July 1, 2022

The Week’s Biggest Winner & Loser

Zoetis (ZTS)

It was another of those weeks where the biggest winner is actually the smallest loser. This time, it was pet play Zoetis’ (ZTS) turn. ZTS came in just under flat for the week with a -0.23% loss. Turns out, despite inflation, pet owners will still pay for their pets’ health. Good thing, too. This makes Zoetis the Week’s Biggest Winner, for whatever that’s worth.

Canopy Growth Corp (CGC)

With inflation causing credit concerns as interest rates rise, industries that need loans, such as the struggling cannabis sector, were particularly hard-hit during the week’s selloff. Canopy Growth Corp (CGC) got positively walloped this week, losing an astounding -25.46% of its value and easily coming in as the Week’s Biggest Loser. Ick.

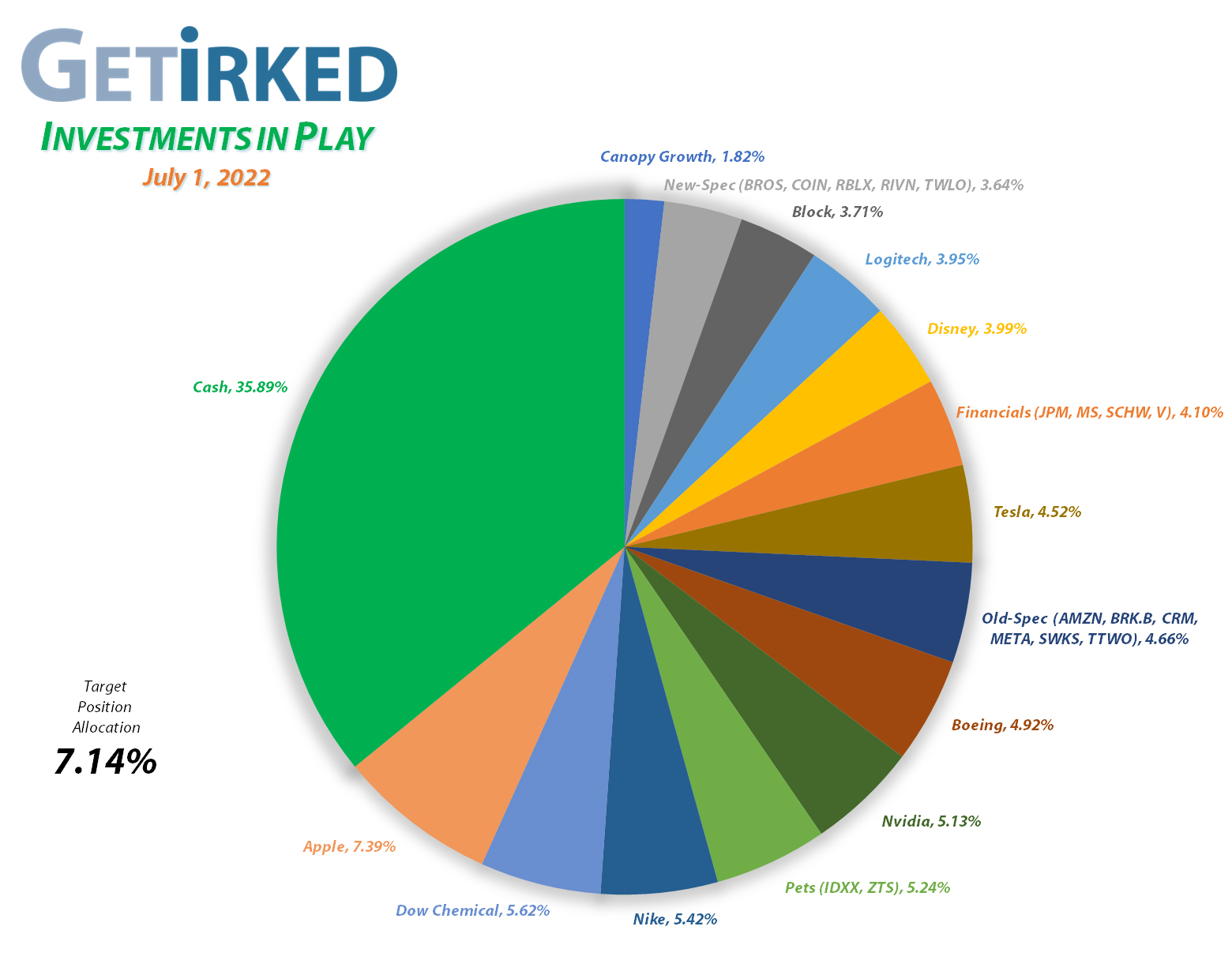

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

Current Position Performance

Apple (AAPL)

+763.41%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$35.15)*

Tesla (TSLA)

+592.75%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Boeing (BA)

+553.52%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$148.35)*

Nvidia (NVDA)

+553.46%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$5.75)*

Block (SQ)

+512.77%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.45)*

Nike (NKE)

+389.83%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.10)*

IDEXX Labs (IDXX)

+338.27%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Skyworks (SWKS)

+316.61%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.65)*

Logitech (LOGI)

+307.24%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $12.70

Disney (DIS)

+160.19%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $36.95

Amazon (AMZN)

+84.92%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $59.25

Meta (META)

+69.45%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Take Two (TTWO)

+65.16%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Dow (DOW)

+54.97%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $33.35

Berkshire (BRK.B)

+51.74%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

JP Morgan (JPM)

+49.87%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $76.10

Salesforce (CRM)

+46.58%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Zoetis (ZTS)

+10.57%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $157.55

Visa (V)

+4.65%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $190.33

Morgan Stan (MS)

-4.36%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $80.25

