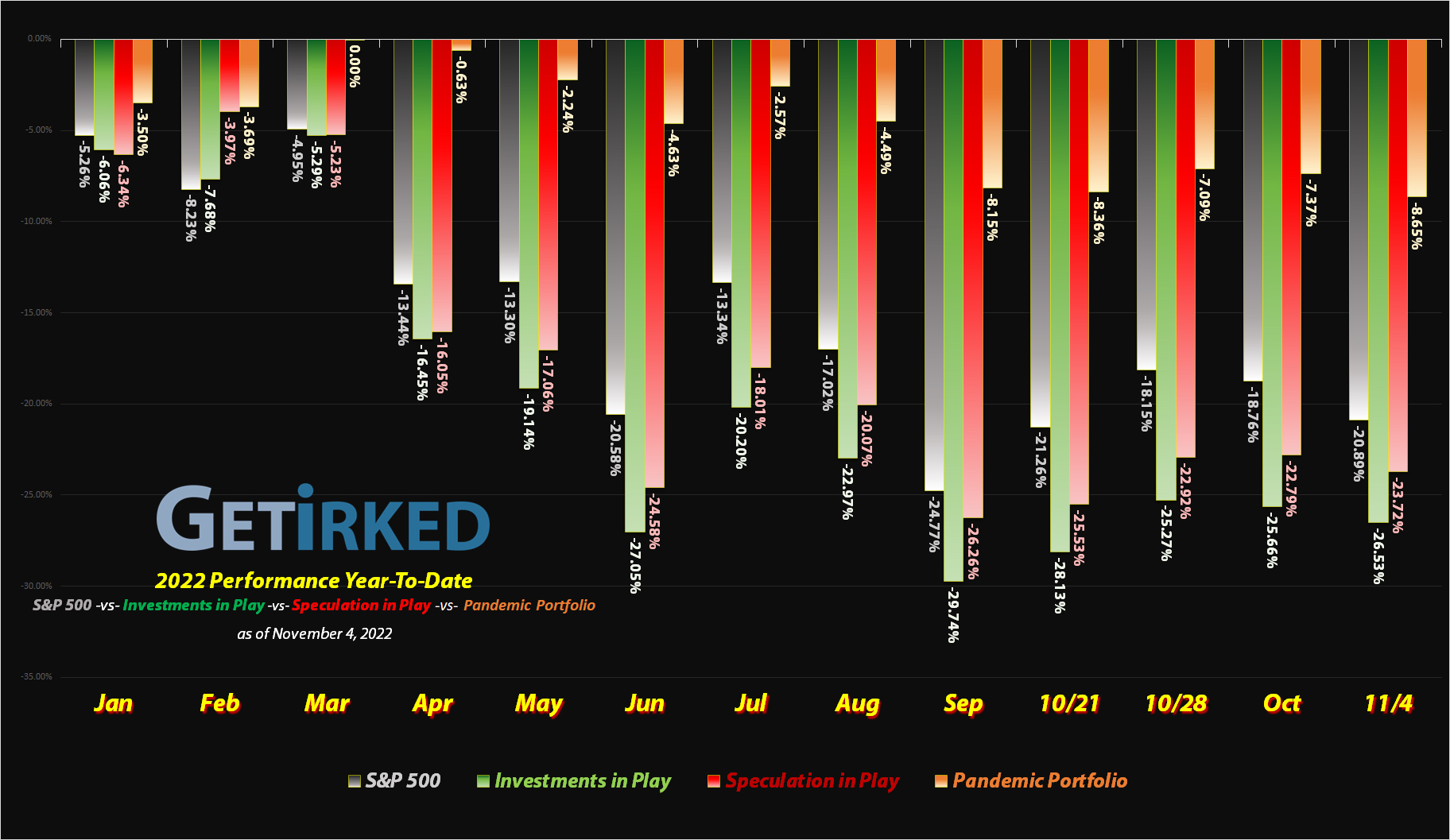

November 4, 2022

The Week’s Biggest Winner & Loser

Boeing (BA)

Boeing (BA) finally showed signs of life this week when the company announced it would be increasing aircraft production in order to meet customer demand. As a result, the stock popped +11.40% in an otherwise dismal week, easily earning the behemoth the spot of the Week’s Biggest Winner.

