June 24, 2022

The Week’s Biggest Winner & Loser

Roblox (RBLX)

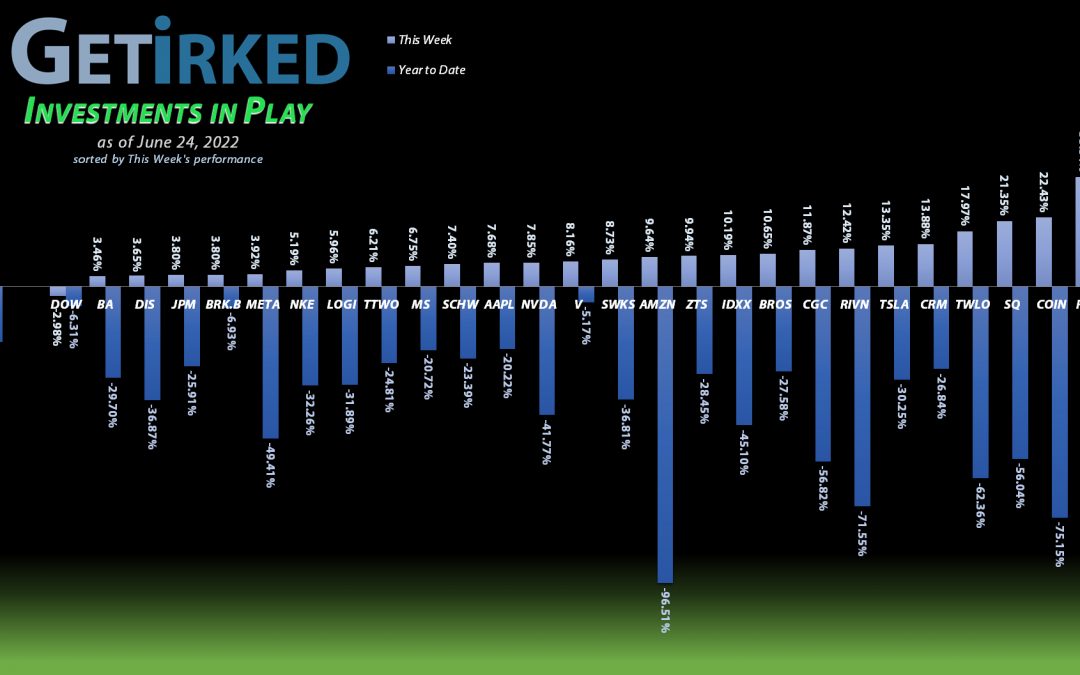

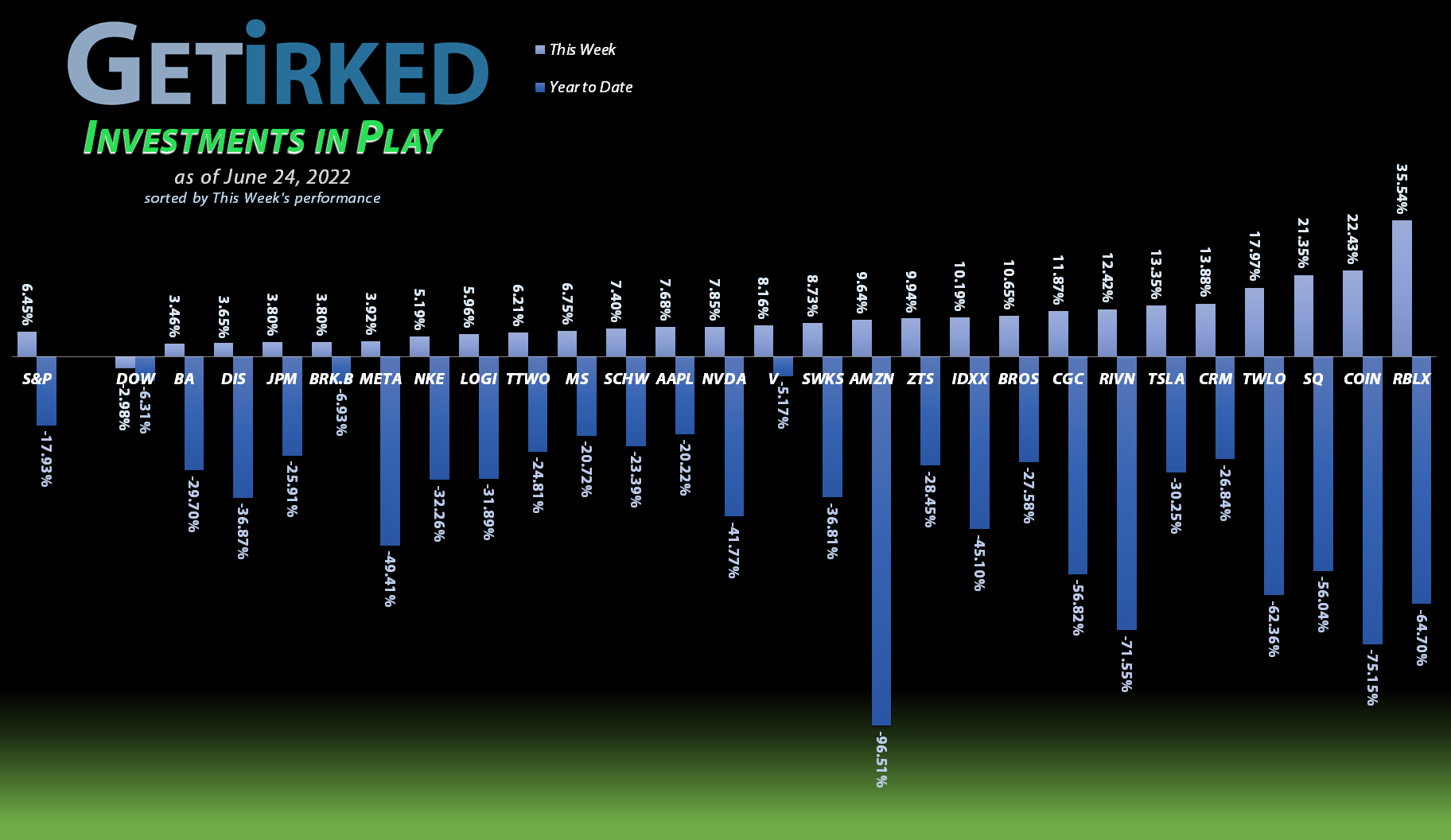

The market went crazy risk-on this week, and there are few riskier plays than Roblox (RBLX), a potential play on the metaverse. RBLX positively exploded to the upside this week, gaining an incredible +35.54% and sliding into the spot of the Week’s Biggest Winner.

Dow Chemical (DOW)

With a potential recession looming on the horizon combined with a selloff in all things commodity (and chemical), Dow Chemical got positively walloped on the week. While a -2,98% might not seem like a big loss, you have to take into account that the second place “loser,” Boeing (BA), actually gained +3.46% which definitely puts DOW in the Week’s Biggest Loser spot.

