November 11, 2022

The Week’s Biggest Winner & Loser

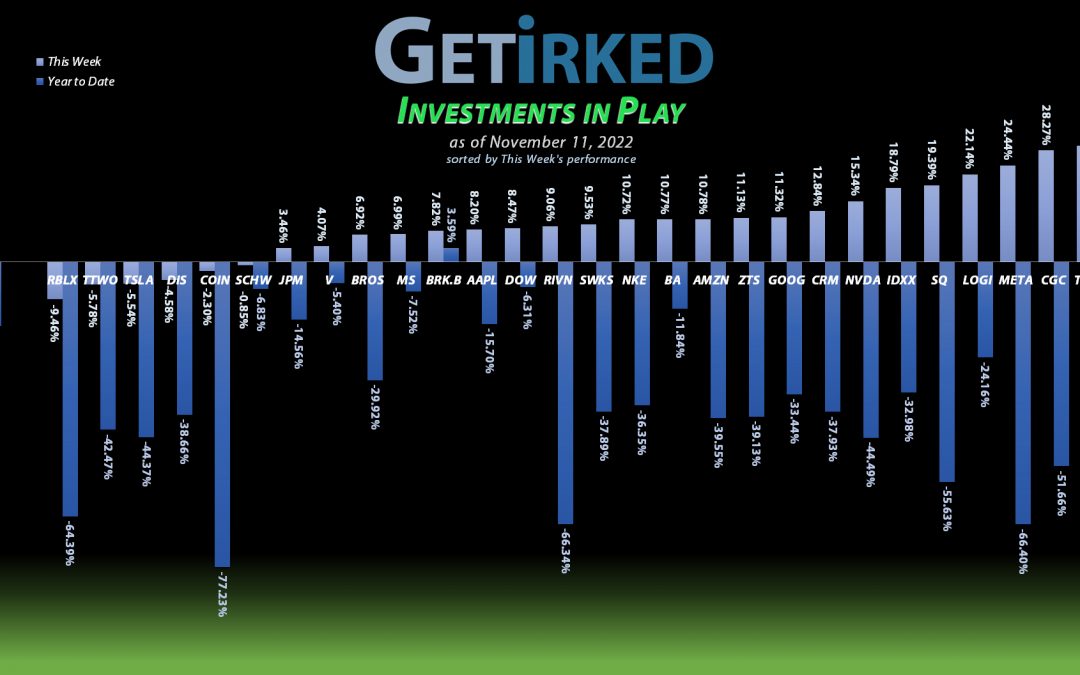

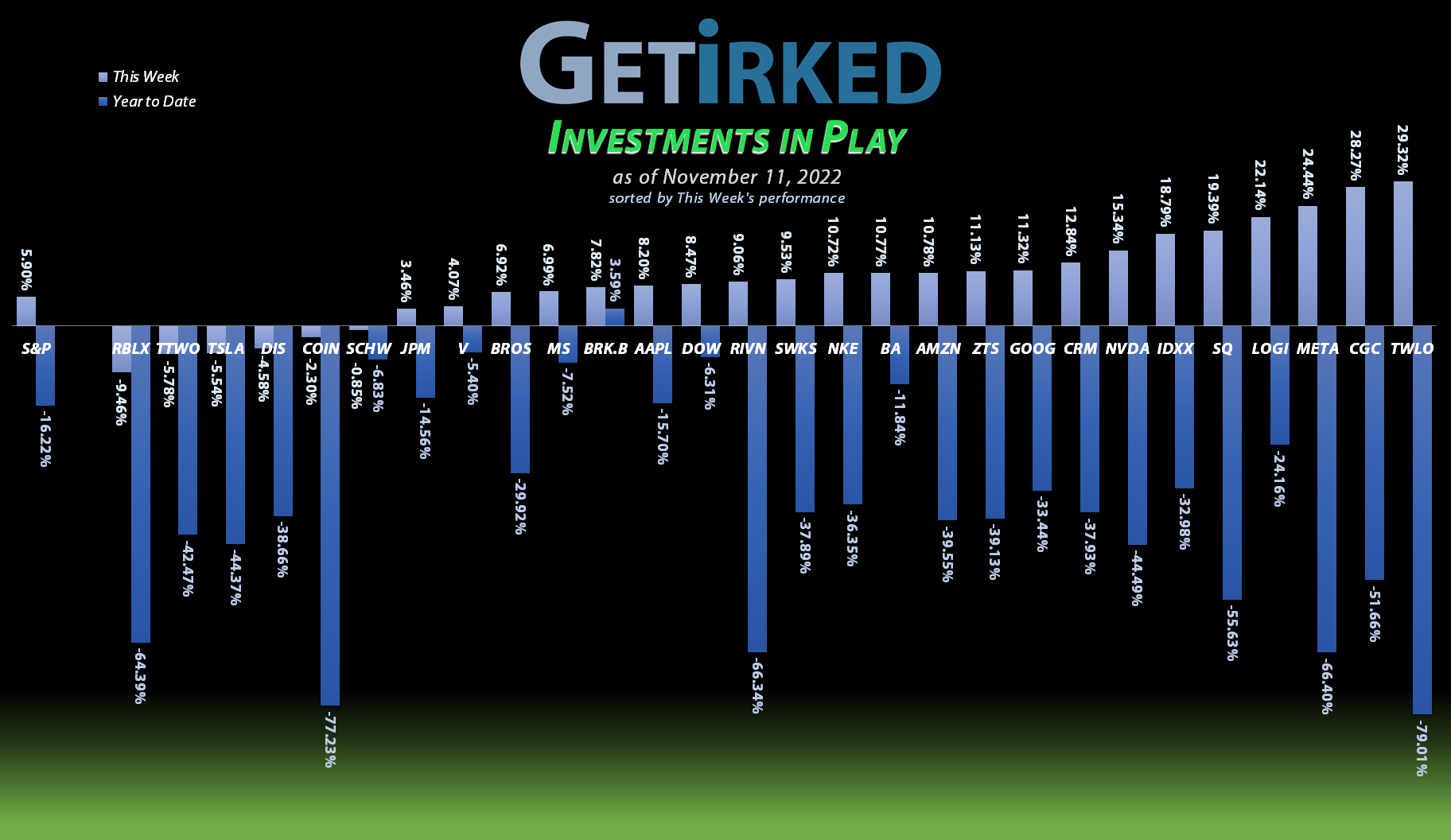

Twilio (TWLO)

Sometimes, the Week’s Biggest Winner isn’t actually the best-performing stock, it’s the stock that was the most oversold in the portfolio seeing a huge bounce off its lows when the market rallies.

This week, that stock was Twilio (TWLO), which jumped +29.32% this week after being particularly brutalized throughout 2022. Even after this week’s jump, the stock is still down an epic -79.01% Year-To-Date (YTD)… ouch!

Roblox (RBLX)

Once a metaverse-darling, Roblox (RBLX) continues to struggle quarter-after-quarter, reporting weak earnings with even weaker guidance for the remainder of 2022. The result was Roblox becoming this Week’s Biggest Loser, dropping -9.46% when almost the rest of the market rallied.

