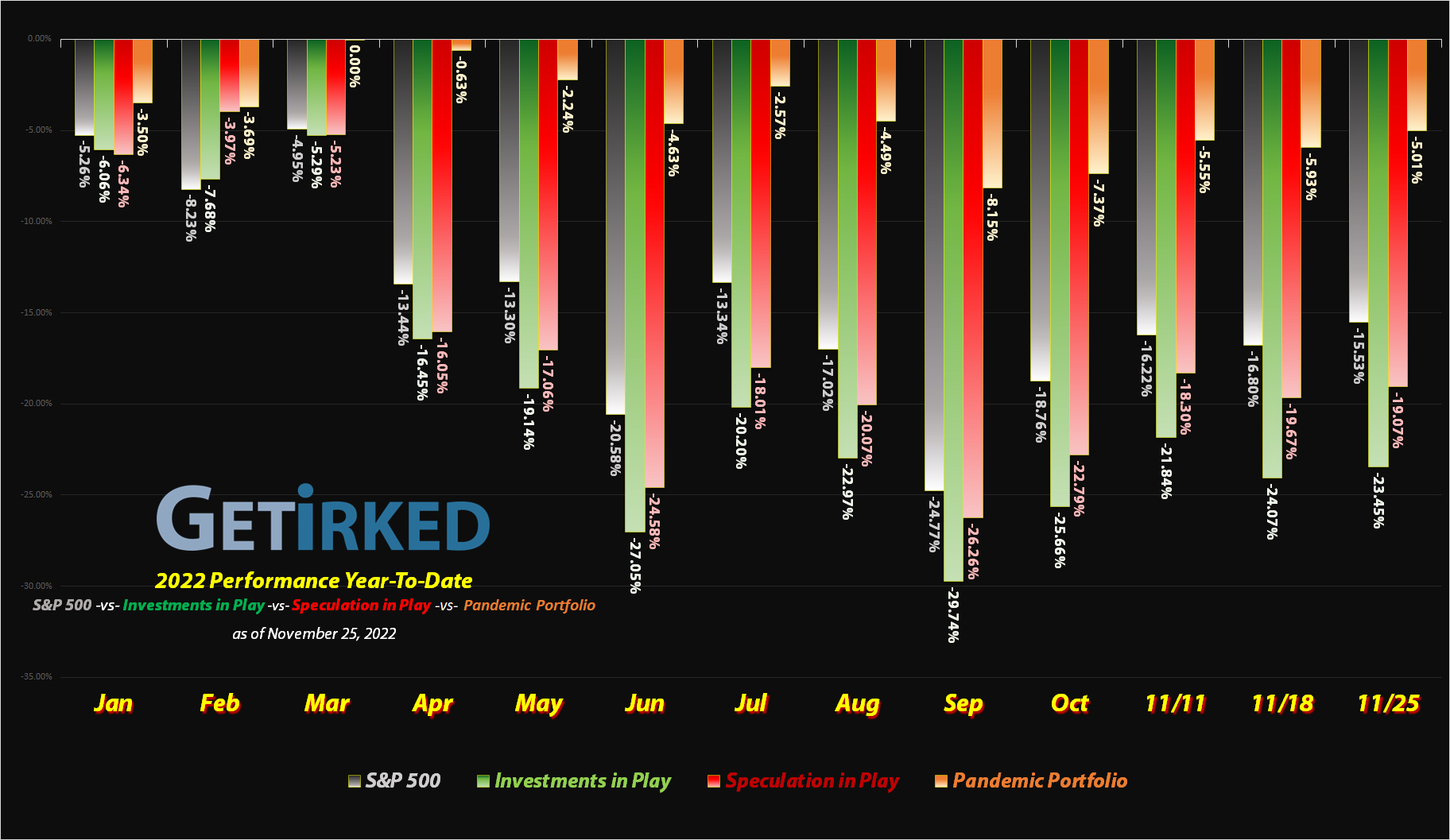

November 25, 2022

The Week’s Biggest Winner & Loser

Disney (DIS)

Nobody wants to think a company is cheering when you leave, but publicly-traded companies sometimes do just that. This week, (now ex-)CEO Bob Chapek got the boot from Disney (DIS) Sunday night with the Board of Directors reinstating Bob Iger, Chapek’s predecessor, as the new CEO for the company. The market apparently fully agreed with the Board’s punting of Chapek, causing Disney’s stock to rocket +7.30% and finishing the week as the Biggest Winner.

SoFi Technologies (SOFI)

SoFi Technologies (SOFI), newly added to the portfolio this week, dropped on the back of announcing that the company had some exposure in its cryptocurrency unit to the recent collapse of FTX, the behemoth taken down by its lunatic ex-CEO and professional moron, Sam Bankman-Fried. SOFI dropped -11.20% this week alone on the back of an already terrible year, earning itself the spot of the Week’s Biggest Loser, but also earning its spot in the portfolio (learn more below).

