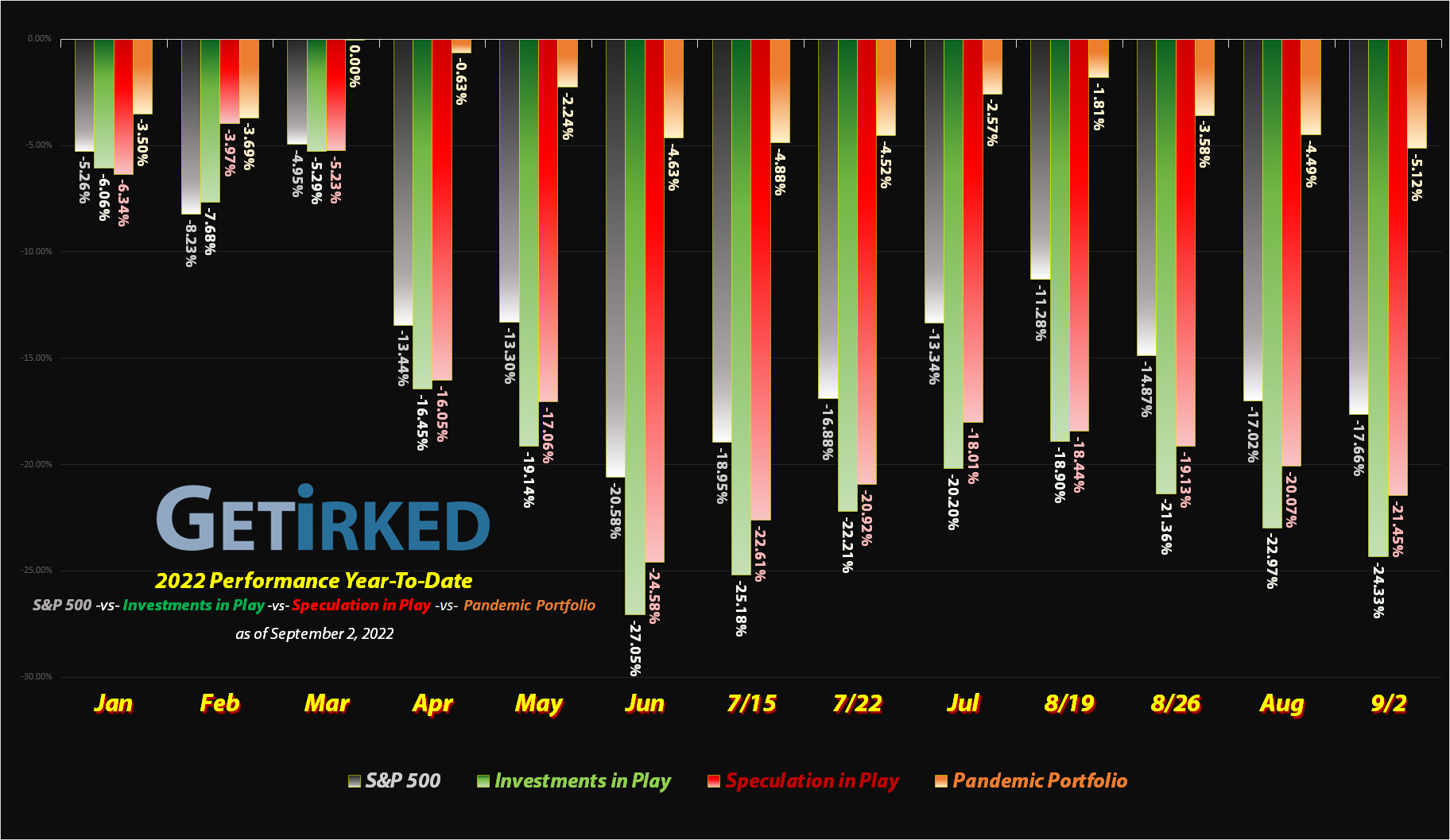

September 2, 2022

The Week’s Biggest Winner & Loser

Rivian (RIVN)