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

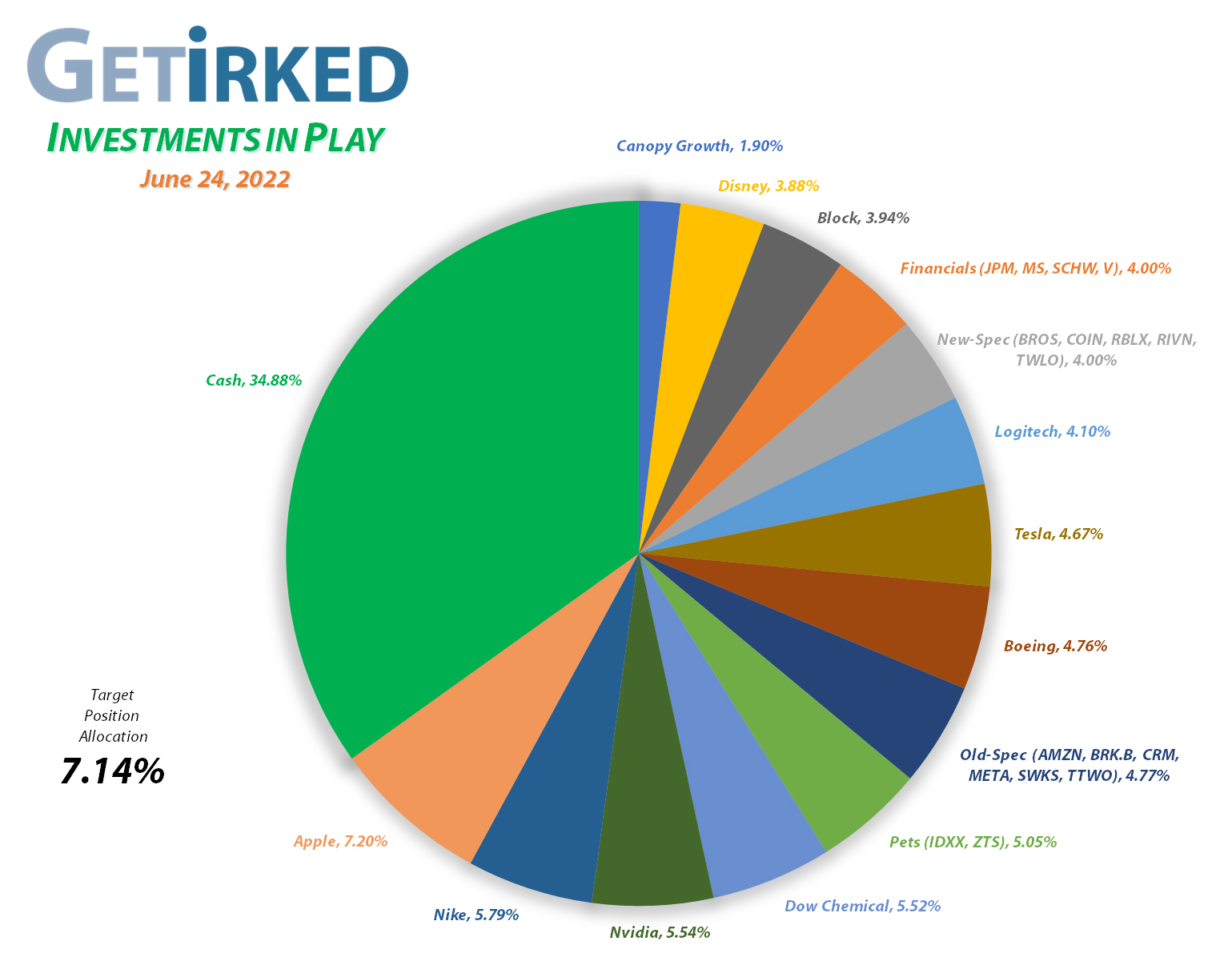

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

The Pets Basket includes the two leaders in pet health, long-time holding IDEXX Labs (IDXX) and newcomer Zoetis (ZTS). Both are considered “Best-in-Breed” (pun intended) for different reasons which is why I’m holding both of them instead of just picking one or over the other.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

Current Position Performance

Apple (AAPL)

+775.38%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$35.15)*

Nvidia (NVDA)

+644.84%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$12.60)*

Tesla (TSLA)

+635.89%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Boeing (BA)

+556.76%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$148.35)*

Block (SQ)

+539.66%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$71.45)*

Nike (NKE)

+432.46%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.10)*

Logitech (LOGI)

+342.36%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $12.70

IDEXX Labs (IDXX)

+340.85%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Skyworks (SWKS)

+339.68%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.65)*

Disney (DIS)

+164.63%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $36.95

Amazon (AMZN)

+96.56%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $59.25

Take Two (TTWO)

+76.75%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Meta (META)

+72.58%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($64.60)*

Salesforce (CRM)

+62.02%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Dow (DOW)

+59.32%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $33.35

JP Morgan (JPM)

+54.17%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $76.10

Berkshire (BRK.B)

+52.17%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

Zoetis (ZTS)

+10.83%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $157.55

Visa (V)

+7.98%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $190.33

Dutch Bros (BROS)

-2.19%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $37.70

Morgan Stan (MS)

-3.03%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $80.25

Schwab (SCHW)

-11.79%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $73.04

Twilio (TWLO)

-15.06%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $116.70

Roblox (RLBX)

-21.00%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.10

Canopy (CGC)

-39.67%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $6.25

Rivian (RIVN)

-50.34%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Coinbase (COIN)

-70.47%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Time for a breather… Buy on Red, Sell on Green