Twilio (TWLO)

There are bad earnings reports, and then there’s the giant, pea-green, elephant-sized turd-monkey that Twilio (TWLO) dumped in the middle of the floor on Thursday.

The report was so bad that it caused the stock, already down –85.53% from its all-time high to drop an additional -43.47% this week.

Please let this be the worst earnings report I ever see in my life because I don’t know how they could be much worse than that.

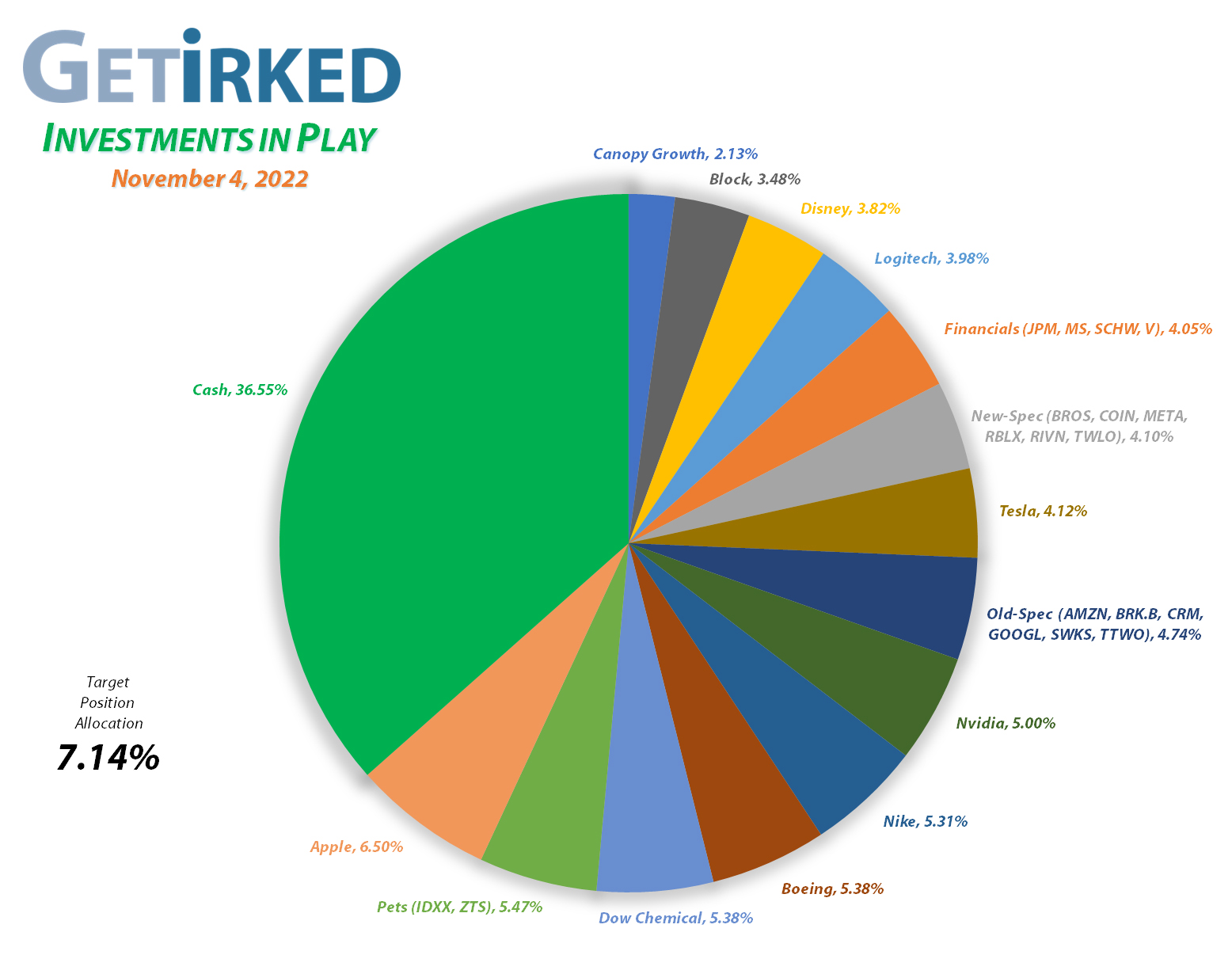

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

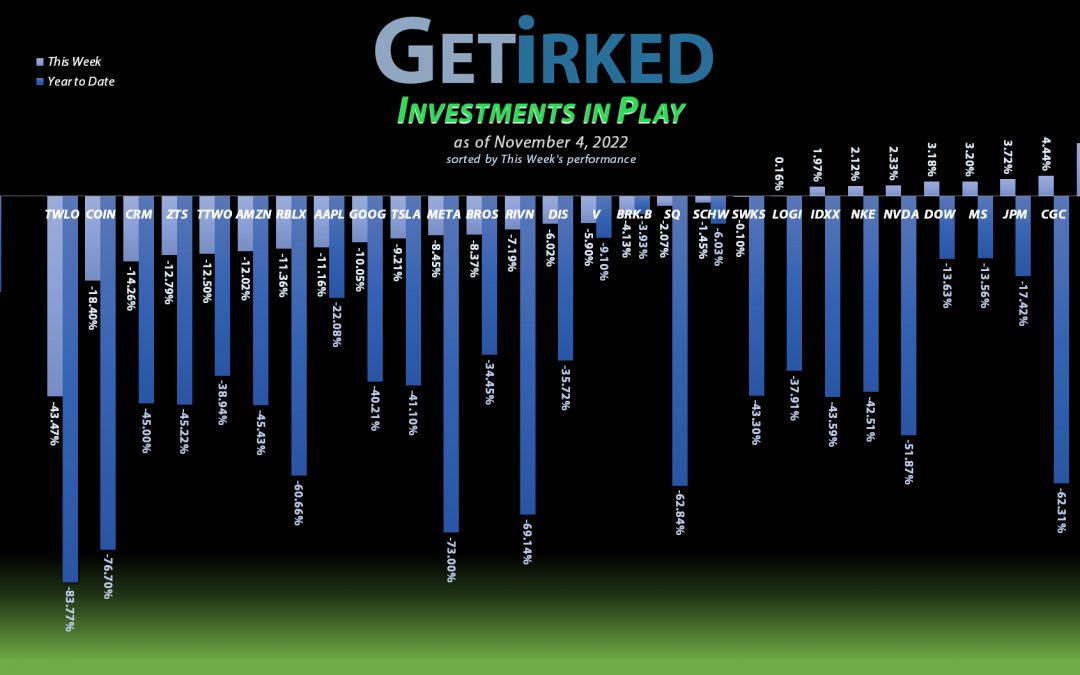

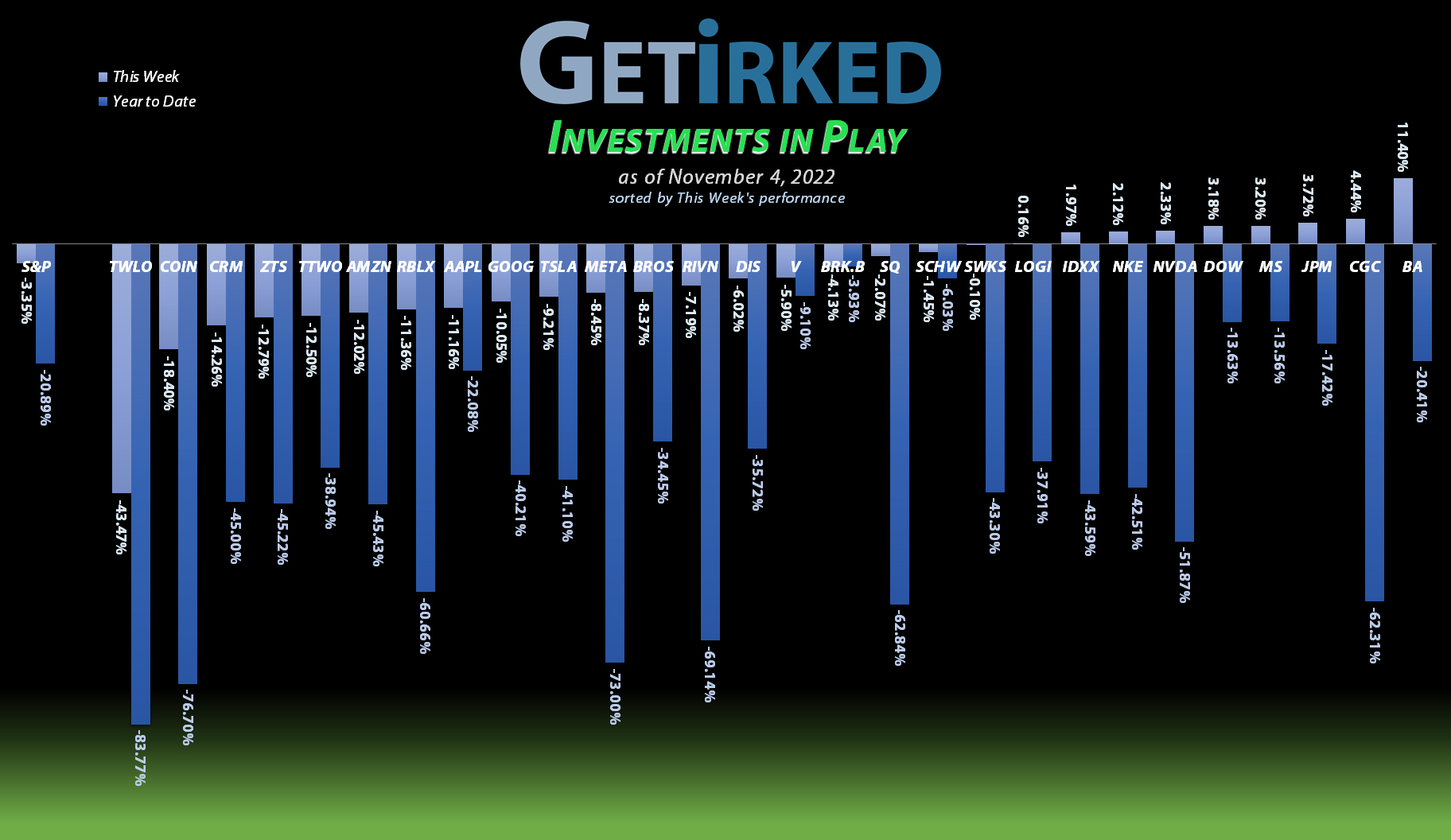

Current Position Performance

Apple (AAPL)

+774.51%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.91)*

Boeing (BA)

+592.56%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$162.30)*

Tesla (TSLA)

+546.22%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$26.14)*

Nvidia (NVDA)

+540.97%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$5.75)*

Block (SQ)

+498.07%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.45)*

Nike (NKE)

+373.85%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$3.59)*

IDEXX Labs (IDXX)

+349.34%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Skyworks (SWKS)

