (NKE)

+434.99%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.70)*

IDEXX Labs (IDXX)

+400.21%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$112.25)*

Skyworks (SWKS)

+334.52%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$35.36)*

Disney (DIS)

+226.47%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+102.16%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $66.87

Berkshire (BRK.B)

+68.36%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Meta (META)

+58.15%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Dow (DOW)

+57.86%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $32.65

Take Two (TTWO)

+40.13%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $77.61

Amazon (AMZN)

+30.38%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $72.20

Morgan Stan (MS)

+27.43%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $72.27

Salesforce (CRM)

+26.00%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Visa (V)

+24.40%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $175.00

Schwab (SCHW)

+15.51%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $71.40

Zoetis (ZTS)

+4.67%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $150.40

Alphabet (GOOGL)

+3.60%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Dutch Bros (BROS)

+1.26%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $36.60

SoFi (SOFI)

-2.08%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.80

Canopy (CGC)

-23.64%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.62

Roblox (RLBX)

-26.19%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.05

Rivian (RIVN)

-47.21%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Twilio (TWLO)

-49.00%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Coinbase (COIN)

-75.77%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $196.75

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Nvidia (NVDA): Profit-Taking

Nvidia (NVDA) rallied along with the rest of the market on Wednesday following Fed Chair Powell’s announcement that smaller rate hikes may happen in December, triggering a sell order of mine which filled at $164.82, locking in a +13.02% gain on shares I bought for $145.83 back on July 1.

The sale lowered my per-share “cost” -$7.70 from -$5.75 to -$13.45 (a negative per-share cost indicates all capital has been removed in addition to $13.45 per share added to the portfolio’s bottom line in addition to each share’s current value).

I decided to take profits sooner than I might have after NVDA sold off more than I thought it would in October, making a low at $108.13. From here, my next sell target is $226.55, slightly below a past point of resistance, and my next buy target is $109.20, slightly above Nvidia’s October low.

NVDA closed the week at $168.76, up +2.39% from where I took profits Wednesday.

Schwab (SCHW): Dividend Reinvestment

Schwab (SCHW) paid out its quarterly dividend Monday night, which, after reinvesting, lowered my per-share cost -0.28% from $71.60 to $71.40. Since Schwab held up reasonably well through the October selloff, I’ve raised my price target to $61.70, a bit above SCHW’s 2022 lows set back in May and June.

Additionally, I do plan to continue taking profits if Schwab rallies into year-end as some of the more Bullish analysts believe we will. My next sell target is around $85.25.

Skyworks Solutions (SWKS): Profit-Taking

Skyworks Solutions (SWKS) shot through my sell price target at $95.53 when the rest of the market rallied on Wednesday, locking in +18.13% in gains on shares I bought a month and half ago for $80.87 on October 11.

The sale lowered my per-share “cost” -$15.16 from -$20.20 to -$35.36 (a negative per-share cost indicates all capital has been removed in addition to $35.36 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $138.70, below a past point of resistance, and my next buy target is $71.35, lower than SWKS’s 2022 lows from October and above a past point of support.

SWKS closed the week at $93.96, down -1.64% from where I took profits Wednesday.

Tesla (TSLA): Profit-Taking

Tesla (TSLA) finally caught a bid on Wednesday, triggering a sell order I had put in place which filled at $190.25. This sale actually took a -12.77% loss on some of the shares I bought over the course of the year at an average price of $218.11.

The sale lowered my per-share “cost” -$18.01 from -$26.14 to -$44.15 (a negative per-share cost indicates all capital has been removed in addition to $44.15 per share added to the portfolio’s bottom line in addition to each share’s current value).

Why did I take a loss on the shares I bought higher?

I have lost a significant amount of confidence in CEO Elon Musk following his acquisition of the social media company Twitter in the past two months. As a result of his distraction trying to run Twitter, Tesla has lost significant value with many shareholders (including myself) concerned that his relentless pursuit of notoriety is causing him to lose focus on the development and operation of Tesla.

Accordingly, I plan to continue reducing my position if Tesla rallies into year-end, with my next sell target at $229.65, slightly below a past point of resistance. Additionally, I do not plan to add to my position unless it sells off significantly to my buy price target at $63.90, a key point of support from not that long ago, actually, in June 2020.

If my position wasn’t entirely operating on profits, I’m even sure if I would remain an investor in Tesla until Elon gets his act together; the situation is truly that bad.

TSLA closed the week at $194.86 up +2.42% from where I took profits Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.