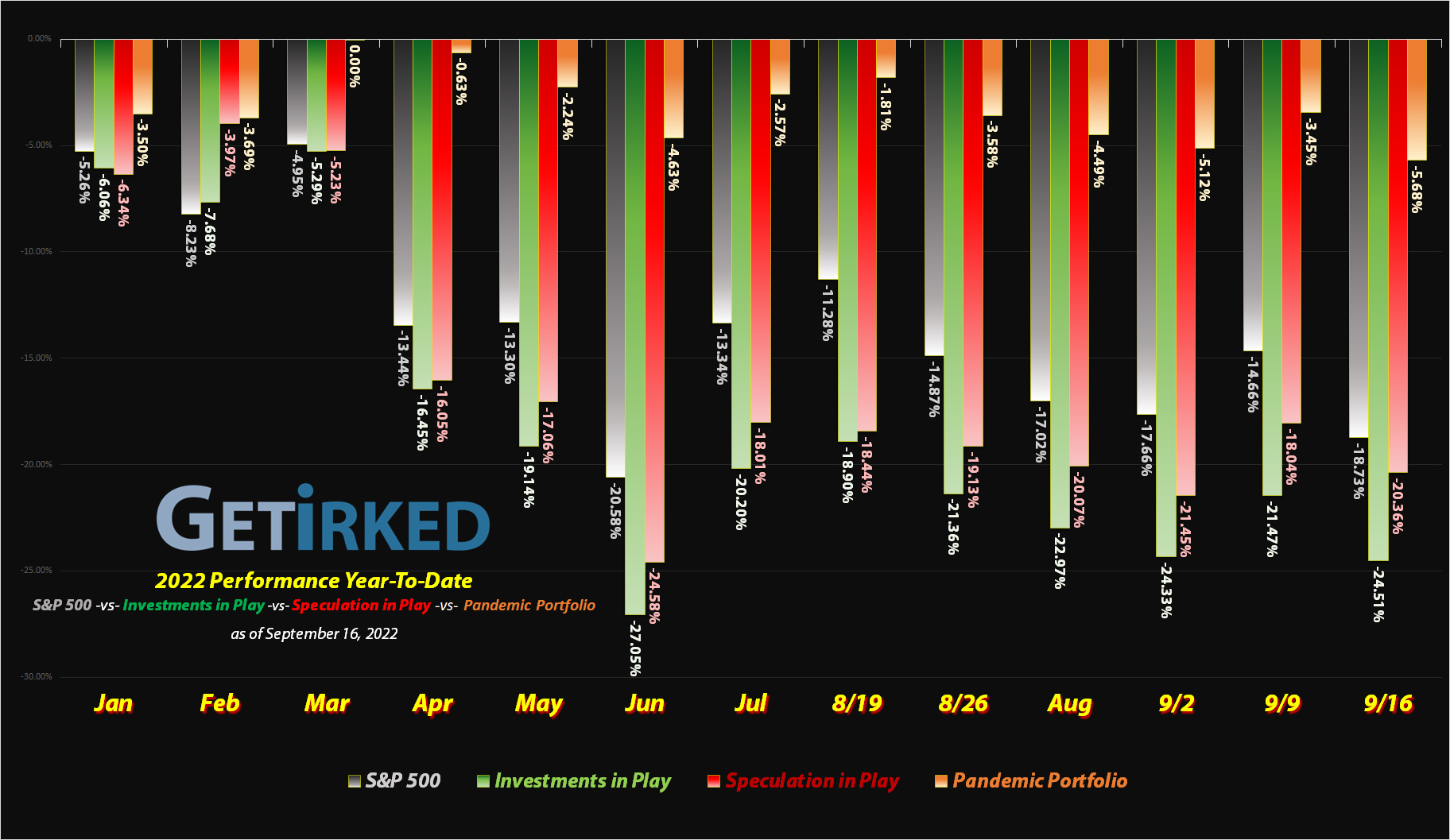

September 16, 2022

The Week’s Biggest Winner & Loser

Rivian (RIVN)