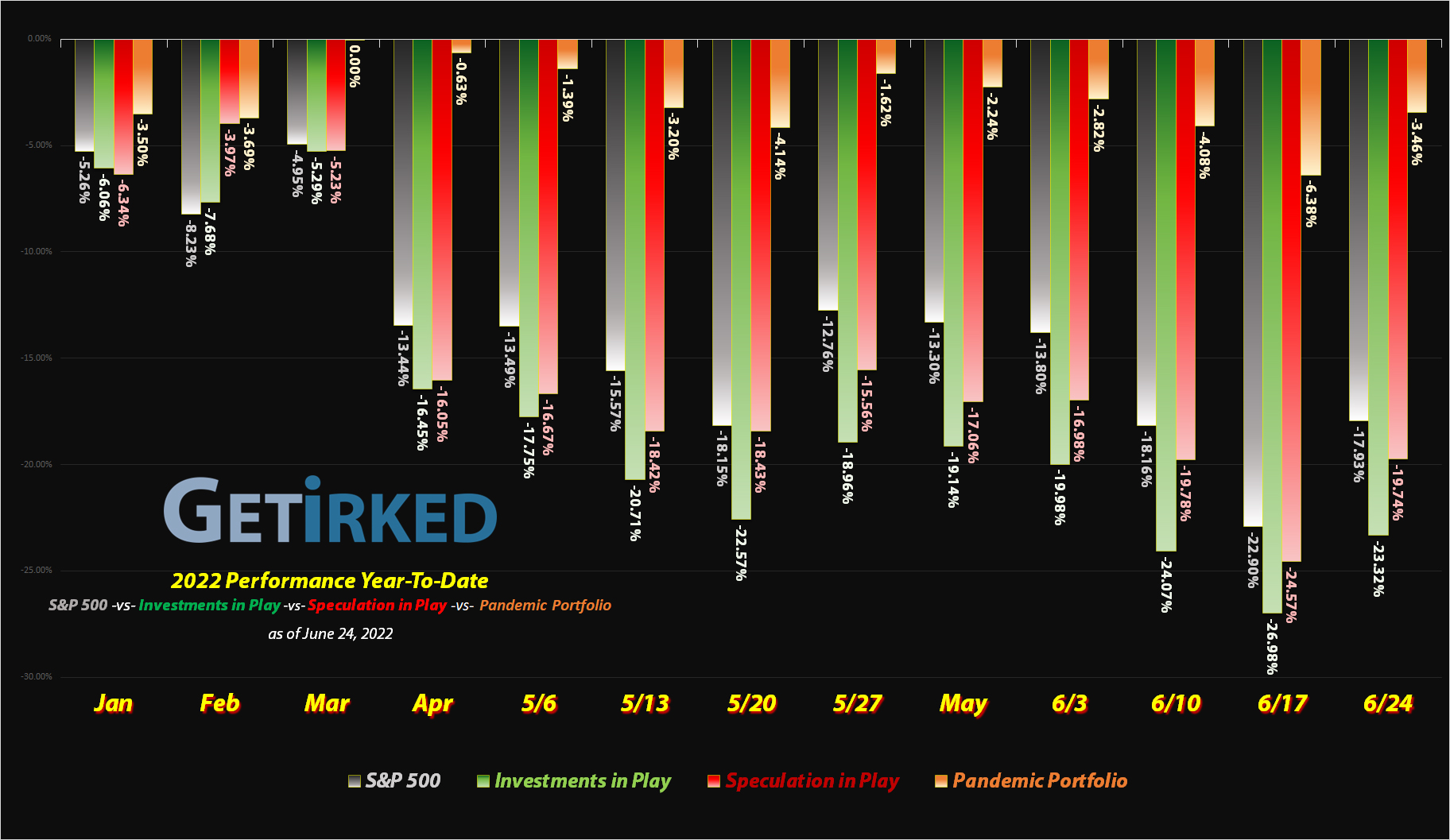

After last week’s dramatic selloff where I added to five (5) positions and opened a new one, I don’t mind having a week where the market calms down, bounces higher, and gives me the opportunity to focus on other priorities going on in my life.

This week’s bounce was decent, however, given how much the markets have sold off this year so far (particularly the NASDAQ, ouch), there really wasn’t any price action this week that was any more impressive than a bounce off oversold conditions. Many analysts believe the lows are not in for the markets this year, yet.

As always, I find it reassuring to remind myself of my disciplines, particularly one key rule: buy on red, sell on green. In other words, I only allow myself to sell on a day when stocks are headed higher (referred to as “selling into strength”), and I only allow myself to buy on days where stocks are headed lower (referred to as “buying into weakness”).

While that method doesn’t ALWAYS pay off, it makes me take a moment to breathe and consider my actions. By following this one key rule, I take emotion out of my investing, and, as any professional will tell you, emotions are the enemy of success when it comes to the stock market.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.