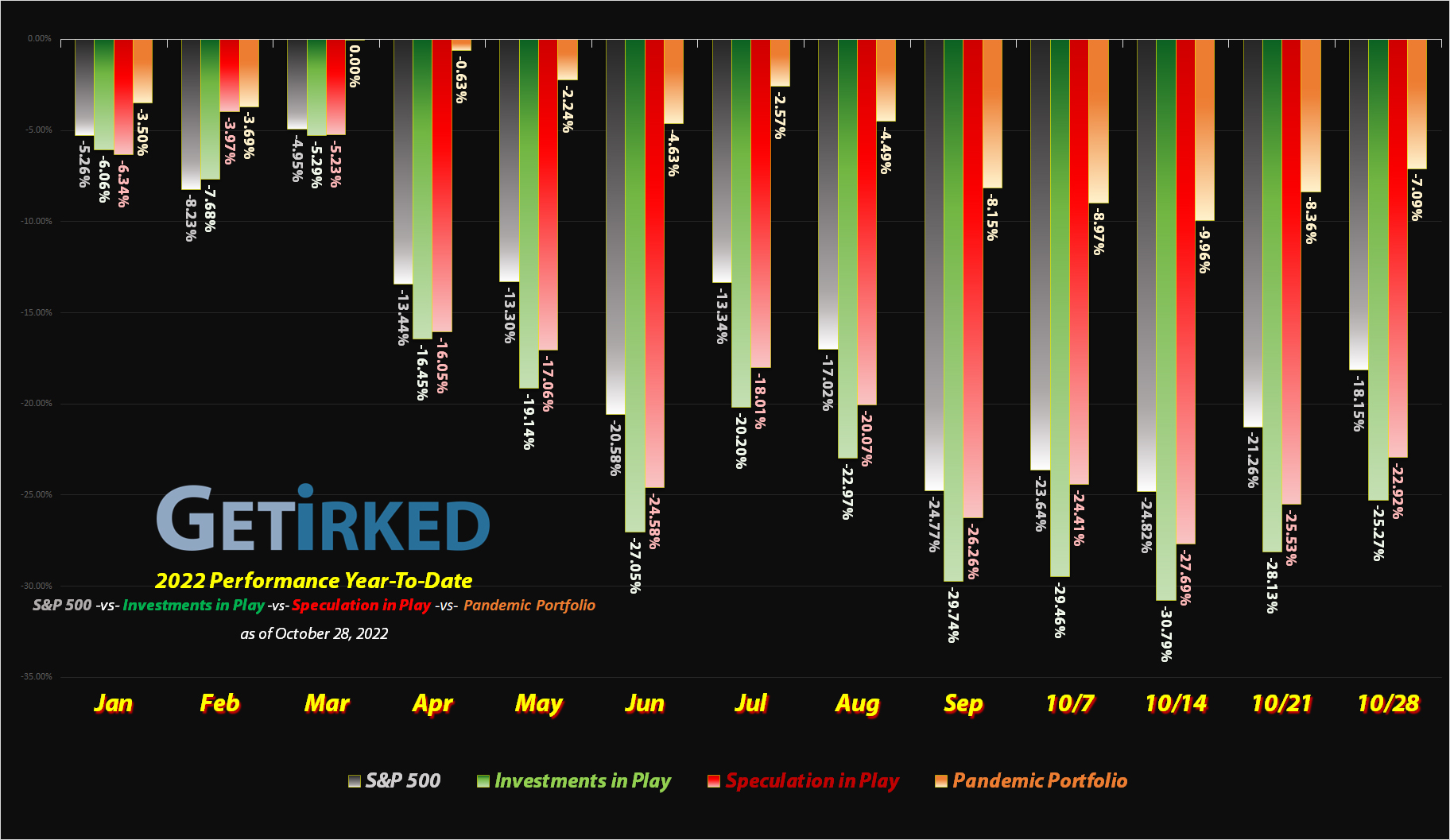

October 28, 2022

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

It’s funny what happens when your company and sector has been oversold for years, and then you do something like organize all of your American assets into a single holding company, revitalizing your firm while preparing for near limitless upside, right? Enter Canopy Growth Corp (CGC), rocking it this week for an insane +32.35% gain to cement itself as the Week’s Biggest Winner.

