July 15, 2022

The Week’s Biggest Winner & Loser

Boeing (BA)

Boeing (BA) really took off this week (sorry… I had to) after reporting the biggest number of airplane deliveries since 2019. Yes, BA seems it may have finally found its footing to remember exactly how to, y’know, be a real company, make things, and deliver stuff. The result was a +6.23% which landed Boeing squarely in the spot of the Week’s Biggest Winner.

Canopy Growth Corp (CGC)

The combined double-whammy of the hated cannabis sector and a liquidation event continue to whale on anyone dumb enough to invest in Canopy Growth Corp (CGC) (wait…. that’s ME!!!! D’oh!)

With only retail hands in the space, Canopy continued to come under serious selling pressure, working its way excruciatingly slowly to the $2.00 mark. CGC lost a whopping -14.50% this week alone, earning this roach of a stock the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

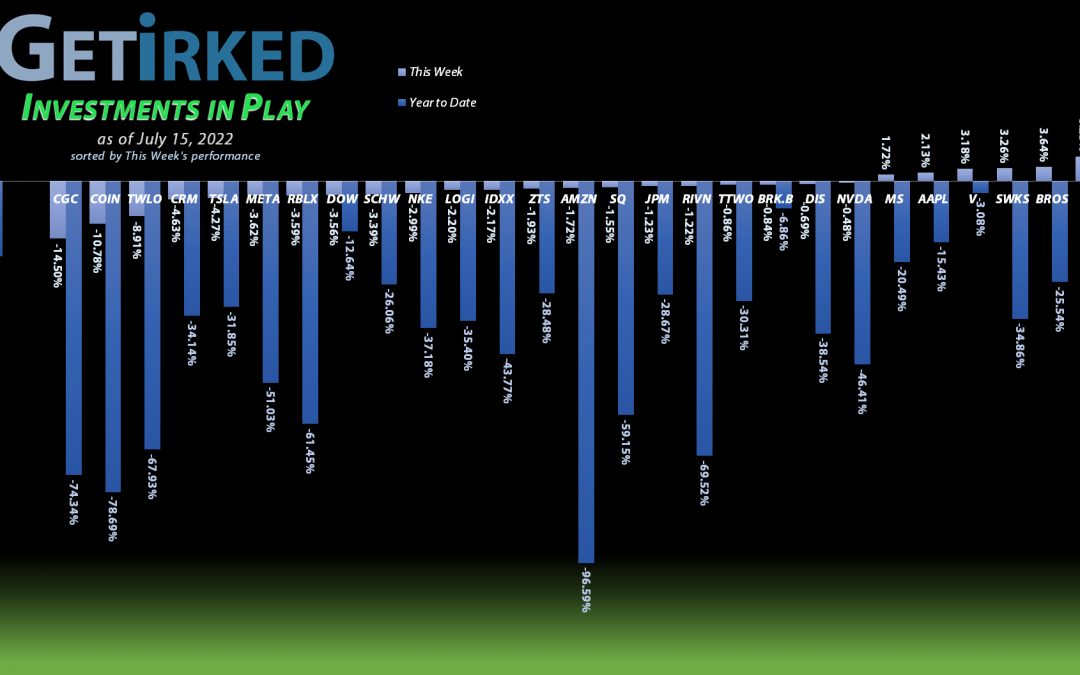

Current Position Performance

Apple (AAPL)

+812.70%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$35.15)*

Tesla (TSLA)

+622.70%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Nvidia (NVDA)

+599.03%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$5.75)*

Boeing (BA)

+568.69%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$148.35)*

Block (SQ)

+520.65%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.45)*

Nike (NKE)

+403.76%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.08)*

IDEXX Labs (IDXX)

+348.21%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Skyworks (SWKS)

+349.80%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.65)*

Logitech (LOGI)

+319.53%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $12.70

Disney (DIS)

+157.65%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $36.95

Amazon (AMZN)

+91.65%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $59.25

Meta (META)

+70.89%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Take Two (TTWO)

+63.82%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Berkshire (BRK.B)

+52.28%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Dow (DOW)

+48.56%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $33.35

JP Morgan (JPM)

+48.42%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $76.10

Salesforce (CRM)

+45.86%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Zoetis (ZTS)

+10.78%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $157.55

Visa (V)

+10.36%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $190.33

Dutch Bros (BROS)

+0.57%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $37.70

Morgan Stan (MS)

-2.74%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $80.25

Roblox (RLBX)

-13.73%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.10

Schwab (SCHW)

-14.87%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $73.04

Twilio (TWLO)

-27.61%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $116.70

Rivian (RIVN)

-46.80%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Canopy (CGC)

-60.13%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.62

Coinbase (COIN)

-74.67%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Why am I not selling any of my Apple (AAPL) position???

One of my more detail-oriented readers asked me why I haven’t taken any profits in my Apple (AAPL) position, particularly given that it’s significantly larger than the target position allocation size of 7.14% for the Investments in Play portfolio, ringing in at x.xx% of the portfolio, as of this update.