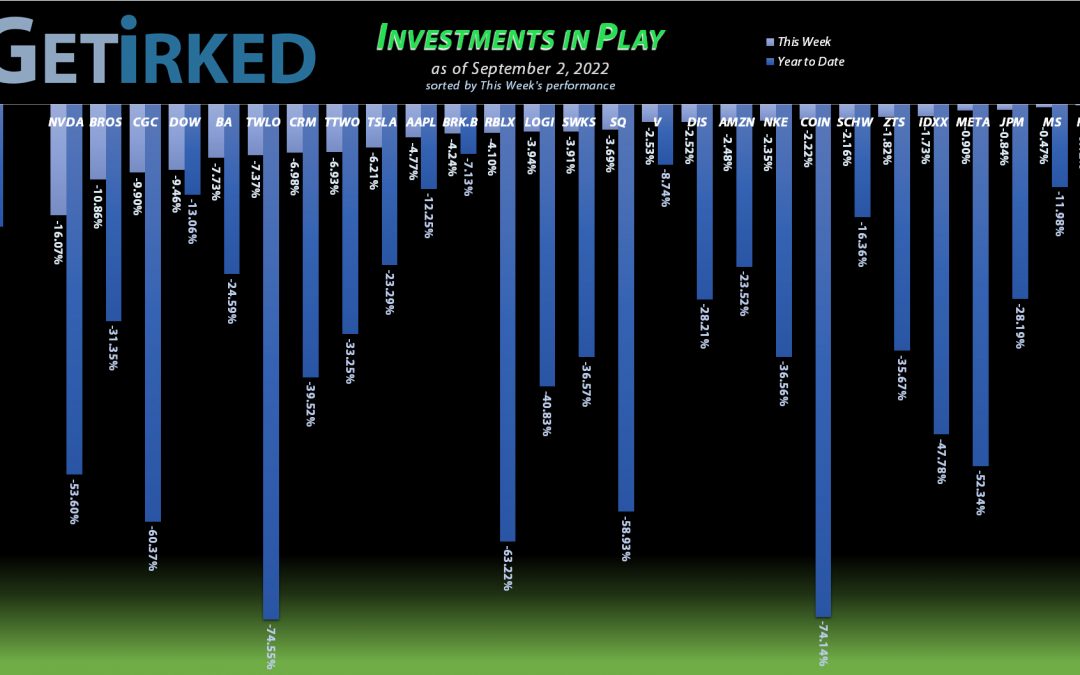

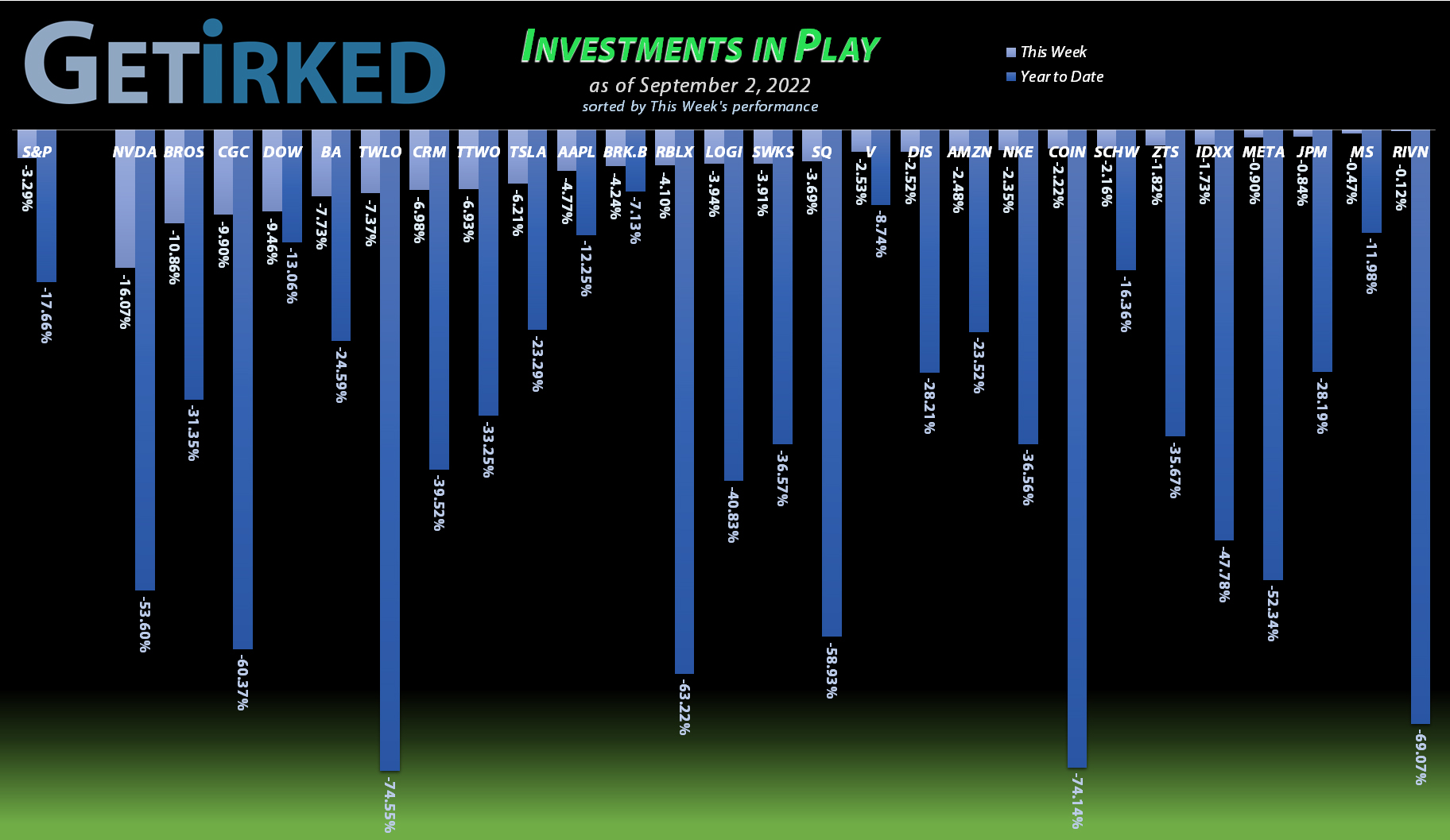

It’s always a rough week when the Biggest Winner is just the Least Loser, and this week’s candidate was Rivian (RIVN), the EV maker who saw a lot of support for its stock when news broke of exactly how vital RIVN is to Amazon’s (AMZN) long-term success. As a result, RIVN dropped only -0.12% this week, making it the best house in a really, really bad neighborhood.

Nvidia (NVDA)

It’s bad when the government tells your company you need to stop selling your products to China. It’s worse when the products you have to stop selling are data center processors worth an absolute fortune and China is one of your biggest customers. That’s what happened when Congress passed a law banning the sale of high-end semiconductors to China. Nvidia (NVDA) announced the loss of sales would ding their earnings to the tune of -$400M per quarter, causing the stock to collapse -16.07% this week alone, bringing it’s YTD drop to -53.60% and earning this monster the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