Meta Networks (META)

It’s bad enough to report poor earnings because your company’s in a cyclical downturn in advertising, but when you announce that you’ve already spent BILLIONS on some crazy metaverse dream you had and that you’re not going to stop spending until the end of time, well, that’s not good for anyone. Chalk it up to Mark Zuckerberg, though, as he’s either going to be right about this whole Ready Player One dream or he’s going to take Meta down with him. META dropped -23.70% this week alone, bringing it’s YTD total to -70.51%. Positively insane and certainly throwing it to the wolves of the Week’s Biggest Loser.

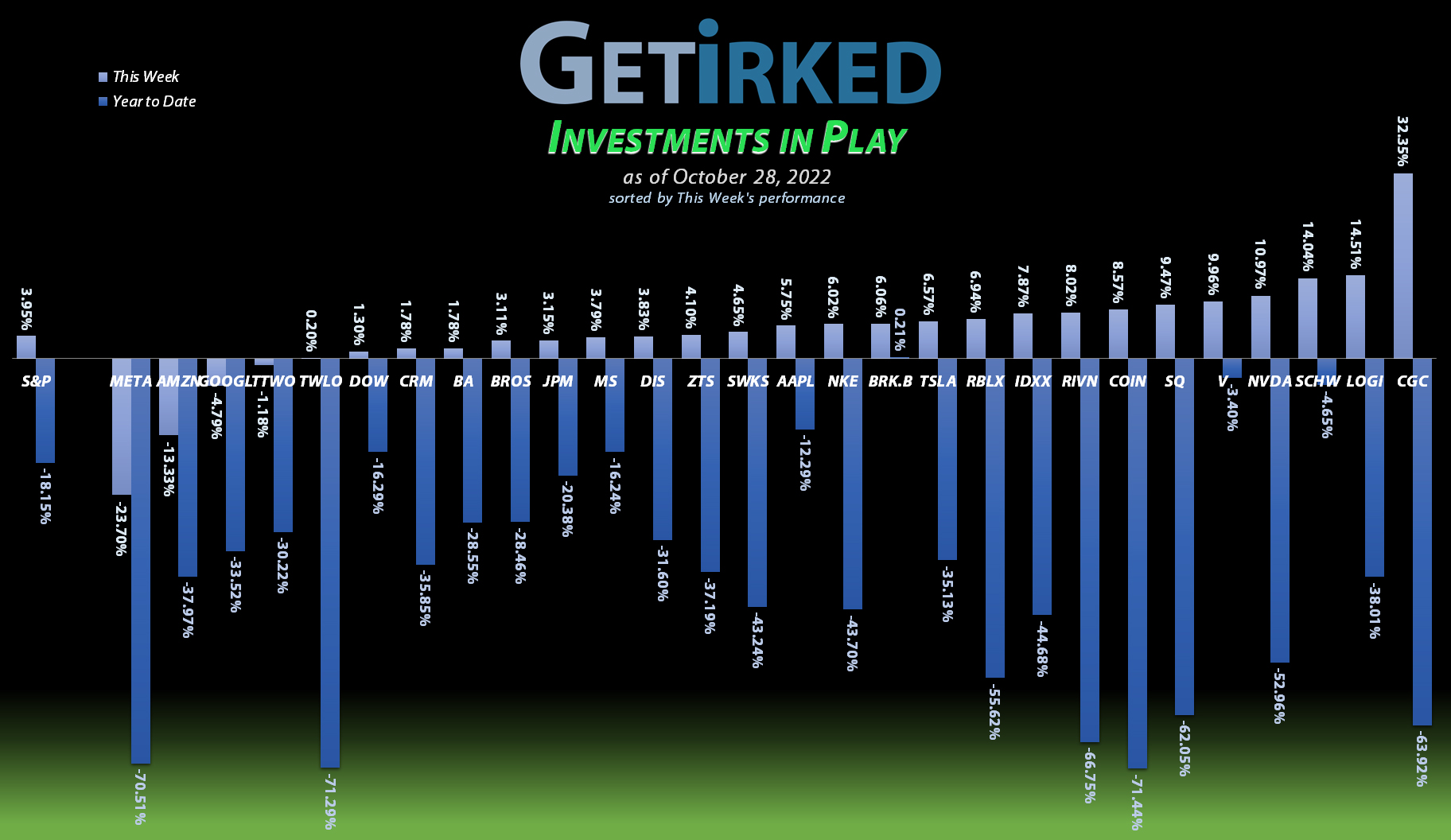

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

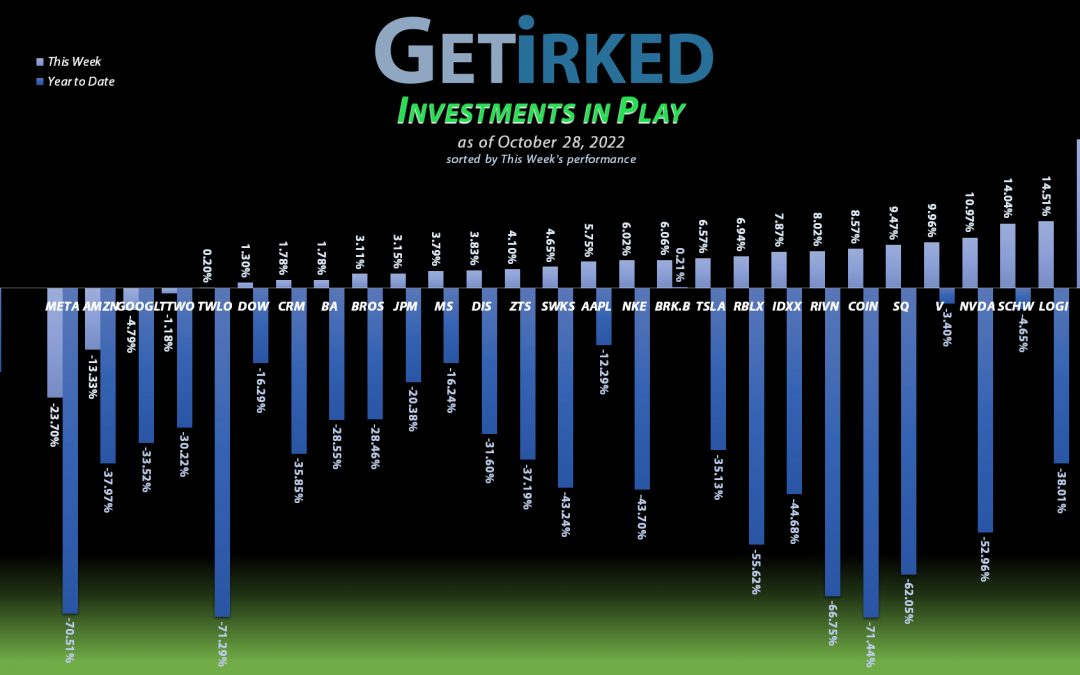

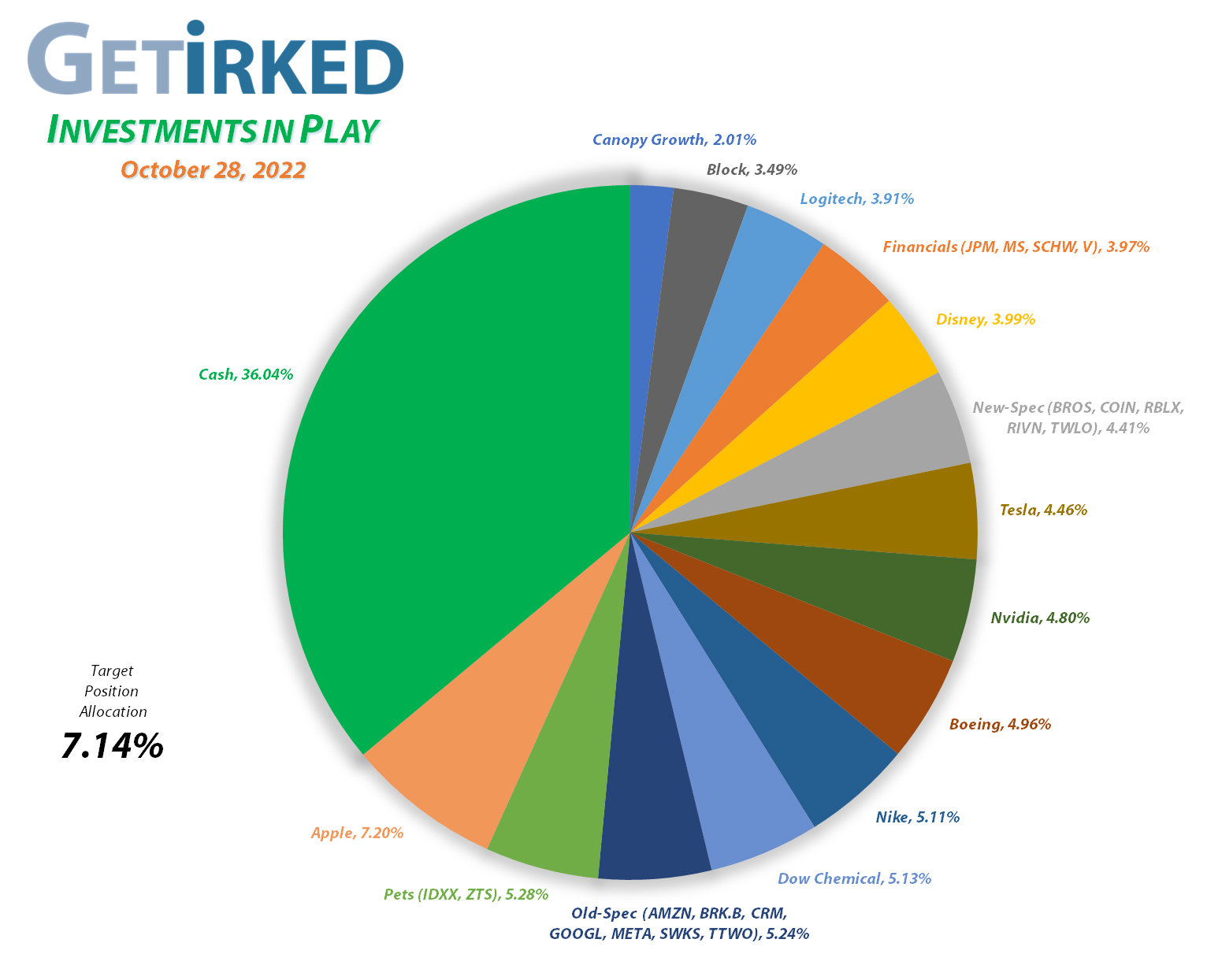

Current Position Performance

Apple (AAPL)

+842.06%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.91)*

Tesla (TSLA)

+595.69%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$26.14)*

Boeing (BA)

+561.20%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$148.35)*

Nvidia (NVDA)