Strict adherence to long-term investing discipline does mean that an investor should reduce a position size whenever it exceeds the target size for a portfolio. Doing so ensures that no one position can dramatically affect the portfolio’s performance.

So, why am I not reducing my Apple position?

Two reasons:

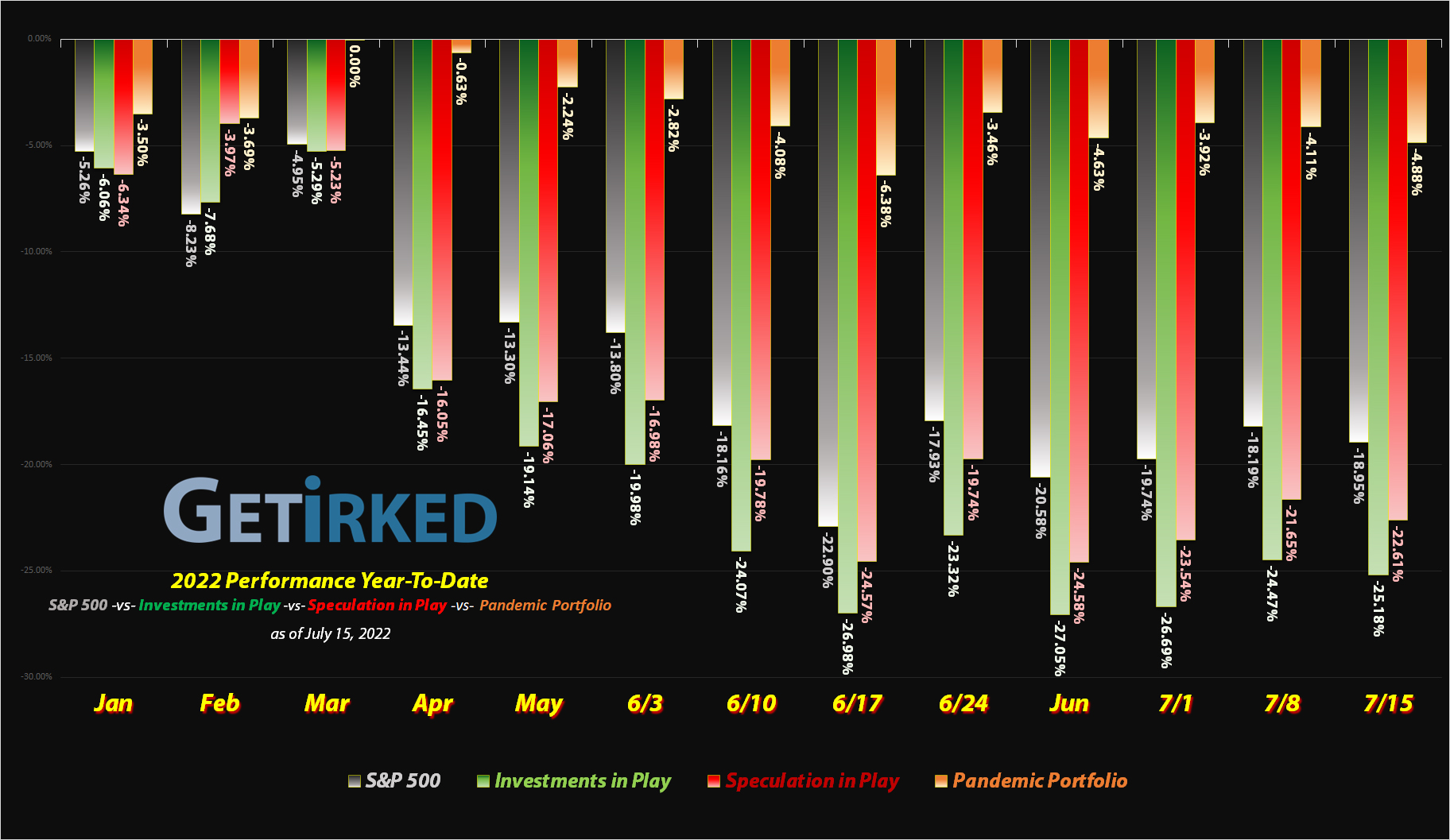

1. I have too much cash.

Currently, my cash hoard is more than 35% and no matter how much I try to take it down, the market’s relentless selling causes the overall portfolio value to DECREASE which causes the cash position to INCREASE, relatively speaking.

If the portfolio was in dire need of cash, I would reduce my Apple position. Since the portfolio has a plethora of cash (relatively speaking, of course), there’s no need to reduce a winning position.

2. Apple is only oversized in relative terms.

While my Apple position is outsized relative to the rest of the portfolio currently, the actual value of my Apple position is actually down -15.966% Year-To-Date. This means that when the position was 6.60% at the beginning of 2022, the position was worth more in actual terms, not relative terms.

Long story short, I’m not reducing my Apple position because it’s not worth as much as I feel it will be and because I don’t need the cash selling any would free up.

The lesson?

As long as you think through why you’re taking the actions you are, you can choose to break investing rules.

As my favorite communications professor used to say:

“It’s okay to break the rules as long as you know what the rules you’re breaking are and you have a purposeful reason to break them.”

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.