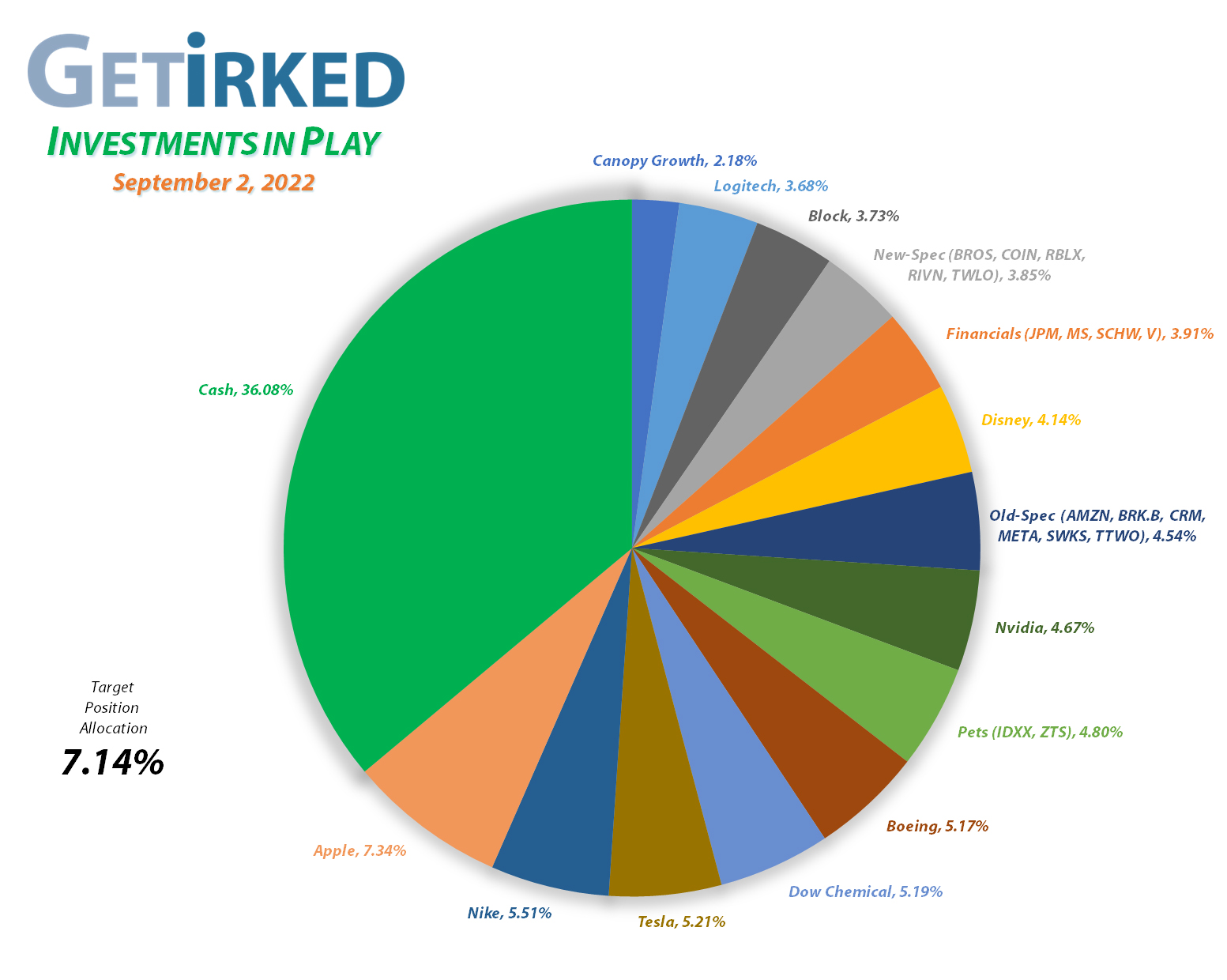

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

Current Position Performance

Apple (AAPL)

+842.14%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$54.05)*

Tesla (TSLA)

+693.21%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$26.14)*

Boeing (BA)

+576.53%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$148.35)*

Block (SQ)

+521.97%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.45)*

Nvidia (NVDA)

+521.48%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$5.75)*

Nike (NKE)

+407.55%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.08)*

Skyworks (SWKS)

+340.91%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.65)*

IDEXX Labs (IDXX)

+325.85%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Disney (DIS)

+265.19%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

Logitech (LOGI)

+262.83%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $13.45

Amazon (AMZN)

+115.21%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $59.25

Meta (META)

+69.54%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Take Two (TTWO)

+56.92%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Berkshire (BRK.B)

+51.84%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

JP Morgan (JPM)

+49.42%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $76.10

Dow (DOW)

+47.84%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $33.35

Salesforce (CRM)

+33.93%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Morgan Stan (MS)

+10.49%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $78.20

Visa (V)

+3.90%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $190.33

Zoetis (ZTS)

-0.36%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $157.55

Schwab (SCHW)

-2.50%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $72.14

Dutch Bros (BROS)

-6.17%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $37.25

Roblox (RLBX)

-17.61%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.05

Canopy (CGC)

-38.42%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.62

Twilio (TWLO)

-38.93%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $109.73

Rivian (RIVN)

-46.01%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Coinbase (COIN)

-69.27%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Twilio (TWLO): Added to Position

The Bear Market in technology stocks has been rougher for some than others, and at least in the Investments in Play, no stock has been mistreated quite as much as Twilio (TWLO), which filled my next buy order on Thursday at $67.93, locking in a -43.07% discount replacing some of the shares I sold for $119.32 back on January 21, 2020.

Just to give you an idea of how hard and fast Twilio has fallen, my last buy was 32.58% higher from here at $90.06 on May 12. Thursday’s buy price also represents a more than -85% drop from Twilio’s lofty all-time high way up at $457.30 set in 2021, and means TWLO is now lower than its pandemic low of $68.06. What a mess for this once cloud data darling!

From here, my next buy target is $53.60, above a past point of support, and my next sell target is around $175, just below a past key point of resistance.

TWLO closed the week at $67.01, down -1.35% from where I added Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.