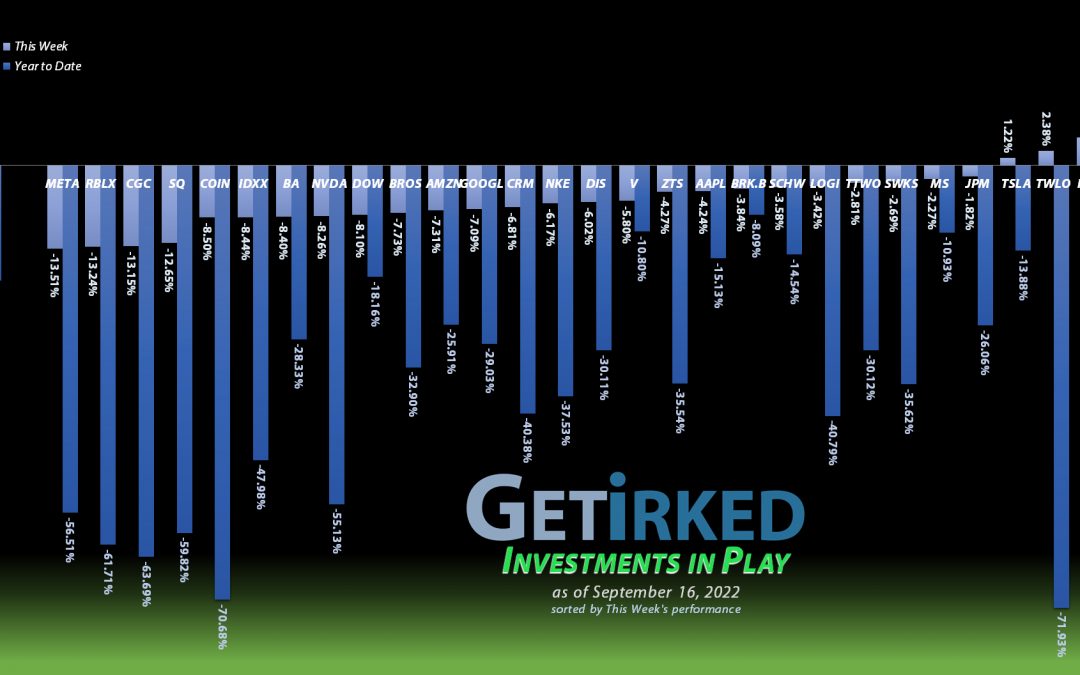

When you’ve got Amazon (AMZN) backing you up, it’s hard to go wrong. EV maker Rivian (RIVN) continued its upward climb this week, earning +4.55% despite a horrible market, quite a feat for this upstart startup, and parked itself in the Biggest Winner spot.

Meta Networks (META)

Metaverse, shmetaverse – no one cares, anymore! Once the darling of the tech world, Meta Networks (META) (formerly Facebook) can’t figure out who or what it is, but one thing’s for sure – it’s willing to spend billions to find out. In an environment where advertising spend will likely be decreased, this does not bode well for Meta, and that showed this week as the stock dropped -13.51% and posted “the Week’s Biggest Loser” on its newsfeed.