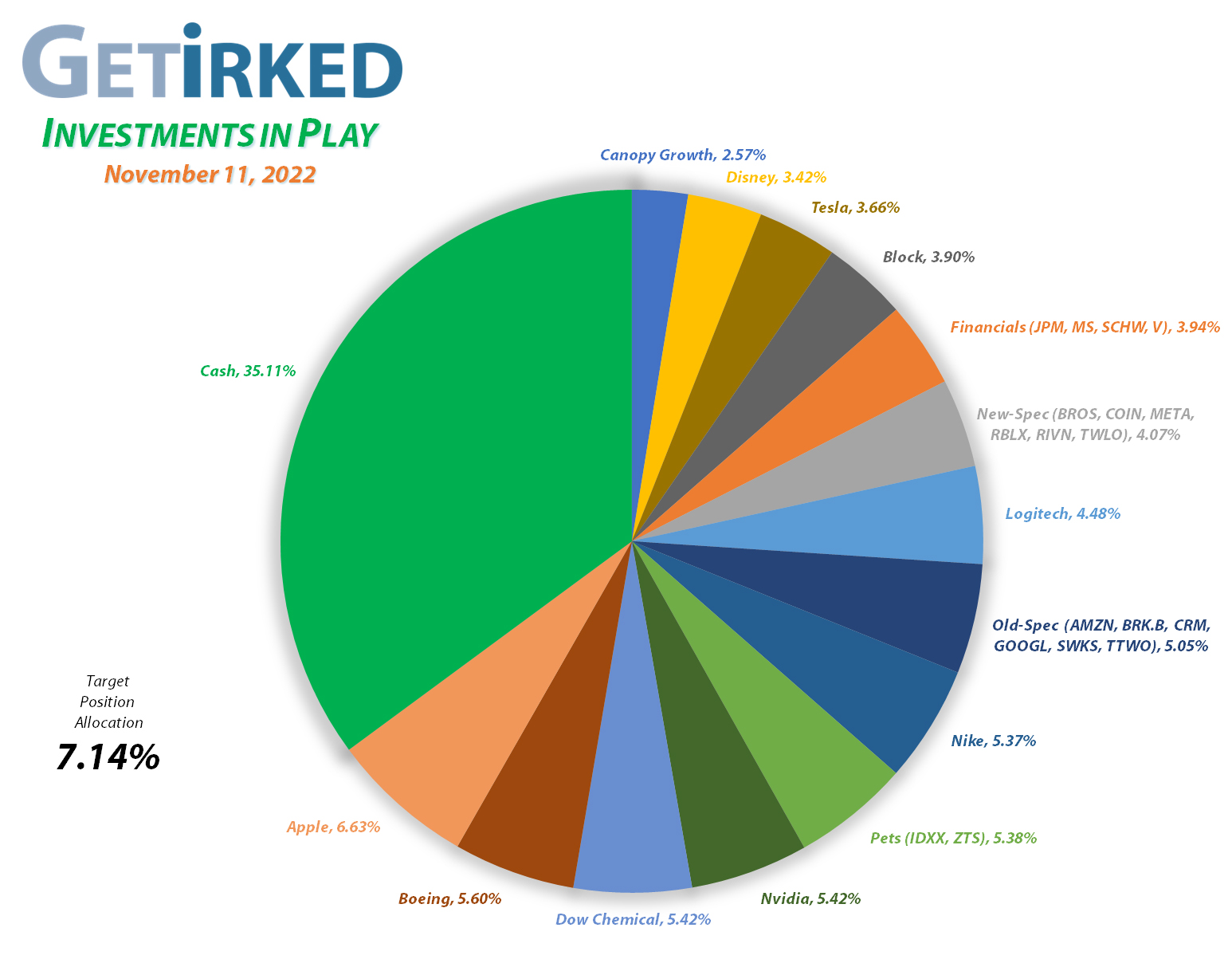

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

Current Position Performance

Apple (AAPL)

+819.49%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.81)*

Boeing (BA)

+624.25%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$162.30)*

Nvidia (NVDA)

+619.94%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$5.75)*

Block (SQ)

+542.16%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.45)*

Tesla (TSLA)

+519.55%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$26.14)*

Logitech (LOGI)

+434.04%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $11.71

Nike (NKE)

+412.50%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.70)*

IDEXX Labs (IDXX)

+404.57%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$112.25)*

Skyworks (SWKS)

+342.91%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$20.20)*

Disney (DIS)

+212.02%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+86.80%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $72.43

Berkshire (BRK.B)

+64.94%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Dow (DOW)

+62.82%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $32.65

Meta (META)

+54.91%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Amazon (AMZN)

+39.60%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $72.20

Salesforce (CRM)

+37.46%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Take Two (TTWO)

+31.74%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $77.61

Morgan Stan (MS)

+18.28%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $76.75

Visa (V)

+17.14%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $175.00

Schwab (SCHW)

+9.44%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $71.60

Alphabet (GOOGL)

-0.56%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Zoetis (ZTS)

-1.23%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $150.40

Dutch Bros (BROS)

-2.51%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $36.60

Roblox (RLBX)

-20.22%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.05

Canopy (CGC)

-24.89%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.62

Rivian (RIVN)

-41.25%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Twilio (TWLO)

-42.03%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Coinbase (COIN)

-72.94%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Amazon (AMZN): Added to Position

Amazon (AMZN) continued to make new lows during Wednesday’s post-election selloff, triggering my next buy order which filled at $85.97. The buy raised my per-share cost +4.87% from $68.85 to $72.20, now bringing it higher than my first buy at $69.15 back on February 6, 2018 (I hate buying up my cost basis, but I want a bigger position in Amazon and there’s no way to no how low it can feasibly go).