+528.50%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$5.75)*

Block (SQ)

+502.88%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.45)*

Nike (NKE)

+366.37%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$3.59)*

IDEXX Labs (IDXX)

+343.23%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Skyworks (SWKS)

+311.41%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$20.20)*

Logitech (LOGI)

+303.17%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $12.68

Disney (DIS)

+247.95%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+72.60%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $73.05

Take Two (TTWO)

+64.05%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Berkshire (BRK.B)

+59.58%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Meta (META)

+50.64%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Amazon (AMZN)

+50.20%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $68.85

Dow (DOW)

+44.28%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $32.91

Salesforce (CRM)

+42.07%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Visa (V)

+19.62%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $175.00

Schwab (SCHW)

+12.00%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $71.60

Morgan Stan (MS)

+5.14%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $78.20

Dutch Bros (BROS)

-0.49%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $36.60

Roblox (RLBX)

-0.59%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.05

Zoetis (ZTS)

-0.92%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $154.71

Alphabet (GOOGL)

-3.63%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $99.91

Twilio (TWLO)

-31.11%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $109.73

Rivian (RIVN)

-41.95%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Canopy (CGC)

-43.93%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.62

Coinbase (COIN)

-66.06%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Alphabet (GOOGL): Added to Position

Alphabet (GOOGL) broke through to new lows for 2022 after reporting an even more disappointing quarter than analysts were expecting Tuesday night. The price action triggered my next buy order which filled at $93.86 on Thursday, lowering my per-share cost -1.98% from $101.93 to $99.91.