+311.06%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$20.20)*

Logitech (LOGI)

+303.80%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $12.68

Disney (DIS)

+227.00%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+80.55%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $72.43

Berkshire (BRK.B)

+52.99%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Dow (DOW)

+48.87%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $32.91

Meta (META)

+48.05%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Take Two (TTWO)

+43.55%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Amazon (AMZN)

+32.14%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $68.85

Salesforce (CRM)

+21.81%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Visa (V)

+12.58%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $175.00

Morgan Stan (MS)

+10.55%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $76.75

Schwab (SCHW)

+10.38%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $71.60

Dutch Bros (BROS)

-8.83%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $36.60

Alphabet (GOOGL)

-10.67%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Zoetis (ZTS)

-11.13%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $150.40

Roblox (RLBX)

-11.88%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.05

Canopy (CGC)

-41.44%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.62

Rivian (RIVN)

-46.13%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Twilio (TWLO)

-55.18%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Coinbase (COIN)

-72.30%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Alphabet (GOOGL): Added to Position

Alphabet’s (GOOGL) precarious selloff continued this week following the Fed’s hawkish comments on Wednesday, with the stock triggering my next buy order on Thursday which filled at $85.10.

The buy lowered my per-share cost -2.96% from $99.91 to $96.95. From here, my next buy target is $77.75, above a past point of support, and my next sell target is $137.75, below a past point of resistance and near a key Fibonacci Retracement level.

GOOGL closed the week at $86.61, up +1.77% from where I added Thursday.

Boeing (BA): Profit-Taking

Boeing’s (BA) stock really took off this week (pun very much intended) after announcing it would be substantially increasing airline production, resulting in the stock triggering my next sell target which filled on Friday at $158.60.