From here, my next buy target is $74.35, above a key point of support from the past, and my next sell target is $146.25, below AMZN’s high from its high from earlier in 2022.

AMZN closed the week at $100.79, up +17.24% from where I added Wednesday.

Dow (DOW): Profit-Taking

The market’s explosive late-week rally following a weaker-than-expected CPI inflation report sent every sector higher, including Dow (DOW), which flew through my next sell target on Friday with a sale filling at $51.29. The sale lowered my per-share cost -0.79% from $32.91 to $32.65.

While I am still a long-term believer in DOW’s story, this position, believe it or not, holds the most actual investment capital than any position in the portfolio, despite not being the largest. Bigger positions like Apple (AAPL) and Boeing (BA) have had so much profit taken out of them over the years that they quite literally have no investment capital in them… at all.

While Dow has been a good performer, I have been too hesitant to take profits in the position when it keeps nearing its all-time high around $72, so I have decided to start aggressively taking profits while it rises by selling some of the shares I have earned from the company’s ample 5%+ dividend yield. Should DOW make another stab at its all-time high, I will remove all of the remaining capital, despite the stock not exceeding the allocation size for the portfolio.

From here, my next sell target is $57.20, near a past point of resistance, and my next buy target is $31.45, below my per-share cost and above a past point of support.

DOW closed the week at $53.16, up +3.65% from where I took profits Friday.

IDEXX Laboratories (IDXX): Profit-Taking

When the market exploded to the upside on Thursday, IDEXX Laboratories (IDXX) rocketed through my next sell target with the order filling at $406.89. The sale locked in +5.16% in gains on shares I bought for $386.92 back on May 4, and lowered my per-share “cost” -$72.68 from -$39.57 to -$112.25 (a negative per-share cost indicates all capital has been removed in addition to $112.25 per share added to the portfolio’s bottom line in addition to each share’s current value).

While IDEXX is nowhere near its all-time high at $706.95, since it now shares a basket allocation with Zoetis (ZTS), it had become overweight in the basket (meaning IDXX was occupying more than 50% of the basket’s total allocation). Combine that with the fact that I think the market over-reacted to the CPI report, and it was time to take profits.

From here, my next sell target is just below a point of key resistance at $553.00 and my next buy target is $320.90, just above IDXX’s 2022 low.

IDXX closed the week at $441.27, up +8.45% from where I took profits Thursday.

Logitech (LOGI): Profit-Taking

The market’s love for technology and Logitech (LOGI) took off on Thursday but didn’t stop on Friday, sending LOGI through my next sell target which filled at $61.15. The sale locked in +20.02% in gains on shares I bought for $50.95 back on August 26 and lowered my per-share cost -7.65% from $12.68 to $11.71.

From here, my next sell target is $78.50, under a past point of resistance, and my next buy target is right around LOGI’s 2022 bottom at $41.70.

LOGI closed the week at $62.55, up +2.29% from where I took profits Friday.

Nike (NKE): Profit-Taking

The stupendous market rally sent Nike’s (NKE) stock flying, triggering my next sell order which filled at $106.31 on Friday. The sale locked in +26.98% in gains on shares I bought less than two months ago for $83.72 on September 30, and lowered my per-share “cost” -$3.11 from -$3.59 to -$6.70 (a negative per-share cost indicates all capital has been removed in addition to $6.70 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $139.10, below a past point of resistance, and my next buy target is $82.25, right above NKE’s low for 2022.

NKE closed the week at $106.09, down -0.21% from where I took profits Friday.

Take Two Interactive (TTWO): Added to Position

Take Two Interactive (TTWO) reported a disappointing quarter Monday with even more disappointing forward guidance, which, truthfully, should have come as a surprise to no one seeing as how the company hasn’t released a significant tentpole game in a few years at this point.

Regardless, the stock plummeted nearly -20% during after-hours trading and triggered my next buy order in early morning trading with a fill at $91.72, locking in a -24.36% discount replacing shares I sold for $121.26 back on December 3, 2019. The buy order raised my per-share cost +2.66% from $75.60 to $77.61, still a -39.55% total price reduction from my first buy at $128.40 on October 9, 2018.

From here, my next buy target is $84.55, above TTWO’s low in 2018 (which is significantly lower than its pandemic bottom at $100.00), and my next sell target is around $175.00, a key point of resistance.

TTWO closed the week at $102.25, up +11.48% from where I added Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.