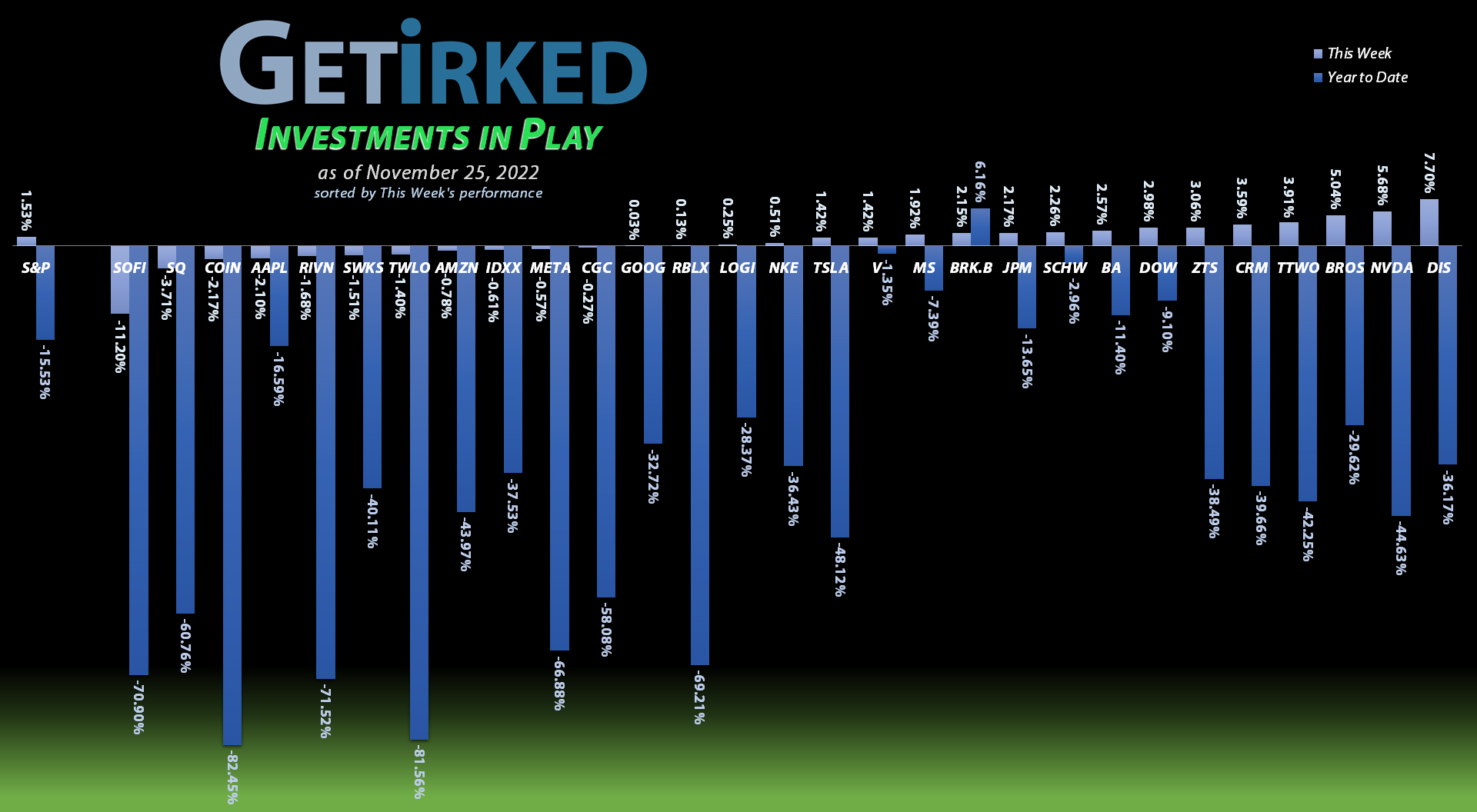

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

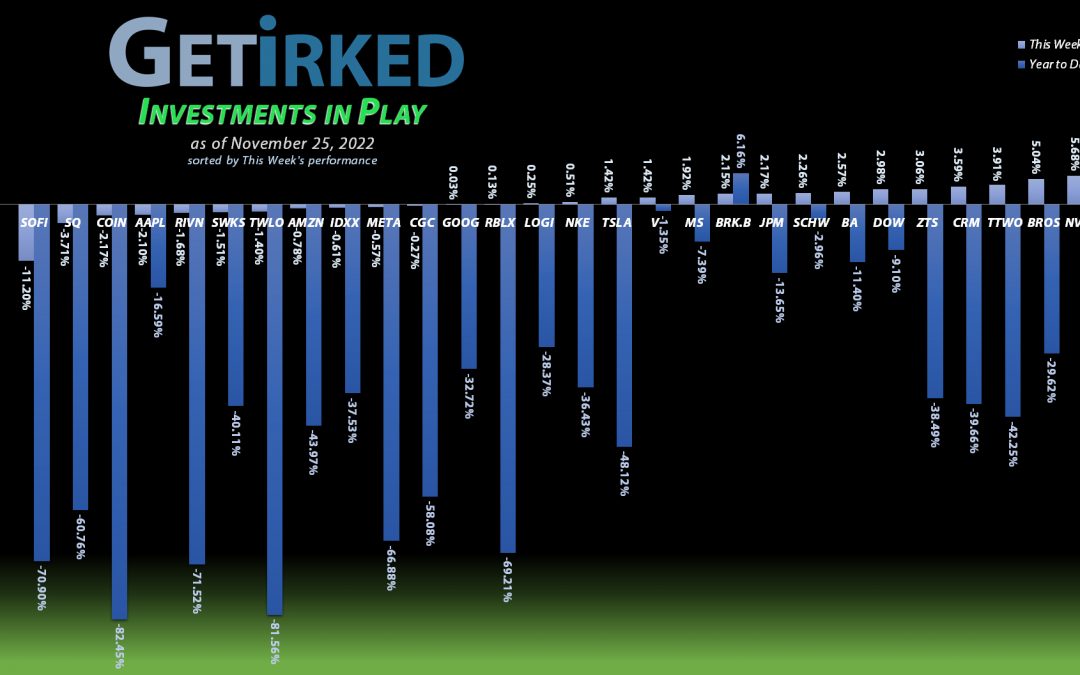

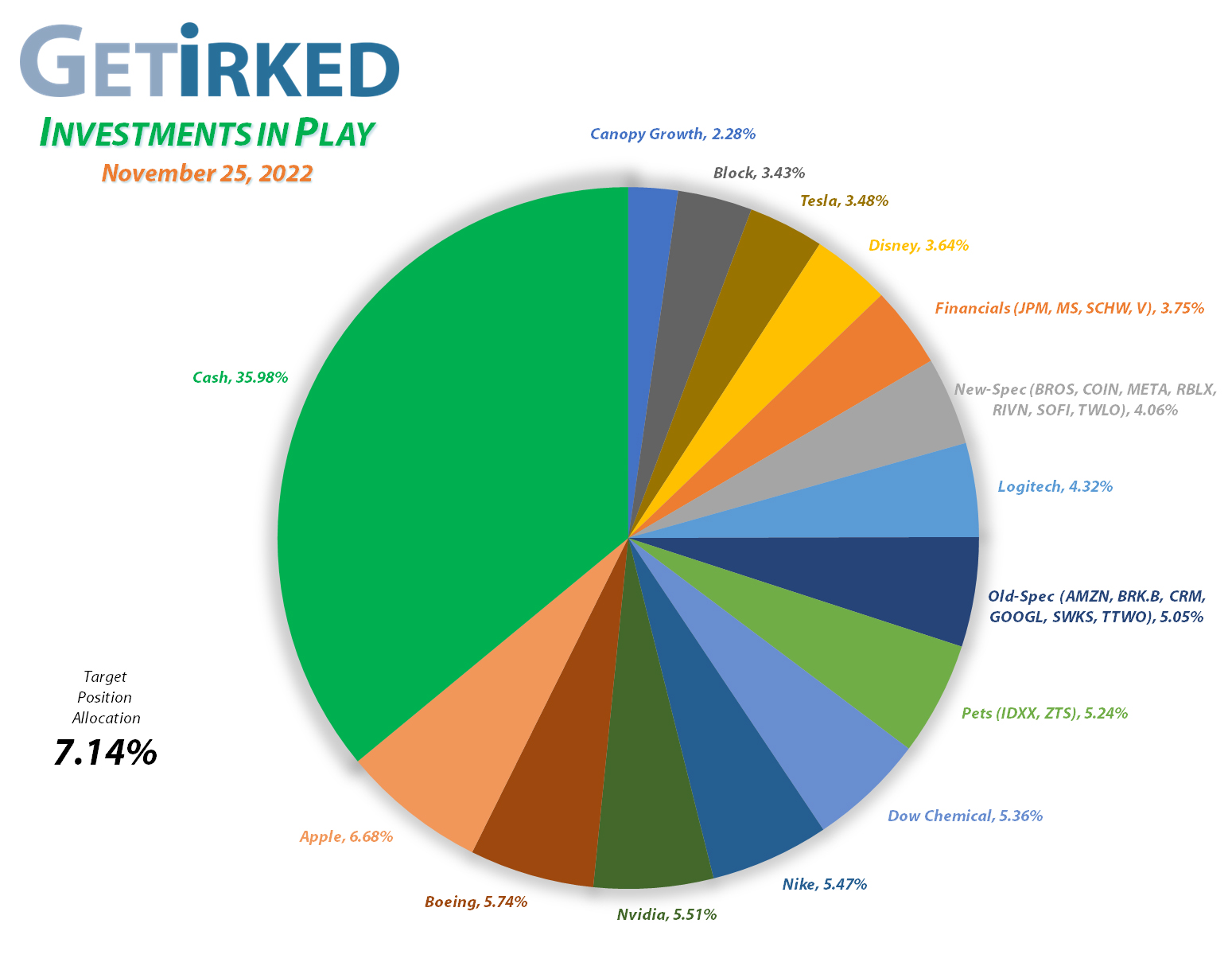

Current Position Performance

Apple (AAPL)

+812.40%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.81)*

Boeing (BA)

+625.85%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$162.30)*

Nvidia (NVDA)

+617.85%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$5.75)*

Block (SQ)

+511.60%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Tesla (TSLA)

+488.89%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$26.14)*

Nike (NKE)

+411.95%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.70)*

Logitech (LOGI)

+404.41%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $11.71

IDEXX Labs (IDXX)

+382.71%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$112.25)*

Skyworks (SWKS)

+329.84%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$20.20)*

Disney (DIS)

+224.83%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+102.44%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $67.55

Berkshire (BRK.B)

+69.14%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Dow (DOW)

+57.92%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $32.65

Meta (META)

+54.42%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Salesforce (CRM)

+33.72%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Take Two (TTWO)

+32.23%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $77.61

Amazon (AMZN)

+29.38%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $72.20

Morgan Stan (MS)

+25.79%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $72.27

Visa (V)

+22.17%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $175.00

Schwab (SCHW)

+13.98%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $71.60

Alphabet (GOOGL)

+0.53%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Zoetis (ZTS)