The sale locked in +34.52% in gains on shares I bought for $117.90 on May 20, 2022 and lowered my per-share “cost” -9.40% from -$148.35 to -$162.30 (a negative per-share cost indicates all capital has been removed in addition to $162.30 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $195.85, below a past point of resistance, and my next buy target is $113.75, just above Boeing’s 2022 low.

BA closed the week at $160.24, up +1.03% from where I took profits Friday.

JPMorgan (JPM): Dividend Reinvestment

JPMorgan (JPM) paid out its quarterly dividend on Monday, which, after reinvestment, lowered my per-share cost -0.85% from $73.05 to $72.43. I find dividends to be a nearly effortless method to increase my holdings without fearing I’m buying at the wrong time (even though dividends are paid out regardless of how overbought or oversold a stock is).

After the payout, my new buy target for JPM is $95.20, above a past point of support, and my next sell target is $142.80, below a key area of resistance from the past.

Meta Platforms (META): Portfolio Adjustment

A few readers have reached out to ask me why I haven’t added to my Meta Platforms (META) given its epic fall from grace with one bad quarter after another, which prompted me to rethink how I had META positioned in the portfolio entirely.

Despite being a relatively older company compared to some of the speculative positions in the New Spec Basket, CEO Mark Zuckerberg’s laser-focused intention to blow billions of dollars creating a nonexistant “metaverse” out of thin air has prompted me to rethink META entirely – this is no longer a reliable social media company with a consistent growth model, META most certainly belongs in the New Spec Basket, so starting with this update, it has been relocated.

As for why my next buy price target (way down at $73.70) is so low, I have a number of reasons for this:

- Even though META is down more than 70% from its all-time high, I think the combination of the market’s hatred for the stock and a potential economic headwind in the next year means META might see a lot more downside.

- This position is made up entirely of profits I took investing in Meta (then Facebook (FB)) back in 2017-2018. I will not put any capital in this position which means I’m limited to using only the profits I have to add to it. Accordingly, my buying levels are dramatically far from each other in order to account for potential epic selloffs in the stock.

So, there you have it. Going forward, META will now be listed in the allocation charts as part of the New Spec Basket, no longer representing the more stable companies currently residing in the Old Spec Basket.

Morgan Stanley (MS): Profit-Taking

It was time for more profit-taking when Morgan Stanley (MS) popped on the market’s interpretation that the Federal Reserve would be easing on its rate-tightening cycle on Wednesday prior to Chair Jerome Powell’s hawkish press conference, triggering a sell order which filled at $85.57.

The sale locked in +11.20% in gains on shares I bought for $76.95 on May 12 and lowered my per-share cost -1.85% from $78.20 to $76.75.

From here, my next sell price target is $92.15, below MS’s rally high in August, and my next buy target is $74.95, above its recent selloff low in October.

MS closed the week at $84.85, down -0.84% from where I took profits Wednesday.

Twilio (TWLO): Added to Position x 2

The market’s hatred for all things new-tech continued this week after Twilio (TWLO) reported an absolutely dismal quarter Thursday evening and the market destroyed the stock on Friday, sending it down nearly -40% on a day when the market was up.

The stock dropped so far that it plummeted through not one, but two of my buy targets with the first filling at $48.50 and the second filling at $41.52, giving me an average buy price of $45.01.

The buys locked in an astounding -62.28% discount on shares I sold for $119.32 back on January 11, 2020 and lowered my per-share cost -13.10% from $109.73 to $95.35.

From here, my next buy target is $35.85, above a past point of support from a time long, long ago, and my next sell target is $148.15, below a previous all-time high and point of resistance.

TWLO closed the week at $42.74, down -5.04% from my Friday’s average buy price.

Zoetis (ZTS): Added to Position

Zoetis (ZTS) sold off in a cataclysmic fashion on Thursday after missing earnings and giving poor forward guidance Wednesday night, triggering my next buy order which filled at $124.51 during Thursday trading.

The buy lowered my per-share cost -2.79% from $154.71 to $150.40, and, from here, my next buy price target is $107.55, above a past level of support, and my next sell target is $161.55, just below resistance recently seen over the past few months.

ZTS closed the week at $133.66, up +7.35% from where I added Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.