From here, my next buy price target is $80.85, above a past point of support, and my next sell target is $143.15, a bit below GOOGL’s all-time high where it has seen repeated resistance in the past.

GOOGL closed the week at $96.29, up +2.59% from where I added Thursday.

Amazon (AMZN): Added to Position

Like Alphabet above, Amazon (AMZN) reported a disappointing quarter and gave weak guidance Thursday evening which led to the stock opening Friday below its 2022 lows. The open triggered my next buy order which filled at $98.73, raising my per-share cost a whopping +16.20% from $59.25 to $68.85 as I continue to build this position slowly.

From here, my next buy target is $70.40, above a past point of support, and my next sell target is $146.20, below AMZN’s high in August.

AMZN closed the week at $103.41, up +4.74% from where I added Friday.

Apple (AAPL): Profit-Taking

Okay, I love Apple (AAPL), you love Apple, the whole world loves Apple, but when AAPL rocketed more than +8% on Friday after reporting a better-than-feared quarter Thursday evening, I had no choice but to take some profits in this position that is, by far, the largest holding in my Investments in Play portfolio.

I mean, how do you say “overexuberant” in terms of market action? We’re in a Bear Market and everyone piles into Apple just because it wasn’t as bad as Alphabet (GOOGL), Amazon (AMZN), and Meta Networks (META)?! Seriously??

My sale went through at $157.30, locking in a whopping +34.79% in gains on shares I bought for $116.70 back on March 8, 2021 and lowered my per-share “cost” a significant -12.69% from -$54.05 to -$60.91 (a negative per-share cost indicates all capital has been removed in addition to $60.91 per share added to the portfolio’s bottom line in addition to each share’s current value).

It’s worth noting that even after this sale, Apple doesn’t just remain the biggest position in the portfolio, it’s still bigger than the portfolio’s target position allocation size of 7.14%, that’s how crazy Apple has been in the market lately.

From here, my next buy target remains near AAPL’s 2022 low at $130.25 and my next sell target is $173.15, around a key downward trendline that’s been in effect for the entirety of this Bear Market which started in 2021.

AAPL closed the week at $155.74, down -0.99% from where I took profits Friday.

Logitech (LOGI): Profit-Taking

The combination of Logitech (LOGI) reporting excellent earnings and the bull rally continuing led to LOGI jumping nearly +15% during the day on Tuesday, and also caused me to take some profits at $50.52, locking in +13.32% in gains on shares I bought less than a month ago for $44.58 on September 26.

The sale lowered my per-share cost -5.44% from $13.41 to $12.68. From here, my next sell target is $59.30, below a past point of resistance, and my next buy target is $42.25, slightly above Logitech’s 2022 low.

LOGI closed the week at $51.13, up +1.21% from where I took profits Tuesday.

Schwab (SCHW): Profit-Taking

Schwab (SCHW) saw a huge pop with the rest of the financial sector on Thursday, triggering my next sell order which filled at $74.89. The sale locked in +10.78% in gains on shares I bought for $67.60 back on April 28 and lowered my per-share cost -0.75% from $72.14 to $71.60.

While it may seem slightly goofy to lock in such small gains, given the volatility of the market combined with the fact that we are, indeed, having a bull rally in a bear market, I prefer to follow the idiom, “If you don’t take profits when you have them to take, the market will take them from you.”

From here, my next sell target is $90.20, below a past point of resistance and key level of Fibonacci Retracement, and my next buy target is $66.50, above SCHW’s recent low.

SCHW closed the week at $88.06, up +17.59% from where I took profits Thursday.

Visa (V): Profit-Taking

Despite being a relatively new position in the portfolio, it was time to take some profits in Visa (V) after it reported an excellent quarter Tuesday night with a sale that went through at $205.04 on Wednesday. Given the amount of volatility in the markets and the potential downside facing consumer spending in the coming months, taking profits seemed prudent with all the headwinds facing financials in 2023.

The sale locked in +9.65% in gains on shares I bought for $187.00 on June 17, and lowered my per-share cost -7.84% from $189.88 to $175.00. From here, I have no more sell targets in the position as I do want to hold this one long-term, and my next buy target is $174.90, slightly below my new cost-basis and above V’s $174.60 low for 2022.

V closed the week at $209.34, up +2.10% from where I took profits Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.