July 8, 2022

The Week’s Biggest Winner & Loser

Rivian (RIVN)

Sometimes, all you have to do to outperform in this market is simply to follow through on exactly what you said you would do. That’s what happened to Rivian (RIVN) this week when the company announced it was on track to produce the 25,000 vehicles it said it would in 2022. As a result, the stock popped an outstanding +24.47% and earned itself the spot of the Week’s Biggest Winner.

Canopy Growth Corp (CGC)

Even in an up week, Canopy Growth Corporation (CGC) yanked defeat from the jaws of victory. Investors were still reeling from last week’s announcement of a significant dilution of the company’s shares, apparently, so CGC dipped -6.76% this week and earned itself the spot of the Week’s Biggest Loser for the second week in a row.

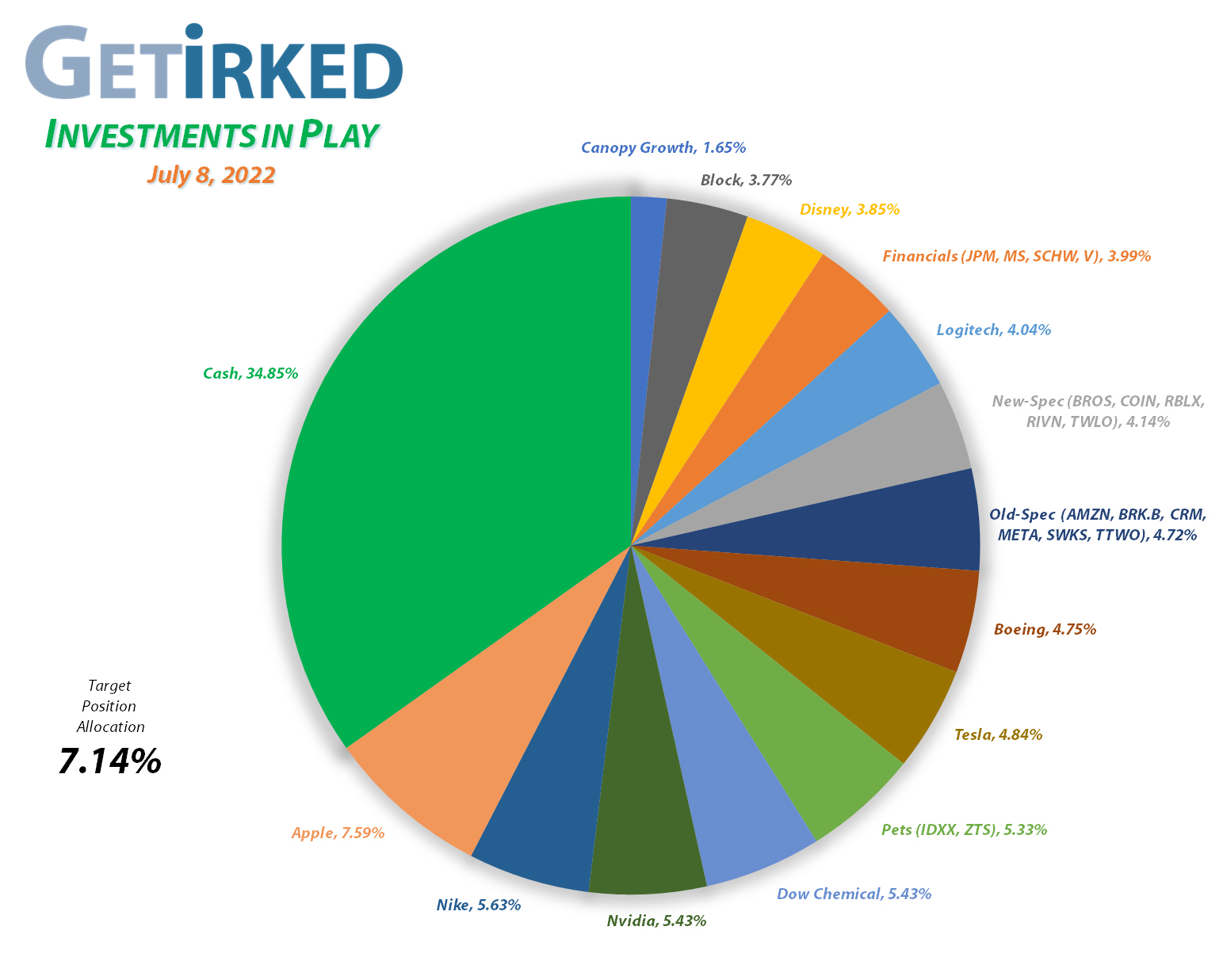

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

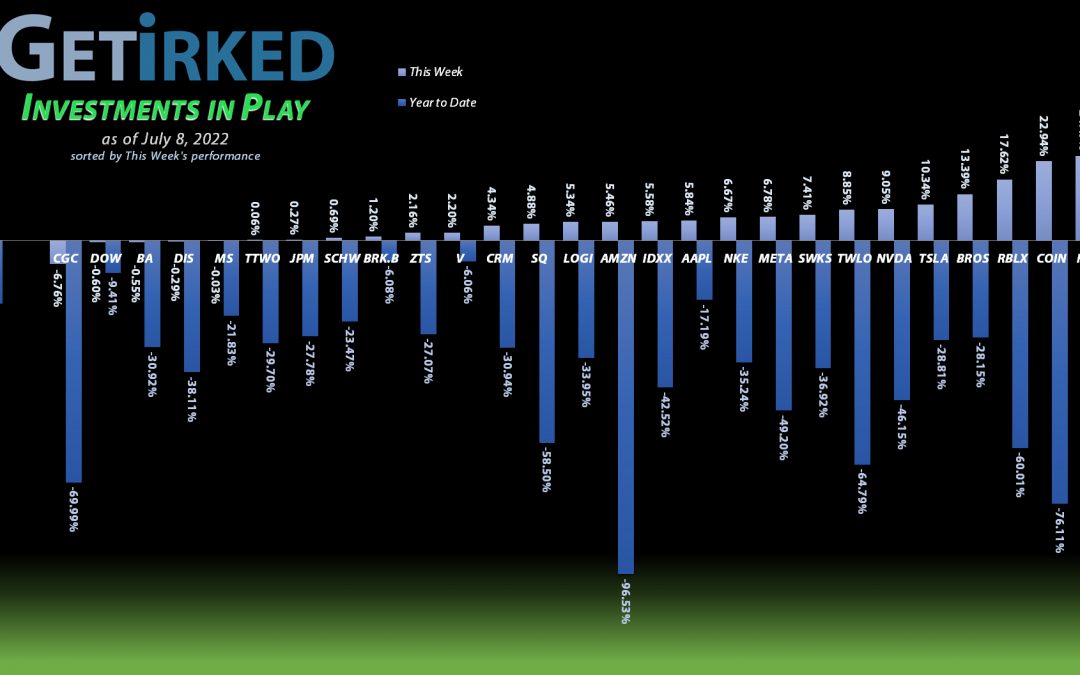

Current Position Performance

Apple (AAPL)

+798.98%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$35.15)*

Tesla (TSLA)

+647.72%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Nvidia (NVDA)

+601.82%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$5.75)*

Boeing (BA)

+552.04%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$148.35)*

Block (SQ)

+524.36%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.45)*

Nike (NKE)

+415.38%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.08)*

IDEXX Labs (IDXX)

+355.27%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Skyworks (SWKS)

+339.14%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.65)*

Logitech (LOGI)

+328.98%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $12.70

Disney (DIS)

+158.84%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $36.95

Amazon (AMZN)

+95.01%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $59.25

Meta (META)

+72.80%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Take Two (TTWO)

+65.25%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Dow (DOW)

+54.19%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $33.35

Berkshire (BRK.B)

+53.51%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Salesforce (CRM)

+52.88%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

JP Morgan (JPM)

+50.30%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $76.10

Zoetis (ZTS)

+12.97%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $157.55

Visa (V)

+6.90%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $190.33

Dutch Bros (BROS)

-2.96%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $37.70

Morgan Stan (MS)

-4.48%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $80.25

Roblox (RLBX)

-10.39%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.10

Schwab (SCHW)

-11.94%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $73.04

Twilio (TWLO)

-20.56%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $116.70

Rivian (RIVN)

-46.14%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Canopy (CGC)

-53.37%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.62

Coinbase (COIN)