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

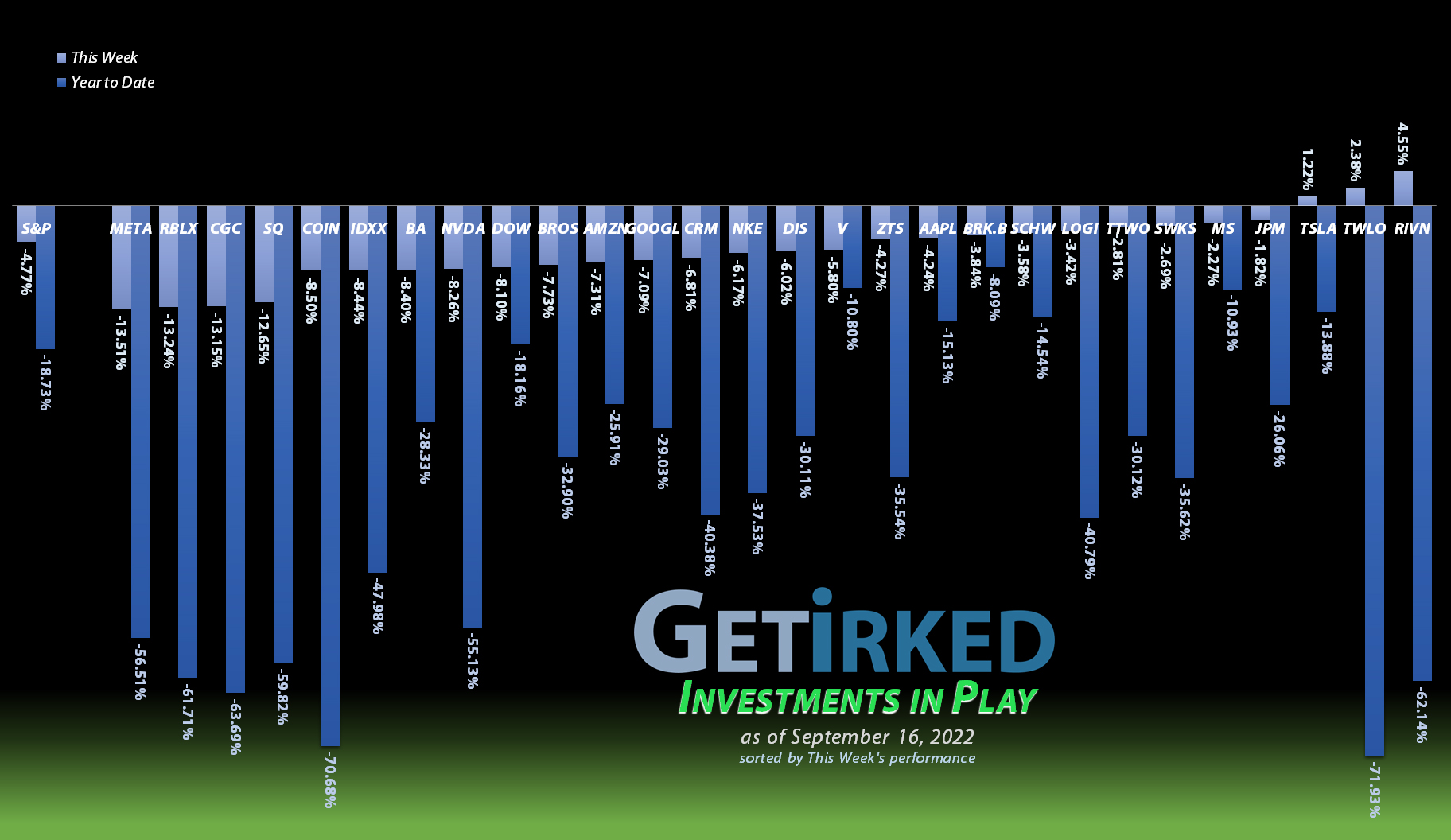

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

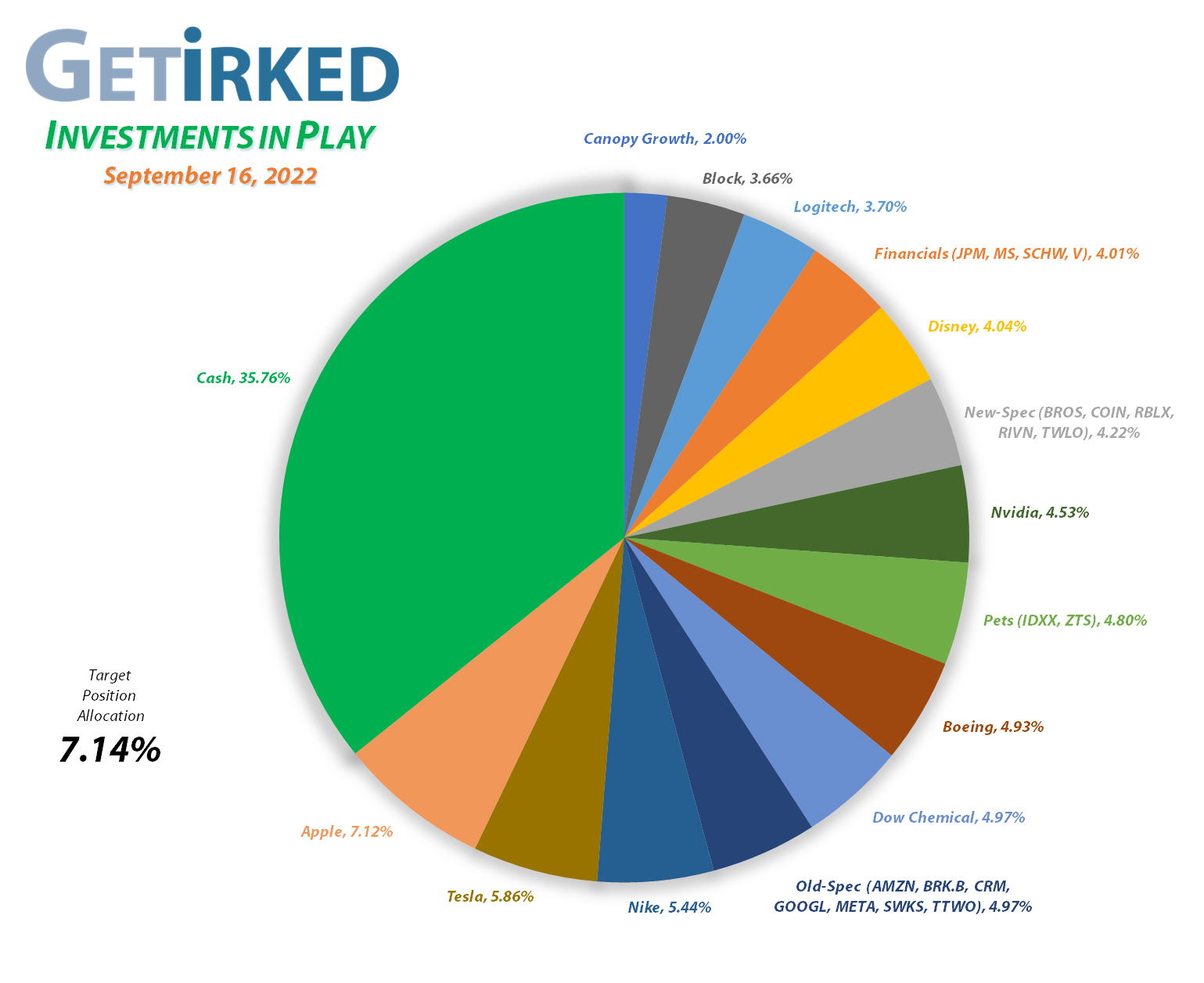

Current Position Performance

Apple (AAPL)

+821.64%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$54.05)*

Tesla (TSLA)

+770.73%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$26.14)*

Boeing (BA)

+562.07%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$148.35)*

Block (SQ)

+516.52%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.45)*

Nvidia (NVDA)

+505.01%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$5.75)*

Nike (NKE)

+401.64%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.08)*

Skyworks (SWKS)

+345.86%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.65)*

IDEXX Labs (IDXX)

+324.77%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Logitech (LOGI)

+263.12%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $13.45

Disney (DIS)

+255.50%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

Amazon (AMZN)