-0.20%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $150.40

Dutch Bros (BROS)

-2.02%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $36.60

SoFi (SOFI)

-4.17%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.80

Roblox (RLBX)

-30.99%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.05

Canopy (CGC)

-34.86%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.62

Twilio (TWLO)

-49.03%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Rivian (RIVN)

-50.29%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Coinbase (COIN)

-77.49%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $196.75

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Coinbase (COIN): Added to Position

With no end to Crypto Collapse in Bitcoin and its brethren, Coinbase (COIN) resumed its selloff this week, testing its 2022 lows on Monday where my next buy order filled at $40.88, lowering my per-share cost -7.34% from $212.34 to $196.75.

I feel like I need to iterate this point every time I do something with Coinbase – I am risking a tiny amount of money in this position, and I am prepared to lose everything I put into this investment as I believe it is that risky.

However, even though it feels like I’m throwing good money after bad to a certain extent, there is the possibility that Coinbase recovers to become the leading crypto brokerage. That slim possibility is why I’m willing to keep adding to my position in incredibly small quantities.

From here, my next buy target is $31.75, a key point of support both psychologically and using Fibonacci Retracement methodology, and my next sell target is around $205.00, COIN’s high from 2022 (which is miles and miles away from here).

COIN closed the week at $44.28, up +8.32% from where I added Monday.

SoFi Technologies (SOFI): *New Position*