-71.61%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

The Joys of Reallocating Capital and Buying in Stages

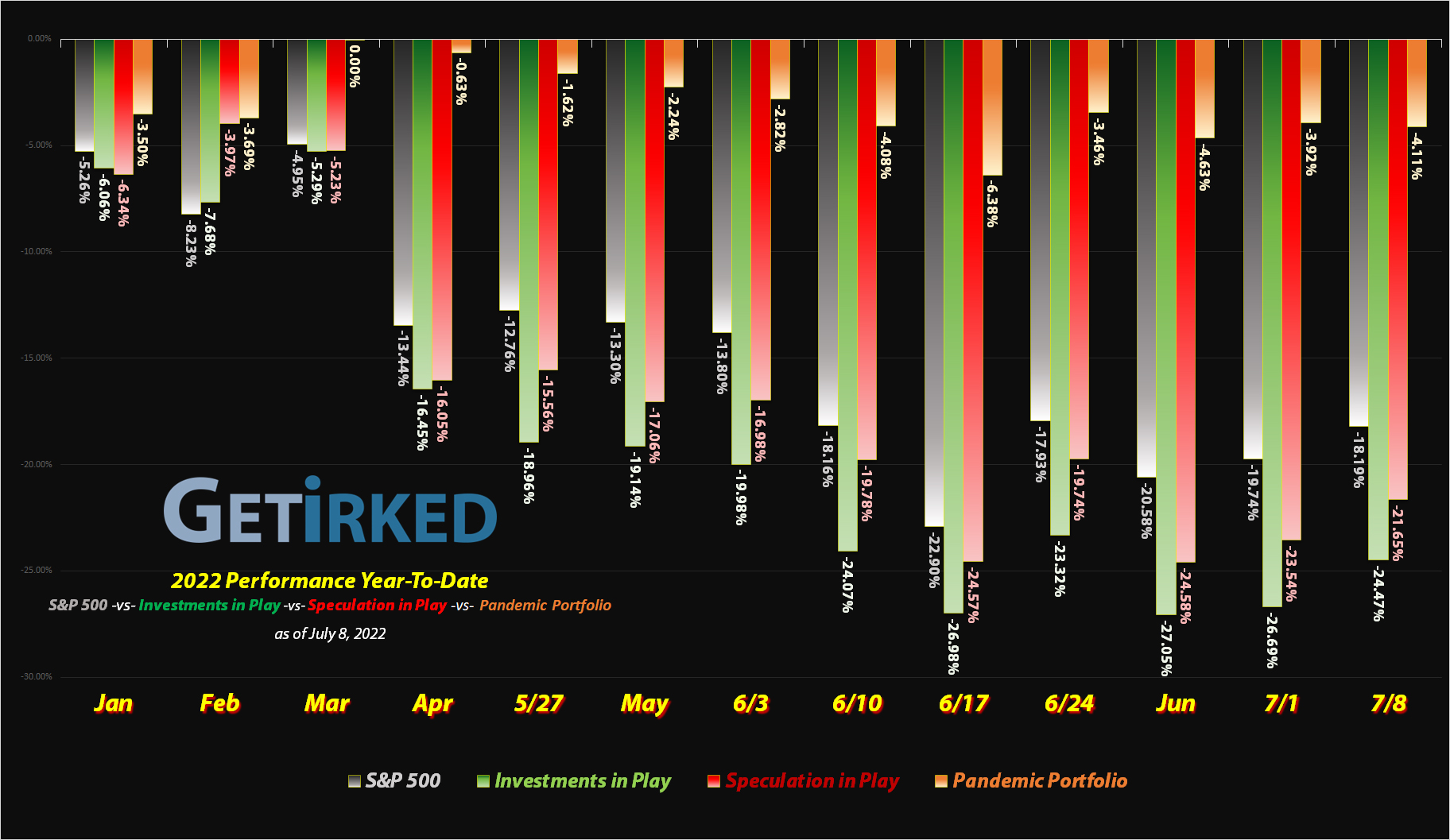

Now that we’ve had a few positive days in a row following the epic selloff that took us to 2022’s lows, a quiet week gave me the opportunity to re-evaluate some of my price targets for a few positions and raise them.

Of course I didn’t raise all of my price targets, but I realized that there were a few positions like Amazon (AMZN), Apple (APPL), Logitech (LOGI), Morgan Stanley (MS), and Schwab (SCHW) where I wouldn’t mind adding to my positions should the stocks pull back to around their 2022 lows.

This kind of price adjustment and decision to reallocate capital wouldn’t be possible if I didn’t Buy in Stages. By not buying all at once, I almost never have a full position which gives me the ability to do exactly this: add more when my stocks drop to a tempting price.

Plus, finding new price targets because this kind of middling price action is booorrrring…

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.