+108.50%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $59.25

Meta (META)

+65.20%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Take Two (TTWO)

+64.27%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

JP Morgan (JPM)

+53.85%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $76.10

Berkshire (BRK.B)

+50.27%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dow (DOW)

+41.06%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $32.91

Salesforce (CRM)

+32.03%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Morgan Stan (MS)

+11.81%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $78.20

Visa (V)

+1.75%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $189.88

Alphabet (GOOGL)

+0.85%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $101.93

Zoetis (ZTS)

+0.04%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $157.23

Schwab (SCHW)

-0.38%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $72.14

Dutch Bros (BROS)

-8.30%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $37.25

Roblox (RLBX)

-14.22%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.05

Twilio (TWLO)

-32.65%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $109.73

Rivian (RIVN)

-33.91%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Canopy (CGC)

-43.58%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.62

Coinbase (COIN)

-65.15%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Alphabet (GOOGL): *New Position*

Friday’s selloff gave me the opportunity to add a new position to the Old-Spec Basket, Alphabet (GOOGL), formerly known as Google. There’s nary a person on the planet who hasn’t heard of Google, the definitive search engine, but Alphabet is also the company behind the Android mobile operating system as well as the most popular streaming site on the planet, YouTube.

When GOOGL sold off nearly -33% from its all-time high earlier in 2022, I decided I wanted to include it in my portfolio, however since I already have so many high-growth tech stocks, I didn’t want to give it a full allocation so I have rolled it into a single basket with the other “older” speculative plays in the portfolio: Amazon (AMZN), Berkshire-Hathaway (BRK.B), Meta (META), Salesforce (CRM), Skyworks (SWKS), and Twilio (TWLO) (yes, these are older in comparison with the companies in the “New-Spec Basket”).

Why GOOGL and not GOOG?

Some investors may not be familiar with why some companies have two tickers. Instead of doing a traditional stock split, some companies, like Alphabet, will split their shares into two “classes” of stock – Class A Shares that have voting rights and Class C Shares that don’t. Back in 2014, Alphabet (then Google) did exactly this, creating GOOGL, shares with voting rights, and GOOG, shares without voting rights.

In practice, both trade very close to each other in terms of stock price. Typically, those with voting rights trade at a premium, but, strangely, in Alphabet’s case, the voting shares are trading at a lower price than the non-voting shares currently.

On Friday, GOOGL dropped below my buy price which filled at $101.93. From here, my next buy target is $88.25, above a past point of support, and I have no sell targets for the stock at this time.

GOOGL closed the week at $102.80, up +0.85% from where I opened it Friday.

Dow Chemical (DOW): Dividend Reinvestment

Regular readers will notice that I don’t often talk about dividend reinvesting in my Investments in Play portfolio, usually reserving that topic for the Pandemic Portfolio, however, in Dow Chemical’s (DOW) case, its dividend is the largest of any of the portfolios, currently ringing in with an annual yield of more than 5.5%!

Accordingly, that means my approach to my DOW position is slightly different than others since it’s gaining 5.5% more shares each year I hold it.

Its quarterly dividend, paid out on Friday evening (September 9), lowered my per-share cost -1.32% from $33.35 to $32.91. Instead of buying above my per-share cost, I’m choosing to only add to this position (which also happens to have more actual capital in it than any of the other positions in the portfolio) only if it pulls back below my cost basis.

That makes my next buy price target $31.45, above a key level of support during its rise off its pandemic bottom. Additionally, since the position does have so much actual capital in it, I now plan to take all of my capital out of it should it make another run for its current all-time high at $71.86 with a sell target around $69.65.

Allow me to assure my readers, I still have great confidence in Dow Chemical as a long-term investment, I’m just choosing not to “break” my cost basis by buying it up; I’d rather wait for DOW to drop below my cost basis to add and use the reinvested dividend as a way to build up the position rather than raise my cost basis only to have DOW drop below the new, higher cost basis potentially.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.