I know it may seem strange for me to add a new position in the middle of a holiday week, but SoFi Technologies (SOFI) has become too interesting for me to ignore. SoFi originally started its life as an education loan provider by consolidating student loans before expanding into banking services, investments, and even crypto.

Did you catch that last one? Crypto? Yeah. That’s giving them some trouble right now.

Despite coming out and explaining that the company has no exposure to the FTX cataclysmic collapse, investors are in a very “shoot first, ask questions later,” kind of mode right now, so combine crypto with SoFi’s focus on being financial technology (called “fintech”) and you’ve got another new IPO of the pandemic which has got decimated this year (down nearly -70% YTD as I write this).

The catch here is that SoFi actually has excellent leadership. CEO Anthony Noto has a long history of creating amazing companies that perform well, so my thinking is that if SoFi survives (note that key word “if”), it could perform well over the long term.

Due to the absolute volatility of this position and positions like it, SoFi takes its place… as a speculative investment… in the portfolio and has been rolled into the New Specs Basket along with some of the other big losers this year (think: Coinbase (COIN), Meta Platforms (META), Roblox (RBLX), Rivian (RIVN), and Twilio (TWLO)).

My first buy went through on Tuesday at $4.80, very close to SoFi’s all-time low at $4.77. However, I’m starting small with a 25% allocation, and my next buy target is $4.10, a price calculated using the Fibonacci Retracement method. My next sell target (yes, I already have a sell target in case SOFI bounces) is $6.00, below its recent high from just last week where I’ll take a small amount of profit.

SOFI closed the week at $4.60, down -4.17% from where I opened it Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.