Schwab (SCHW)

-12.49%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $73.04

Dutch Bros (BROS)

-14.58%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $37.70

Roblox (RLBX)

-23.93%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.10

Twilio (TWLO)

-27.02%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $116.70

Canopy (CGC)

-49.99%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $5.62

Rivian (RIVN)

-56.73%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Coinbase (COIN)

-76.90%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Canopy Growth Corp (CGC): Added to Position

Canopy Growth Corporation (CGC) completely imploded on Thursday along with the rest of the cannabis sector, opening below the $3.00 mark where it triggered my next buy order which filled at $2.90. The buy lowered my per-share cost -10.01% from $6.25 to $5.62.

From here, my next buy target is $2.05, around a point of potential support calculated using the Fibonacci Method and above $2.00 which may provide psychological support to traders and investors. Given how large the position continues to grow as it sells off precariously, I will start taking profits to reduce its size with my next sell target at $6.60, slightly below the high of its last bull rally in 2022.

CGC closed the week at $2.81, down -3.10% from where I added Thursday.

Nvidia (NVDA): Added to Position

Despite the rest of the market bouncing on Friday, Nvidia (NVDA) and the rest of the semiconductor space continued to sell off. NVDA started to approach the $145.00 mark where it triggered a buy order of mine which filled at $145.83, raising my per-share “cost” +$6.85 from -$12.60 to -$5.75 (a negative per-share cost indicates all capital has been removed from the position in addition to $5.75 per share which adds to the portfolio’s bottom line).

Just to give you an idea of how much Nvidia has been beaten up this year, Friday’s buy represents a -25.39% reduction from my last buy at $195.45. That’s right. NVDA has sold off an epic -57.91% from its all-time high at $346.47 last year to where I added to it on Friday.

Naturally, that doesn’t mean NVDA doesn’t have further downside to go, so my next buy price target is $116.10, above a past point of support. As my position to continues to grow in size, my sell target comes down, too, so my next sell target is around $245.00, the 50% retracement from NVDA’s high to the low of the selloff.

NVDA closed the week at $145.23, down -0.41% from where I added Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.