September 30, 2022

The Week’s Biggest Winner & Loser

Coinbase (COIN)

You know it’s been a week full of whipsaw action when everyone’s favorite whipping boy, Coinbase (COIN), actually finishes UP +4.22% and brings home the Week’s Biggest Winner award. Even I don’t understand this one and I have a position in the stock…

Nike (NKE)

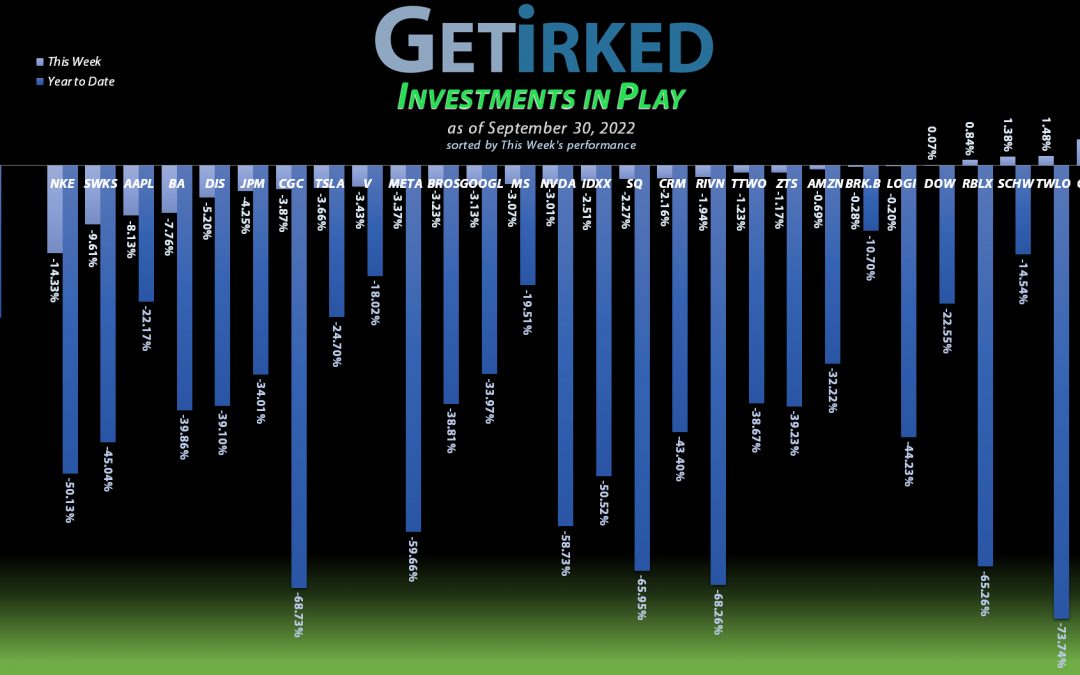

It’s one thing to miss expectations going into earnings. It’s an entirely different thing to have everyone’s expectations RAISING into earnings and THEN miss expectations. While Nike (NKE) reported “decent” earnings this week, it also announced that it made a “whoopsie” when it comes to ordering and ended up with 44% more inventory on-hand than it should. That’s a BAD thing for retail as it means less profit so the markets blew up Nike to the tune of -14.33%, leaving Nike with the title of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

Current Position Performance

Apple (AAPL)

+771.48%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$54.05)*

Tesla (TSLA)

+681.61%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$26.14)*

Boeing (BA)

+517.49%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$148.35)*

Block (SQ)

+479.01%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.45)*

Nvidia (NVDA)

+466.18%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$5.75)*

Nike (NKE)

+325.04%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$3.60)*

IDEXX Labs (IDXX)

+310.53%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Skyworks (SWKS)

+298.87%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.44)*

Logitech (LOGI)

+243.04%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $13.41

Disney (DIS)

+209.79%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

Amazon (AMZN)

+90.72%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $59.25

Meta (META)

+61.92%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Take Two (TTWO)

+44.18%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Berkshire (BRK.B)

+42.21%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

JP Morgan (JPM)

+37.32%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $76.10

Dow (DOW)

+33.49%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $32.91

Salesforce (CRM)

+25.35%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Morgan Stan (MS)

+1.04%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $78.20

Schwab (SCHW)

-0.38%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $72.14

Zoetis (ZTS)

-5.69%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $157.23

Alphabet (GOOGL)

-6.16%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $101.93

Visa (V)

-6.49%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $189.88

Dutch Bros (BROS)

-16.38%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $37.25

Roblox (RLBX)

-22.17%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.05

Twilio (TWLO)

-36.99%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $109.73

Rivian (RIVN)

-44.60%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Canopy (CGC)

-51.41%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.62

Coinbase (COIN)

-69.63%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Logitech (LOGI): Added to Position

Logitech (LOGI) got pushed down to new lows this week and filled my next buy order on Monday at $44.58. The buy locked in a -52.44% discount replacing some of the shares I sold for $93.74 back on November 5, 2020, and raised my per-share cost +4.46% from $13.45 to $14.05, still a -42.42% from my initial buy at $24.20 back on November 11, 2016.

On Thursday, Logitech paid out its annual dividend. Since Logitech is based in Europe and my broker does not allow me to reinvest dividends in internationally-based stocks, I received the dividend as a cash payout. The substantial dividend payout reduced my per-share cost -4.56% from $14.05 to $13.41.

From here, my next buy target is $39.40, above a past point of support, and my next sell target is around $78.00, just under a key resistance point from one of LOGI’s 2022 rallies.

LOGI closed the week at $46.00, up +3.19% from where I added Monday.

Nike (NKE): Added to Position

Nike (NKE) reported earnings this week where they released news about an oversupply of inventory, never a good thing for any consumer products company, causing the stock to drop more than 12% on Friday, triggering my next buy order which filled at $83.72.

The buy raised my per-share “cost” +$2.48 from -$6.08 to -$3.60 (a negative per-share cost indicates all capital has been removed in addition to $3.60 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $68.95, above a past point of support, and my next sell target is around $135.00, a key point of past resistance.

NKE finished the week at $83.12, down -0.72% from where I added Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.